When Will the Next Recession Hit?

When Will the Next Recession Hit?

The market is afflicting the comfortable... and discomforting the afflicted. What felt like a relief rally Wednesday abruptly turned negative to end the week....

When Will the Next Recession Hit?

When Will the Next Recession Hit?The market is afflicting the comfortable... and discomforting the afflicted. What felt like a relief rally Wednesday abruptly turned negative to end the week....

Relief Rally on ‘Expected’ Fed Move

Relief Rally on ‘Expected’ Fed MoveThe Fed's $1.44T QE program is going to end in a few months. Great news... but I would argue 6-9 months too late. They caused a bubble in speculative assets (which will bust) - not to mention stoking dangerous levels of unwanted inflation.

It’s All About the Fed…

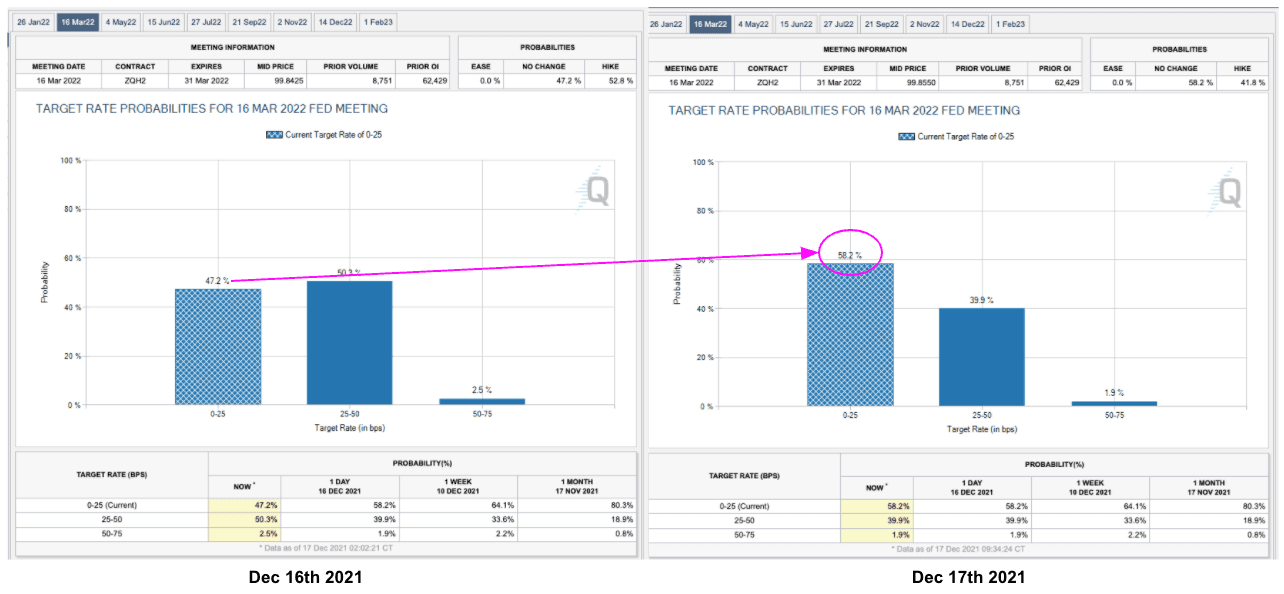

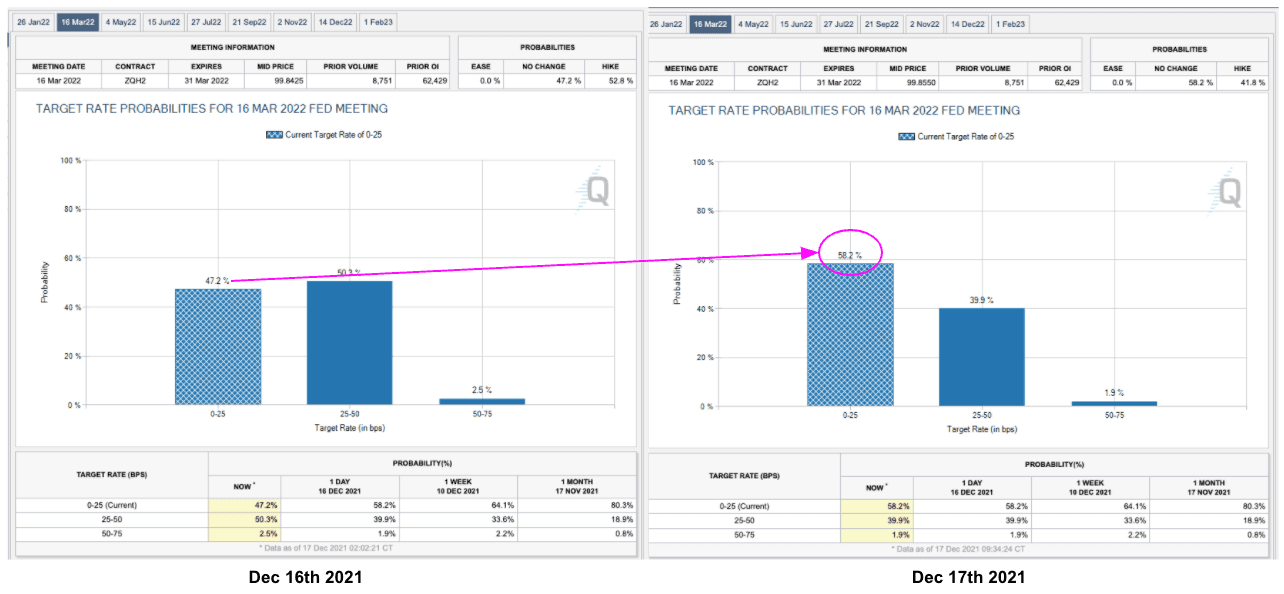

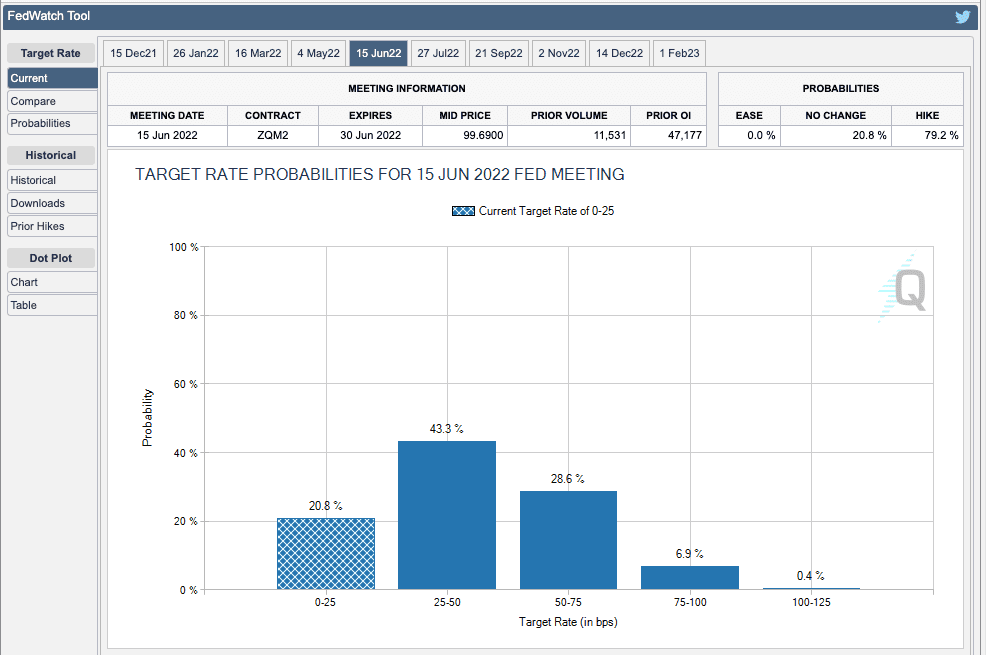

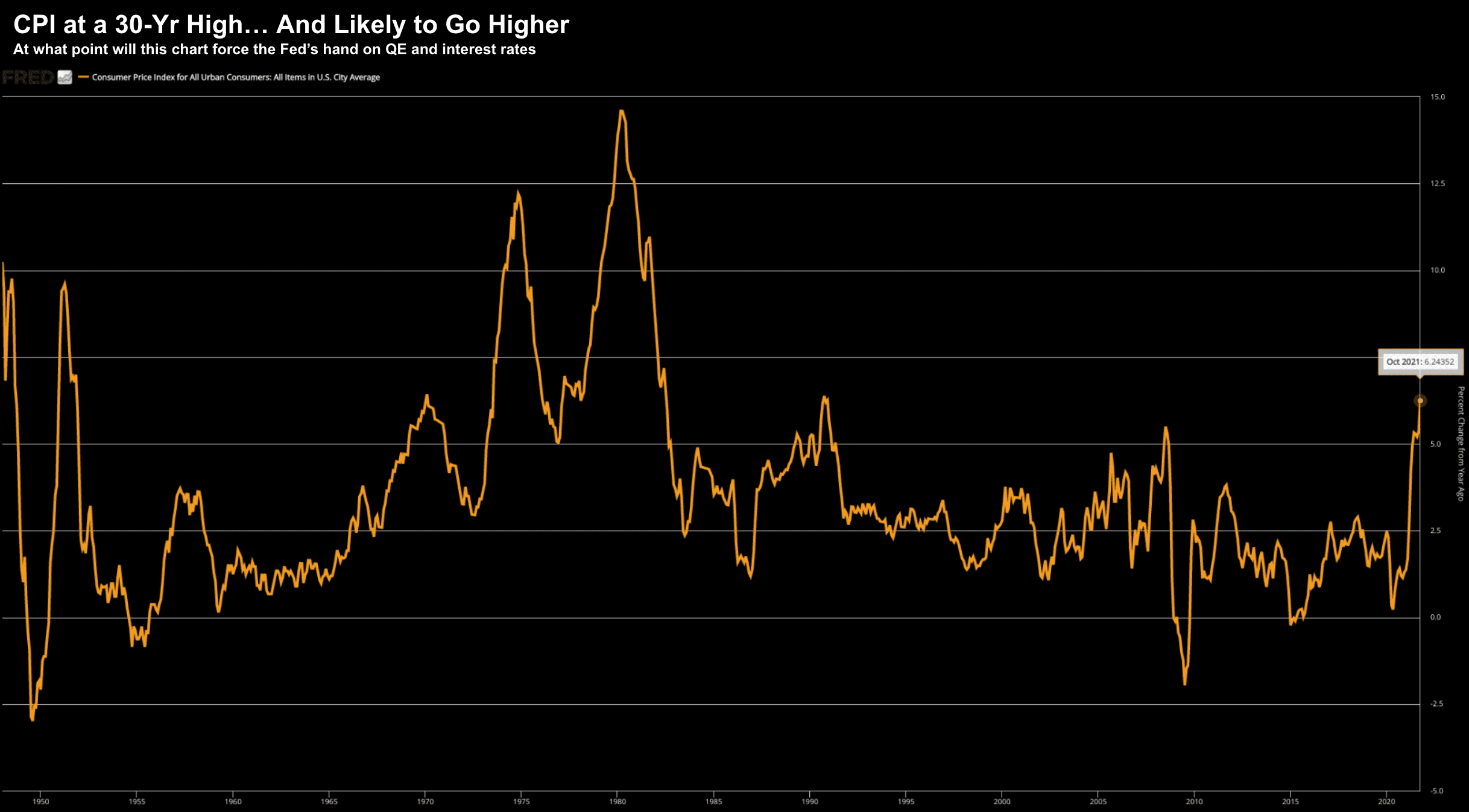

