- Jay Powell gets to keep his job…

- Bond yields and US dollar index to dictate the narrative

- Be selective if trading tech stocks… not all are equal

Today investors breathed a sigh of relief…

Jay Powell was nominated by Biden to be re-elected as Fed Chair from Feb 2022.

Good news… he gets to try to “land the plane” he piloted (as he should!)

We will see how that goes… as that runway gets shorter by the day.

As context, leading into this week, there was a small possibility a more “progressive” Lael Brainard may succeed Powell – which would have sent a ripple through the market.

I saw that because the market will generally prefer a known quantity.

And whilst Brainard is a supporter of Modern Monetary Theory – Powell is the person they want in the job.

Bond Yields Call the Narrative

Personally, I don’t think there’s been a more dovish Fed Chair in history than Powell.

And whilst some say he is arguably more ‘hawkish’ than Brainard… he’s a dove.

I will let the numbers tell the story…

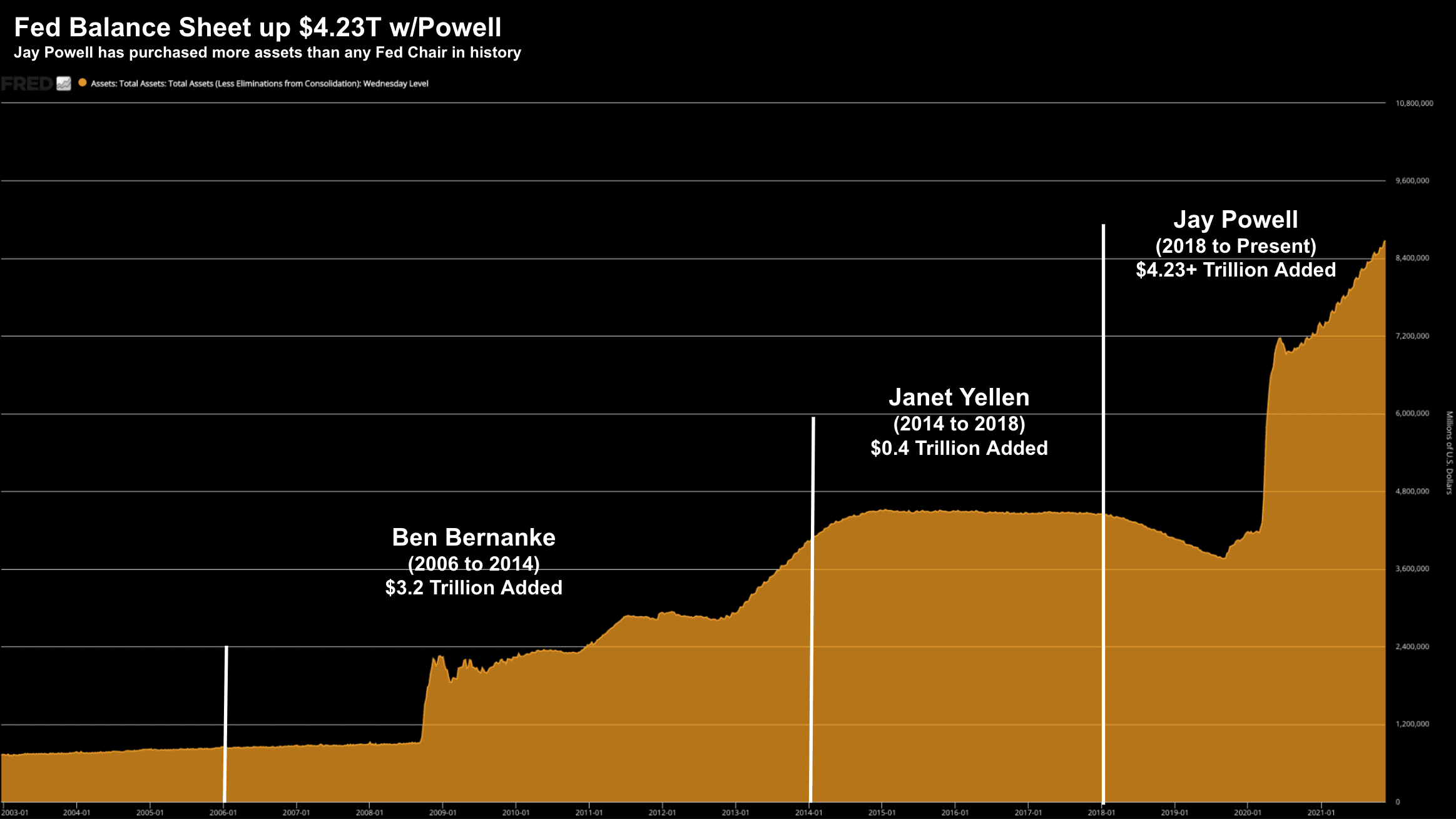

First up, Powell has added $4.24+ Trillion to the Fed’s Balance Sheet since he took the chair in January 2018.

