Tread Carefully…

Tread Carefully…

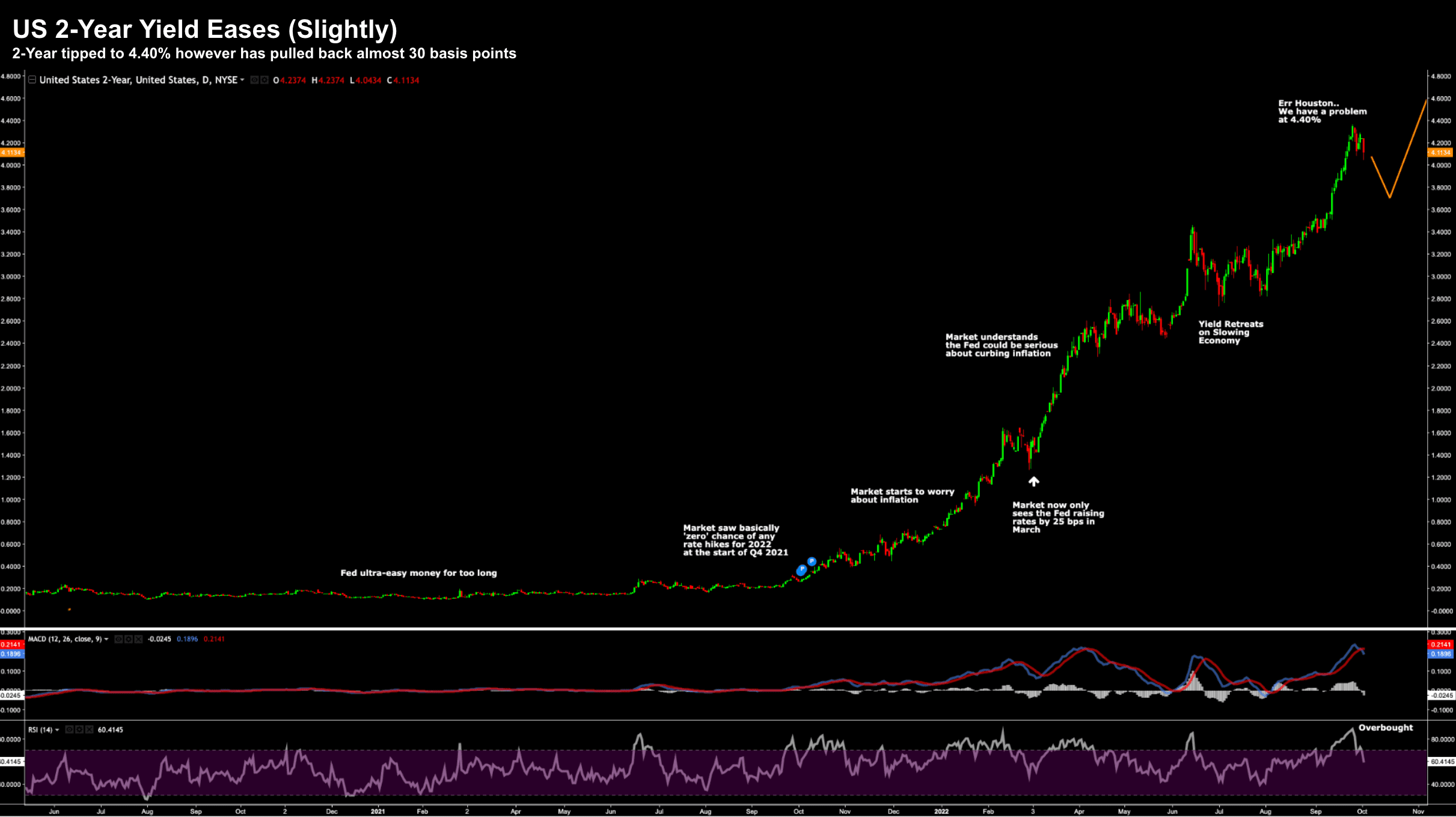

