Big Tech Earnings on Tap… as Bond Yields Jump

- Are the Fed about to reduce support into economic weakness?

- Does Snap"s 27% daily plunge spell "social anxiety" for tech?

- $9 Trillion of market cap earnings next week

Earlier this week I said bond yields are now calling Jay Powell"s bluff.

My take is bonds sense higher inflation ahead (at least for next year).

And as we know – "bond markets are typically early… but generally right".

It"s a great investing maxim.

Because if you"re looking for clues as to how the "smart money" see the economic outlook – start with bonds.

Equity markets trail bonds. It"s never the reverse.

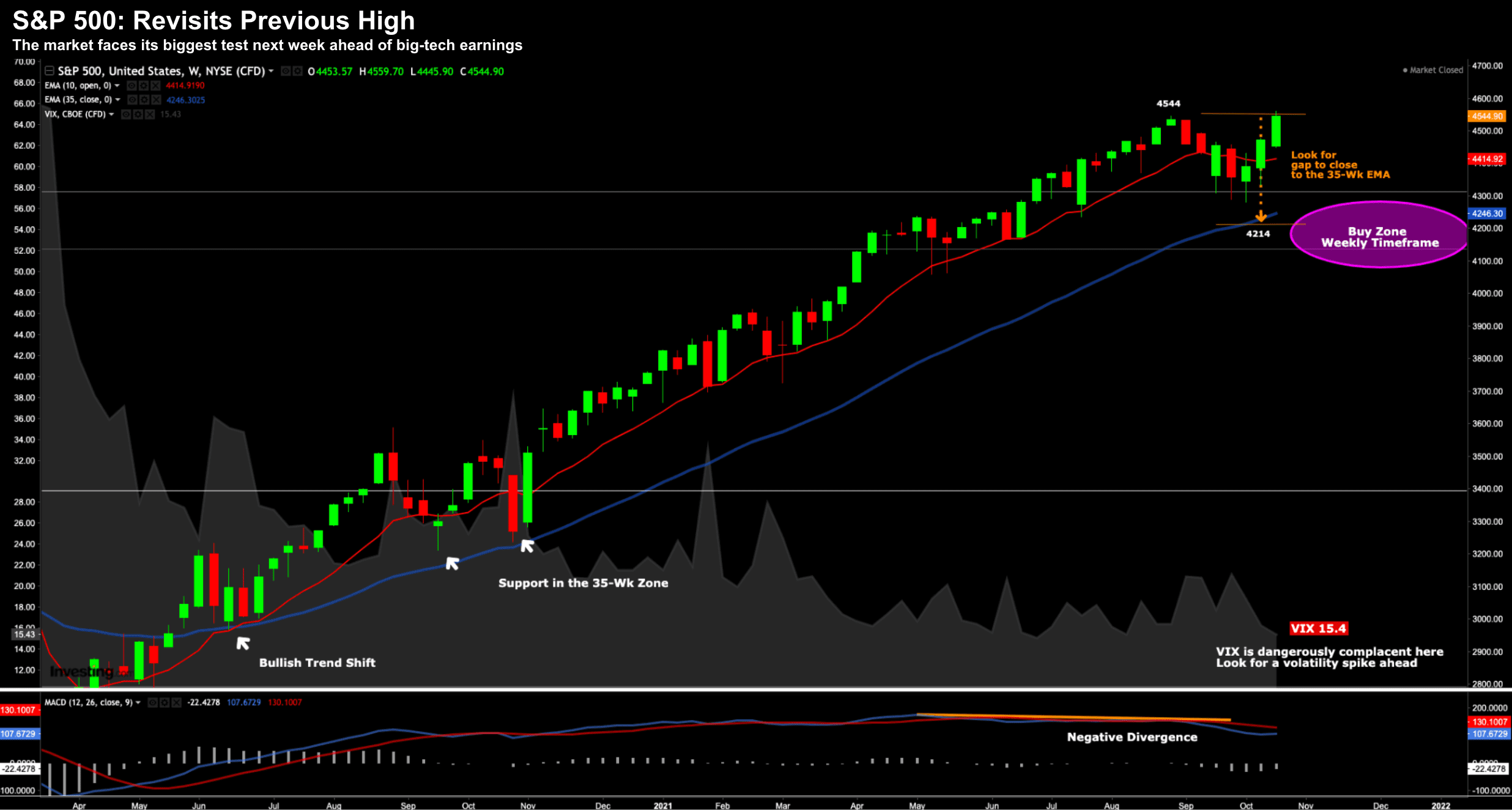

To start this Friday"s missive – let"s see where the S&P 500 finished the week.

The bulls have reasserted some control… however a week of meaningful earnings from big-tech is its next litmus test.

S&P 500 – Will the Bounce Stick?

Whilst the market posted gains for a second week – next week could be telling.

We hear from big-tech… which comprises more than 20% of the entire market cap of the S&P 500.

In fact, a whopping 30% or over $9 Trillion in market cap report earnings next week.

Outside of tech, names include (but not limited to) HSBC, Visa, UPS, 3M, GM, McDonalds, Boeing, Ford, Coca Cola, Comcast, Starbucks, Caterpillar and Chevron.

Now as a potential sneak-peak into tech – social media company – Snapchat – closed 26.5% lower today after missing third-quarter revenue expectations.

However, what made me pay attention was the revenue impact of Apple"s iPhone privacy changes disrupting its advertising business.

This could be a big deal…

For example, it"s something Facebook highlighted a few weeks ago as potentially "material".

The short version is these platforms now lack the ability to better target iOS (Apple) users.

And for regions such as the US and Europe (where advertising spend is significantly higher) – iOS constitutes a much larger portion of the user base.

The thing is for Snap and similar (social) platforms (e.g. Facebook, Pinterest, Twitter etc) – it"s unlikely Tim Cook (Apple"s CEO) will back away from their (new) privacy stance (and nor should they!)

