A ‘Dovish’ Fed Cuts Growth but Raises Inflation Outlook

- Has the Fed boxed themselves into a corner?

- Stocks exhale on the Fed"s lack of a definitive taper timeline

- Expert short-term rate lift-off in 2022 (not 2023)

"Coming soon" is all the Fed could offer with respect to a definitive timeline on tapering their $120B monthly asset purchases.

Suitably nebulous if you ask me…

Earlier this week I played down any expectations from the Fed – suggesting the "nail in the taper coffin" was the weak August jobs report.

Here"s Jay Powell:

"If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted".

Soon to be warranted?

What"s soon?

My take: they"re doing everything they can to appease the market – petrified of any negative response.

But that could be at a much greater cost down the road.

Regardless of the Fed"s nebulous language – I was most interested in their view on inflation (and growth). And to that end, the Fed shared the following:

- They cut their growth outlook for 2021 by 1.1% (down to 5.9%);

- They raised the 2022 growth forecast by 0.5%; and

- Also raised inflation forecasts

A quick take: inflation is proving to be stickier (maybe less "transitory") than they first expected – and growth looks like coming down.

Rate Rises will be Sooner than 2023

As regular readers will now, I felt a Fed rate lift-off was more likely to be 2022 than 2023.

And the reason – higher than expected "sticky" inflation (e.g. wage increases).

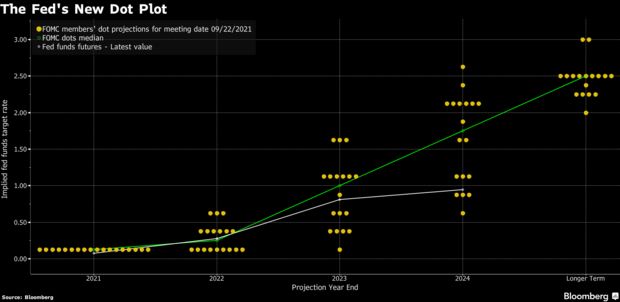

To that end, today we also received the so-called Fed dot plot.

For those less familiar, this is what the Fed uses to signal its outlook for the path of interest rates.

It shows Fed officials are now evenly split on whether or not it will be appropriate to begin raising the fed funds rate as soon as next year.

That said, there were 2 Fed officials who moved their rate-lift off to 2022 from 2023.

In June, when members last released their economic projections, a majority put that increase into 2023.

Not now…

Sept 21 2021

My view is if inflation continues to be persistent into 2022 – watch the "dot plot" lift.

In other words, the number of dots below the green line in 2022 will move higher.

As an aside, look at 2025, Fed officials see short-term rates as high as 3.0% – with the majority around 2.50%

With respect to inflation (and employment) – here"s additional language from Jay Powell:

For inflation, we appear to have achieved more than significant progress, substantial further progress. That part of the test is achieved in my view and the view of many others.

My own view is the test for substantial further progress on employment is all but met".

This echoes what I wrote earlier in the week… more to do on the employment front.

But coming back to inflation (and the risks)…

FOMC members see inflation stronger than projections in June.

For example, Core inflation is projected to increase 3.7% this year, compared with the 3% forecast the last time members gave their expectations.

Officials then see inflation at 2.3% in 2022, compared with the previous projection of 2.1%, and 2.2% in 2023, one-tenth of a percentage point higher than the June forecast.

Including food and energy, officials expect inflation to run at 4.2% this year, up from 3.4% in June.

The subsequent two years are expected to fall back to 2.2%, little changed from the June outlook.