Now that is more than Yellen and Bernanke combined.

And he’s not finished yet…

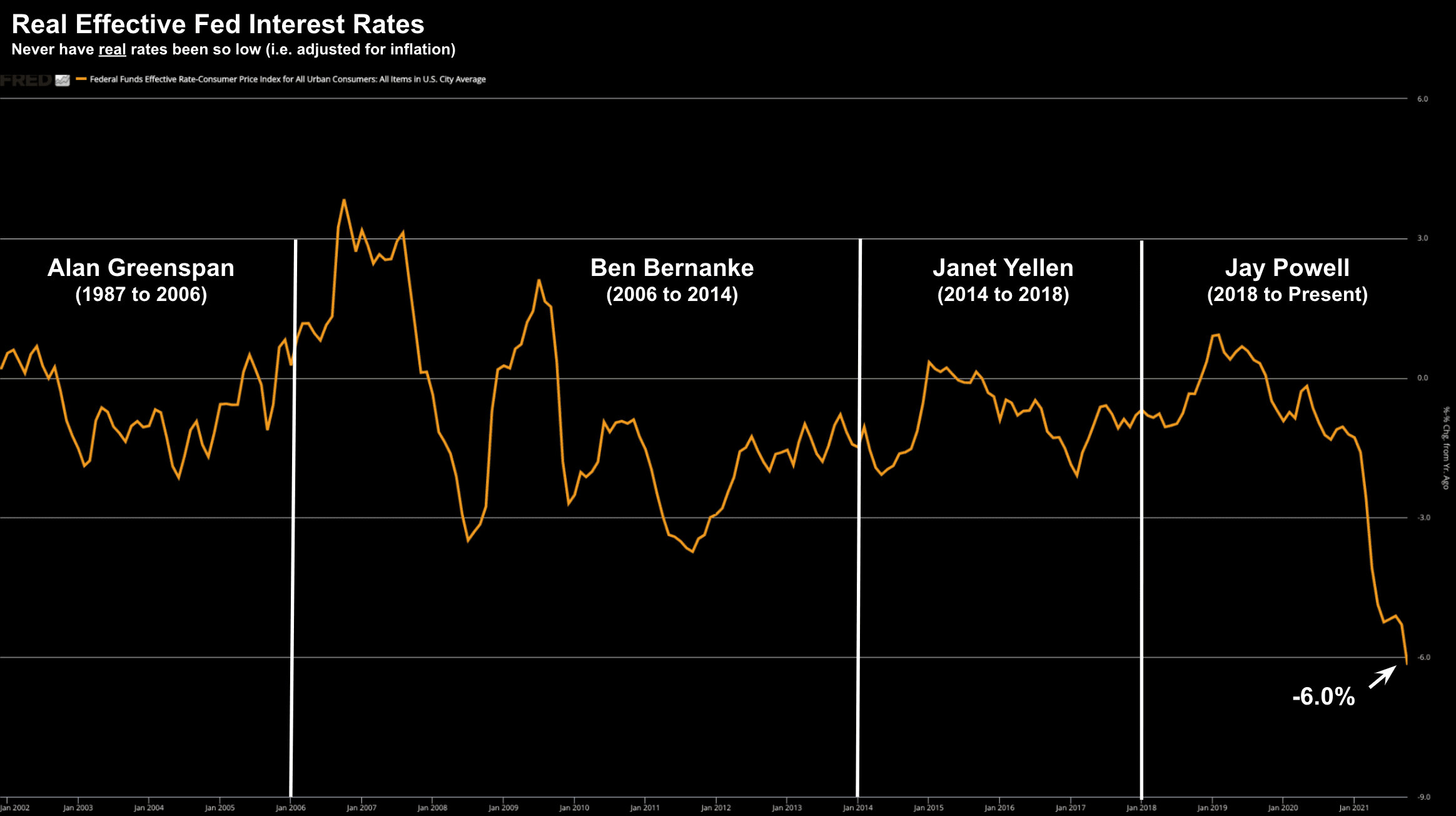

What’s more, take a look at the trend in the real rate of interest over the past few decades (i.e., adjusted for inflation)…

Nov 22 2021

Bernanke oversaw a real rate of -3.7% in September 2011.

