Big Tech Breaks Out… Two More Quality Stocks to Watch

- Big tech enjoys another strong day…

- Two more stocks for your watchlist on a "buyable dip"; and

- Nvidia blows away revenue and earnings expectations

It seems yesterday"s post was well timed…

Big tech had a good day… with Apple, Google and Amazon moving higher.

Amazon was up $120 per share – now challenging almost $3,700.

Apple added another $4 to almost $158… on news of its expected circa 2025 entry in the EV market.

Why they didn"t buy Tesla 5-7 years ago I don"t know?

These two recent additions to my portfolio are up 16.2% and 14.5% respectively… but I think there"s a lot more to go.

My largest portfolio position – Google – is up over 65% this year. Google has probably been the stand-out performer of the 5 for 2021.

Now yesterday I offered two names for your watchlist:

1/ Snowflake (SNOW); and

2/ Taiwan Semiconductor (TSM)

TSM was up a few percent- perhaps on news of strong chip demand from NVDA.

Keep an eye on these two names… however be patient.

Here are two others I am watching…

#1. Charles Schwab (SCHW)

Readers have heard me recommend JP Morgan and Bank of America the past 12+ months.

They were my two preferred plays in the sector and have performed well.

The logic was not complex (nor should it ever be):

- I expected the yield curve to steepen (i.e., improving bank"s margin)

- The Fed was adding significant liquidity to the system (banks always do well with QE); and

- Consumers (and business) remained in very healthy financial position (i.e. lending would grow)

As an aside, if you can"t explain why you are buying something in three bullet points… something is wrong!

Well, turns out banks did trade higher this year.

A lot higher!

But Schwab is a little different to a bank – but I think very well positioned for a rising interest rate environment.

A quick overview:

Schwab is a leader in the discount broker / asset wealth management services industry.

They are one of the 8 leading players and account for 11% of all client assets in retail financial services.

But let"s look at why I think they are going to continue to grow (and make a lot of money for shareholders)

And it"s not in trading commissions!

1. Interest Income

Charles Schwab wrote in his 2019 book, Invested, Changing Forever the way Americans Invest:

[Cash] is a crucial source of revenue for us. We could earn a small spread on the cash clients kept at Schwab by investing it in very safe and short-term investments. … the considerable amount of client cash we hold [is] the bedrock of our business."

In that sense – Schwab is not dissimilar to a deposit taking bank.

Schwab generates interest revenue by investing its clients" account cash balances in fixed income securities but paying clients less interest than it receives.

The spread between the gross interest income Schwab receives and the interest expense it pays out to clients is reported as "net interest income".

But here"s the kicker:

Schwab"s business (or income) improves in a rising interest rate environment.

Now where they differ to a bank is the cash that sits in their accounts is arguably more "sticky"

That cash is client"s trading and investing "funding pools".

And those typically those funding "pools" average around 10-14% on average over the past 5 years.

Naturally in bearish environments – that cash position is a lot higher.

What"s most important to understand is Schwab"s net interest income is highly sensitive to short-term treasury rates.

So if you think the Fed is likely to raise rates (e.g., to tame inflation / reduce money supply) – then a business like Schwab should benefit.

2. Non-Interest Income

This comprises primarily asset management, administration fees and trading revenue.

For example, Schwab makes money when investors deploy capital in either Schwab money market funds, mutual funds, or ETFs.

Here they earn a management or advisory fee.

They also make money via third-party mutual funds — for which it receives a distribution fee from the underlying mutual fund manager.

Finally, there is also client trading revenue.

Put it like this, if money is passing through Schwab"s hands (or sitting on their ledger) – they are making money. Period.

Now trading revenue grew significantly in the first half of 2021 – where Schwab attributed it to increased trading activity and a higher percentage of options trades.

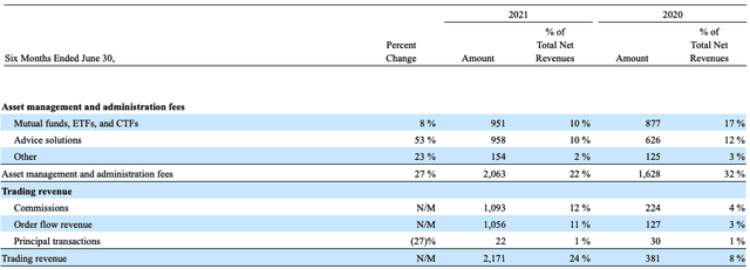

Below is a summary of their asset management and administration fees (32% of all revenue) and trading revenue (8%):

Turning to its fundamentals – Schwab trades at a forward PE of 23x

It"s not cheap – but not that expensive (with the broader S&P 500 trading at a similar multiple).

