Fasten Your Seat Belts…

Fasten Your Seat Belts…

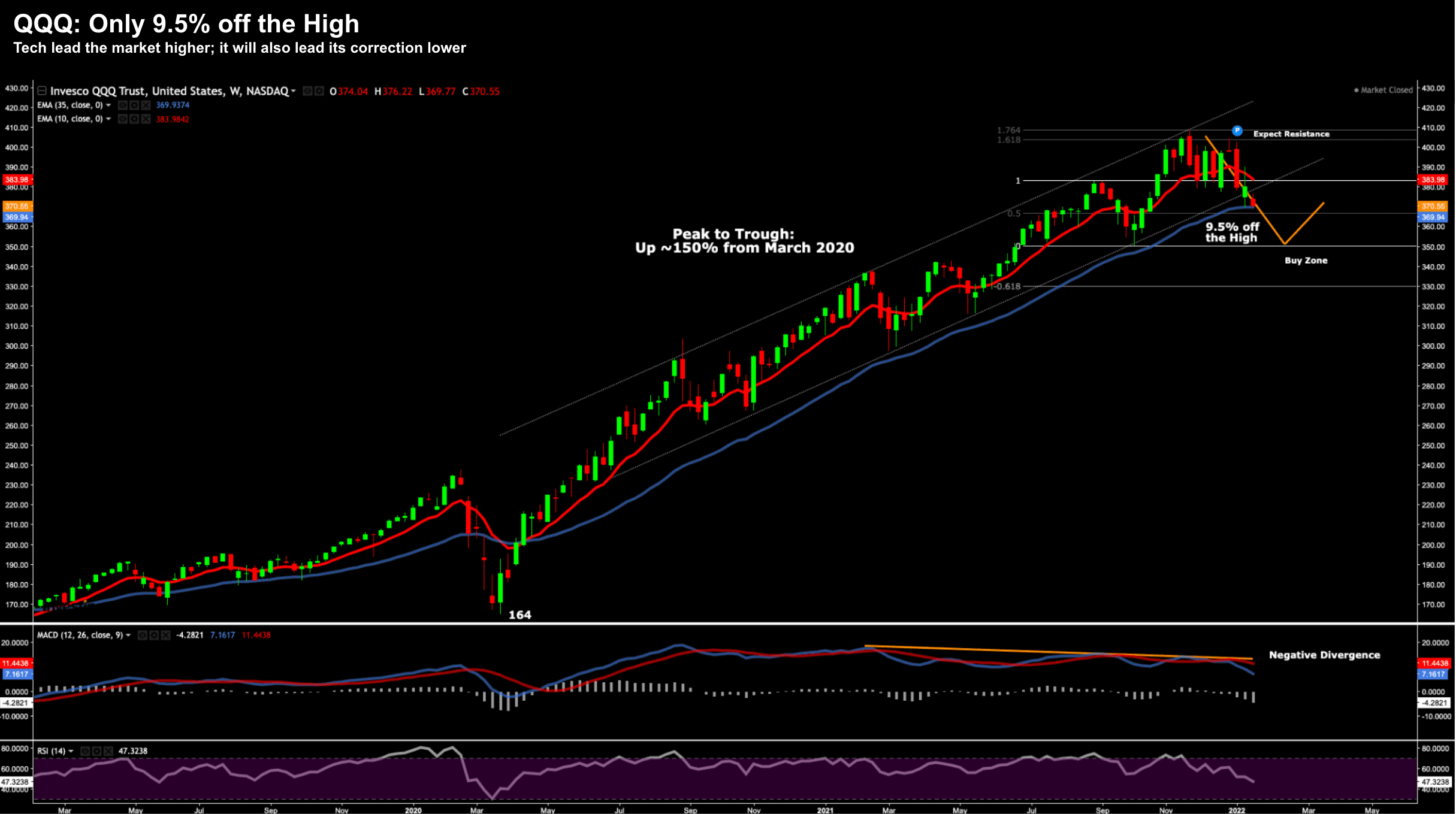

Get ready for a lot more volatility. In short, "more Fed will equal more vol". Rate hikes are coming... only question is how many and how fast...

