Wage Growth of 5.2% to Strengthen Fed’s Resolve

Wage Growth of 5.2% to Strengthen Fed’s Resolve

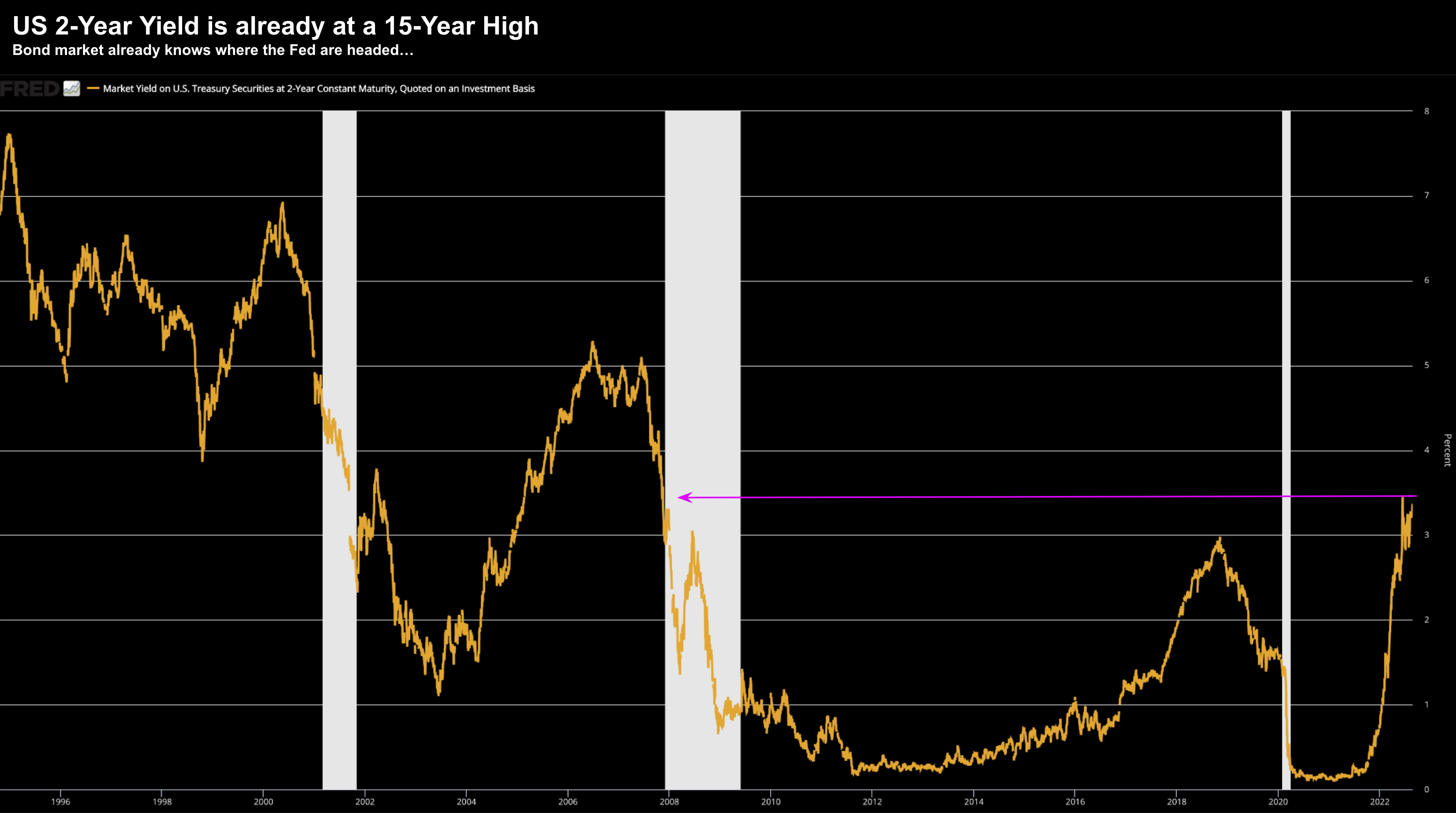

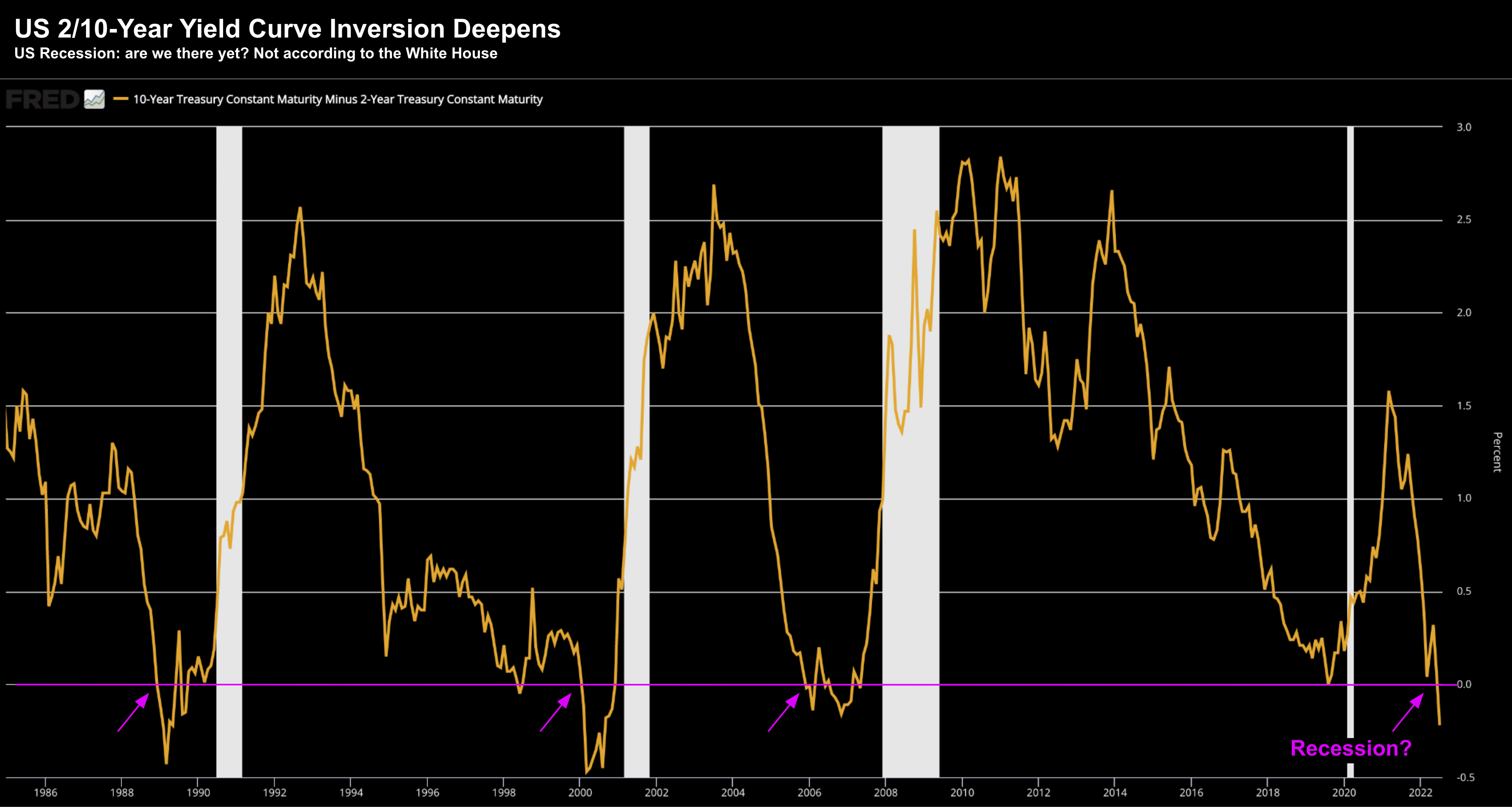

The US economy added 315K jobs in August. Good news. However, wage inflation ripped higher at 5.2% YoY. Based on this, it's likely the Fed will continue with a period of 'unusually high' rate hikes to reduce demand and wage inflation.