It’s All About the Fed… Nothing has a greater impact on financial risk assets than the availability of liquidity and its price. Rate hikes are coming - it's just how many and how fast?

Hot CPI Priced In… But are 3 Rate Hikes for ’22?

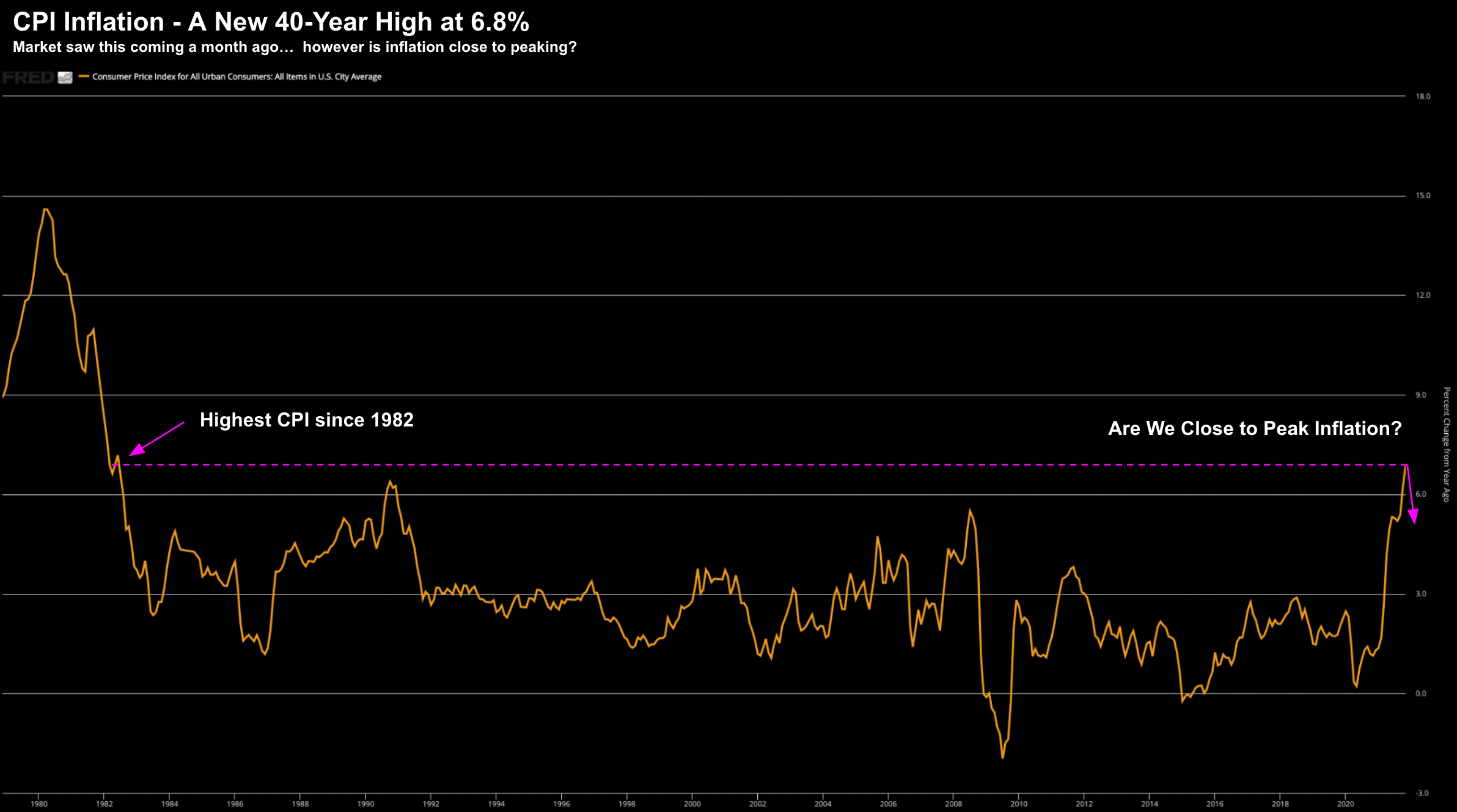

Hot CPI Priced In… But are 3 Rate Hikes for ’22?Friday we learned US CPI hit 6.8% year-on-year for the month of November. Here's the thing: there is an entire generation of people have never experienced 'sticker shock' like this in their adult lives.

