Why The “Fed Put” is a Lot Lower

- Market could be getting closer to a bottom

- Why the "Fed Put" is potentially a lot lower

- A good time to start adding to quality for the longer-term

Commentating on the daily price action of the market is pointless.

It"s just more noise.

What I"m focused on are broader longer-term trends.

As such I"ve deliberately refrained from writing of late – as the narrative hasn"t changed; i.e.,

- Markets are calibrating for a (far) less accommodative Fed; and

- Multiples continue to come in (adjusting for a higher rate environment)

As I flagged 6+ months ago – stock multiples needed to come in a long way given what we saw with inflation risks and a far more hawkish Fed.

And to a degree they have.

The prices of certain quality companies are now as attractive as they have been in years (and I"ve been actively adding to these positions; e.g. Apple, Amazon)

But to give you an example of how multiples have come in – consider streaming leader Netflix.

It has gone from 60x forward earnings to only around 16x. That"s now looking like a more reasonable bet (longer-term).

With respect to Meta – it has come down from ~30x forward earnings to ~13x (adjusted for its cash per share). Again, now is a good time to pick up this stock (long-term) at a decent risk/reward valuation.

However, for companies with little-to-no earnings / negative cash flows / trading in excess of 15x sales in some cases – they have been decimated (e.g. Zoom, Twilio, Peloton, Carvana, Upstart, Teladoc, Docusign… it"s a long and sorry list)

Note: as a rough rule of thumb – anything greater than 10x sales is an aggressive valuation for speculative (high growth) type businesses with poor moats.

But let"s take a look at the S&P 500 – it"s now closing in on what many consider "bear market territory"

For what it"s worth… that"s good news.

S&P 500 Approaches a "Bear Market'

The world"s largest index closed at its lowest level for the year last night – down ~19% from its high in early January.