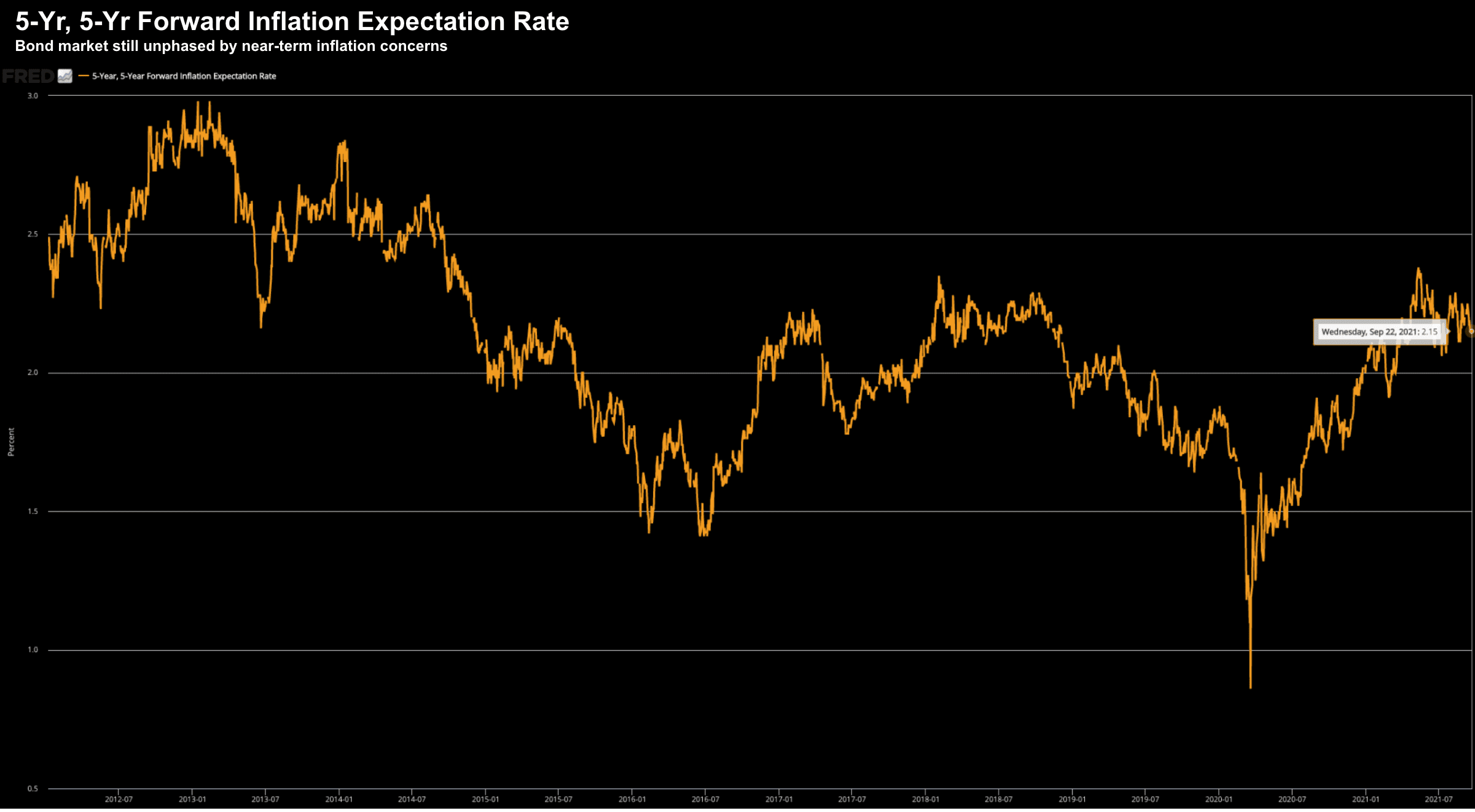

With respect to the latter – below is the 5-year, 5-year forward inflation expectation… which sits at a modest 2.15%

Sept 22 2021

Market Reaction(s)

There are three key market reactions I watch with any Fed announcement… and equities is the least important:

- US 10-Year Yield

- Dollar Index

- US Equities (S&P 500)