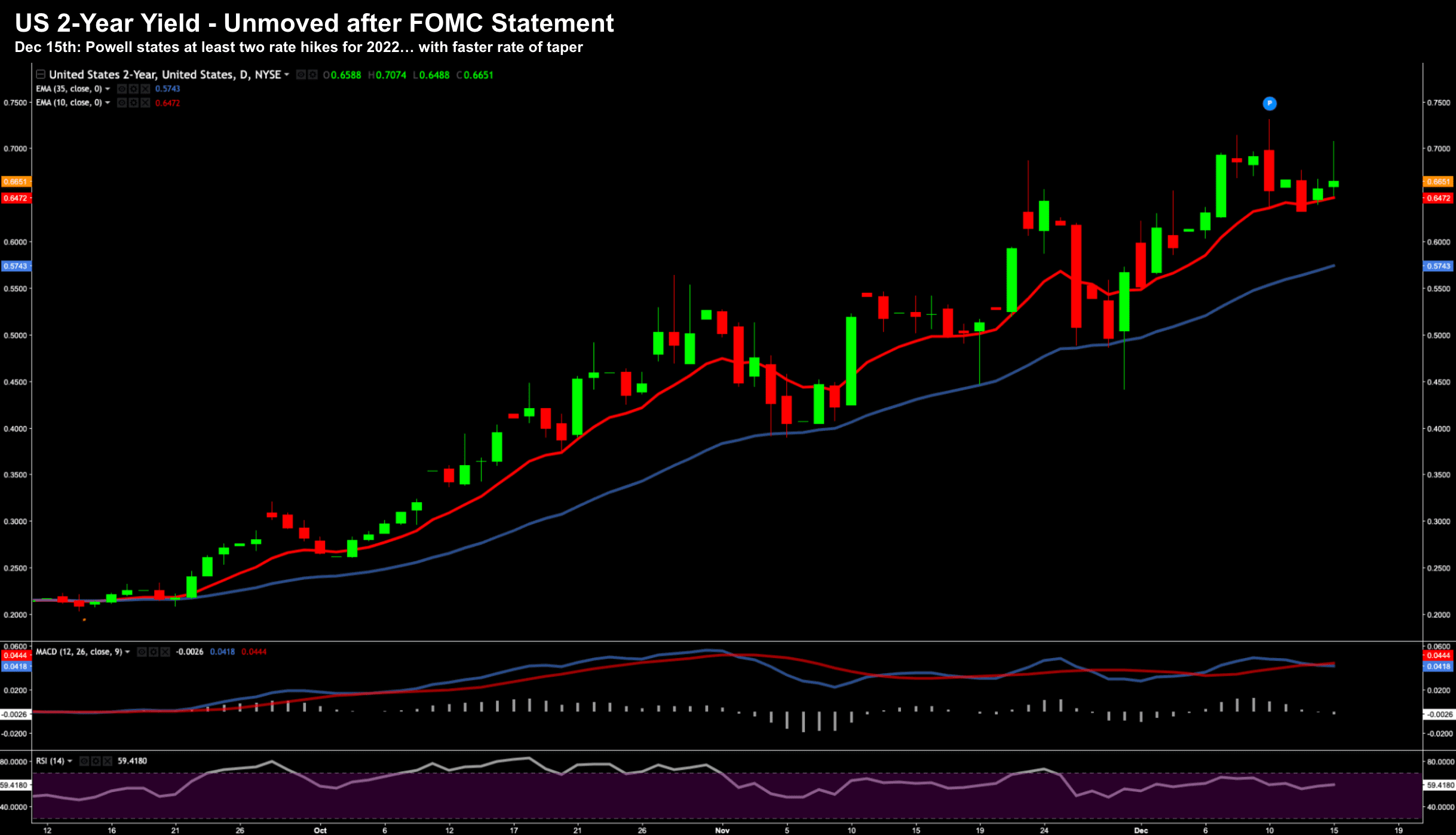

Reaction in Bond Yields to Tell CPI Story…

Reaction in Bond Yields to Tell CPI Story…Ready for higher rates? They are coming. Higher rates will equal a stronger dollar -- which will pressure global markets and particularly emerging market debt.

