Buyable Dip Followed by Another Rally

- Why I think you stick with quality growth names…

- Will stocks pull back before the end of the year?

- Two quality stocks on my buy radar…

My most recent post concluded with the thesis that stocks are headed higher.

Why?

A few reasons:

- Interest rates likely to remain at record lows (negative in real terms) over the next 12+ months;

- Cash is likely to lose 5%+ over the next year;

- Stocks continue to generate incredible cash flows and profits;

- Credit spreads remain low (i.e. risk); and

- With the system flooded with liquidity… where else is money going to go?

But…

Do you simply "hold your nose" and buy at nose-bleed levels?

I don"t think so…

From mine, building your portfolio is something you "scale" into.

Take Apple and Amazon…

These two stocks both reside in my Top 5 holdings (Microsoft, Google and Facebook the balance)

Now regular readers will know I added to my existing positions in these names a few weeks ago.

Apple was trading around $138 and Amazon below $3200 – and I felt both were worth adding to.

Apple is now back above $152 and Amazon above $3500.

Both appear to be going higher…

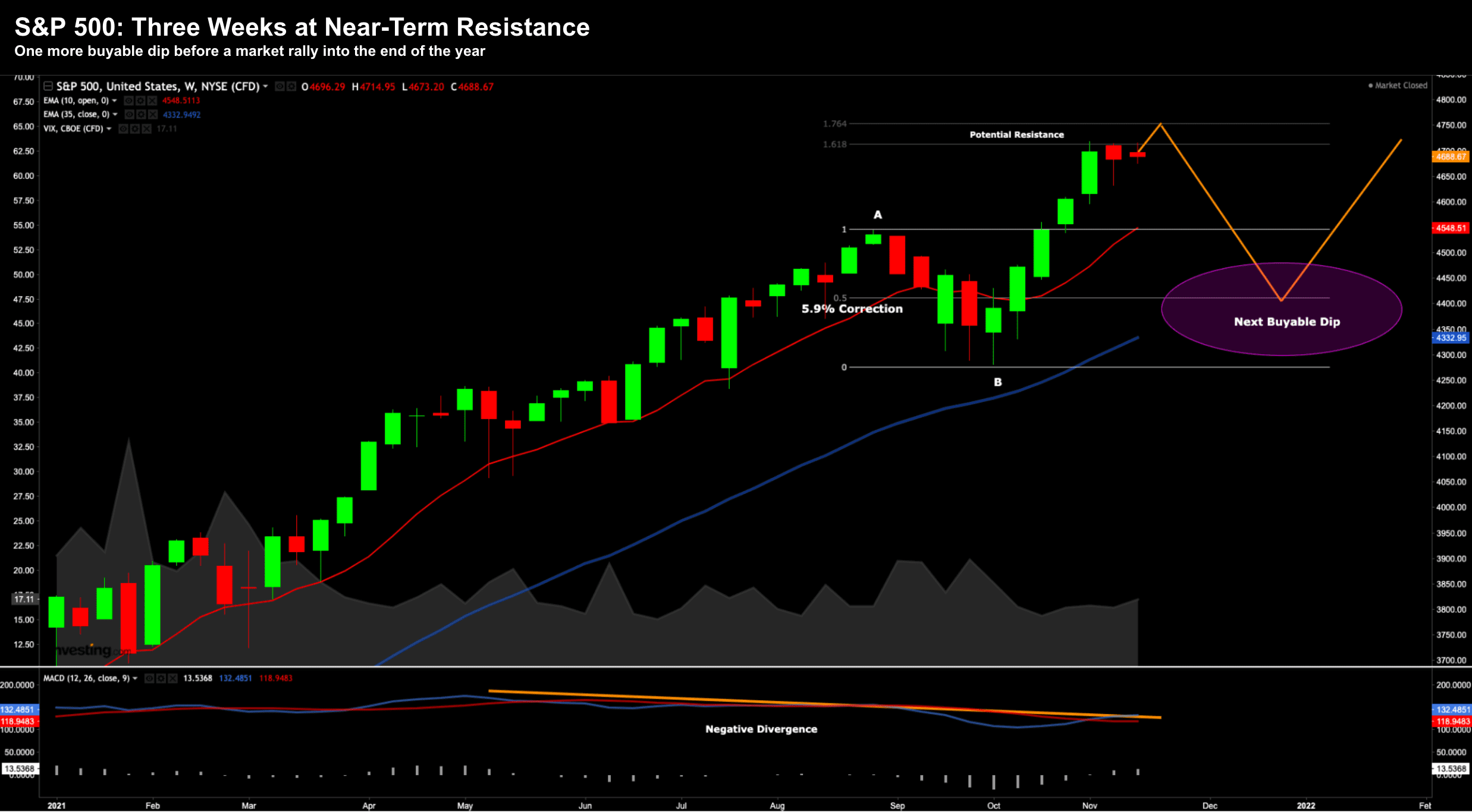

Tonight I want to look at the S&P 500 Index (as this is also a holding in my portfolio) – as I think a buyable (but modest) dip is coming – before the market takes another leg higher.

A Buyable Dip

The last "buyable dip" offered a modest 5.9% over four weeks in September.

And it"s the only buyable dip we have seen since October 2020 – when the market last tested the 35-week EMA.

With respect to the most recent pullback – I was hoping to see the market correct in the 7-10% realm – but it didn"t happen.