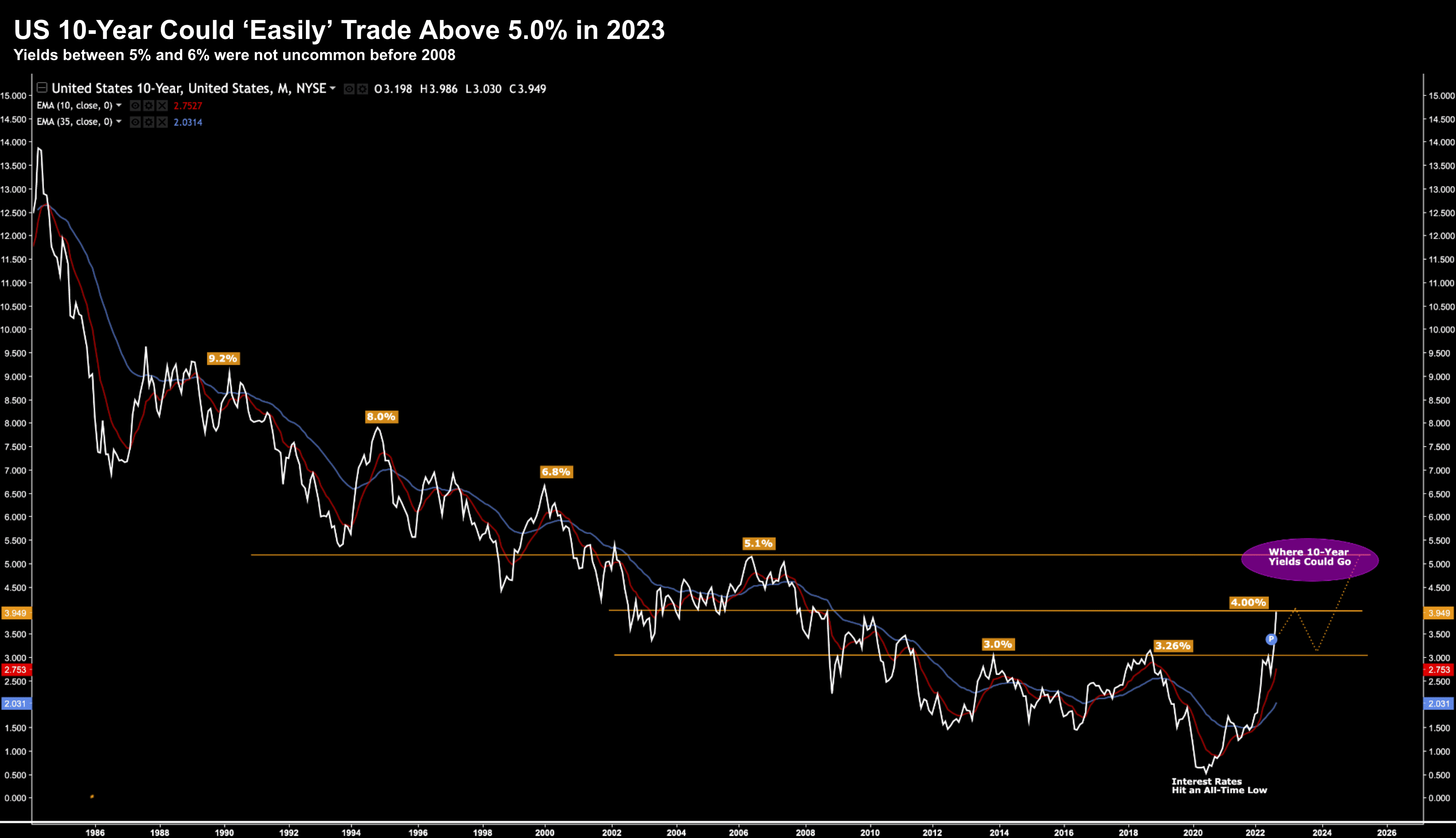

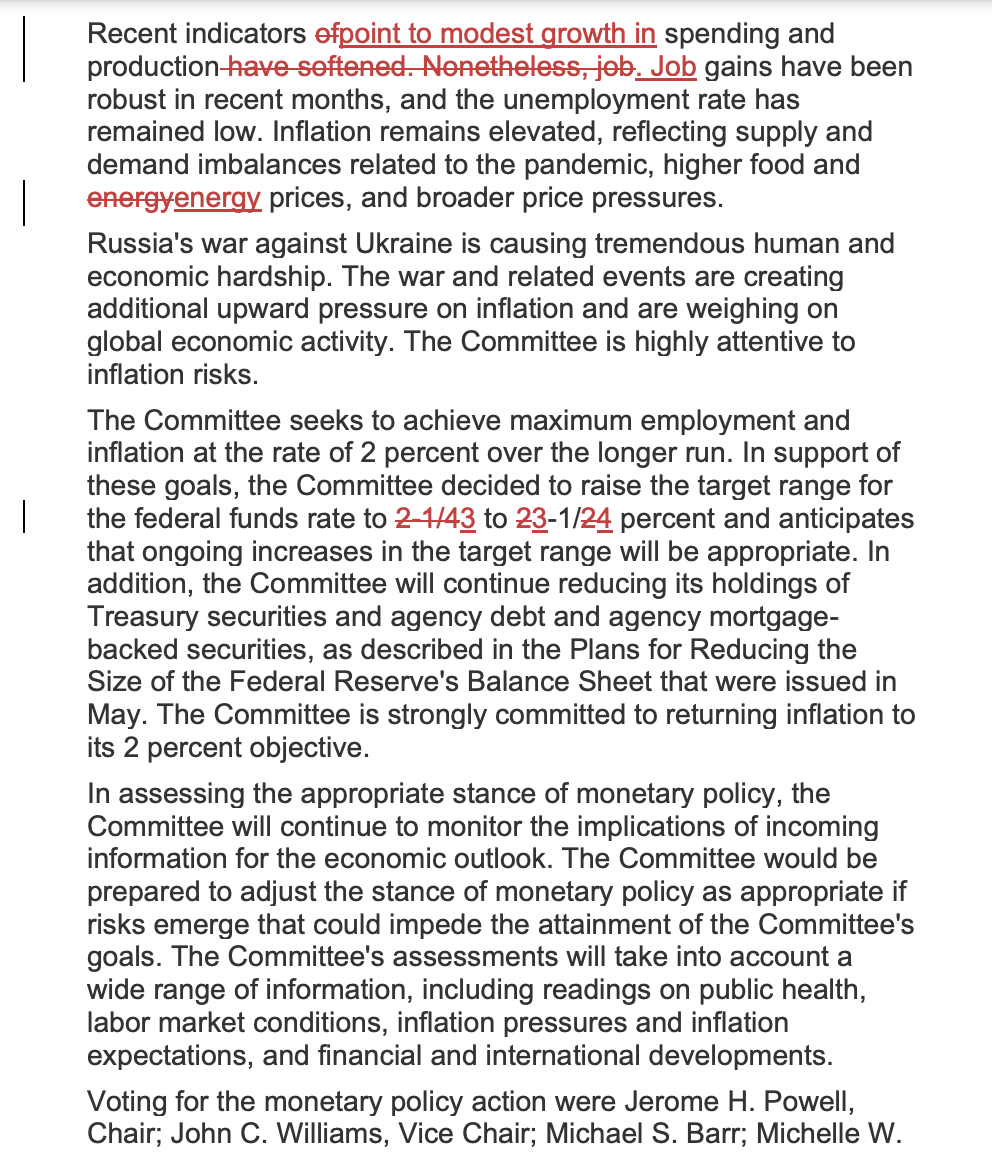