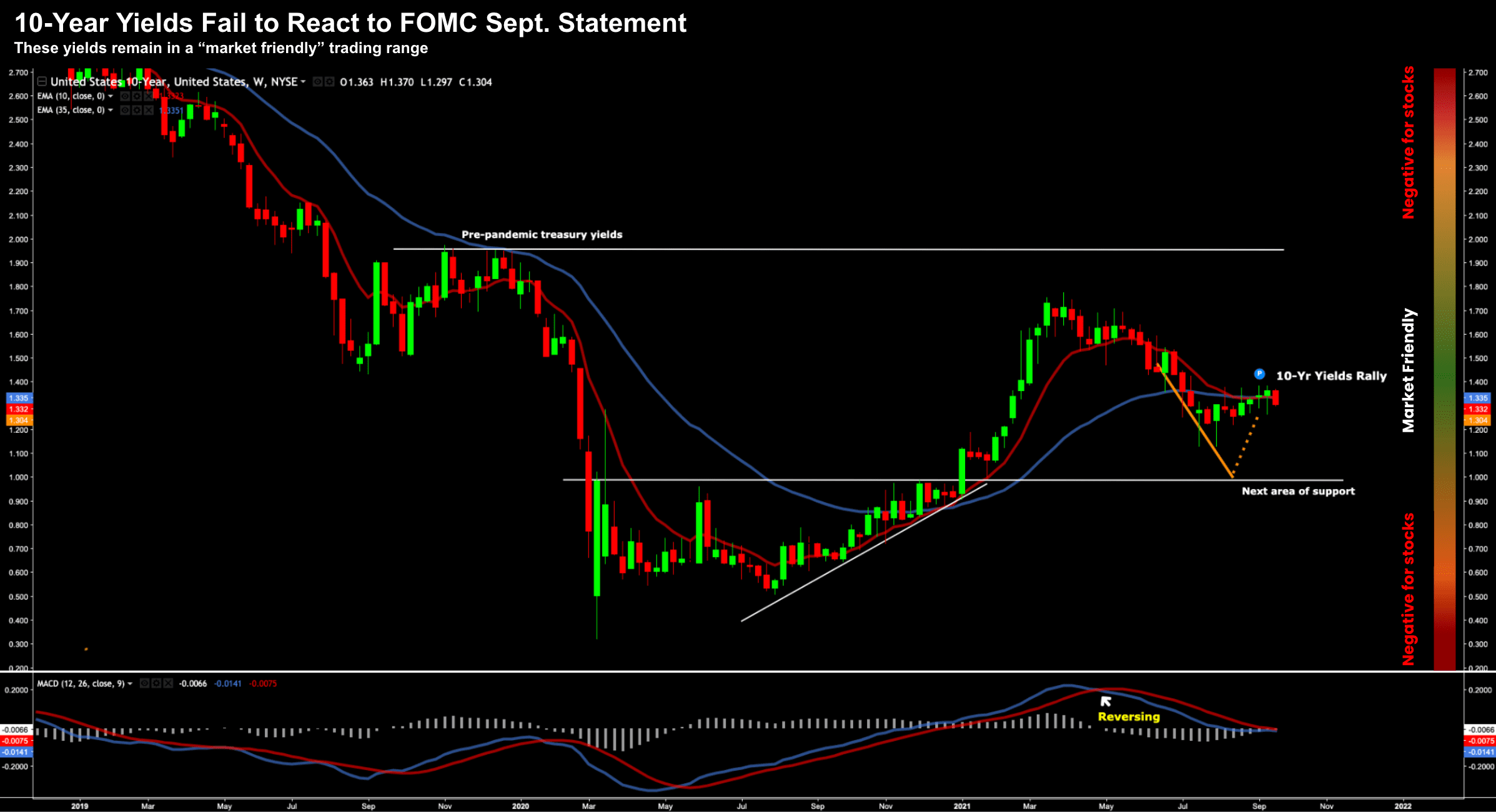

Let"s start with the 10-year yield.

1. 10-Year Treasury Yield

In short, today"s news was a non-event, as these yields barely moved (i.e. the Fed"s language (or lack of any definitive policy move) was priced in)

Sept 22 2021

What"s most noteworthy for me is yields have trended lower.

Put another way, if bond markets felt the Fed was likely to definitively tighten – yields would be higher.

