Powell’s Punch

Powell’s Punch

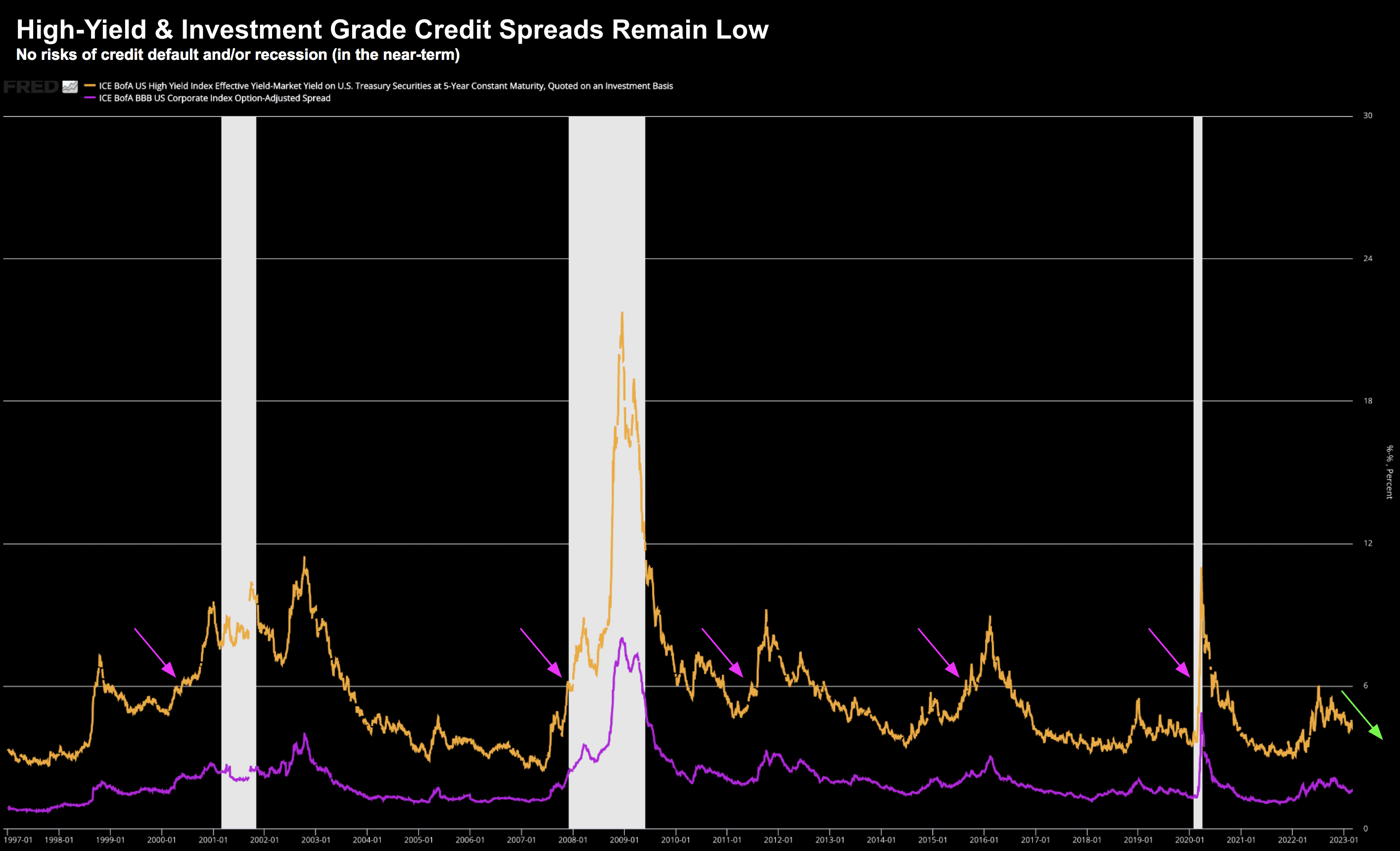

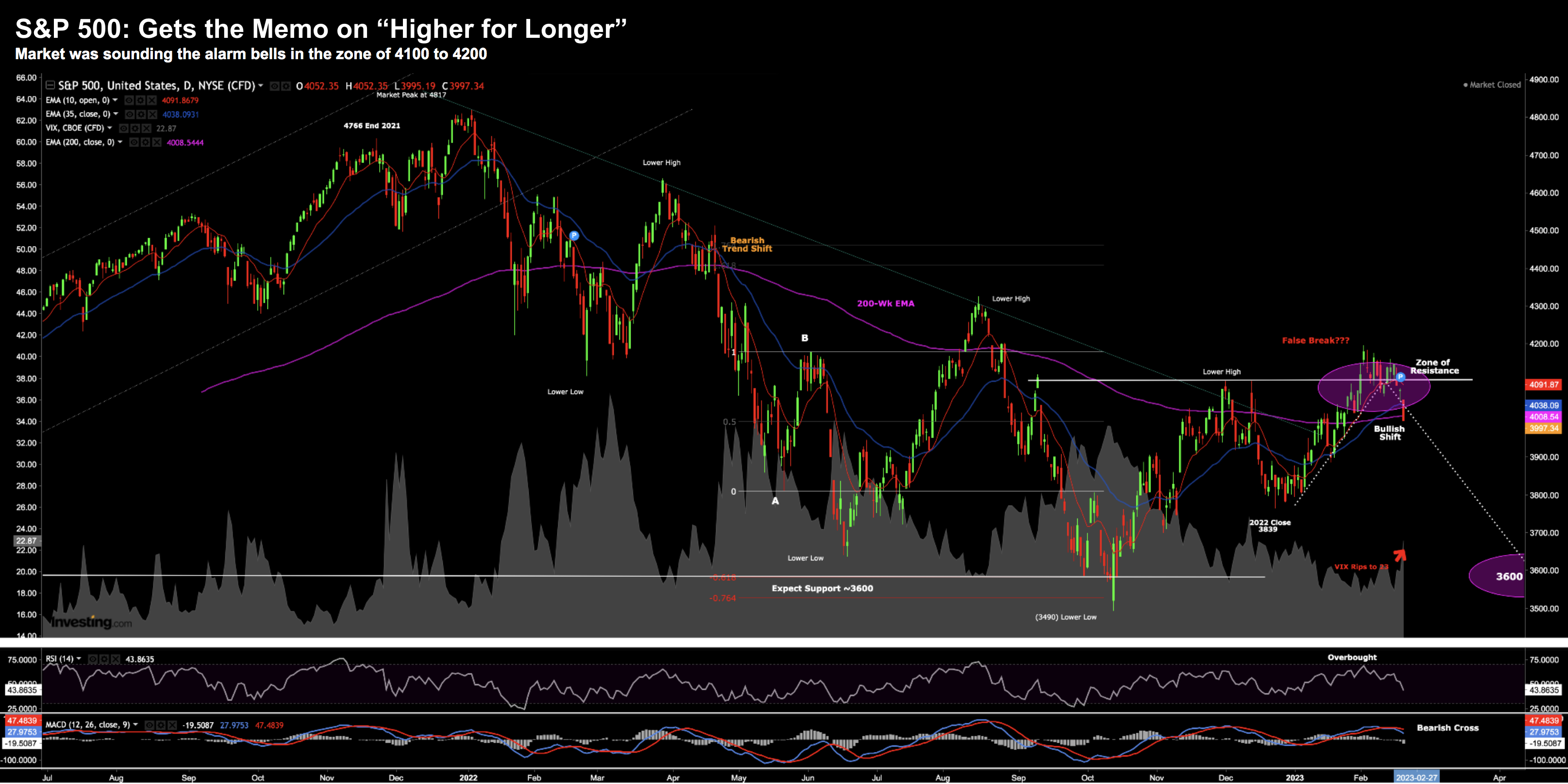

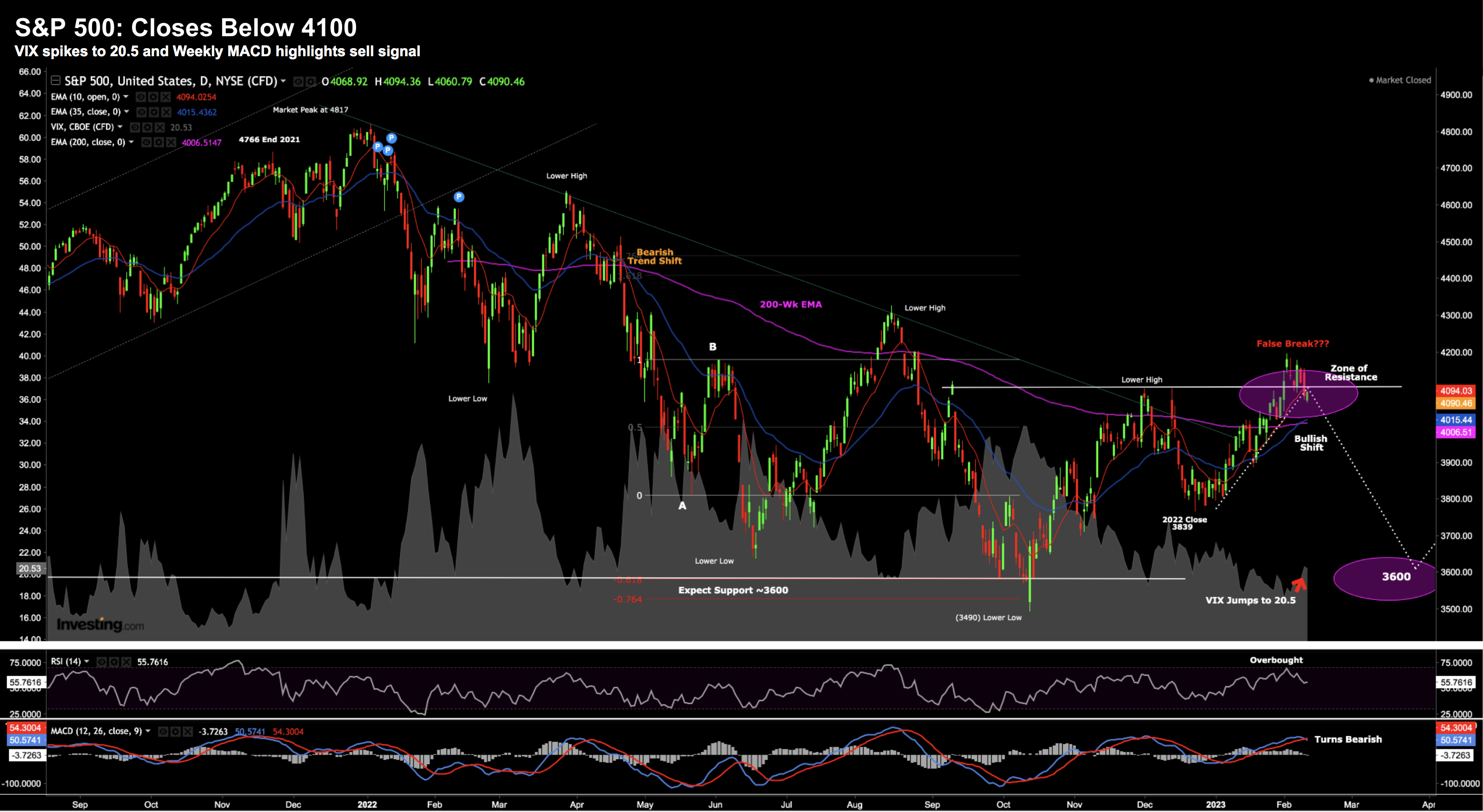

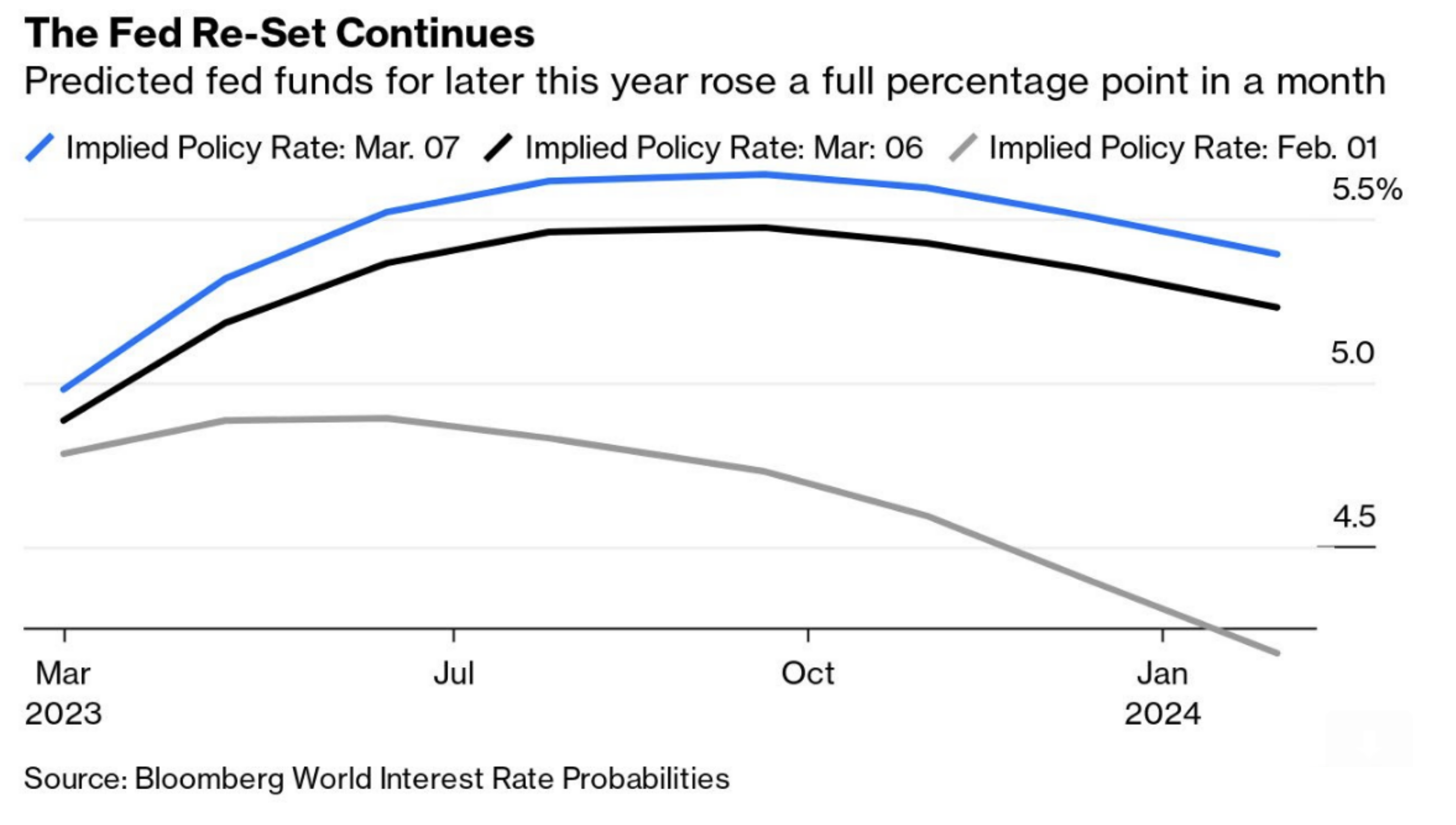

In what was supposed to be a 'vanilla' testimony to Congress - Jay Powell turned this into a market moving event. Not pleased with how market participants interpreted his previous address - he set the record straight that rates will be higher for longer. His testimony left no room for ambiguity - it was full hawk. Markets quickly revised their forecasts for the peak Fed funds rate - with some now thinking 6.00%. What's more, the 2/10 yield curve is now negative 107 basis points. We have not seen that since 1981. Soft landing? Good luck.