Fasten Your Seat Belts…

Fasten Your Seat Belts…Get ready for a lot more volatility. In short, "more Fed will equal more vol". Rate hikes are coming... only question is how many and how fast...

Tech Sell-Off Not Finished Yet

Tech Sell-Off Not Finished Yet109 of the S&P 500 stocks are now 20% off their highs. But I think there's much more to come... you need to stay patient here.

Earnings: Will Value Outperform Tech?

Earnings: Will Value Outperform Tech?Money has been rotating from growth names into 'value' (i.e. those that pay dividends; have predictable cash flow and trade at lower multiples).

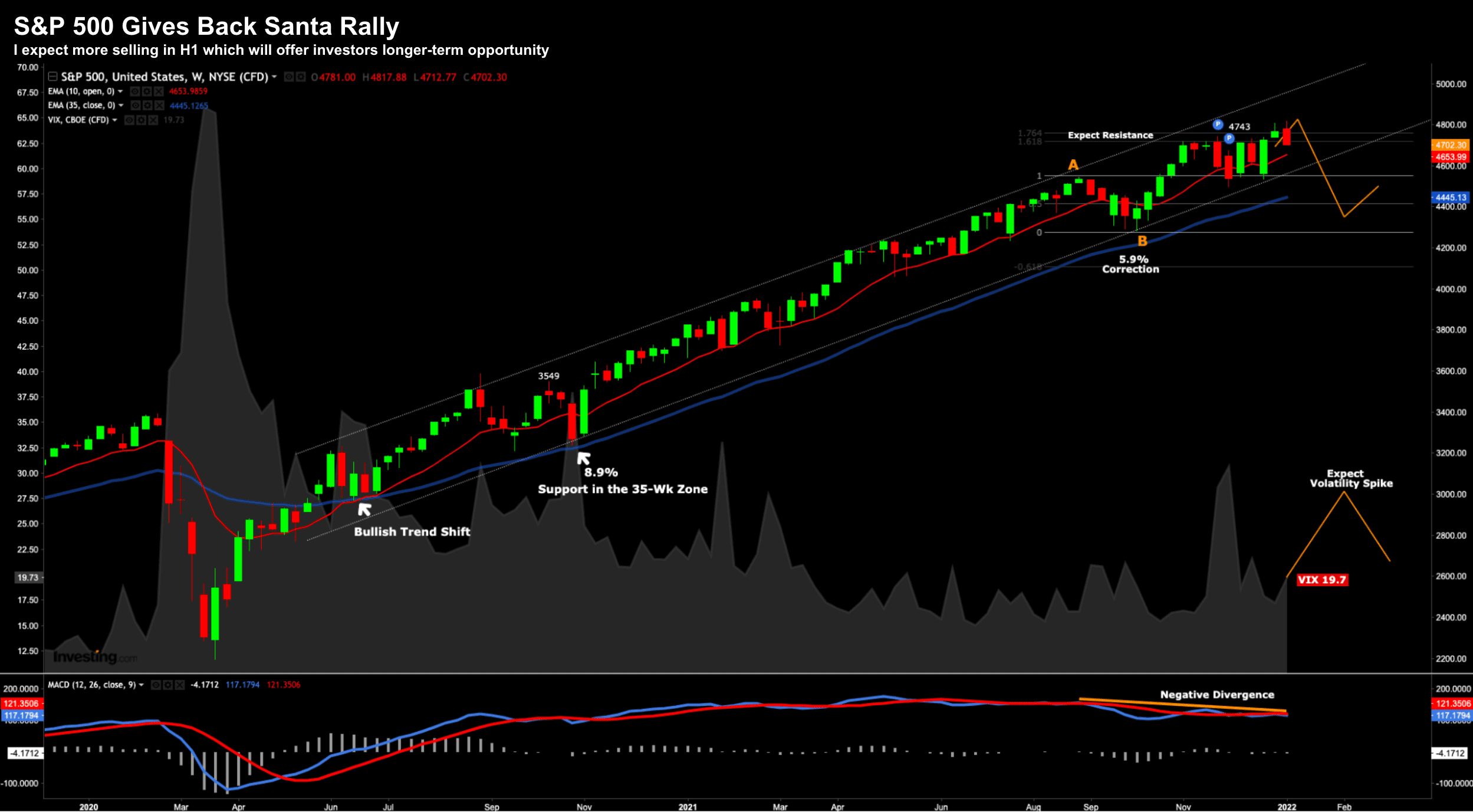

Remain Wary of this Bounce

Remain Wary of this BounceOver the longer-term - the market always correlates to the direction of earnings. The exception is when we have a negative economic backdrop... which we don't have today...