It runs at a strong profit margin of around 30%… and is expected to grow at 21% per year over the next 5 years.

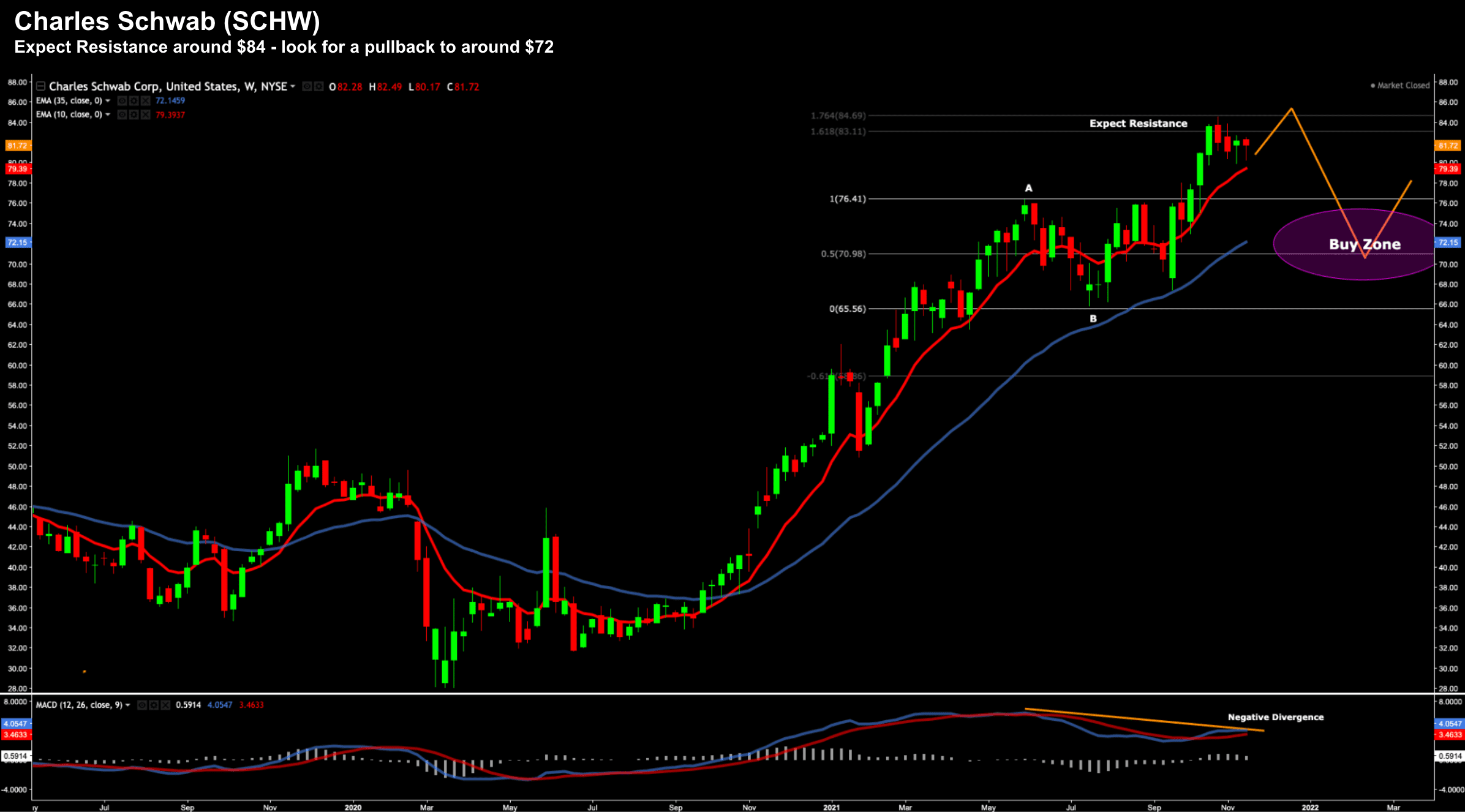

To the weekly chart (and the zone I will get interested):

Nov 28 2021

Technically I see overhead resistance around in the current zone (i.e. ~$84)

That level is 61.8% to 76.4% outside the retracement labelled A-B (i.e. the pullback from May to July)

My thinking is the stock could pull back closer to its 35-week EMA – which is also around mid-point of the distribution (i.e. ~$72).

That"s where I would look to add to the stock.