But we’ve seen nothing like what Powell has facilitated since 1975 when real rates hit -4.92%.

Powell is as dovish as we have seen…

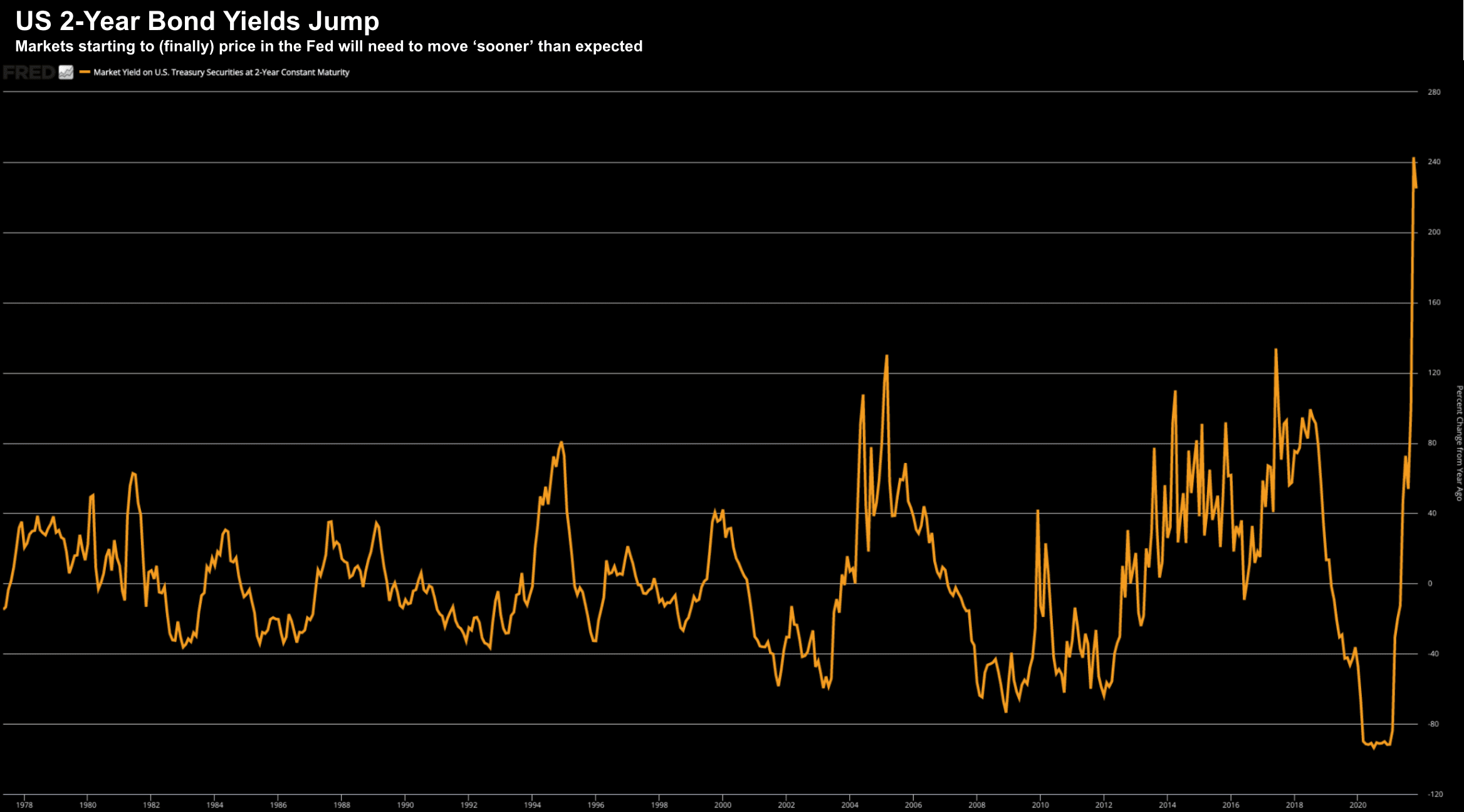

Now over the past few weeks – we’ve seen the nominal 2-year yield (as a proxy for short-term rates) move sharply higher.