Let"s take a look:

Nov 17 2021

A couple of technical observations:

- After the retrace concluded early October – I was able to construct a new Fibonacci retracement;

- 61.8% to 76.4% outside this retracement (labelled A-B) – is where the S&P 500 has seen resistance for 3 weeks;

- The Index is still quite extended beyond the 35-week EMA (blue line);

- VIX remains very low (i.e. complacent) – which tells me a volatility spike isn"t far away; and

- We find strong negative divergence with the weekly-MACD (i.e. its making lower-highs vs higher-highs on the price)

This is what I"m looking for over the next few weeks… a bout of technical selling.

However I also don"t think it will last long… perhaps 2-3 weeks at a guess.

My target zone for any near-term selling is around 4400 – which is about 6% from today"s level.

That"s where I will be assessing quality stocks trading at more attractive levels…

Question is – what are they?

Where Am I Looking?

In terms of what I"m looking to add – I only look at quality names.

For example, my "Top 5" (~50% of my total portfolio) remains big tech.

And there is a good reason….

They are all:

- double-digit top-and-bottom line growth;

- tremendous free cash flow;

- bullet-proof balance sheets; and

- extremely strong defensible market positions.

These names – Microsoft, Google, Apple, Amazon and Facebook – are the names which will carry the market higher.

But what am I looking at beyond "FMAGA"?

I am going to offer 2 names today (and 2 tomorrow night)

#1 – Snowflake (SNOW)

The first recommendation is operating in one of the biggest "gold rushes" of modern times – cloud computing.

And guess what, it"s also where you will find Amazon, Google and Microsoft!