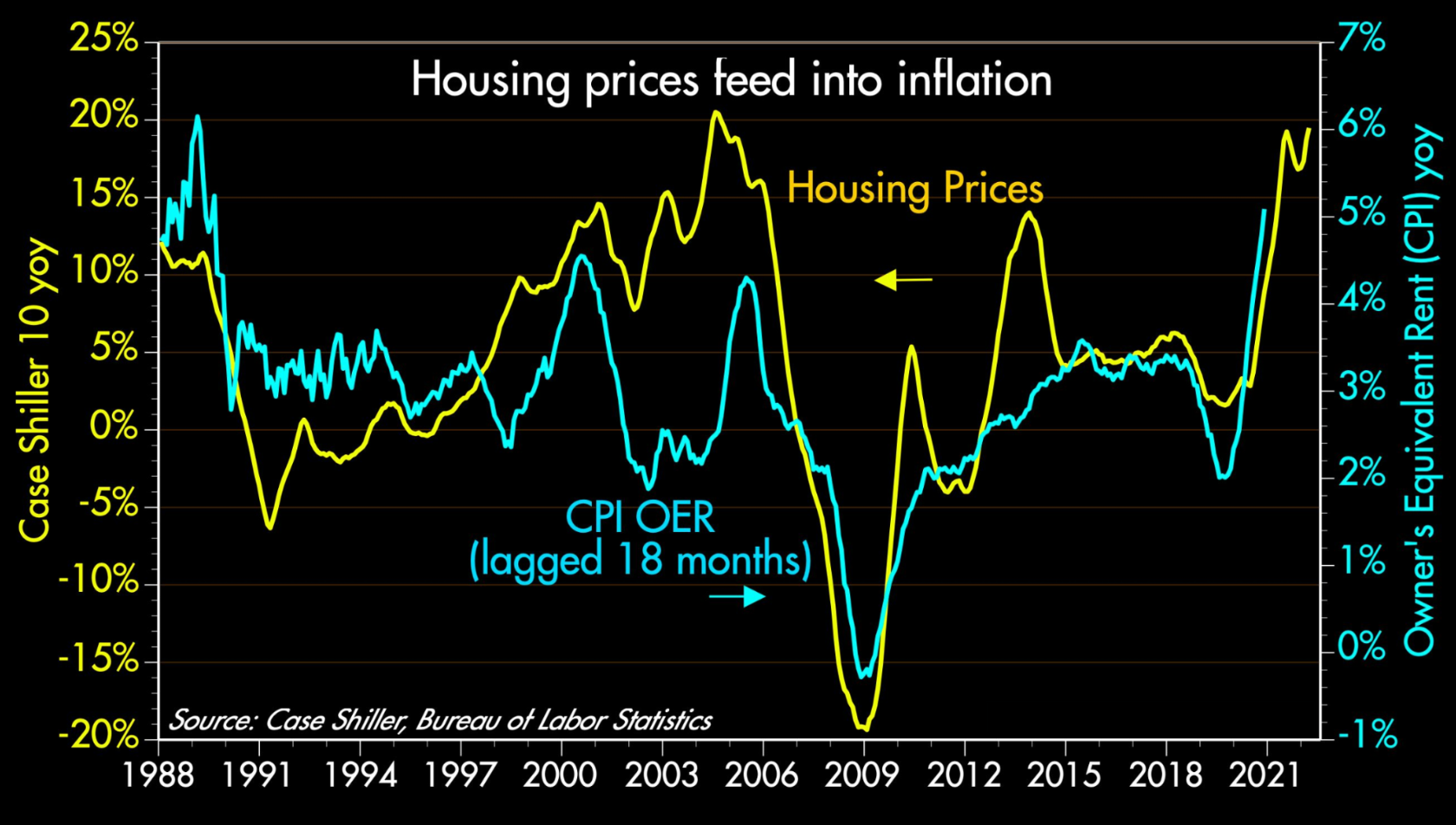

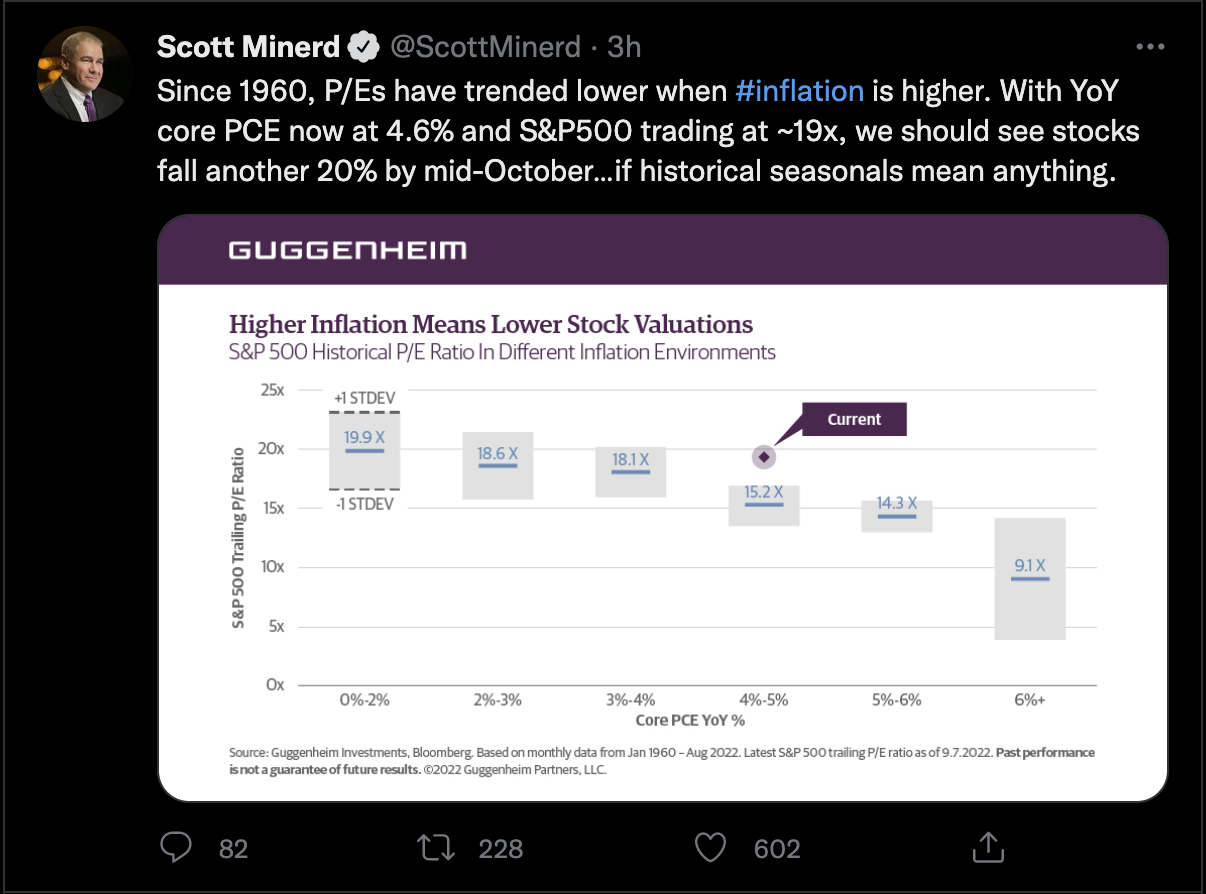