Now if you look at the chart above, you will notice I"ve added a thematic bar on the right-hand axis.

This is intended to show what I think are:

(a) market friendly zone for 10-year yields; vs

(b) levels which could be problematic for risk assets.

For example, if yields were to plunge back below ~1.0% in nominal terms (i.e., deeply negative in real terms) – this would be negative for markets.

This would be the bond market throwing in the towel on risk assets – concerned with risks to the economy and growth (i.e. seeking shelter).

On the other hand, if yields are to roar back above 2.0% in quick fashion (which now seems most unlikely in the near-term), this would also be detrimental to stocks.

For example, high growth stocks (such as tech) and other heavily leveraged sectors are very much exposed to higher rates. If this was to occur, their extended multiples would come in as they are discounted for future cash flows.

In between those two levels feels like a "market friendly" zone.

But again, a lot of this will depend much on the pace of any change. For example, a slowly upward moving 10-year bond yield might be okay for the market.

2. US Dollar Index

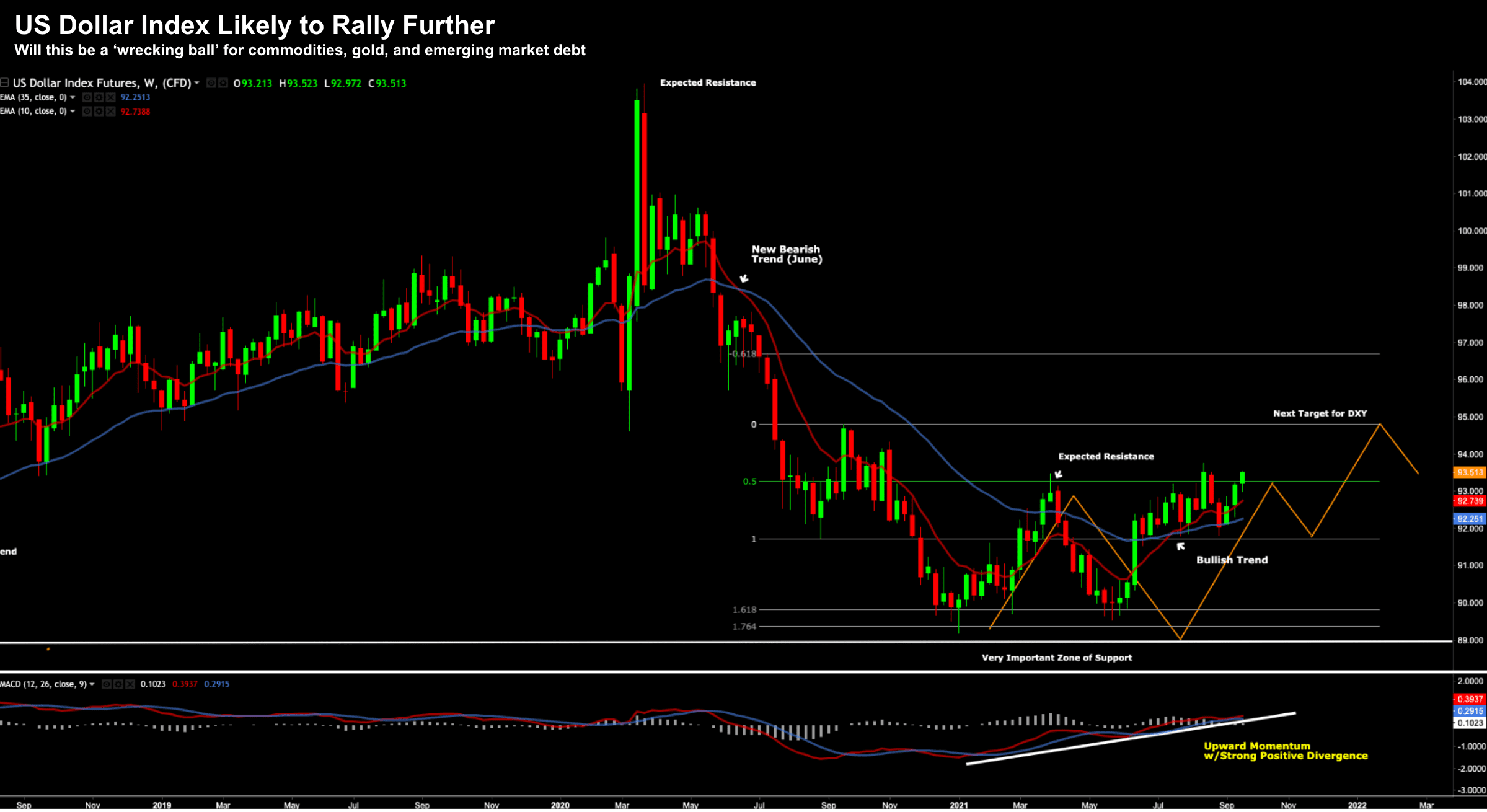

The US Dollar Index (DXY) continued its recent bullish trend on the news…

Sept 22 2021

I covered the price action on the dollar (and my sentiment) earlier this week.

In short, I think it"s headed higher… and it could be meaningful.

And if so, it could be a "wrecking ball"…

We saw the DXY inch higher today… again largely pricing in the expected news.

The dollar index is finding resistance around 93.5 but I sense this is about to break out.

Look for a move straight up to around 95 over the coming weeks and months… which will be bearish for gold, commodities and emerging markets (with US denominated debt)

On the flip side, a stronger dollar is deflationary.