This could be problematic for a company like Snap who is simply a platform (with no control over the hardware or operating system)

Anyway… I digress.

It was a case of "social anxiety" today as the ad-tech sector pulled back sharply on Snap"s news (e.g. Pinterest, Snap, Facebook, Twitter and Google)…. and we will get more color on the issue when Facebook reports Monday.

That said, Facebook has already warned us of the impact and a lot of the bad news is priced in.

Let"s take a look at how the S&P 500 finished the week:

October 22 2021

As I say, it was another solid week for the bulls.

The S&P 500 was a mere 15 points higher than its previous record high of 4544.

However, from a technical perspective, not much has changed.

Three things to highlight technically:

- The August high is likely to act as near-term resistance;

- The VIX is ominously low – which tells me a volatility spike may be close; and

- We still see strong negative divergence with the weekly-MACD

As I say, the market"s direction will largely depend on what we see from big-tech.

Facebook reports Monday; Google, Microsoft and Twitter on Tuesday; with Apple and Amazon Thursday.

With respect to Facebook… I think it goes higher (and I am long the stock)

Whilst I don"t like what the company does for people"s mental health (n.b., I"m not a user of either Facebook or Instagram for these reasons) – the stock"s numbers are impressive.

For example, revenue growth, free cash flow, daily active user growth, and their balance sheet etc are all extremely strong.

What"s more, it"s incredibly cheap relative to its peers; e.g, ~21x forward earnings compared with 30x vs its peers.

But my take here is the market will "hold its nose" and buy it (i.e. it"s like owning the "Phillip Morris" of tobacco)

To that end, if big-tech not only beat Q3 expectations (and I think they will) – but also provide strong Q4 guidance – we"re likely headed into record territory over November and December.

Remember – November and December are two of the strongest months of the year for the market.

On the other hand, if they disappoint, it"s hard to see how the S&P 500 can maintain its highs – given their sheer weight on the Index.