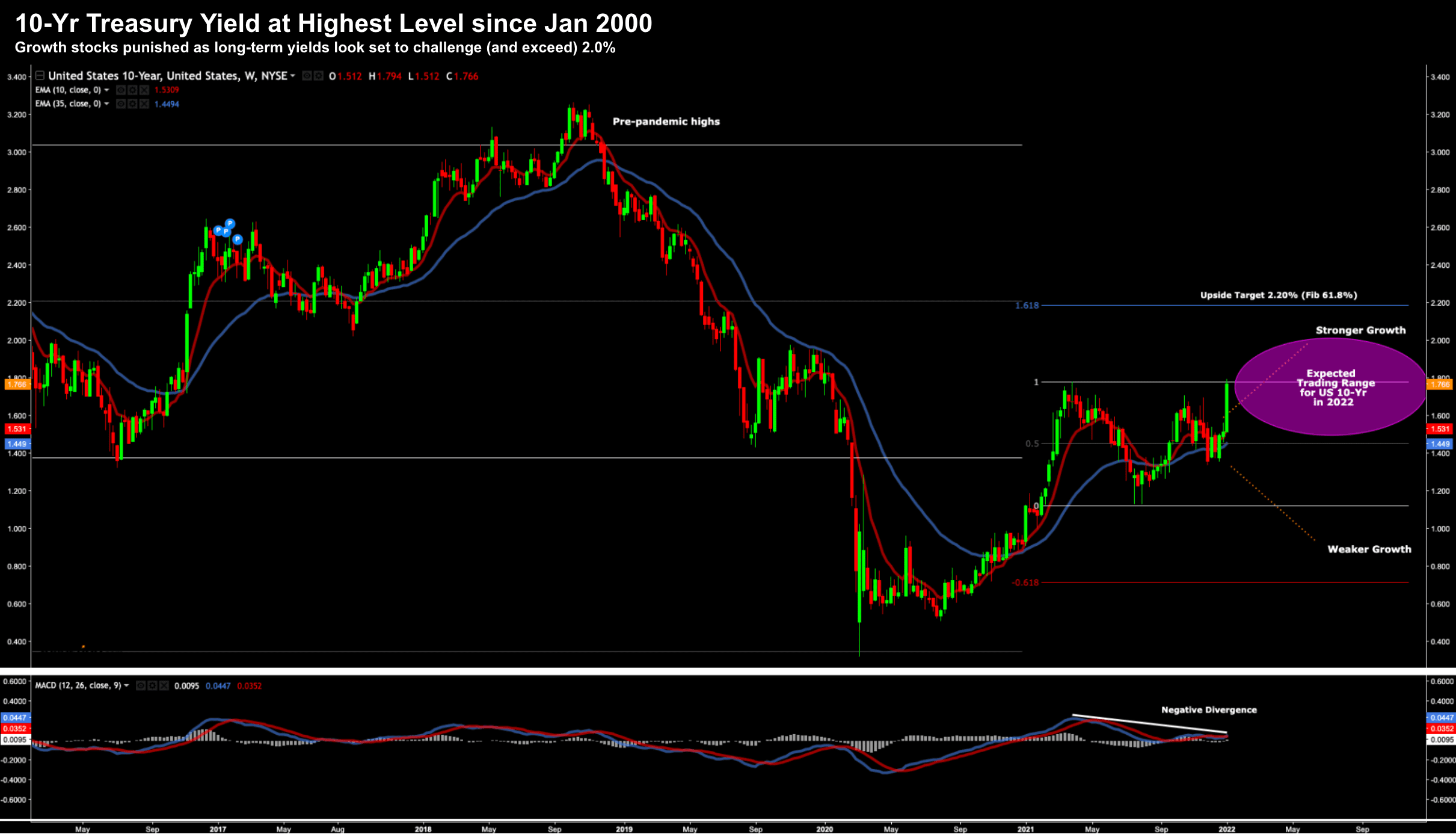

Massive Bond Exodus to Start ’22

Massive Bond Exodus to Start ’22Whilst we are just one week into the new year - the selling in bonds has been nothing shy of ferocious. A combination of red-hot inflation (more to come with CPI this week) and a hawkish Fed has sent bond investors racing for the exits - sending yields (and rates) sharply higher.

Value over Growth

Value over GrowthEquities are starting to understand the Fed is serious about containing inflation. This is no longer "let's wait and see" ... it's "we have a problem". This will have meaningful impacts for growth stocks...