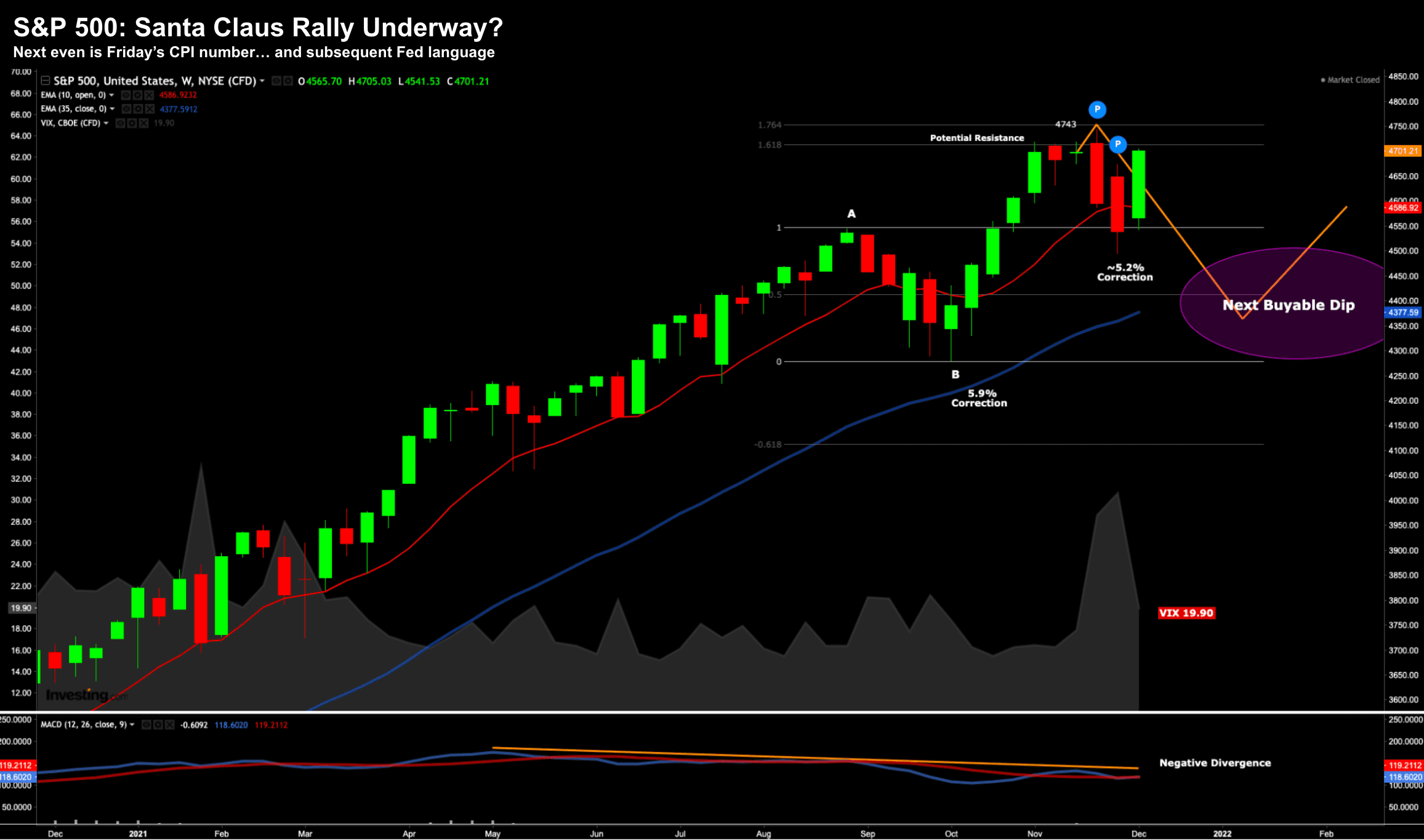

Stocks Rebound… With “Big Tech” Upgraded

Stocks Rebound… With “Big Tech” UpgradedAre the lows in before Christmas That's hard to know. Stocks have rallied strongly to start the week after last week's ~5.2% pullback. It's been 'higher-risk' names leading the rebound... with the Russell 2000 and tech surging.