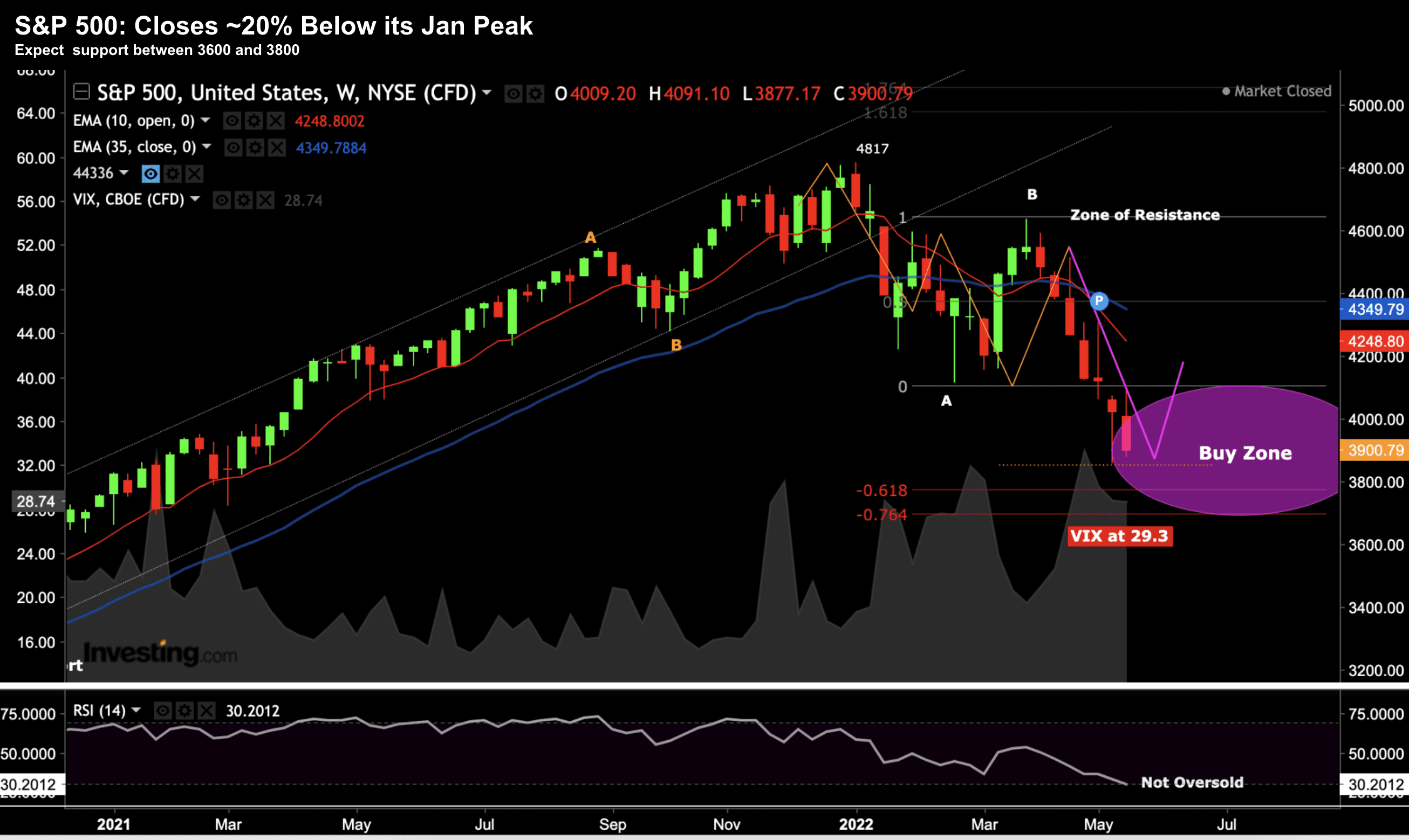

Below is the weekly chart…

May 20 2022

A couple of technical observations:

- The market remains in a strong bearish trend. As such, we should expect "sharp rips higher" (i.e., short covering) – however any strength will most likely be sold. Note – you know it"s short covering when highly speculative names are rallying and quality names don"t catch a bid.

- I"ve pencilled in a new distribution labelled "A-B". This is formed by the latest retracement higher of around 10%. It"s my expectation we could test support around 61.8% to 76.4% outside this distribution on the low side (i.e. around 3700)

- Any rally back to the top of the distribution (i.e. "B" at ~4600) will most likely be met with strong resistance.

- The Relative Strength Index (RSI) in the lower window is now very close to "oversold" territory. If this value falls below 30 – we are technically oversold; and should expect a bounce.

Echoing what I"ve been saying in recent weeks – I think the market makes "lower lows" here.

That"s what probabilities tell me.

But the good news is we"re getting closer to the bottom.

Will there be a Fed Put?

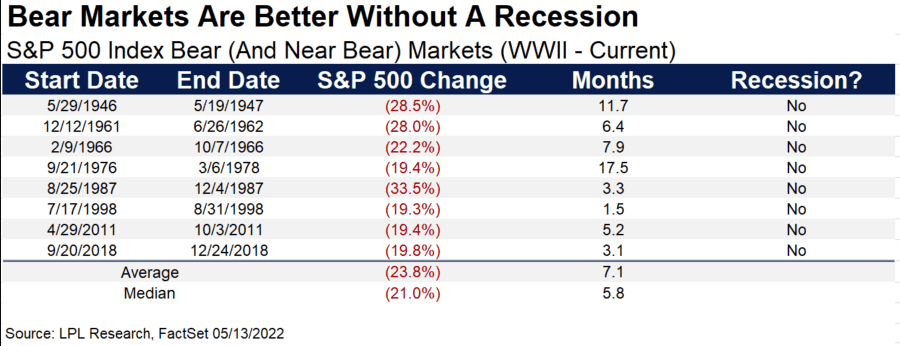

Over the past few years – there have been plenty of 20% plus corrections.

And many of these were in the absence of a forthcoming recession.

That said, there are a couple of major differences to recent corrections:

- CPI inflation is running close to 9% YoY (something we have not seen in 40+ years); and

- The Fed no longer has the luxury of "saving" equities with persistent ultra-easy monetary policy.

