Stunning Intraday Reversal… What Does It Mean?

Stunning Intraday Reversal… What Does It Mean?

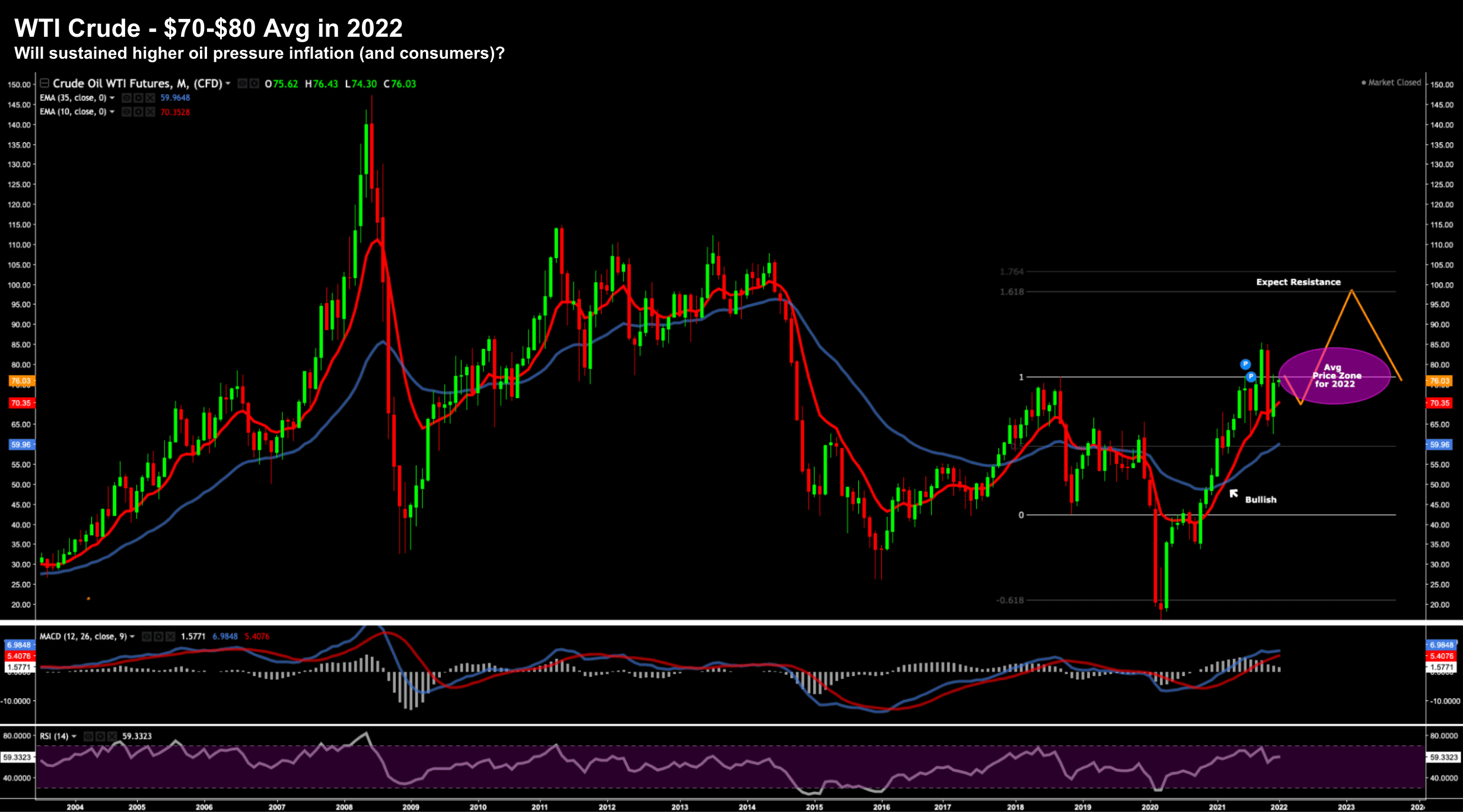

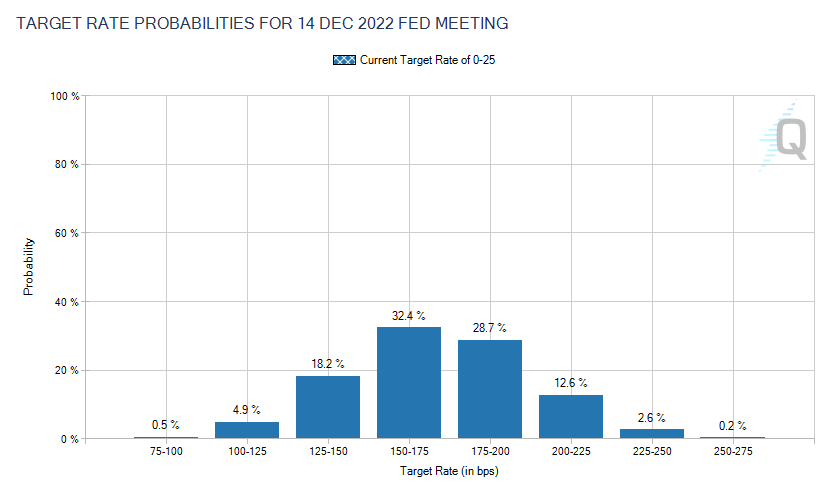

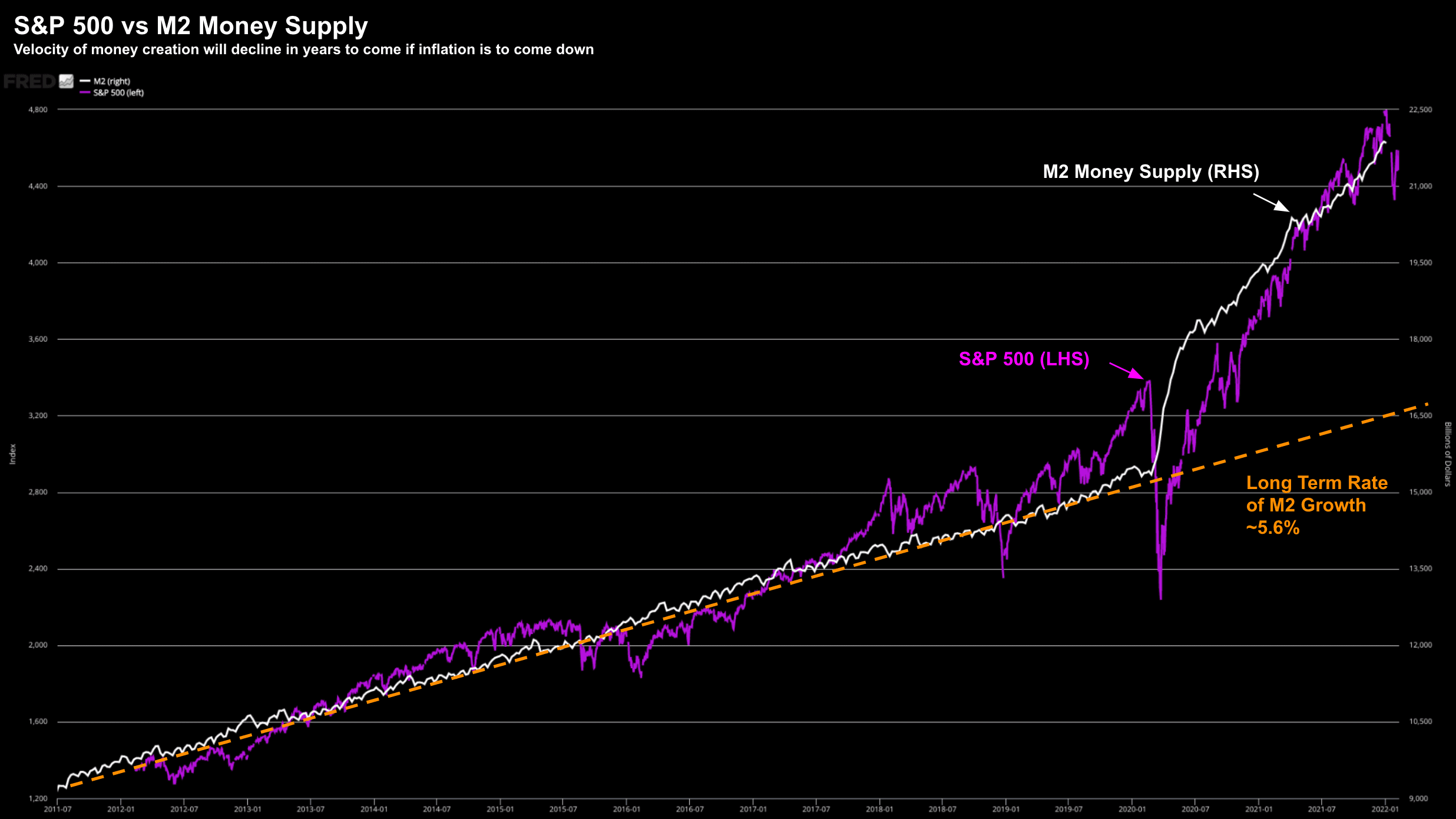