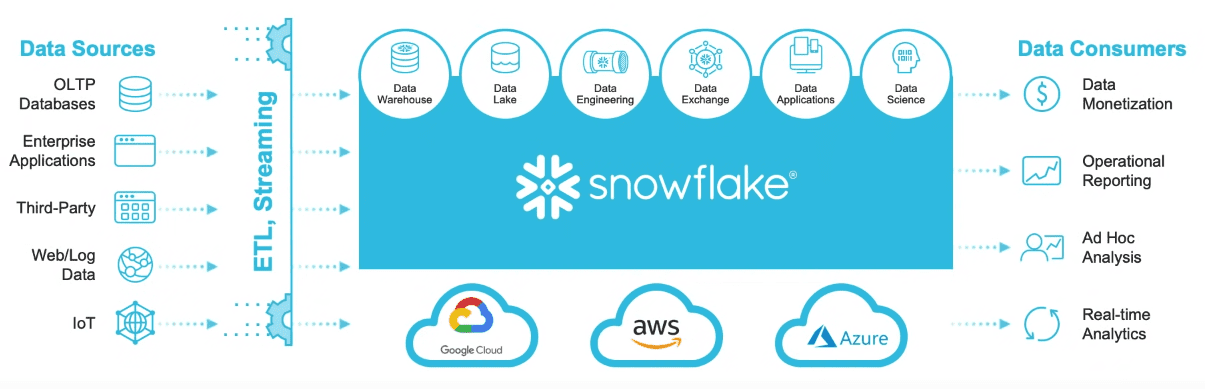

If you"re unfamiliar – Snowflake consolidates advanced analytics, data lake, and data sharing workloads into low maintenance easy to use services available on Google Cloud, AWS (Amazon) and Azure (Microsoft).

Without going into great lengths of detail on their business models or value proposition – here"s a great YouTube video which offers a real-world example of Snowflake"s platform.

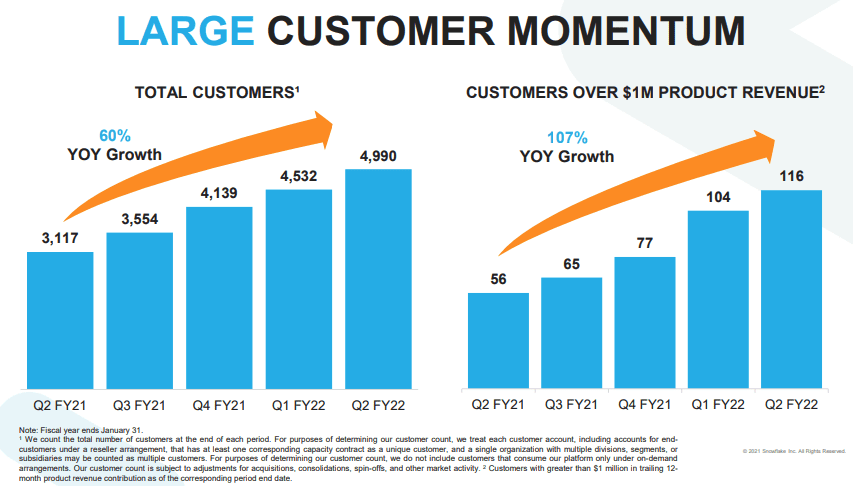

Snowflake are "crushing it" when it comes to customer satisfaction metrics and growth:

- 612% Customer ROI over 3 Years

- 71 Net Promoter Score (very high)

- 100% of Snowflake customers would recommend their service

Therefore, the following chart is of no surprise… customer and revenue growth

- 60% YoY Customer Growth; and

- 107% YoY Growth for Customers Over $1M in Spend

As an aside, Berkshire Hathaway bought Snowflake at its IPO.

Great move!