Now let"s consider the following bear markets (i.e., 20%) corrections:

The consistent theme opposite each of these corrections was the Fed coming to the rescue…

But this time around – we have inflation at unacceptable levels (which has not been the case in recent years).

To that end, this week Kansas City Fed president Esther George said the Fed wasn"t deterred by a falling stock market. I quote:

"I think what we are looking for is the transmission of our policy through markets understanding, and that tightening should be expected.

It is one of the avenues through which tighter financial conditions will emerge."

Scott Minerd – CIO of Guggenheim – echoed this sentiment as said there is no "Fed Put" – and we are set up for a "season of pain".

But think about what"s happening here…

Lower asset prices are exactly what the Fed wants to achieve.

For example, if stock prices fall, it makes it more expensive for companies to raise equity.

In turn this impacts the so-called "wealth effect"

Now if consumers / investors "paper wealth" falls – they feel more cautious about the outlook – and are less likely to spend.

Put together, we potentially have "less (not more) money chasing fewer goods"

This is what"s needed for inflation to come down.

But…

How does the Fed achieve that objective without "crashing" the economy (i.e., a softer landing).

That"s the difficult part.

A crash in risk assets will most likely bring forward a recession… and this is probably "70%" priced in already (more on this in a moment).

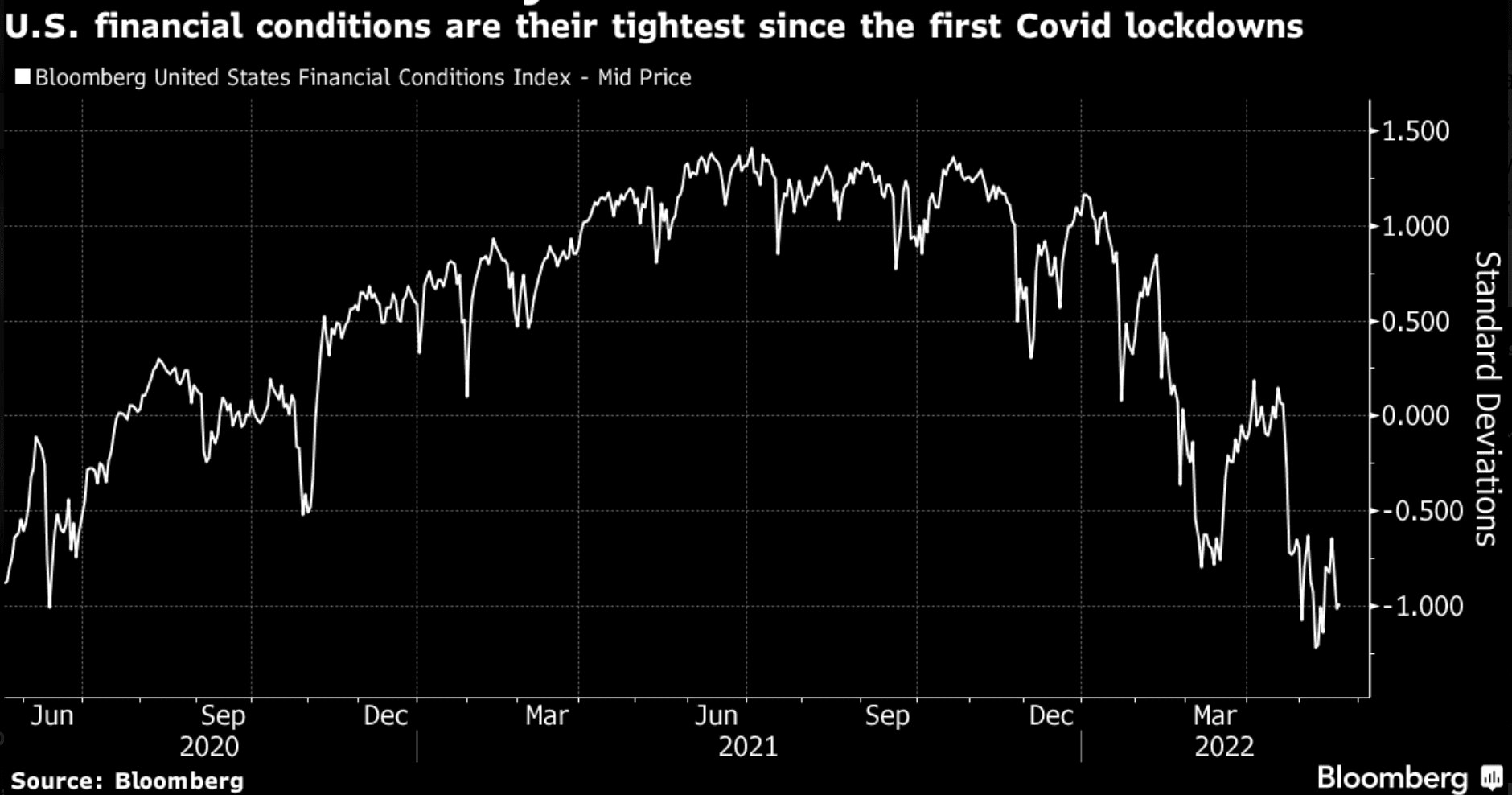

Here"s Bloomy on how financial conditions are tightening:

And whilst I think this is "good news" — the more interesting thing from this chart is not so much how things are tightening… it"s how long the Fed kept an ultra-easy policy.

That was their mistake.

Are Things Turning on a Dime?

This week we heard from the US" second and third largest retailers — Walmart and Target respectively (with Amazon the largest).

Target and Walmart are two great bellwether stocks – which help us get a read on the consumer.