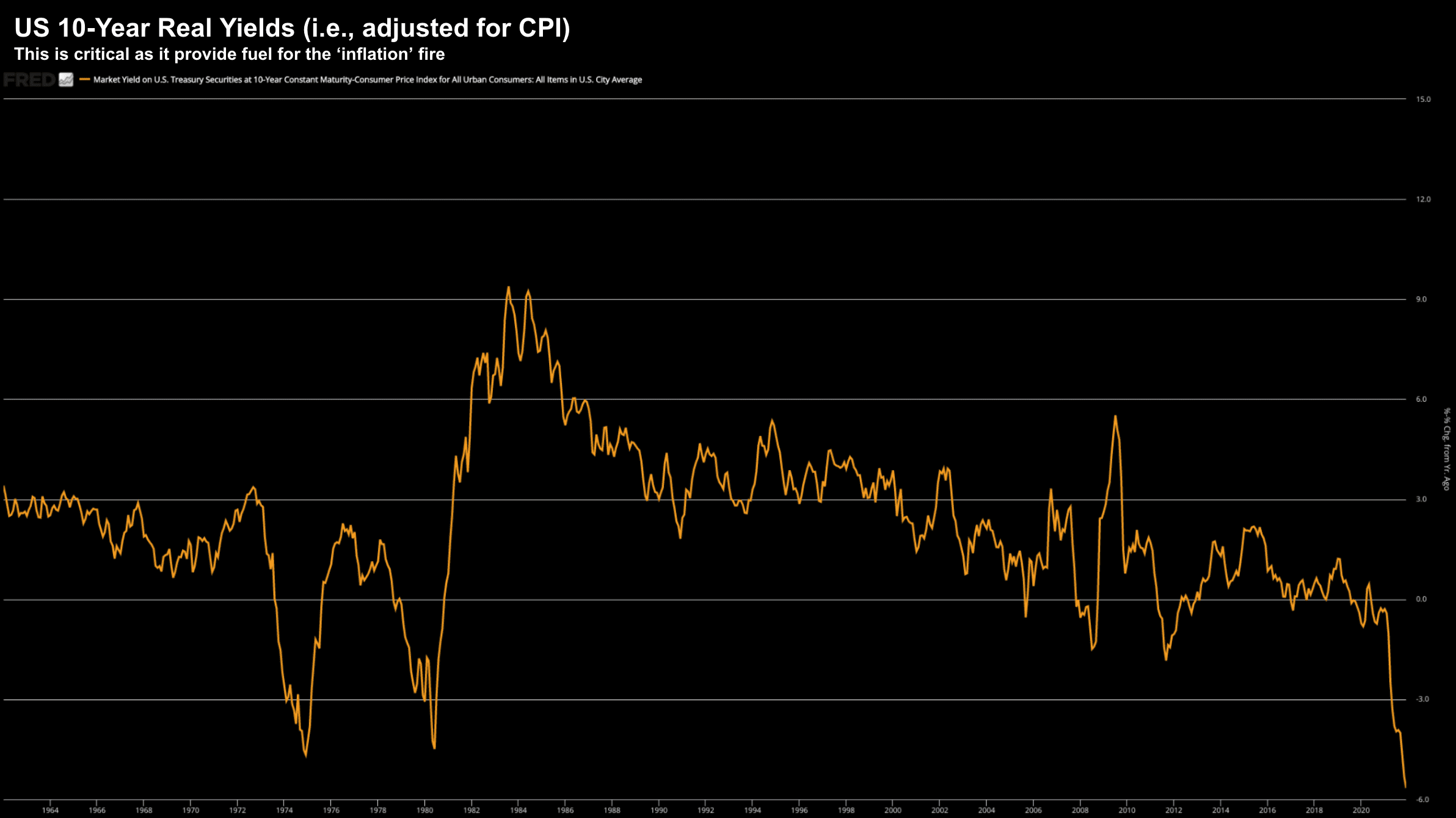

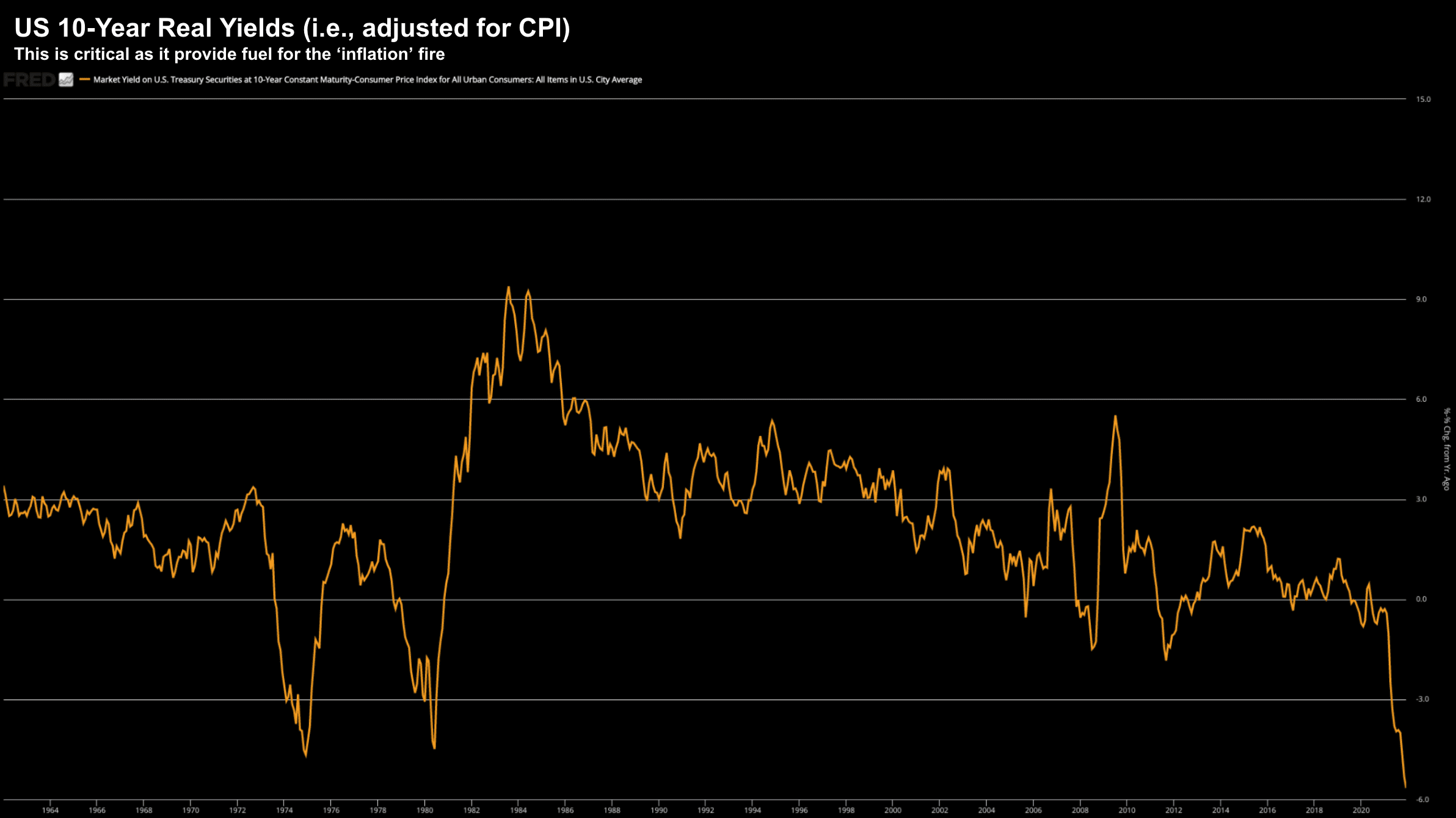

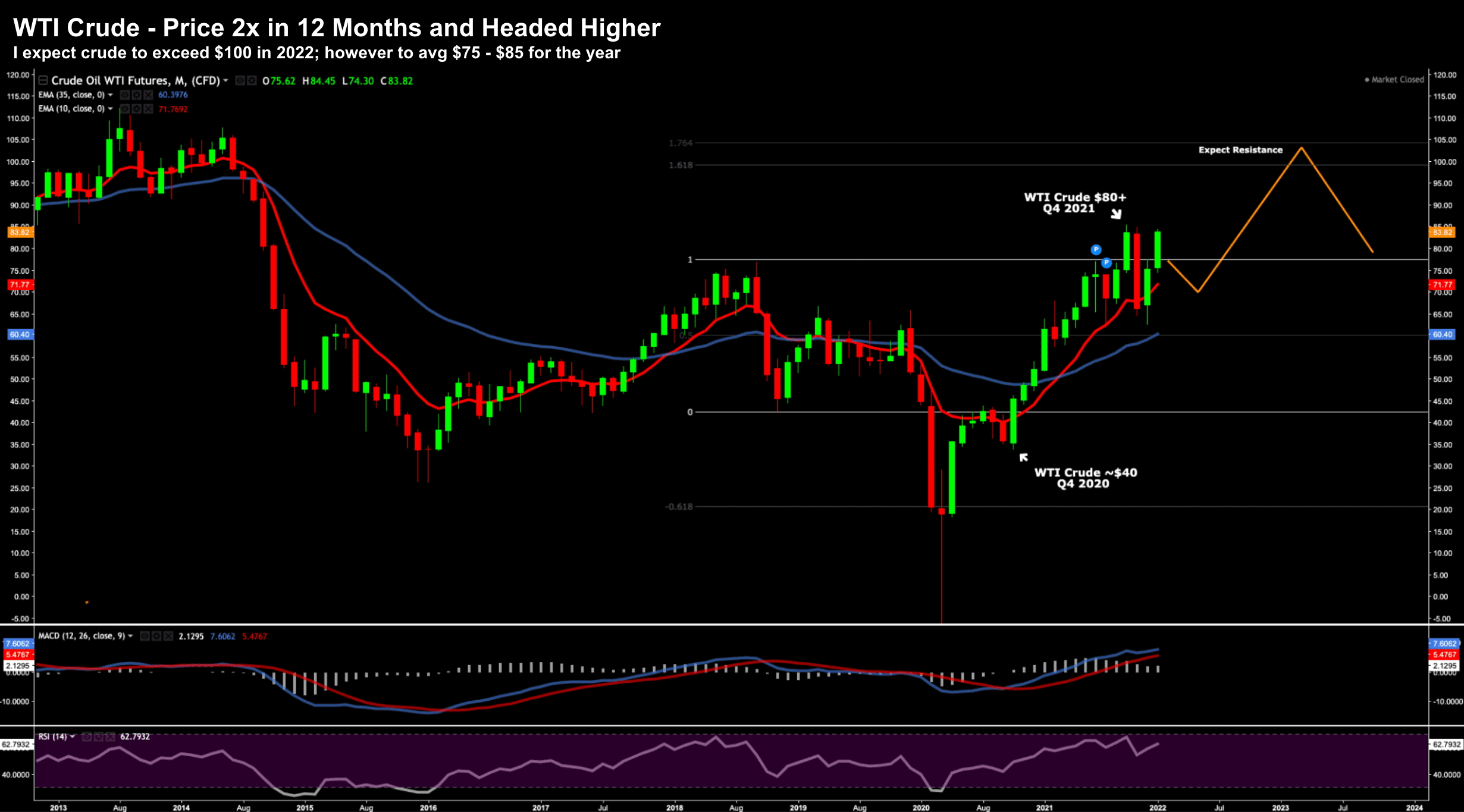

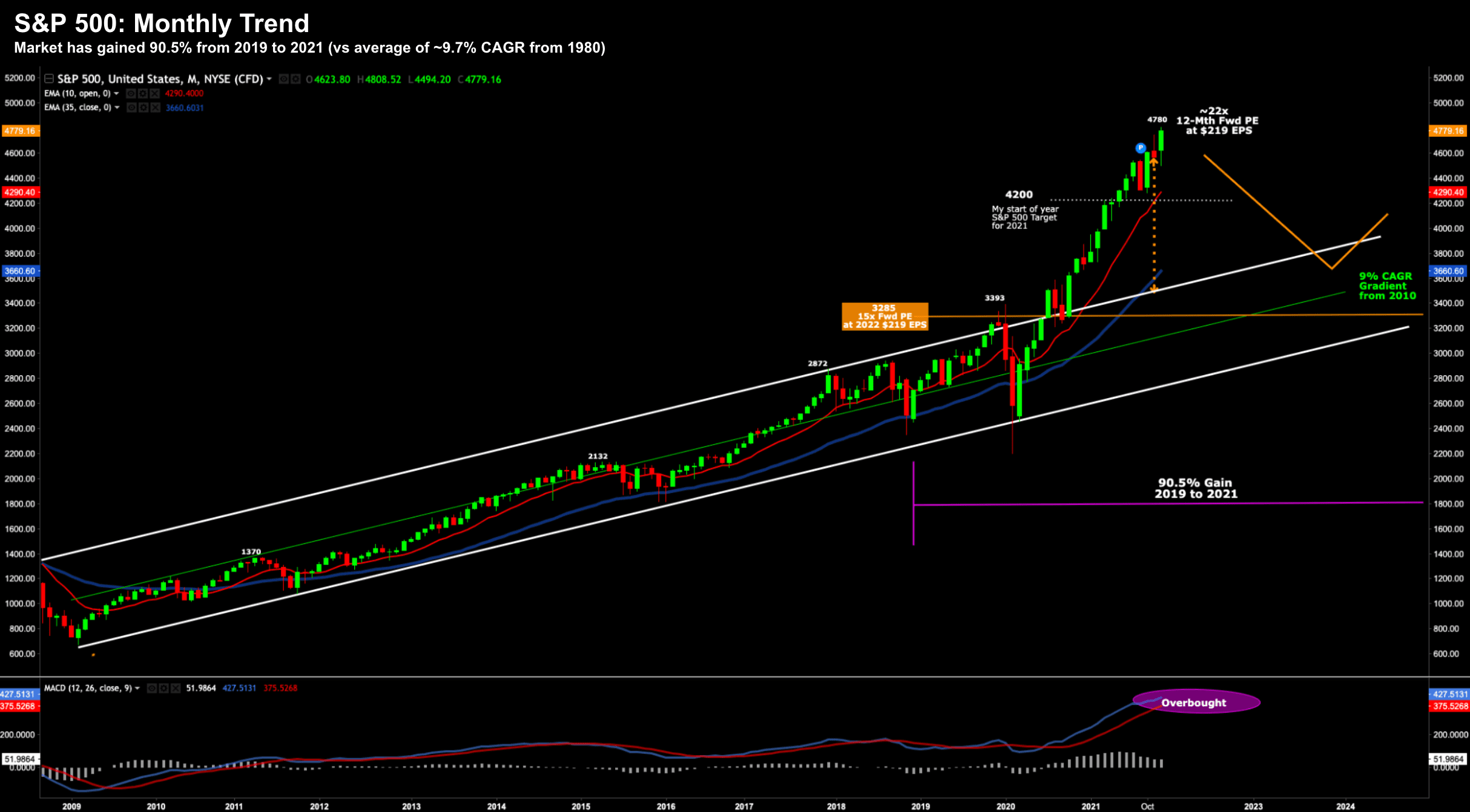

Thoughts on ’22 with 5 Charts

Thoughts on ’22 with 5 ChartsThis post looks