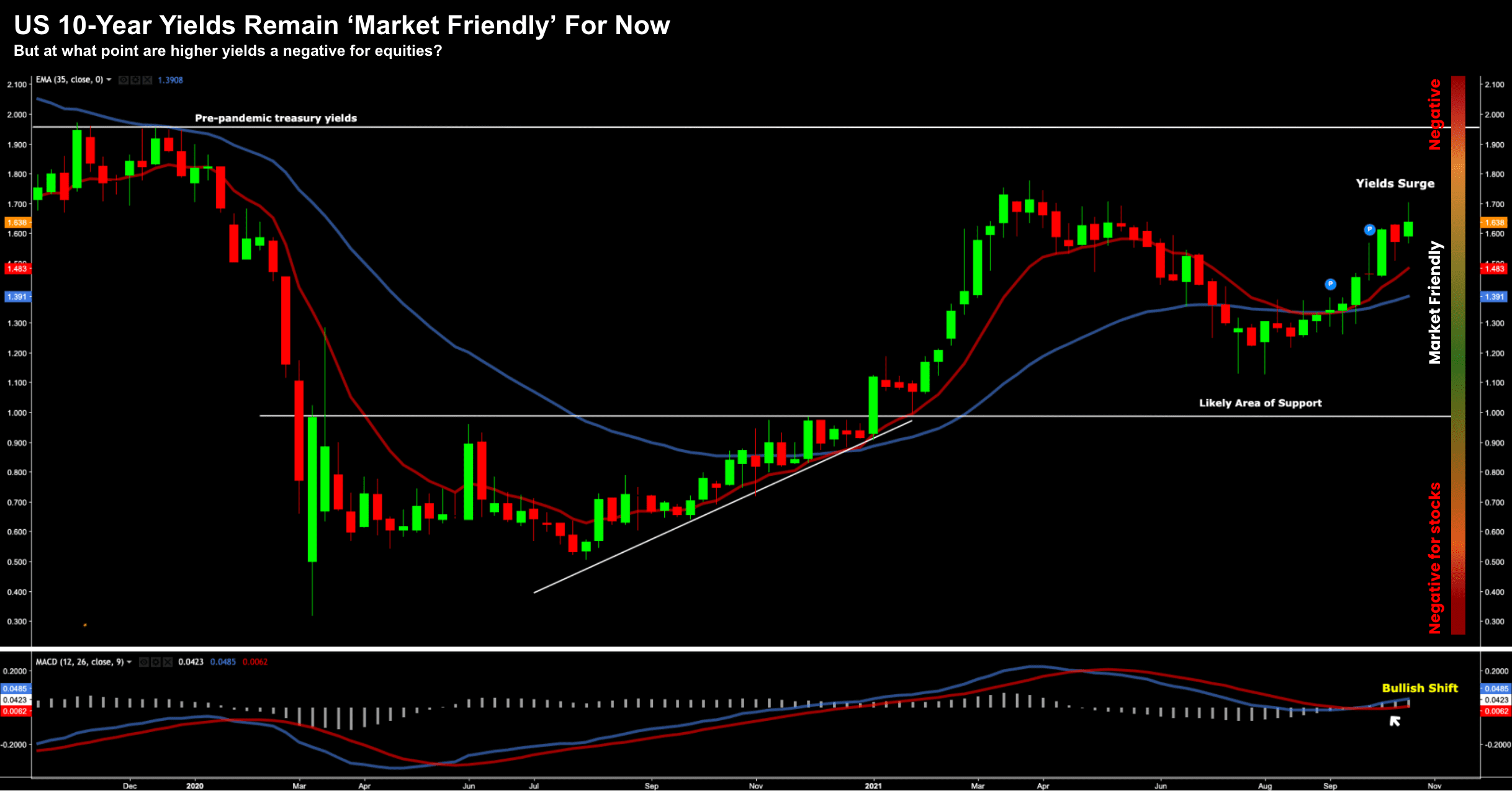

10-Yr Yields are Awake to Inflation Risks

Moving on…

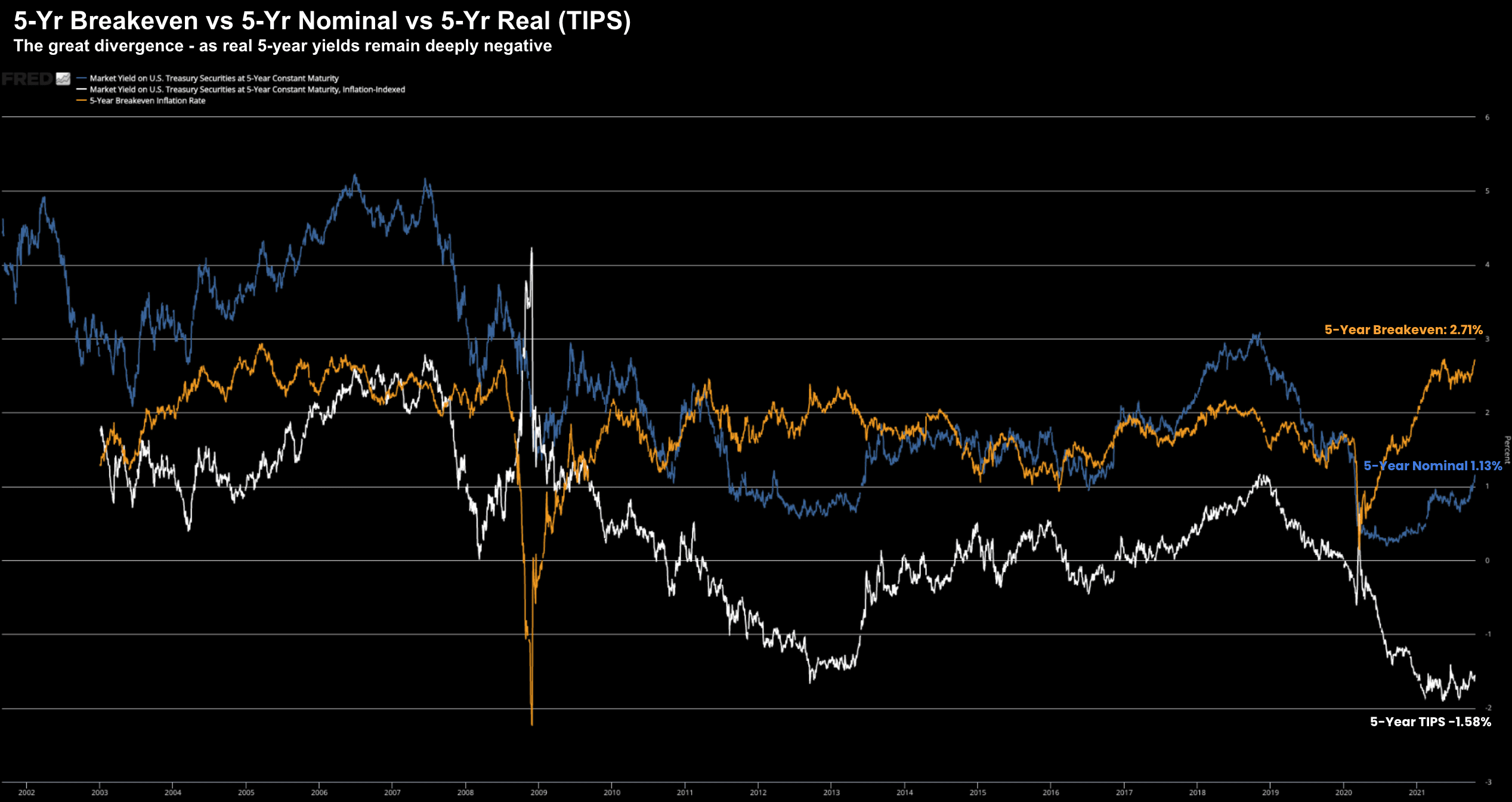

As part of my previous post "Inflation: Here Today… Gone Tomorrow?" – I shared the following chart for inflation "break-even rates" (i.e. expectations for 5-years hence):

October 19 2021

I think this is one of the most important charts for both traders and investors to grasp.