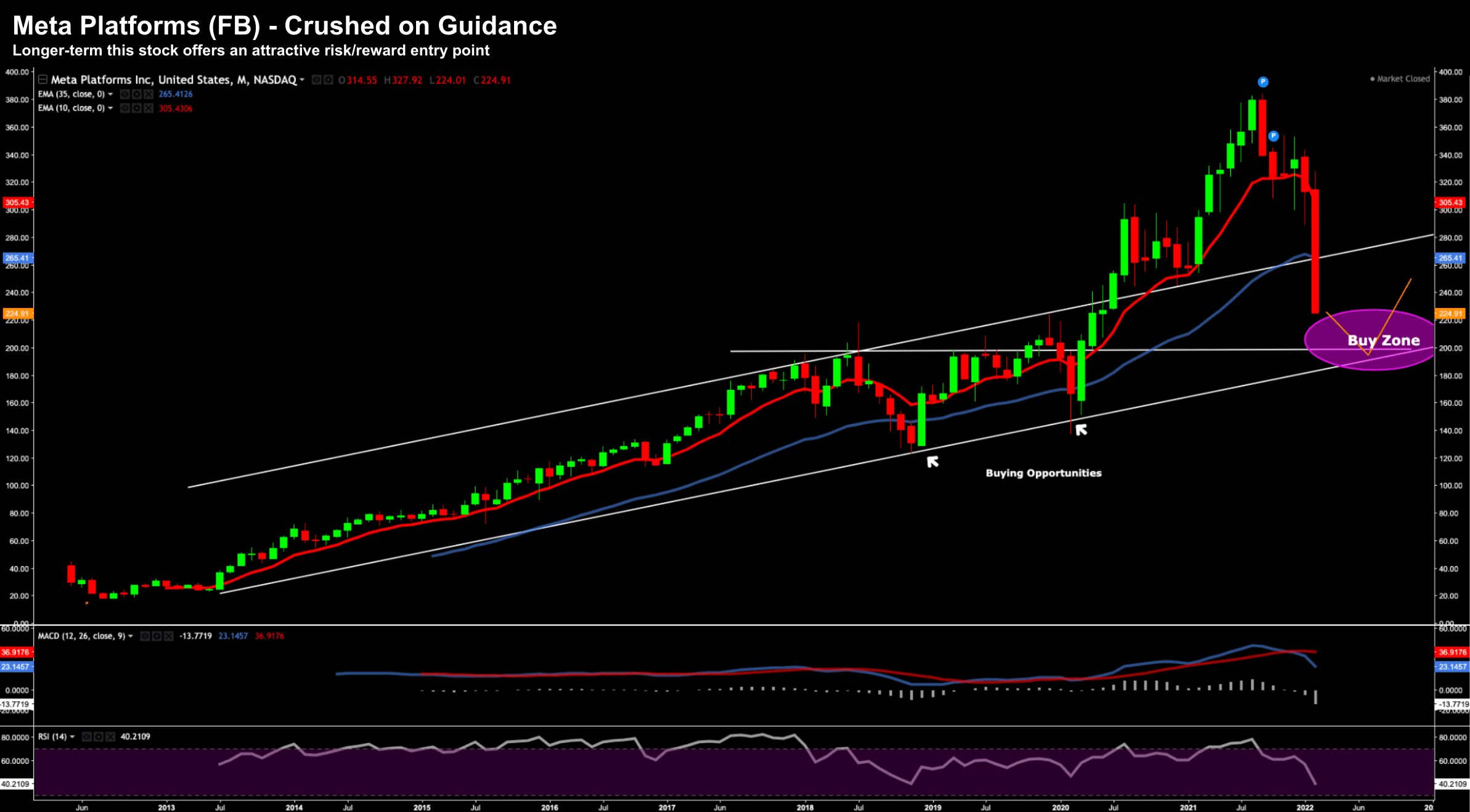

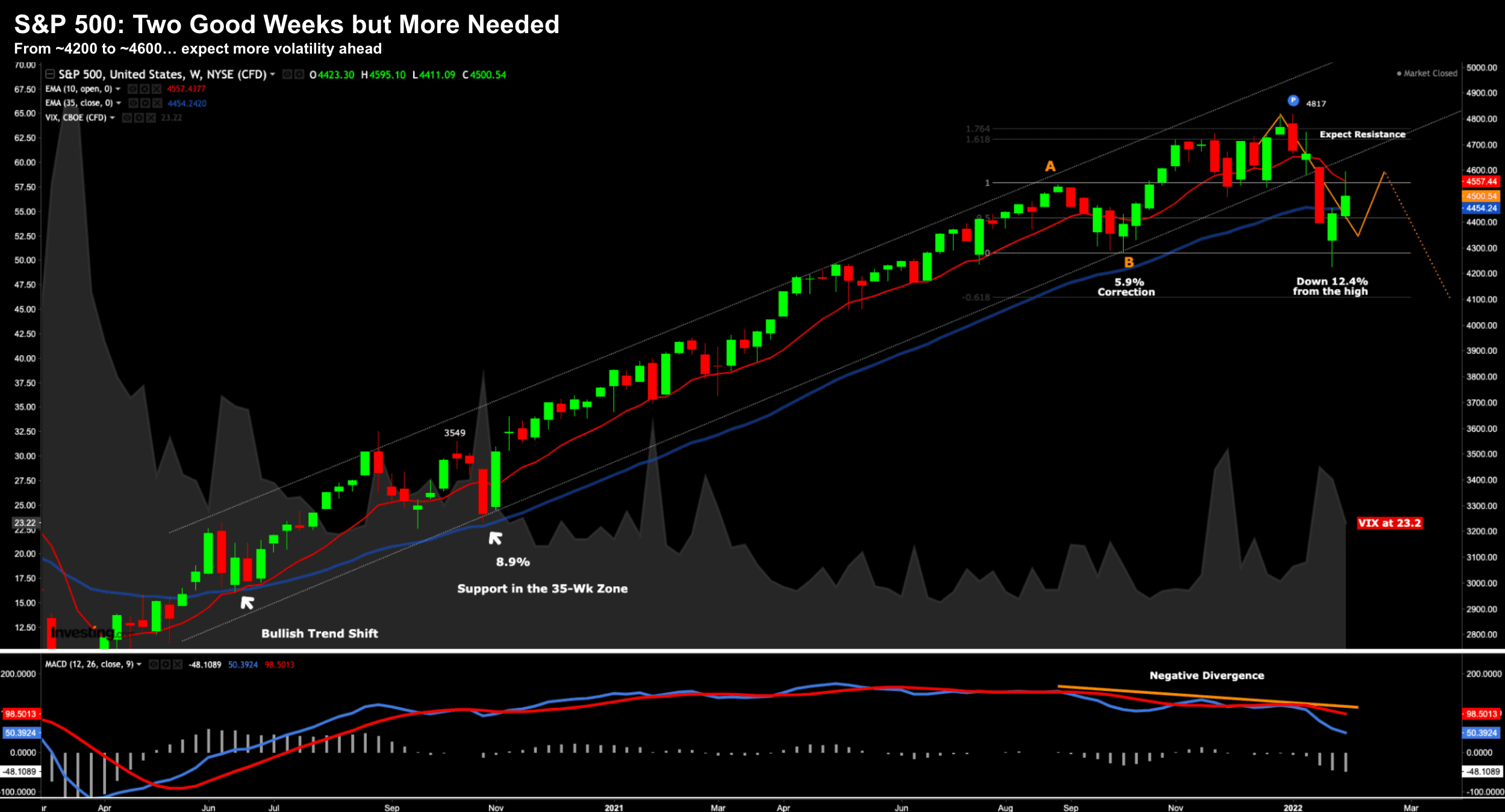