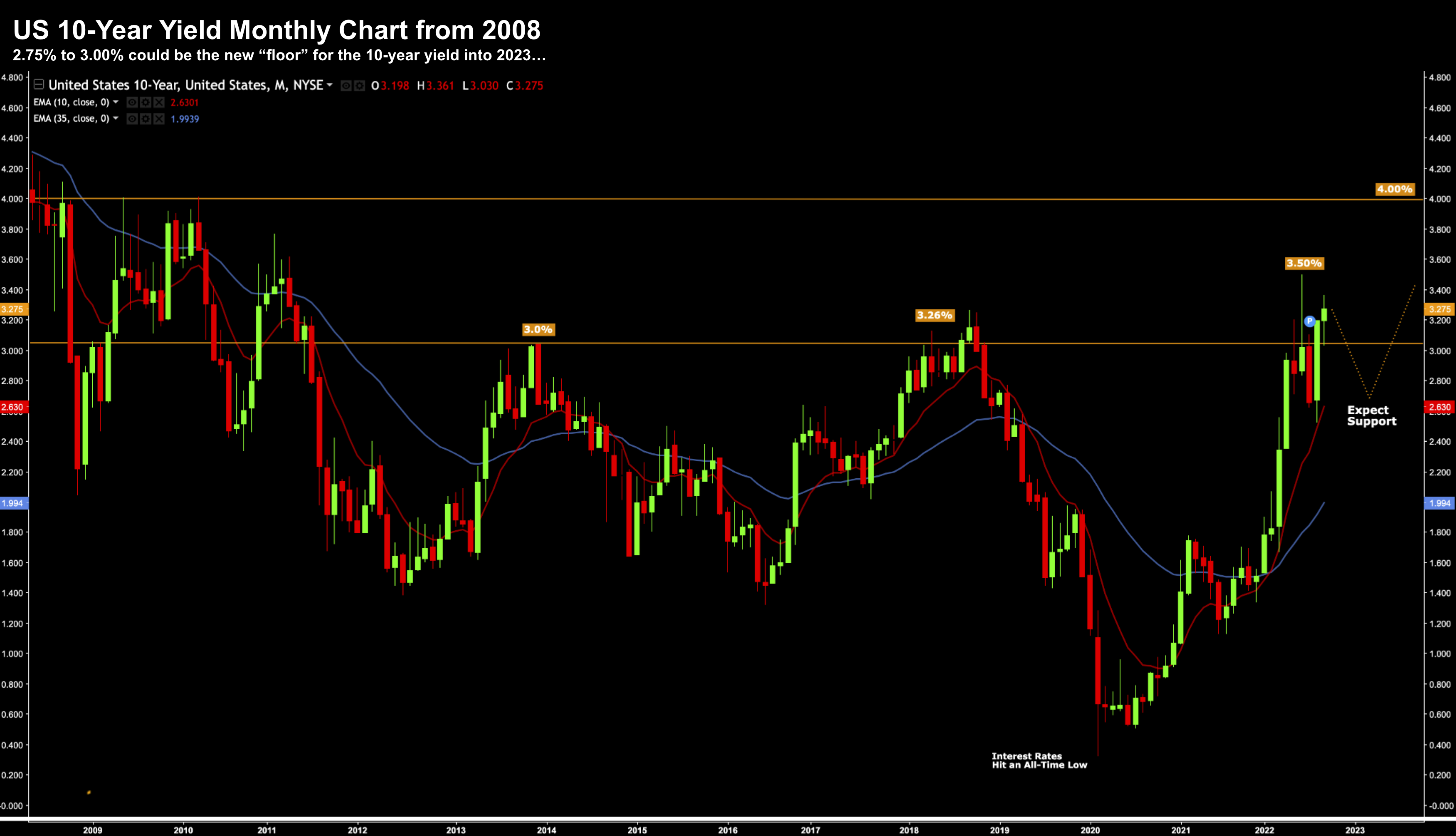

The two biggest headwinds facing stocks are higher rates (bond yields) and the US dollar index. Both are yet to peak or show signs of a downward trend. And until they do - we can't call a bottom in equities.