In short, their commentary and earnings shocked the market.

These two companies suffered their worst trading days since 1987… where Target crashed more than 20%!

But it"s not hard to explain…

As context – earlier in the pandemic – consumers were flush with cash from (excessive) government stimulus checks who then "invested" heavily in upgrading their homes and furnishings.

Not this year…

Consumers slashed their spending on home goods like TVs and kitchen appliances—which left retailers holding extra inventory they can"t sell; and what"s more – don"t have space to store.

Here"s Target"s CEO – Brian Cornell – on their earnings call:

While we anticipated a post-stimulus slowdown and we expected consumers to continue refocusing spending away from goods and into services, we didn"t anticipate the magnitude of that shift,"

Target"s net income fell 52% in the first quarter of 2022 compared to the same period in 2021.

But it gets worse…

Whilst it"s painful for the retailers – the flow-on effect is massive.

For example, consider the domino-like effect all the way down the goods supply chain. Here I am talking about the truckers, the shippers, the packers — who will all feel the impact of what Target and Walmart"s CEO"s told us.

My take is expect major earnings revisions lower for these types of companies… which is not yet fully priced in.

Putting it All Together

Whilst all this sounds like bad news… there"s reason to be optimistic.

I think we are now a "good distance" towards pricing in a recession in 2023.

We are not quite there – but we are close.

For example, with the market down ~20% – I estimate we could see:

- 10-15% more downside if we"re heading into a recession (which I think is likely); or

- If there is not a recession next year – we"re likely within 5-10% of the bottom.

… at a guess.

But here"s the thing:

It"s near impossible to pick market bottoms.

It"s not something I pretend to do.

But the good news is there are many quality businesses offering attractive multiples (e.g., GARP) that we have not seen in a long-time.

And it"s a good time to start adding to these names.