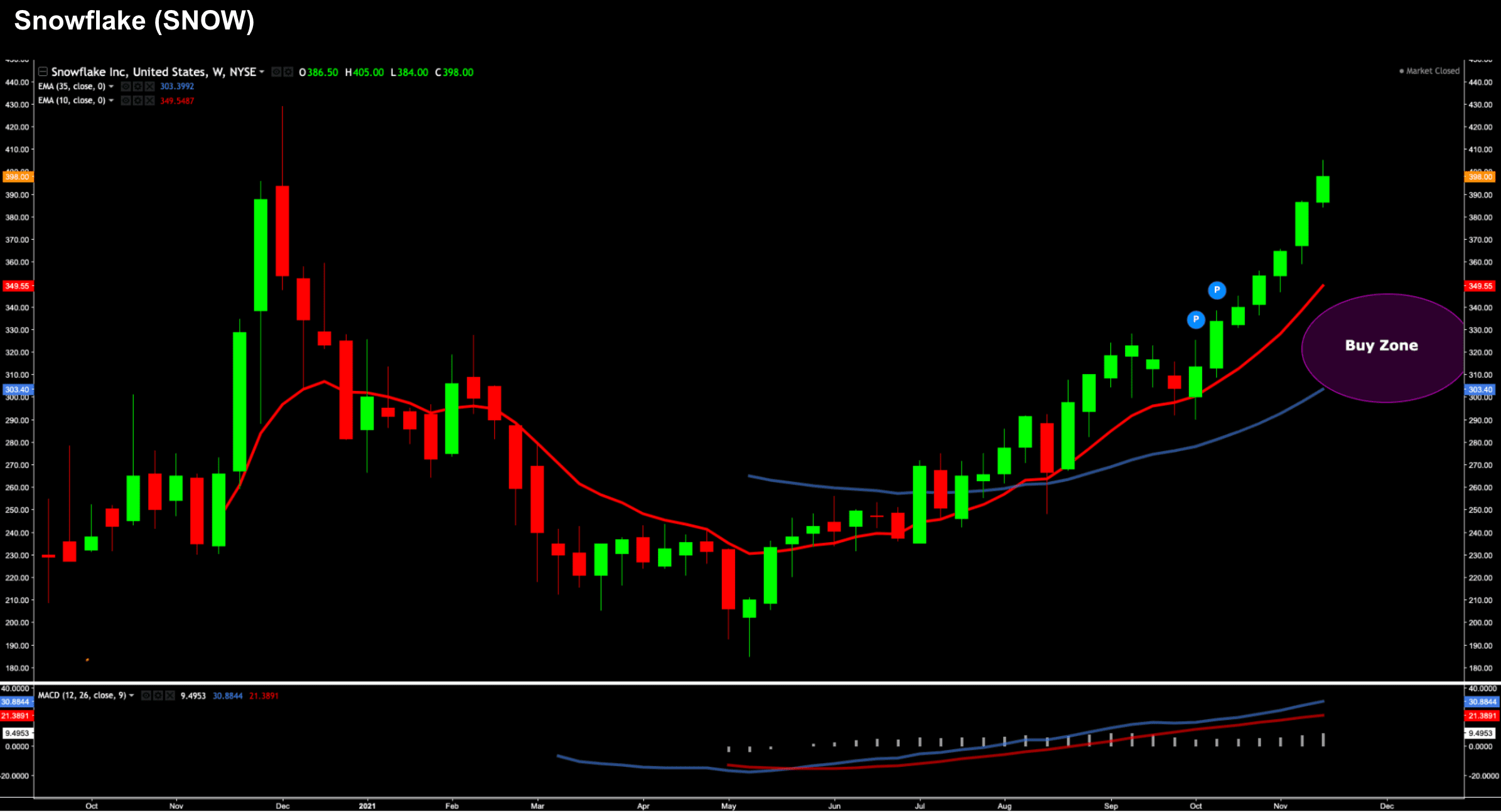

I could spend a lot more time talking about why I like this (cloud) business – but I will cut to the weekly chart:

Nov 17 2021

I like this stock anywhere between $310 and $340 if it presents.

For example, the last dip saw a pullback to $290, but it didn"t last long.

Since then, the stock has gone vertical.

Let"s see when (not if) this stock offers a decline… but look to add it to your long-term buy list.

