Fed Aftermath

Fed Aftermath

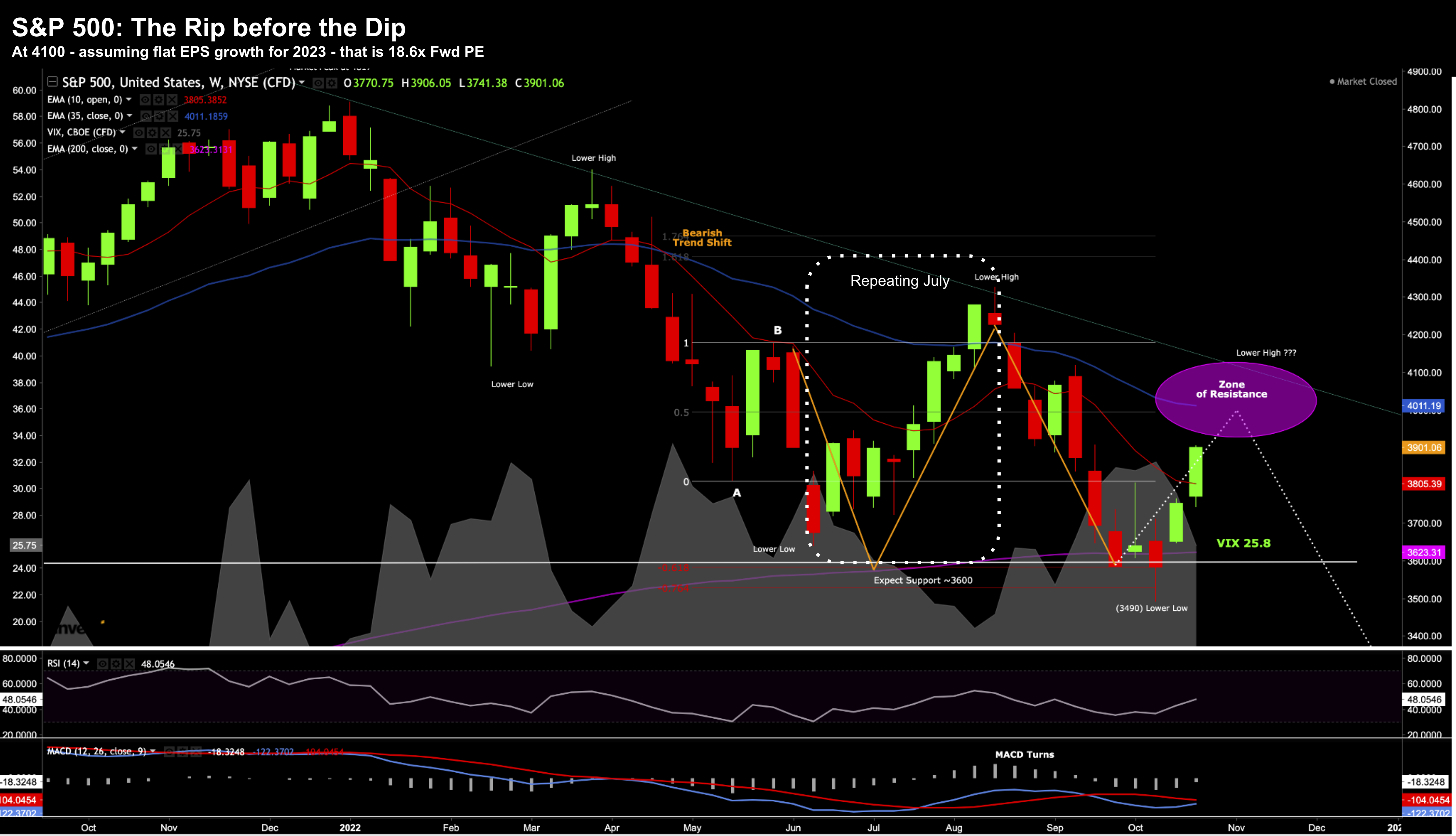

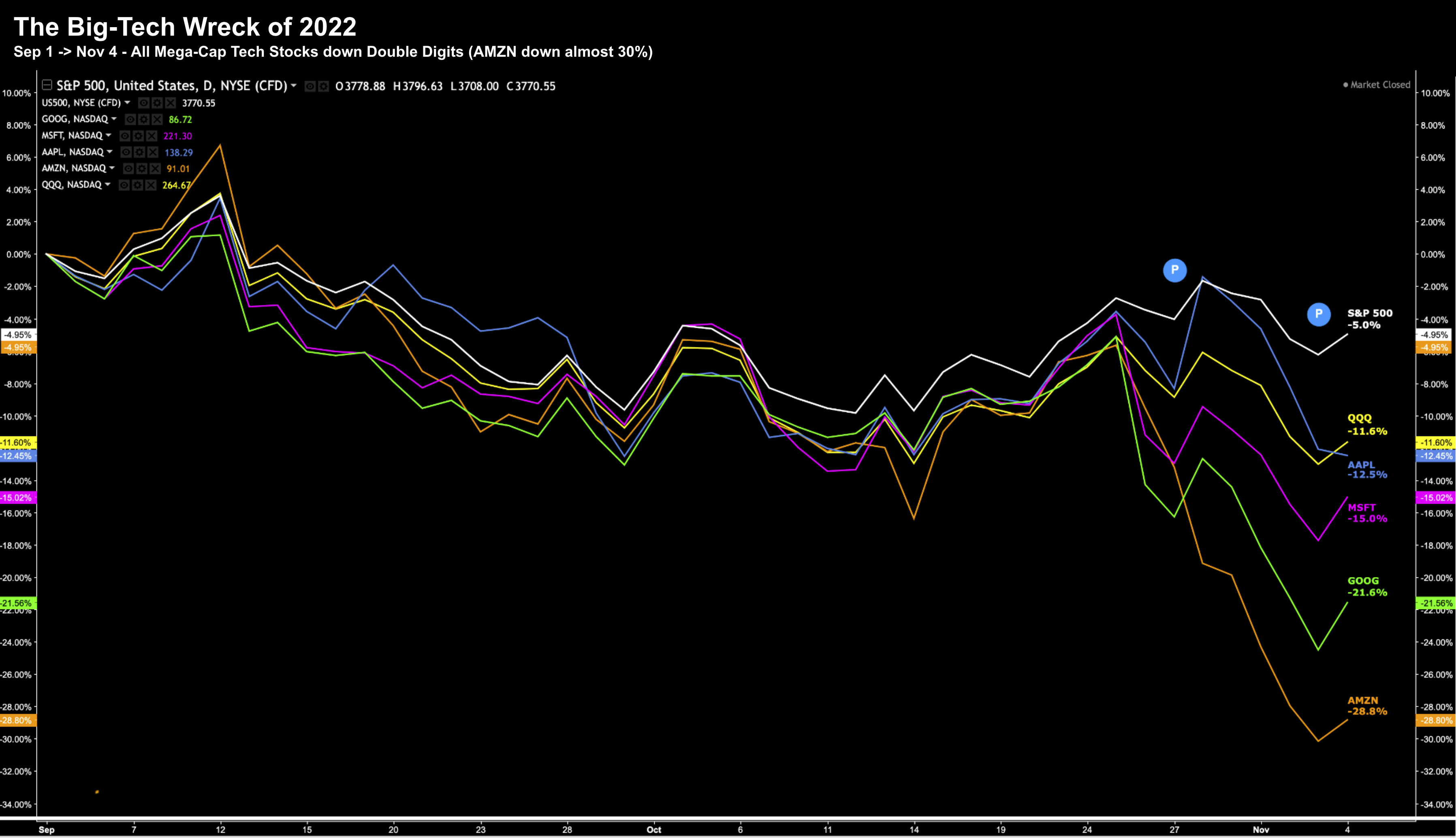

Apple, Amazon, Microsoft and Google have all been crushed post earnings. Apple is the 'best' performer - down approx 13% the past two weeks. What's next for large cap tech? I see more downside... and this post explains why.