As an aside, hedge fund Eaton Vance ($72B AUM) added 6.5M Units ($473M) of SCHW last quarter (according to their Q3 13F) – at an average price of ~$72.

Clearly they see value.

#2. Micron (MU)

For my other pick – I"m going back to the "semi" sector.

This time it"s Micron (MU) – who specialize in memory semiconductors.

Specifically, MU are market leaders in memory: both DRAM and NAND.

In these respective markets, they have a market share of 20% for DRAM and 11% for NAND.

These forms of memory are essential for such things as:

- mobile phones

- personal computers

- data centers

- automotive (a massive growth area)

- consumer electronics

- industrials… and finally

- AI, 5G and IoT.

This year, MU"s stock has moderated (much like TSM) amid concerns of low inventory levels and weaker pricing trends.

And to be fair, this is bound to have an impact on FY22.

The price has fallen from $96 down to $67… recovering a little recently.

And whilst the near-term outlook is uncertain (again due to supply-chain constraints / low levels of inventory) – demand remains strong (as I will share below)

To add some more context (and this isn"t meant to be a deep dive) – the memory market accounts for a third of the semiconductor market size.

In terms of these two segments – for FY2021 – we saw:

- DRAM – Revenue growth of 28% YoY / ~72% of all revenue

- NAND – Revenue growth of 14% YoY / ~25% of all revenue.

Their total revenue growth the past five years has been around 22.3% each year.

What"s more – they have maintained average gross and net margins of 42.9% and 26.4% respectively for DRAM and NAND.

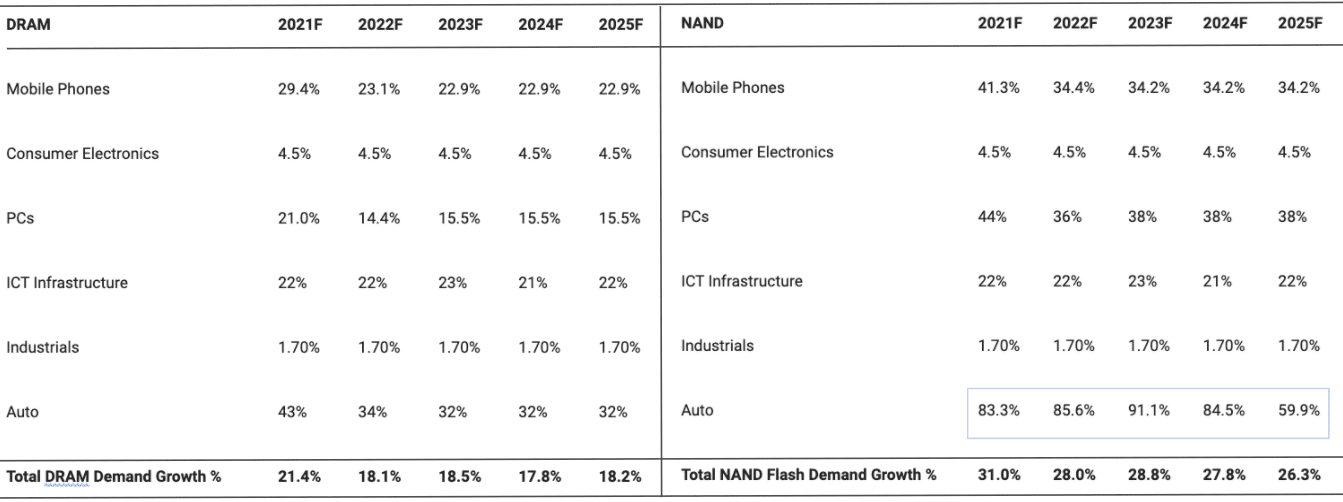

Looking ahead at the demand outlook across the various segments for DRAM and NAND – it appears strong (with research from Khaveen Investments)

In terms of valuation – MU trades at a forward PE of just 8x.

Again, this is low given the uncertainty over the near-term outlook and impact to inventories.

However, it"s expected to grow at something like 20-22% YoY for the next 5 years.