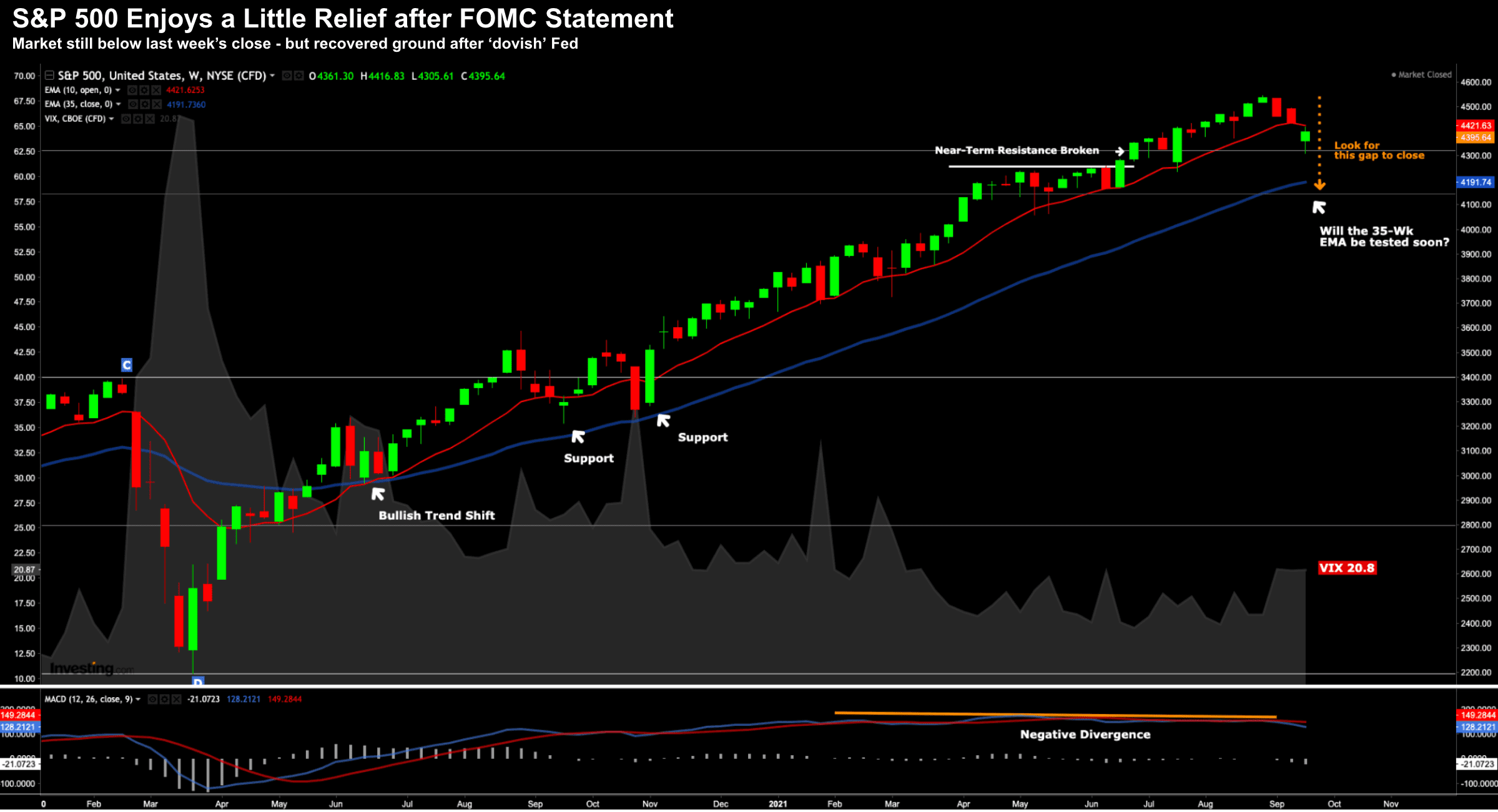

3. Equities – S&P 500

The third and final reaction is what we saw from equities.

Stocks enjoy some relief today after the Fed reassured the "liquidity spiggots" are still on (for now)…

Sept 21 2021

More liquidity is typically good news for risk assets.

But my view is that nothing has changed from what I wrote approx two weeks ago.

That is, the buyable correction remains in play.

Despite the S&P 500 rallying around 41 points today – it"s still trading well below the levels of the past two weeks (and below the 10-week EMA)

Again, a dovish Fed is helpful for stocks – but rate rises are coming (my best guess is 2022) and we might see taper as soon as December.

Is that priced in?

Now the next major hurdle for equities will be Q3 earnings.

The earnings bar is already sky-high (e.g., based on multiples) and the year-on-year comps are getting harder as we climb out of the pandemic.

We"re already starting to learn about the disruptive impact of higher costs in the supply chain (e.g. FedEx"s warning). What"s more, we also heard from one of the US largest" homebuilders Lennar. Their Executive Chairman – Stuart Miller – told us:

"… the homebuilding industry as a while continues to experience unprecedented supply chain challenges which we believe will continue into the foreseeable future"

This meant Lennar were able to make fewer homes available… despite stronger demand. Net result – prices are up sharply.

Finally, tomorrow we hear from NIKE…

And whilst I"m sure revenue will show double-digit growth… I"m most interested to hear their commentary on their challenges with supply-chain (and any impact to Q4 (holiday) sales)

From mine, sales revenue missed in Q4 are not "sales delayed"… they are sales lost.

Putting it All Together…

Both bonds and currency traders knew what was coming today from the Fed.

They were unmoved.

However equities exhaled after what can only be considered dovish language.

My view is the Fed has boxed itself into a tough corner.

For example, they are so "wrapped around the axle" on not wanting to upset equities (e.g. at pains to telegraph their plans well in advance) – they are now behind the inflation curve.

This will only make any rate rise and/or taper harder to swallow.

Remember:

Central banks exaggerate both the "boom and the bust" cycle with interventionist policies for too long.

For example, any taper should have begun whilst growth was ripping higher; earnings were hitting records; and consumer sentiment was high.

The market would have most likely seen the market take taper in its stride.

Now we have a situation where earnings comps are likely to be tougher; growth expectations are being revised lower; inflation risks are growing; and the Fed is looking to reduce its support.

I wonder how this will work out?

In summary, the Fed had a solid window to move on reducing asset purchases but were afraid of how equities would react.

That may end up being a policy mistake (as I wrote at the time)

Happy to be wrong.