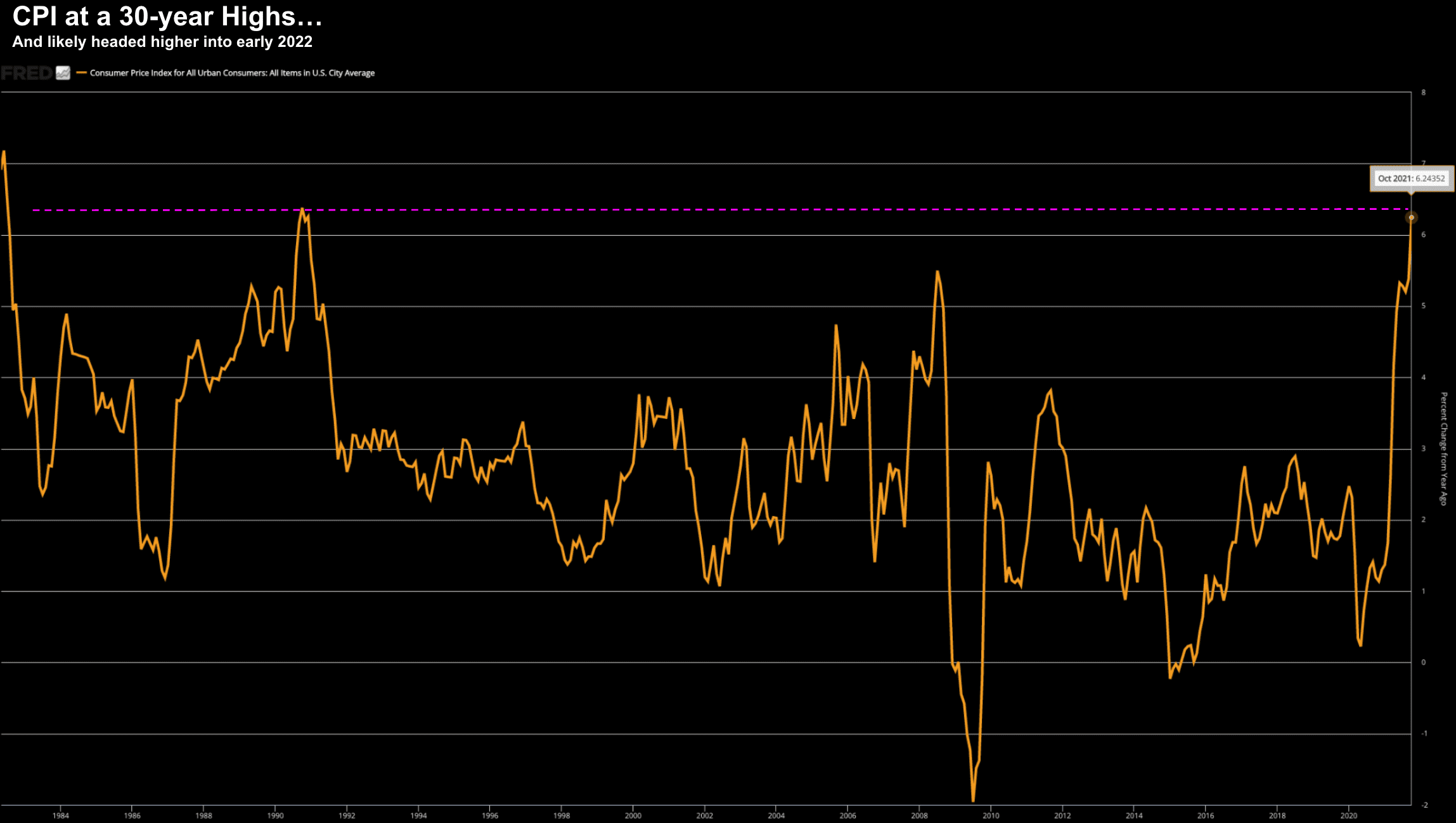

Turbulent Times Ahead

Turbulent Times AheadCPI is expected to jump above the annual pace of 6.2%... the hottest in 30 years. Makes sense to me - the Fed has expanding its balance sheet to $9T and real rates remain negative - why wouldn't we see inflation? It's going higher.

Powell’s Pivot… As Market Frets over Omicron

Powell’s Pivot… As Market Frets over OmicronHow quickly things can change. From the Fed pivoting on its dovish sentiment... to the 'Omicron' variant arriving in California. This has seen the market turn on a dime.