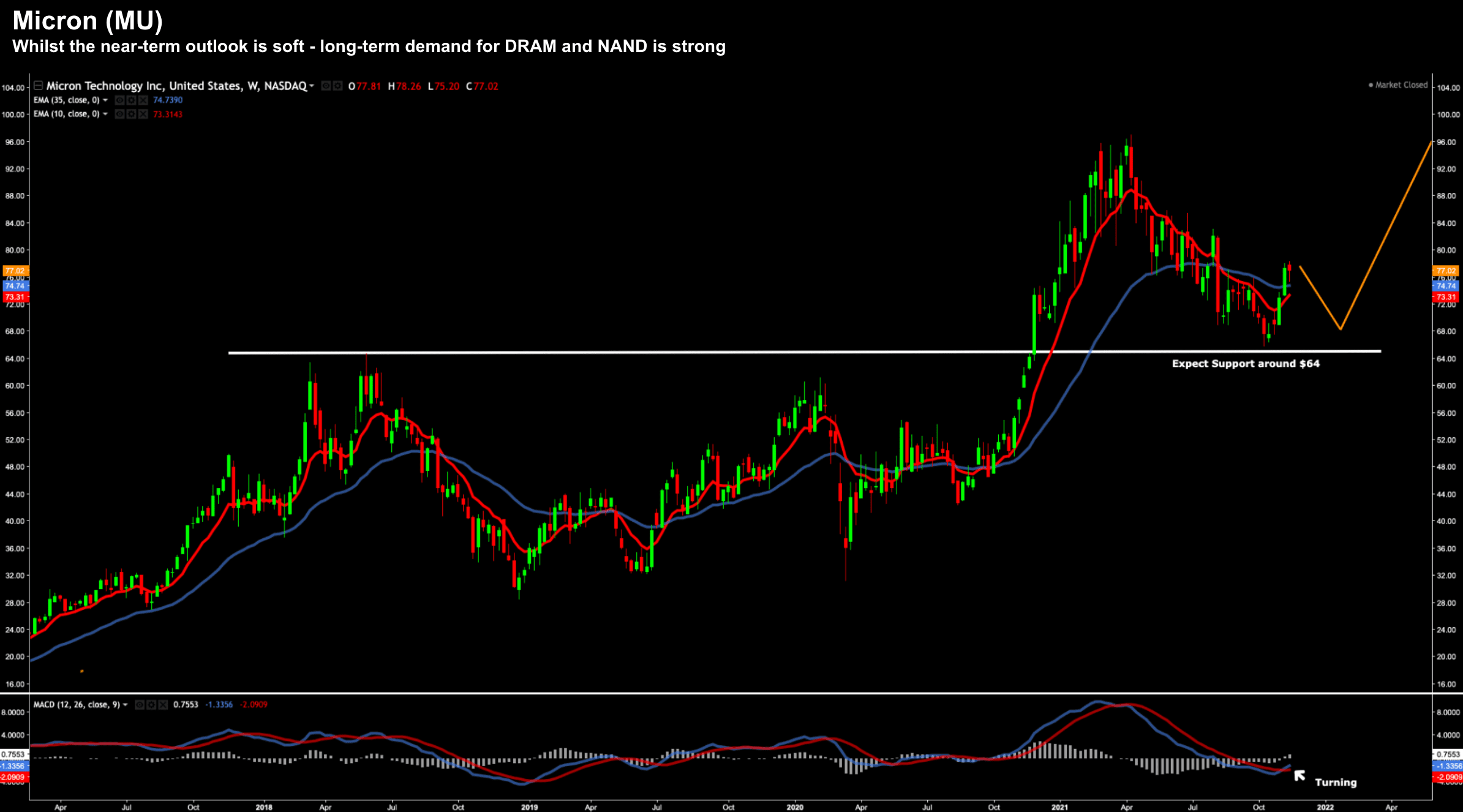

Let"s look at the weekly chart:

Nov 18 2021

Technically we find long-term support around $64.

What I like here is the "knife appears to have stopped falling".

For example, if we look at the weekly MACD (lower window), this has turned positive. This is often an indicator the near-term bottom might be in.

I think this is one to put on your radar.

And whilst the next 12 months are less certain (where low inventories will hit revenue) – I think the sell-off in the stock has removed a lot of that (known) risk.

Demand will still be there for memory over the coming years… and so will profit margins.

My guess… I think we see MU well above $100 within the next 2 years.

Putting it All Together

Before I close… a couple of words on Nvidia (NVDA)

This is a quality company doing all the right things – in all the right markets – but it"s expensive!

Their shares surged 8.3% after the company beat on the top and bottom lines and issued a bullish revenue forecast.

As I say, this helped lift the entire chip sector.

The chipmaker saw a 55% gain in data center sales from the same period a year ago; and a 42% increase in gaming, its biggest market.

The gain brought its market value to $791 billion.

I like the stock (as I have said in numerous previous posts) – but I don"t like it at ~63x forward earnings.

That said, the market expects NVDA to keep growing at over 30% each of the next 5 years… which isn"t hard to believe given the applications.

Keep an eye on this stock too… but I would wait for a better entry level.