The 2-year is now trading at 0.58%

And whilst that is still low in historical terms – it’s 240% higher than a year ago.

Below is the year-on-year percentage change for this bond from 1978… it dimensions just how sharp the move has been.

Nov 22 2021

But as I said the other day – there is no real “recession” risk just yet.

That will start to come into focus as the Fed hikes rates a couple of times next year.

In summary, what this price action tells me is the bond market is starting to dictate the narrative to the Fed.

For example, two weeks when Powell gave his update – he tried to reassert control.

Let me paraphrase his sentiment:

“There’s no plan to raise rates yet… we have the tools to act if needed… inflation appears to be transitory… etc etc”

And for a moment – bond yields pulled back.

But it didn’t stick…

Yields are moving higher in quick fashion.

And it’s the velocity of the move which will knock equities off balance.

My (consistent) take is bond yields (and rates) are going higher sooner than what’s priced in.

As I said months ago – I think the Fed moves before June next year.

And today we saw some (early) nerves in the market – especially around yield sensitive names.

For example, stocks with sky-high multiples and a lack of earnings consistency were punished.

Some of these names (mostly in tech) are already down 25%+ from their highs… but they were sold again.

These names will typically not do well in a higher-rate environment (n.b., more on this where I offer a basic ‘quality’ framework in my conclusion)

However, quality (defensive) names will withstand the pain.

US Dollar Index also Rallying

The other asset I recommend paying extremely close attention to is king dollar.

Regular readers will know I’m dollar bullish.

You could also read that as being (a) risk currency (e.g., EUR, AUD) bearish; and (b) gold bearish.

What’s more, I’m also emerging market bearish – given the sheer magnitude of US dollar denominated debt.

In that sense, a strong dollar can be a global ‘wrecking ball’.