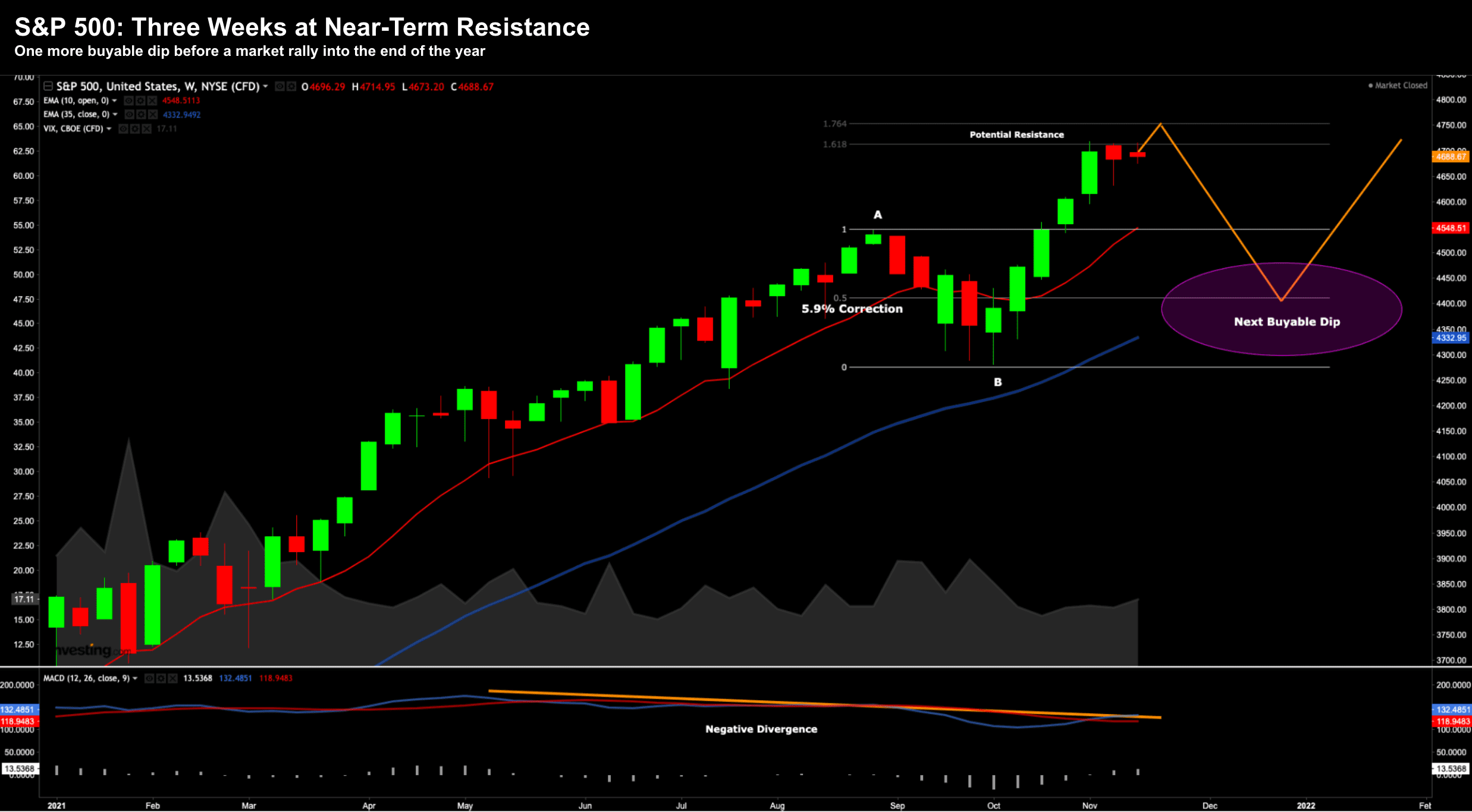

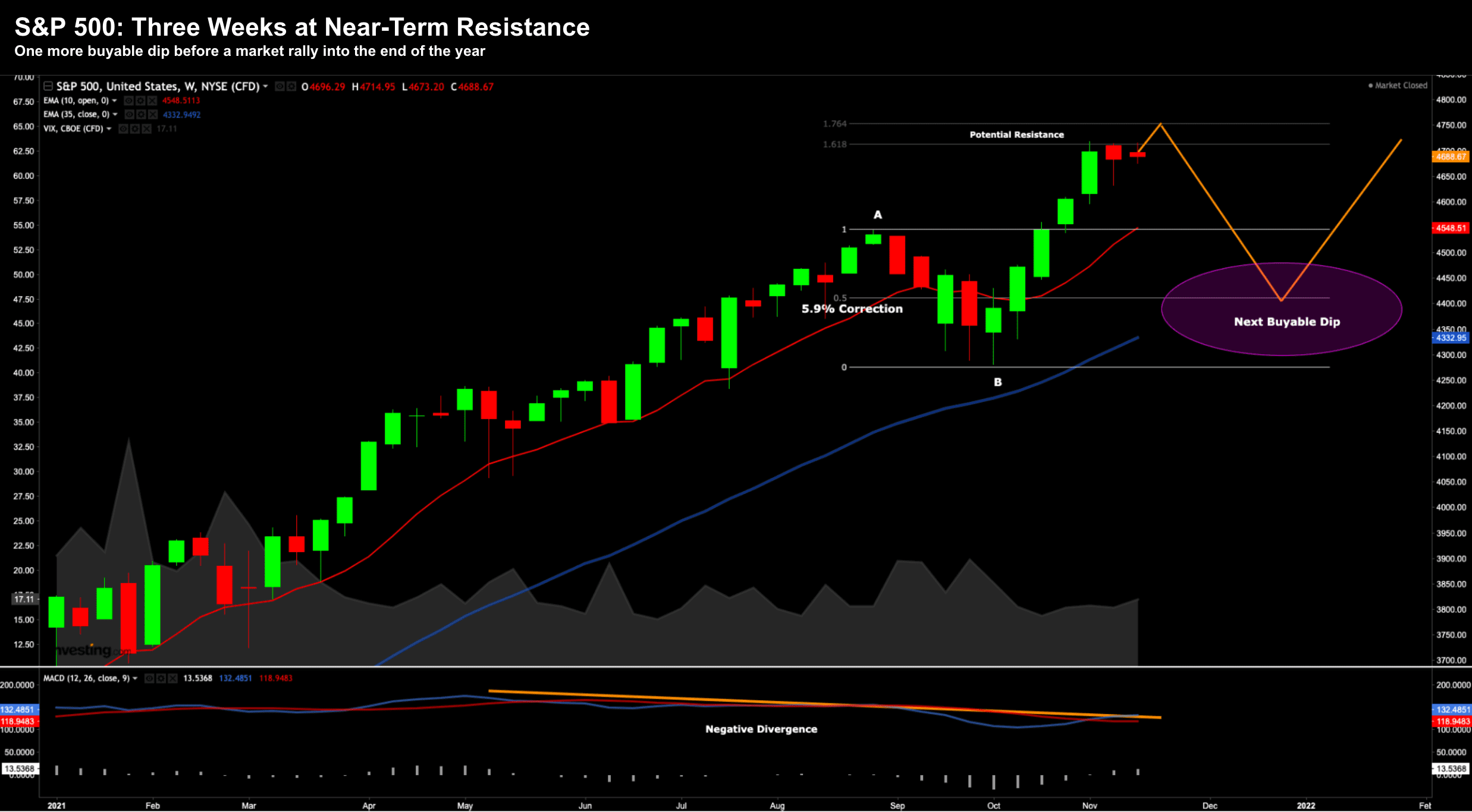

Ready to Buy the Dip?

