Bullard: “50’s at Every Meeting”

- Bullard calls for Fed Funds rate at 3.50% by year"s end

- Goldman Sachs puts odds of a recession within 2 years at 35%

- "Margin pressure" to be the dominant theme for Q1 2022 earnings

Rates up. Stocks down.

St. Louis Fed James Bullard threw more fuel on the "interest rate fire" today – suggesting the nominal Fed funds rate needs to be at 3.50% by the end of the year.

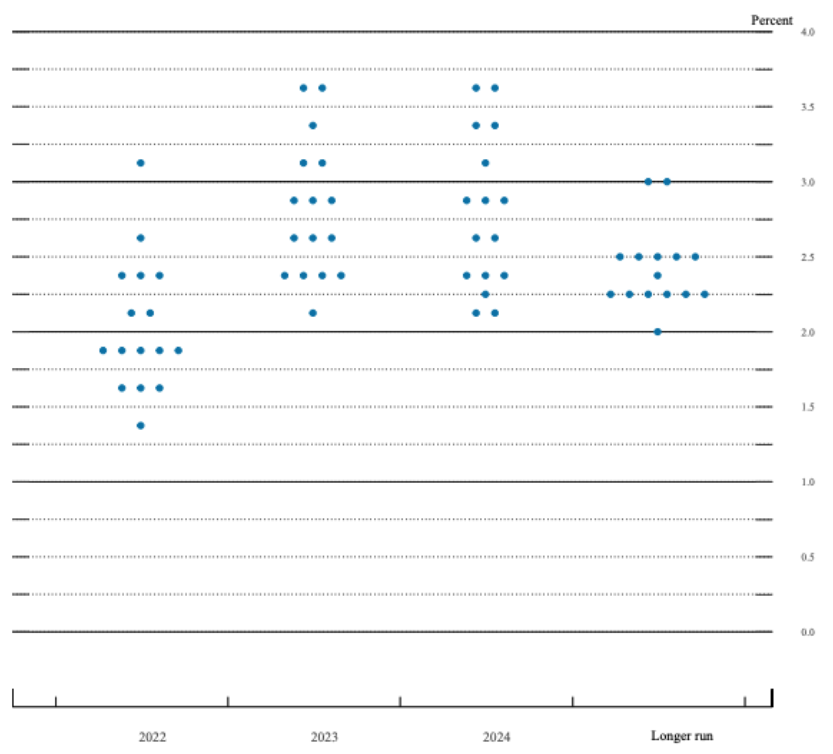

And if he had his way – that would roughly be 100 basis points higher than what"s currently shown on the Fed dot plot.

Bullard sees a series of 50 basis point hikes through to the end of the year… and is not ruling out a 75 basis point hike.

Here"s MarketWatch:

Bullard said he remains on board with an almost certain series of half percentage point rate rises as the central bank presses forward with plans to help bring inflation, now at 40-year highs, under control by lifting the federal-funds rate target to around 3.5% by year-end.

Bullard is a voting member of the rate setting Federal Open Market Committee, which last month raised its overnight target rate range by a quarter percentage point to between 0.25% and 0.5%. The FOMC also pencilled in more rate increases for this year.

In his appearance Monday, Bullard said inflation is "far too high for comfort, and so we have to move to get inflation under control," adding "not all hope is lost here. I think we"re in a position where we can maintain credibility and get inflation lower."

It"s worth noting that Bullard is a consistent Fed hawk.

He"s been call for more aggressive rate hikes well before his peers…. so bear that in mind.

However, what"s interesting is Bullard sees "little impact" with 325 basis points in rate hikes.

In other words, he still see above average GDP growth with neutral rates (which is said to be anything about 2.50%)

He"s right that the Fed needs to hike rate well above a neutral rate (i.e. 250 bps) to help curb inflation… but I"m less convinced it won"t come at meaningful cost (e.g., either to the real economy and/or the market).

We will see.

10-Year set to Challenge 3.0%

The US 10-year treasury continued to advance on Bullard"s remarks – trading at their highest level in 3 years:

April 18 2022

The chart above shows how bond yields (and rates) have traded progressively lower from 1992.

But is this 30-year trend about to reverse course?

In other words, is the multi-decade bull run in bond prices (which trade inversely to yields) over?

The zone of 3.2% appears to be a level of clear overhead resistance (also support in 2003)

My best guess is the 10-year will challenge this zone before finding pressure (i.e., bond buying – which sends yields lower)

The two questions I have are:

(a) how much of the Fed"s hikes are already priced into the bond market? and

(b) what"s priced into equities?

From more, there is more priced into bonds than there is equities.

Earnings Season: Focus on Margins

Earning season is off to a good start…

Of the 40 S&P 500 companies to report so far – 81.5% have reported earnings per share have been above expectations according to FactSet.

Analysts believe first-quarter earnings will jump 5.3% for the quarter when all companies finish reporting, according to FactSet"s analysis of actual results and future estimates.

However, Morgan Stanley analysts say earnings reports for the first quarter could end up being more disappointing than expected.

"Earnings revisions breadth for the S&P 500 has resumed its downtrend over the past two weeks and is once again approaching negative territory," the firm"s equity strategist Michael Wilson said in a note Monday.

"The Morgan Stanley Business Conditions Index (a survey of our industry analysts) fell to its lowest level since April of 2020, and margin expectations look overly optimistic for the balance of "22 given the myriad of cost pressures companies face."

Wilson is right to call out "cost pressures" and "margin expectations"

From mine, there will be one word to dominate earnings calls: inflation.

We already know how working class families are struggling with inflation – but what about corporate America?

For example, consider the following sectors:

- Food service companies are paying more for food and workers to serve their customers

- Transports are struggling under the weight of sharply higher fuel costs

- Auto companies are paying more for components (if they can get them);

- Retailers face higher merchandise costs; and

- Tech and finance companies are having to pay more for highly-skilled staff.

Tell me one area of the economy where inflation is not having an impact?

Now there are some companies who will benefit from inflation / higher rates (e.g. financials, commodities, utilities and energy).

However, there are those who will come under pressure.

In short, if companies are not able to raise prices for the things they sell (what they call pricing power) – profits will decline.

And soon, we will find out who can pass the costs on and those who simply can"t.

Putting it All Together

For me, it"s how to see how a nominal Fed Funds rate at 3.50% by year"s end will be "accommodative" for economic growth and the market.

I don"t share Bullard"s sentiment.

Yes, a portion of the hikes are priced into stocks and bonds.

However, that is more like 200 to 225 bps…. and not 350.

In closing, Goldman Sachs said today there is a real chance the U.S. economy is going to suffer a recession in the next two years.

The bank"s economists see the odds of a recession at:

- 15% in the next 12 months;

- 35% over the next 24 months.

With the Fed benchmark rate historically low (or deeply negative in real terms) – they felt this reduced the chance of recession in the near-term (something I also highlighted last week).

They add the main goal of the Fed"s planned rate hikes is to slow wage growth from its recent 5%-6% pace to at least 4%-4.5%

They believe that would help cool inflation close to the Fed"s 2% target in 2023 and 2024 (n.b., TIPS suggest inflation will be much higher)

The investment bank said it expects the Fed to raise its benchmark rate up to a range of 3.00 – 3.25% before they are able to get inflation under control.

And this is what raises the odds of a recession.