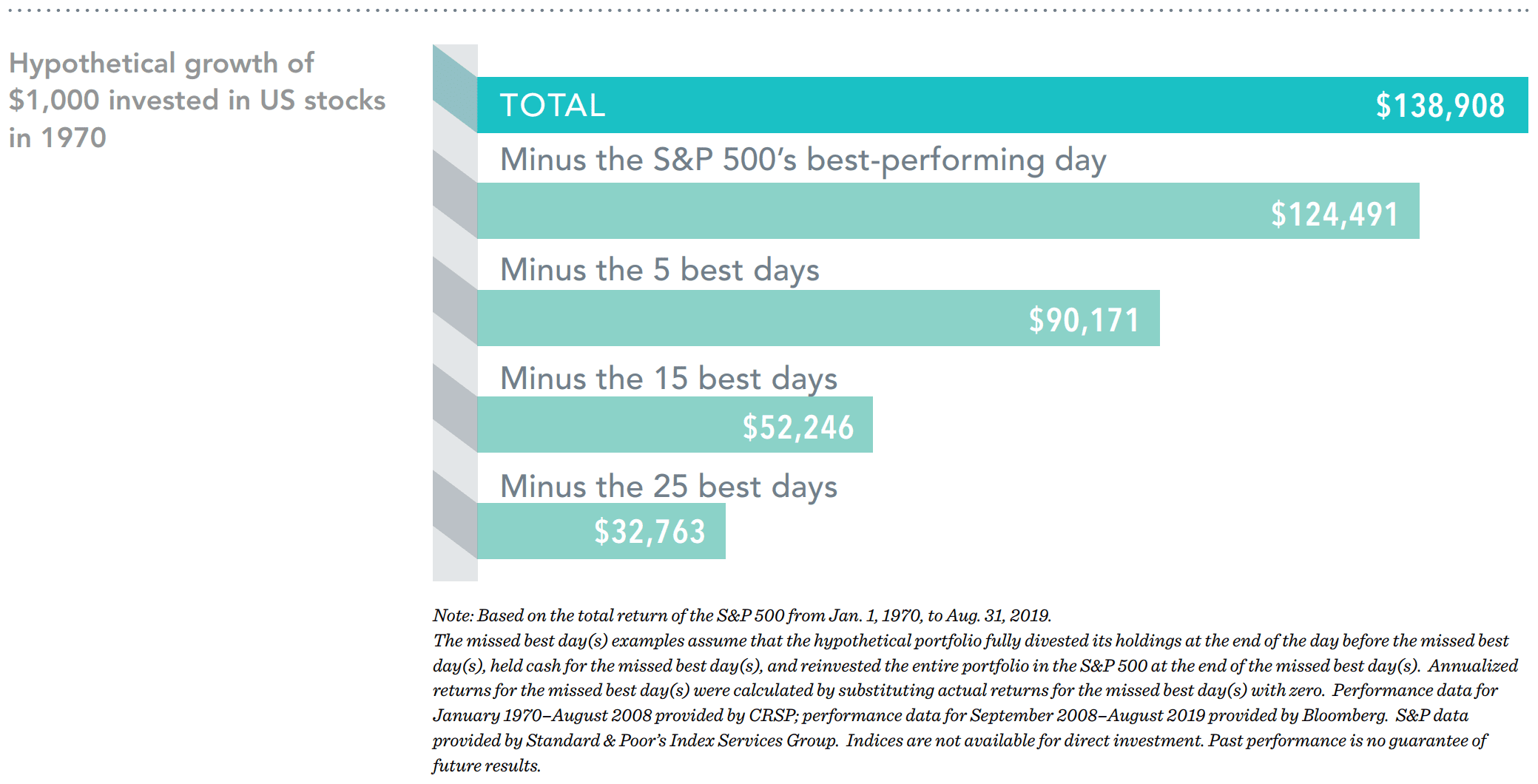

Before I close – an interesting data point around trying to pick (or time) bottoms.

Research from Dimensional Fund Advisors below shows how staying out for only a few days can be disastrous.

This chart (courtesy of Bloomberg) shows what would have happened by late 2019 to $1,000 invested in U.S. stocks in 1970. Missing out on only a few of the best-performing days would have a drastic effect on compounded returns.

In summary, you won"t be able to time the bottom.

If you do – it"s luck.

You"re going to wake up one morning and the market is up 5%. And the next week, it"s up another 5%.

Before you know it, the bottom is in.

As such, I think now is a good time to start adding to quality.

And whilst you might wear a further "10-15%" downside from here (it"s difficult to know)… that"s okay.

Over the longer-term (e.g. 3+ years) – buying when the market pulls back in the realm of 20% to 30% has proven to be a very profitable venture.