Ready to Buy the Dip?Of late, investors focused on risks surrounding unwanted inflation, central bank tightening and supply-chain snarls. The VIX lingered below 15 - a sign of complacency and what I felt was over-confidence. Overnight that changed...

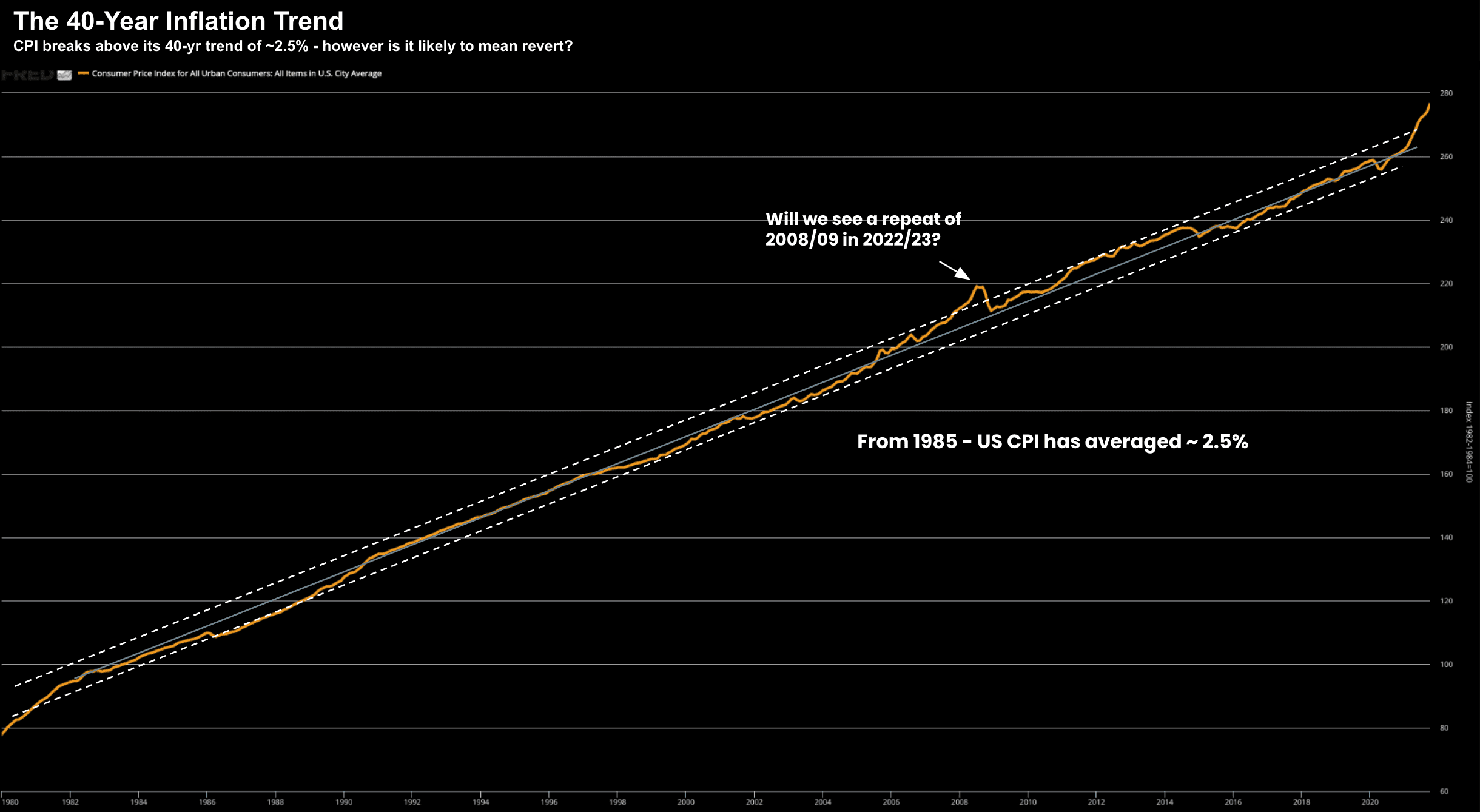

Is this 40-Year Inflation Trend Over?

Is this 40-Year Inflation Trend Over? When it comes to inflation, I continue to pay attention to the 5-Year, 5-Year Forward expectations... which trade at a very modest 2.33%. And whilst inflationary pressure will not ease a great deal over the coming 12+ months (maybe longer) - beyond that the market sees mean reversion.