From mine, this is the "smart money" waking up to reality.

That is, higher-than-desired inflation is here for longer (e.g., at least 2022 and perhaps into 2023)

For example, note the orange (5-year inflation expectations) and blue (5-year nominal yields) lines have moved meaningfully higher in recent weeks.

And whilst it"s true that higher rates are "generally" a positive for the economy (and a welcomed development) – the question is how much higher?

For now, the stock market is not concerned.

Below is what we see with the 10-year yield and what I think is a "market friendly" zone…

October 22 2021

However, should these yields press 2.00% by year"s end… the equation for equities shifts.

What"s more, there"s a risk November and December could see the market pause (especially opposite higher multiple names)

Something"s Gotta Give…

From mine, the situation we find ourselves in with negative real yields isn"t sustainable… not for the long-run.

Now when I say "real yields" – here I am referring to nominal yields (5-year at ~1.13%) trading well below the rate of inflation (e.g. 4-5%).

And over the long-run, this doesn"t bode well.

In short, negative real yields will distort the risks associated with borrowing – in turn leading to the misallocation of capital.

That is, investors / companies / governments etc will borrow large amounts of cheap money (as they are heavily incentivized to) and then go long assets (e.g. stocks, houses, etc etc)

As I say, with your cash now trash, the Fed has all but forced this outcome.

From there, you have excess "unwanted money" as the fuel for higher inflation (and perhaps the beginning of what we"re experiencing on shelves).

Over time, bond yields wake up to this fact which then sees the Fed act.

However, this response will not be based on what"s happening with the economy (or any apparent weakness). That won"t be their focus.

It will be in reaction to unwanted inflation and cues from bond markets.

The Fed is then likely to reduce monetary accommodation in the face of what will be a slowing economy.

Case in point…

This week, the Atlanta Fed GDPNow forecast expects US GDP growth of less than 1.0% in Q4

That"s abysmal.

But what will the Fed"s response be?

Ignore it? Hold off any taper?

Or proceed with their (planned) reduction in asset purchases and slightly hawkish sentiment around rate rises?

As I said many months ago – the Fed had a lengthy "window" to reduce their support when the economy was expanding; inflation was still largely benign; and consumers were confident.

But they failed to act – perhaps scared of what reaction they"d see in equities.

Now they are stuck…

The net result (from mine) is we have the bond market saying brace for higher rates next year.

To be clear, bond markets are generally early. And this isn"t a risk for 2021…

But the real risk for the economy is when:

(a) effective real Fed short-term interest rate is much higher (2.50% to 3.0%); and

(b) we see the yield curve invert.