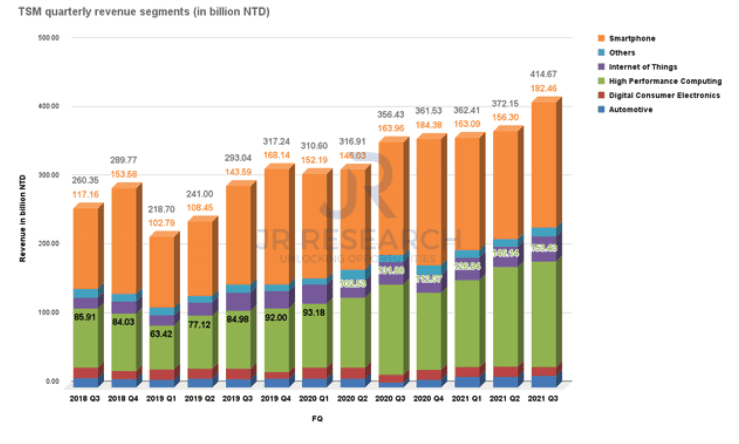

#2. Taiwan Semiconductor (TSM)

Whilst I"m generally bullish on the chip sector (they are the new "oil" of today"s economy) – most of these stocks are overvalued.

For example, two that I really like – Nvidia (NVDA) and Advanced Micro Devices (AMD) are both very expensive.

NVDA is trading at least 60x earnings and I think AMD around 48x.

I have tipped both of these stocks in the past 12 months… and they have gone vertical.

And whilst they both deserve strong (growth) multiples… a lot of their upside on things like the "metaverse" (a buzzword many like to use) is largely priced in.

Taiwan Semi (TSM) is another great chip stock which is not trading at scary multiples… and has lagged their semi peers.

My quick take is some may have overlooked how important TSM remains in this market / supply chain.

And to that end – look no further than its exclusive relationship with Apple.

Now Apple accounts for ~25% of TSM"s revenue.

What"s more, TSM"s smartphone segment accounted for 44% of its Q3"21 revenue.

Translation:

If you are bullish on AAPL (and I am) – it pays to be bullish on TSM.

AAPL relies on TSM exclusively after shelving its arrangements with Samsung in 2016. Both companies are entirely dependent on each other"s success.

Apple knows TSM can"t do without its business; and Apple has full faith in TSM delivering.