at what I think will be the most important (or influential) charts for this year. Spoiler alert: much of this centers on crude oil, inflation, rates and of course the Fed...

Hits & Misses for 2021

Hits & Misses for 2021At the end of every calendar year, I like to look back at what worked and what didn't. I'm mostly interested in reviewing my mistakes... versus trades that worked well. Let's take a look...

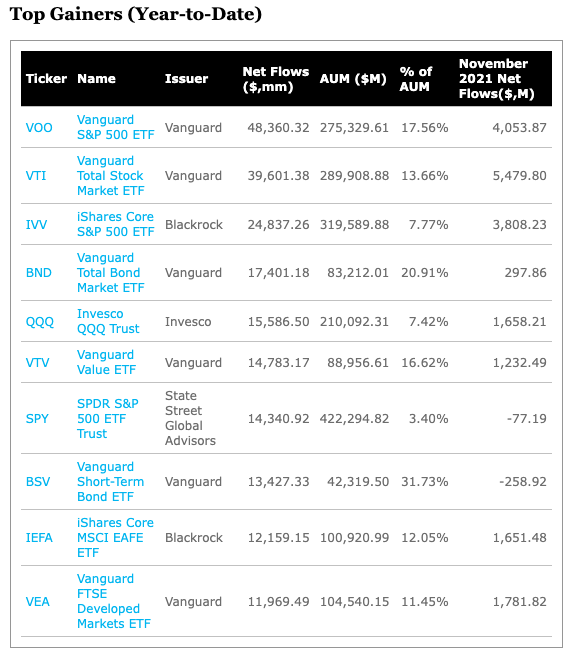

2021 – A Torrent of Buying

2021 – A Torrent of BuyingWhen stock indices double their average rate of return in any one year (typically around 10%)... you need to ask why. Two catalysts which come to mind: (i) negative real rates; and (ii) central bank liquidity.

Will We See a Santa Rally?

Will We See a Santa Rally?The S&P 500 dropped ~3% over the past three days - marking the worst decline over a three-day span since September. I feel we are working through the early stages of a decent (buyable) correction.