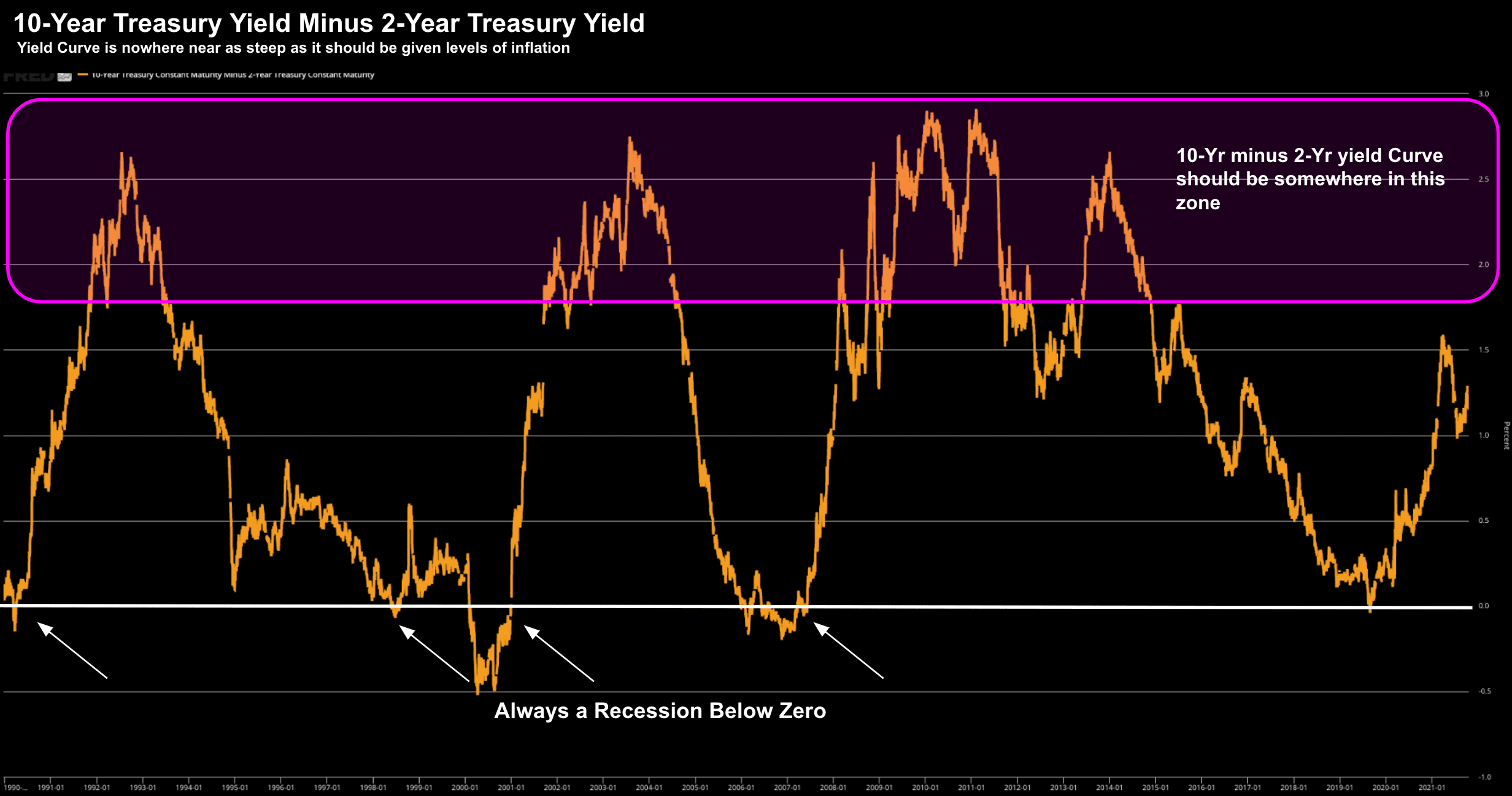

But as you can see below (10-year less the 2-year yield) – this isn"t a threat.

Oct 22 2021 – 10-Yr less 2-Yr Yield Curve not at Risk of Inversion

Real short-terms rates above 2.50% and a negative yield curve have been two precursors to every recession since the 1950"s (excluding the pandemic of last year)

Neither of these conditions are present today.

Putting it All Together…

With something like $9 Trillion in market cap reporting next week – we will get a more colour into how corporate America is navigating the challenges of higher inflation, a slowdown in business, supply-chain risks and labor shortages.

From mine, I will be focused on big-tech. For example, if companies such as Google, Facebook, Apple, Amazon and Microsoft issue strong Q4 guidance – expect the S&P 500 to rally to finish the year.

The reverse also holds true.

However, I also don"t think these companies are immune to the pain being felt in the "old" economy (as advertising budgets are tempered).

In closing, the story with rising bond yields could just be the beginning.

Will we see 2.00% on the 10-year by year"s end? And how much further will things go into 2022?

The answer largely depends on inflationary risks and what actions (not language) we see from the Fed.

To that end, is Powell likely to reduce monetary support in what appears to be a slowing economy?

It would not be the first time…