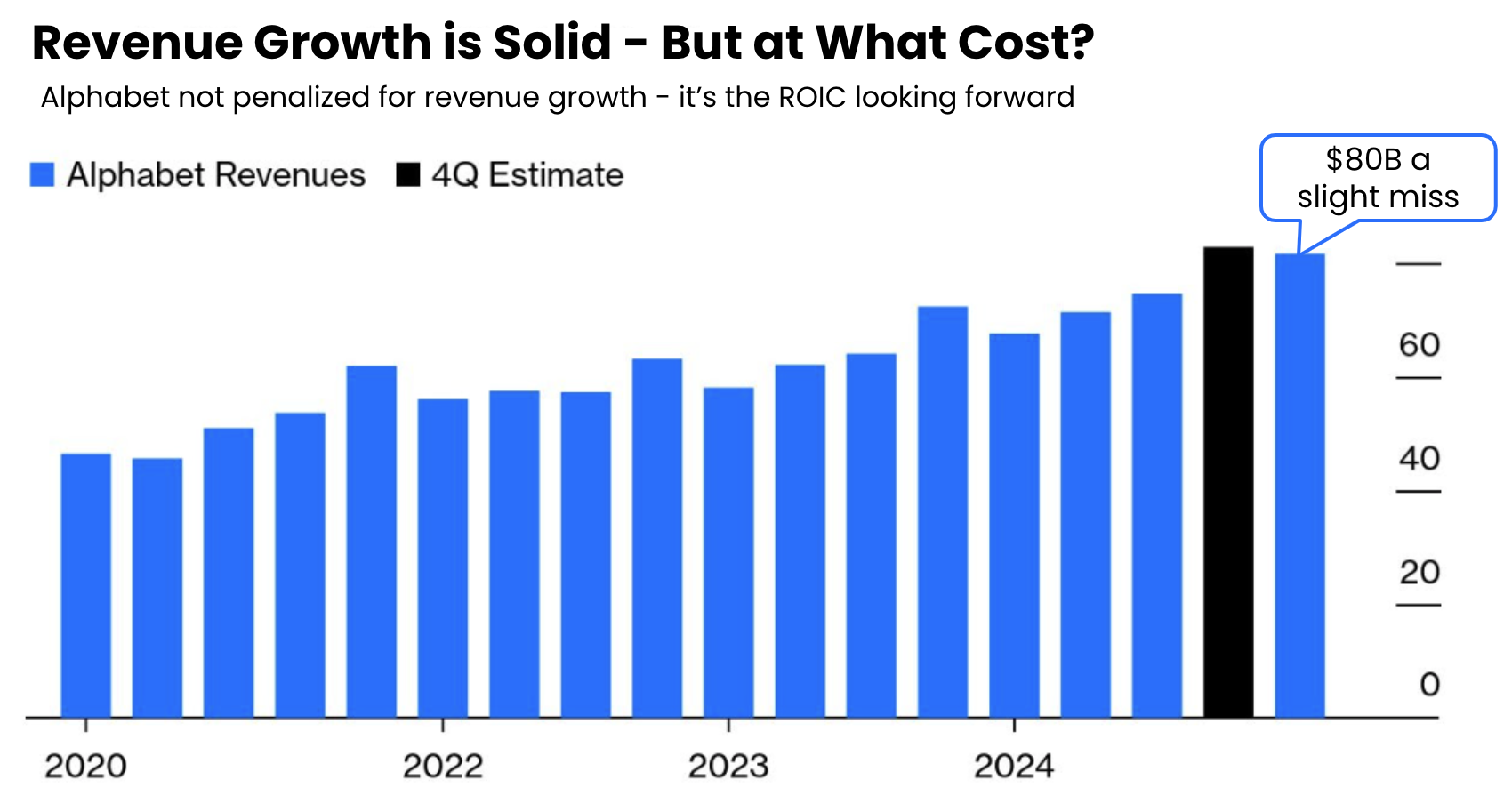

Large Cap Tech: Cautious on Guidance

Large Cap Tech: Cautious on Guidance

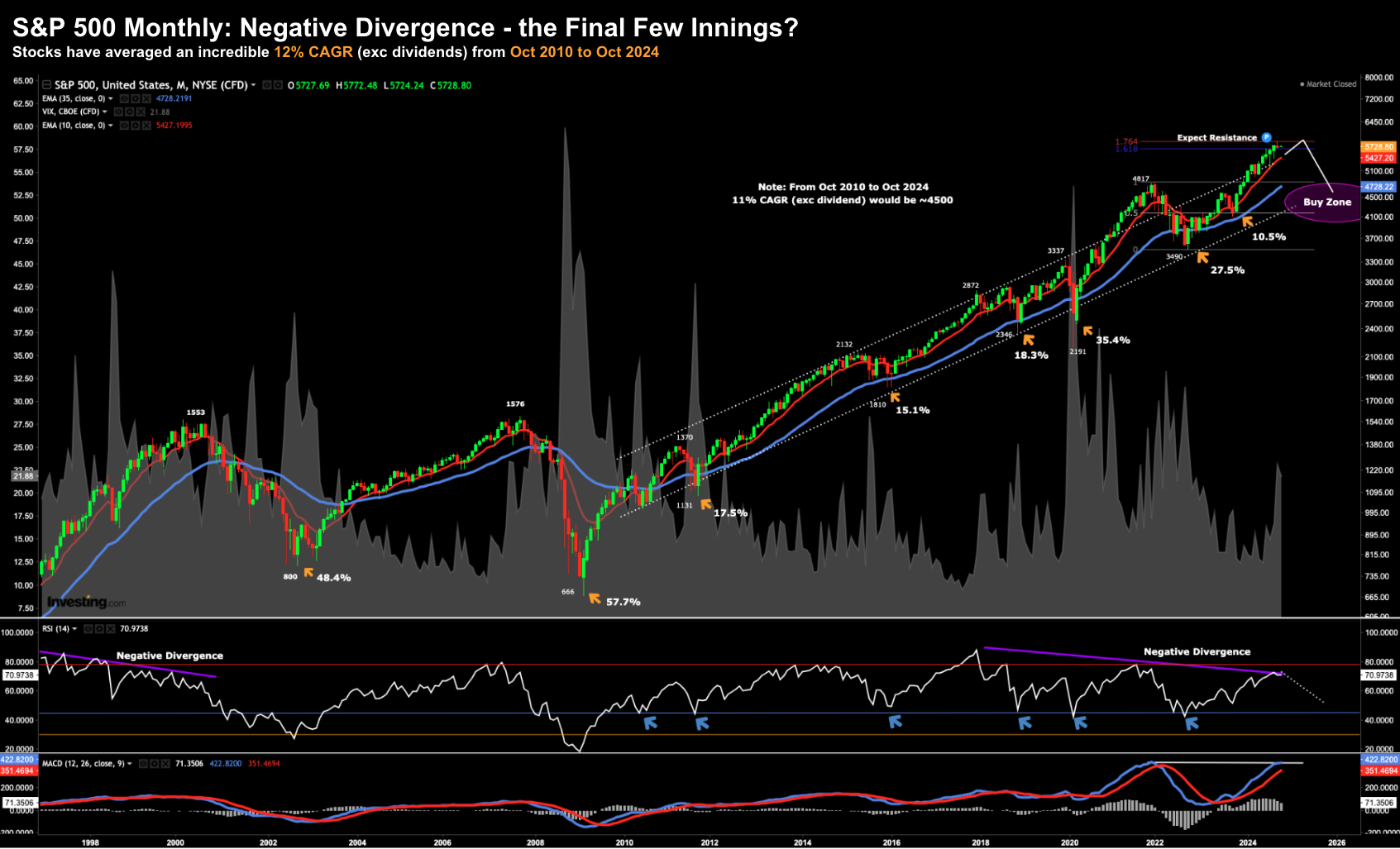

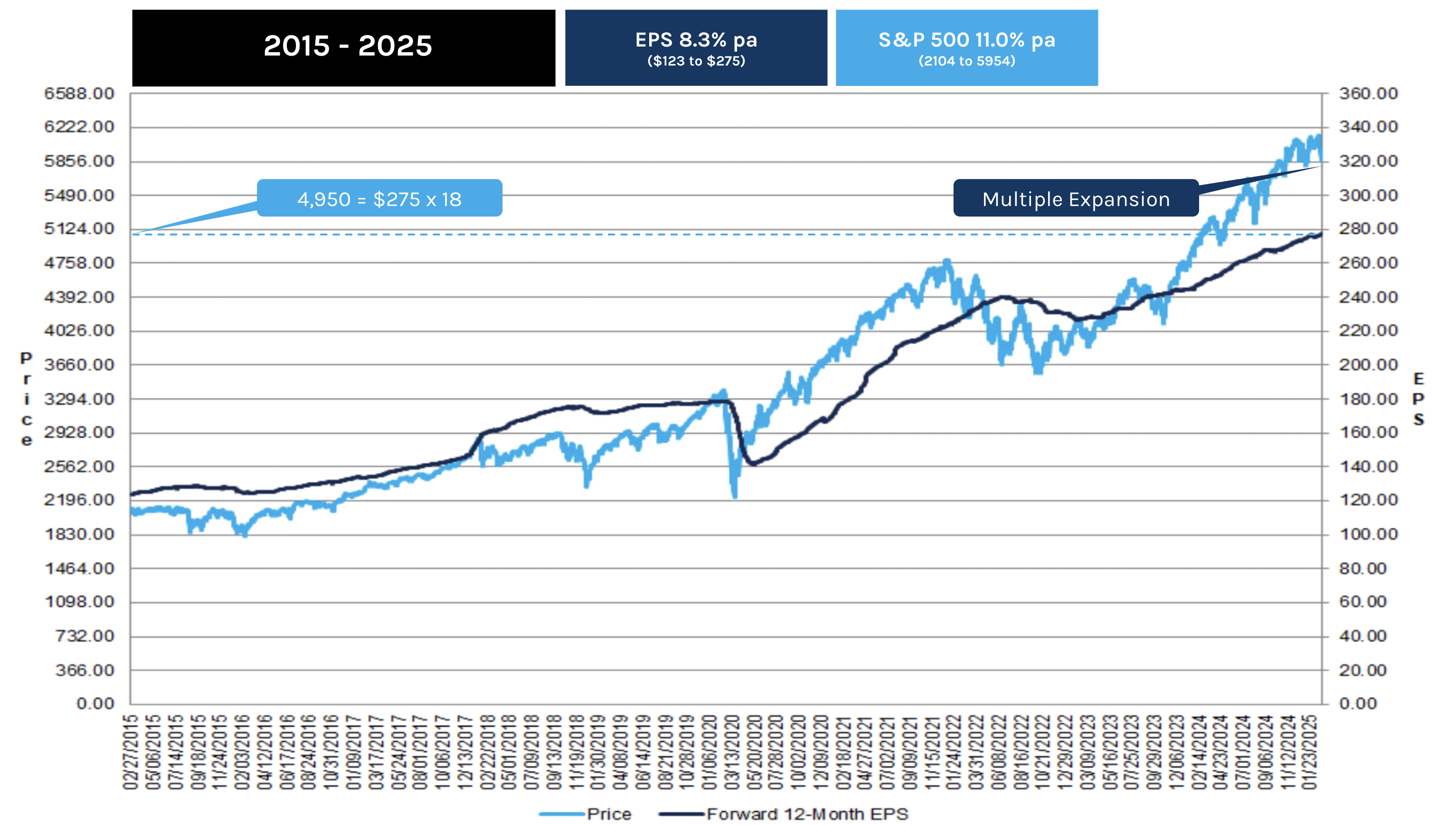

When Charlie Munger was asked the secret to his success - he answered “I’m rational.” Rational is not paying "33x forward earnings" for a company like Apple or Microsoft - despite their quality. Rational is also not selling the S&P 500 when it plunges to trade at just 16x forward earnings - because you are worried about a possible recession. Rational is adding exposure to high quality assets when they are at or below their long-term mean. And the more below the mean they trade - the stronger your (long-term) conviction should be.