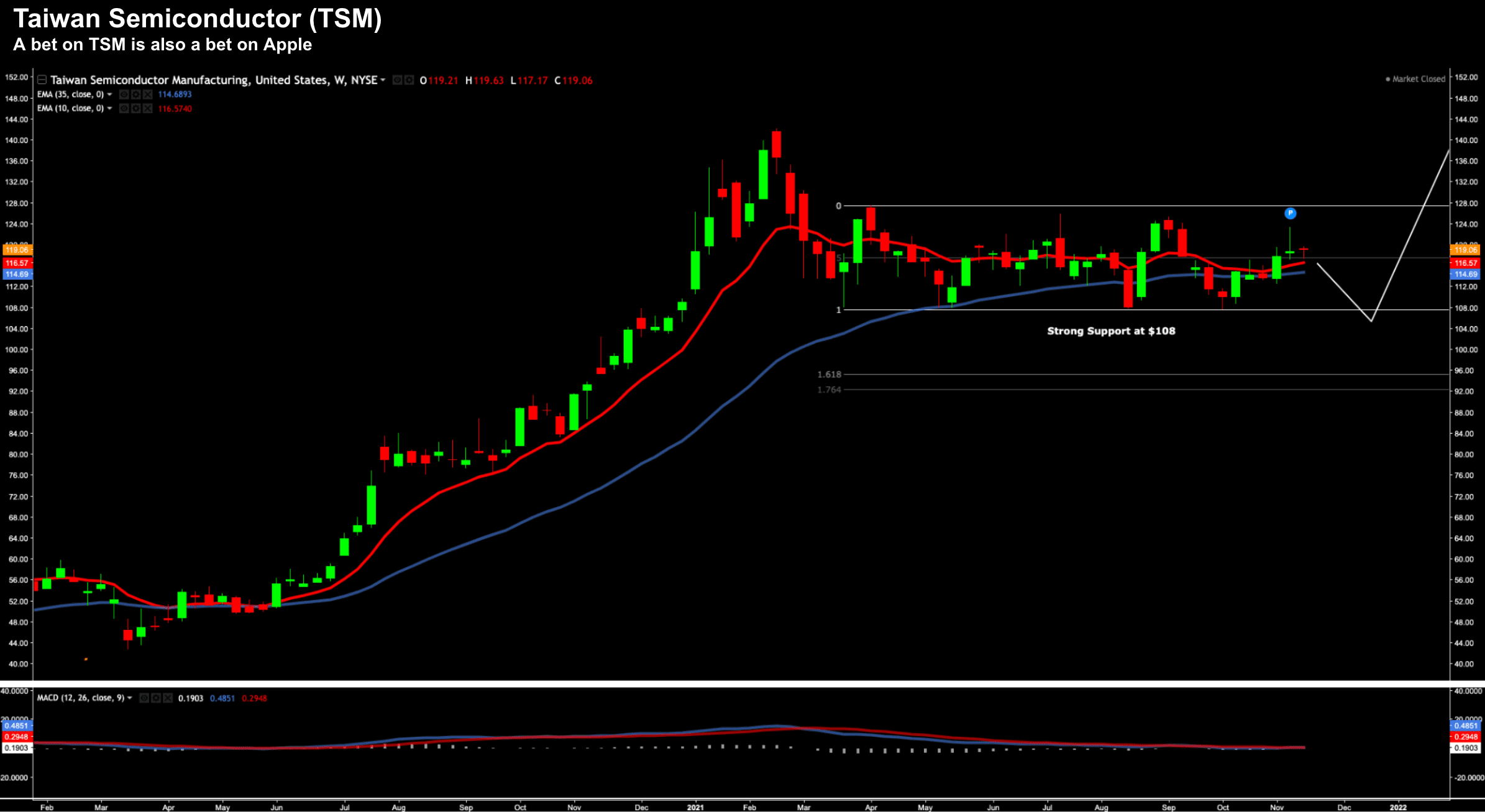

Let"s look at the weekly chart:

Nov 17 2021

TSM has traded in a sideways range for the entire year…. after a big run higher in 2020.

And I think the nervousness is around expected softness in the sector over the next 12 months.

As an aside, I saw the same sideways pattern with Amazon recently, when I commented that this is likely to break higher.

We also see very strong support at $108.

For whatever reason, the stock has not fallen below that level.

Now at the current level (~$119) – the stock trades for a forward PE of around 25x

That"s well above the market average of around 22x – however TSM deserves a premium.

For example, it"s expected to grow at 15% the next 5 years.

Again, if you believe in Apple, then TSM is a good bet.

But equally – TMS is not a "60x or 48x" multiple we see with the likes of NVDA or AMD.

I would look to buy this anywhere around $108 to $112 (as part of your long-term portfolio)

Putting it All Together

Today we received strong earnings from big-box retailers…

But the takeaway was the impact of inflation on their growth and specifically their margins.

Target, Lowe"s and TJX Companies all offered greater earnings beats.

However, Target shares fell 4.7%… as their CEO said they will absorb the margin hit (rather than pass it onto consumers).

Big call.

If you ask me, if I had to buy a "big-box" play (and I don"t own one today) – it would not be either Walmart or Target… it would be Costco (COST).

The stock was around $369 at the start of the year… it"s now $526

Costco said recently they will be passing the higher costs on… operating at margins of less than 3%.

But the inflation risk is real… and it"s having an impact.

What"s more, the brunt of it is only just starting… as big-box reported on its Q3 sales… where their inventory was purchased over Q1 and Q2.

The question I have is what will that look like with inventory bought in Q3 – with prices significantly higher?

Before I close, and on the subject of TSM and inflation, remember they raised their chip prices by 20% back in August.

This saw TSM continue to maintain an incredible 38% margin…. that"s a nice business growing at 15% pa (trading at a modest multiple).

Consider these two stocks (TSM and SNOW) in your long-term portfolio at the right price.