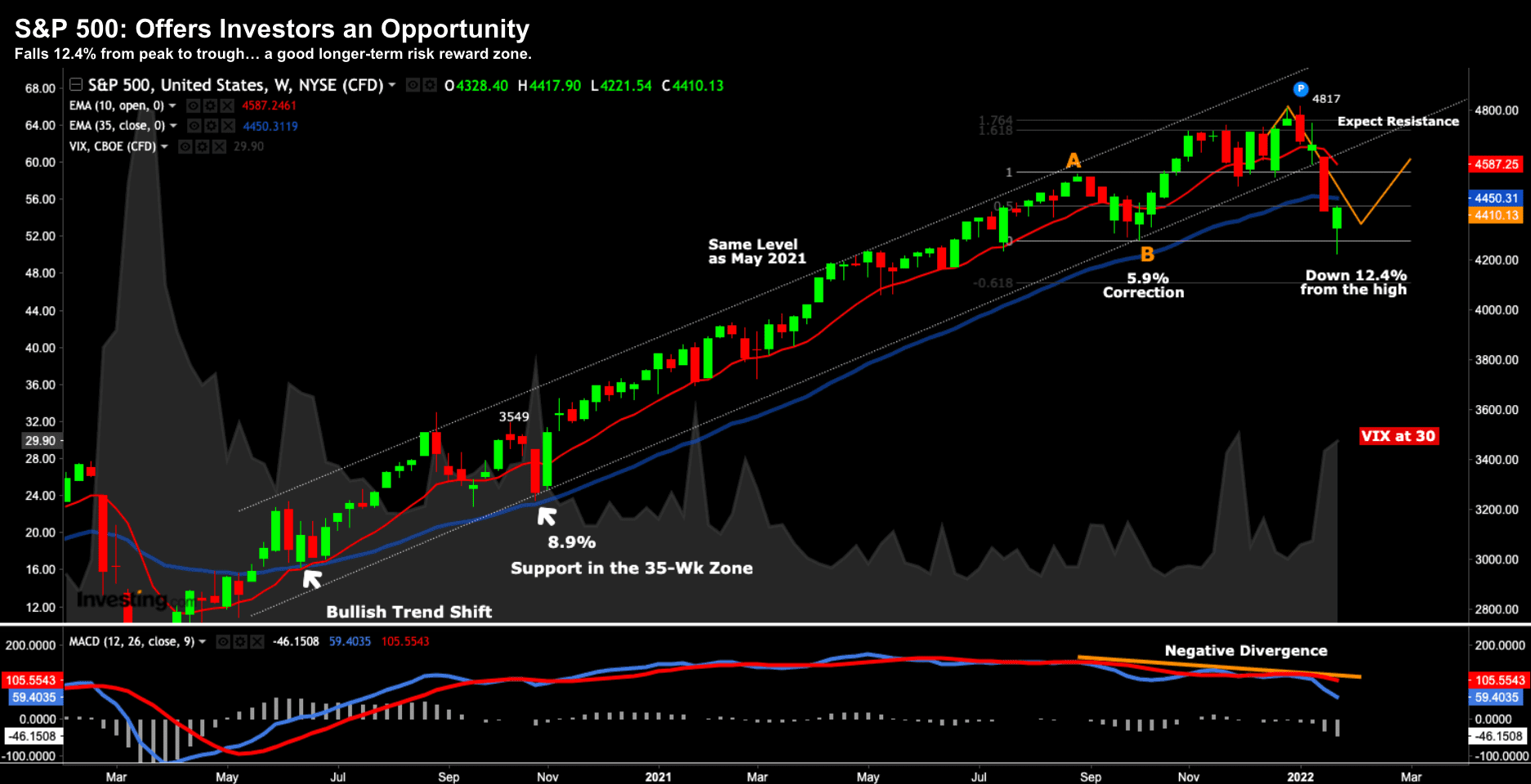

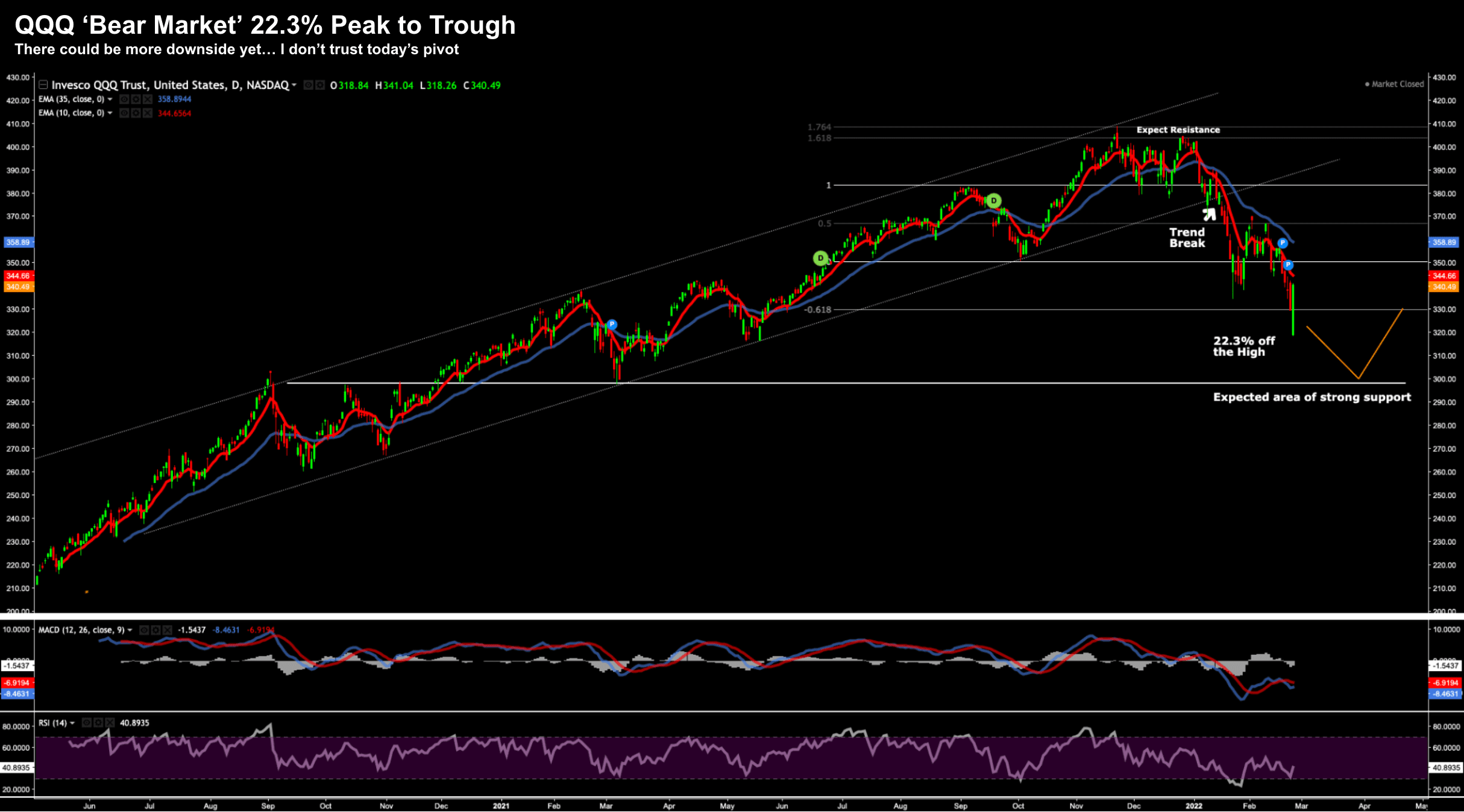

Short covering rally? Or genuine buyers? Why aren”t bonds catching a bid on Ukraine? Real 10-Yr Yields highlight the inflation problem Before trade opened today – Dow Futures were down some 800 points. The unprovoked attack on Ukraine from Russia…