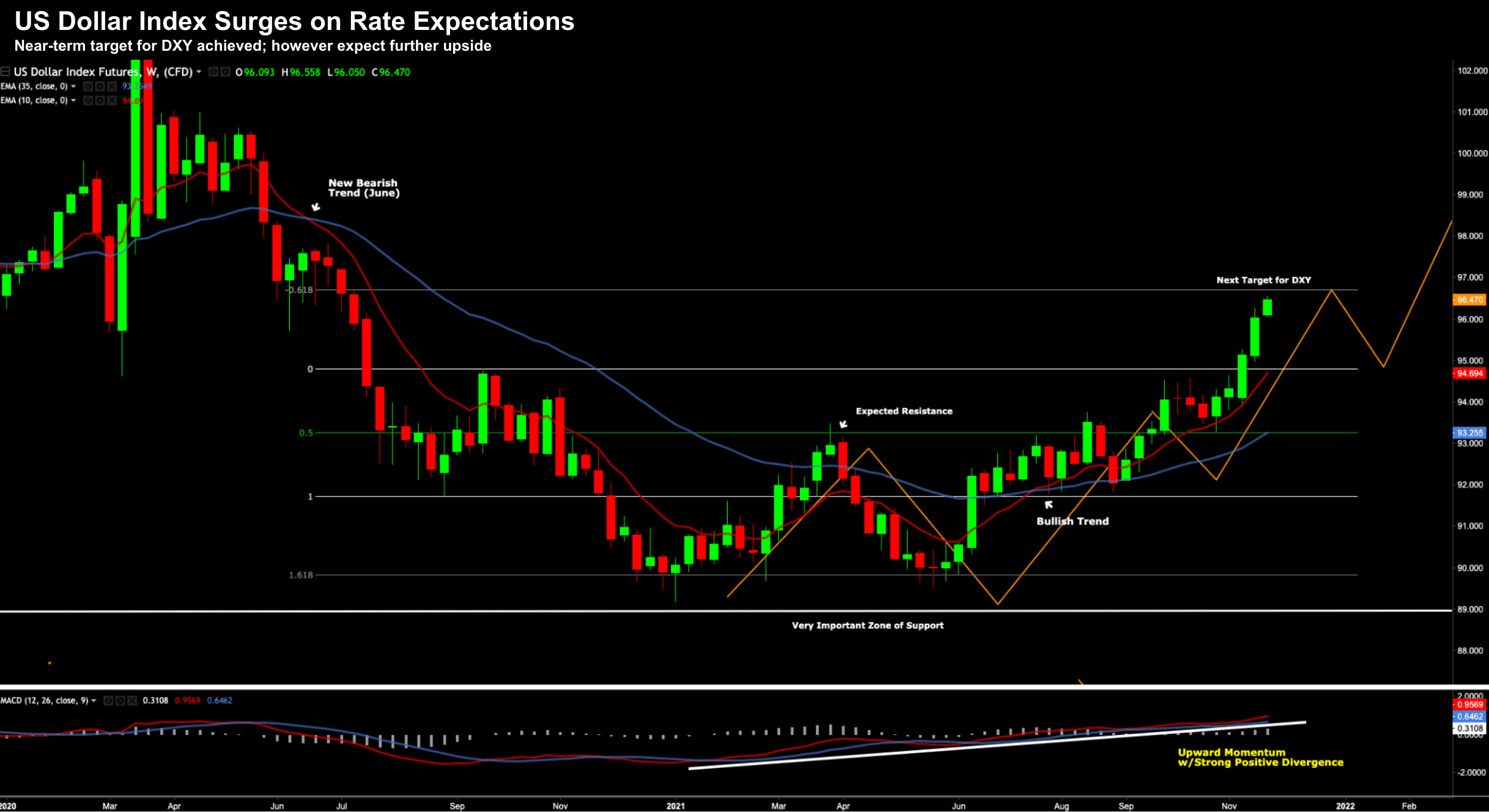

Let’s take a look using the weekly timeframe… as there is a nice move happening (‘gold bugs’ will not enjoy this chart):

Nov 22 2021

The DXY (dollar index) is trading per the script.

For example, I sketched in the near-term target of around 96.5 several weeks ago.

Three technical observations I called out:

- Strong positive divergence

- Weekly bullish trend; and

- ~96.5 being a level of ~61.8% outside the distribution of the past 12 months.

Now we might see some resistance here before its next leg higher.

The ‘good news’ for Powell is a stronger dollar is deflationary.

This also might help offset some of the unwanted inflation the next few months.

However, it’s also a headwind for companies with large amounts of offshore revenue (i.e. big tech among others)

For example, if the dollar continues to move higher (on the expectation of higher rates) – look for dollar strength impact to be a theme in Q4 earnings reports.

Putting it All Together

With yields surging – lower quality (less proven) tech names will be punished.

For example, high-flyers like (but not limited to) Snap, Pinterest, Nvidia, Peloton and even Cathie Woods’ Ark Innovation ETF (ARKK) were hit today.

“40x plus” earnings multiples don’t work with sharply higher rates.

As I mentioned, some of these names are already down at least 25% from their highs… however it doesn’t mean they won’t make lower lows.

Don’t try and catch any falling knives here (as I warned with Chinese tech names several months ago)

Bottom line is we have a bifurcated market when it comes to tech…

For example, there is quality tech – where balance sheets are strong; moats are large; and they have a long proven record of consistent quarterly earnings growth.

They will do okay in the face of higher yields.

However, there are those businesses who are still trying to either scale; and/or prove the longevity of their business model(s).

Here’s my own (high level) three-point framework I apply when assessing these names (if helpful)

- What is their access to eyeballs and/or customers (and how fast is that growing)?

- What is unique about their technology / IP (i.e. how defensible is their moat; how easy is it to replicate?); and

- If applicable, what unique content are they able to generate / scale?

For example, take Zoom (ZM).

Whilst they have a lead in the video conferencing space, there is nothing they are doing which cannot easily be replicated by any major tech company (e.g. Facebook, Microsoft, Google, Cisco all offer this today).

And yet, the stock trades at forward PE of ~51x. Crazy.

And I could highlight many examples like this.

Understanding each of these parameters will give you a stronger sense as to what is genuinely unique about their business (and if the large premium is justified)

It also helps you understand just how strong businesses like (but not limited to) Google, Apple, Amazon, Microsoft and Facebook are in their respective markets.

In a higher rate environment – a rising tide may not lift all boats.