Stocks Are Not Cheap

Stocks Are Not Cheap

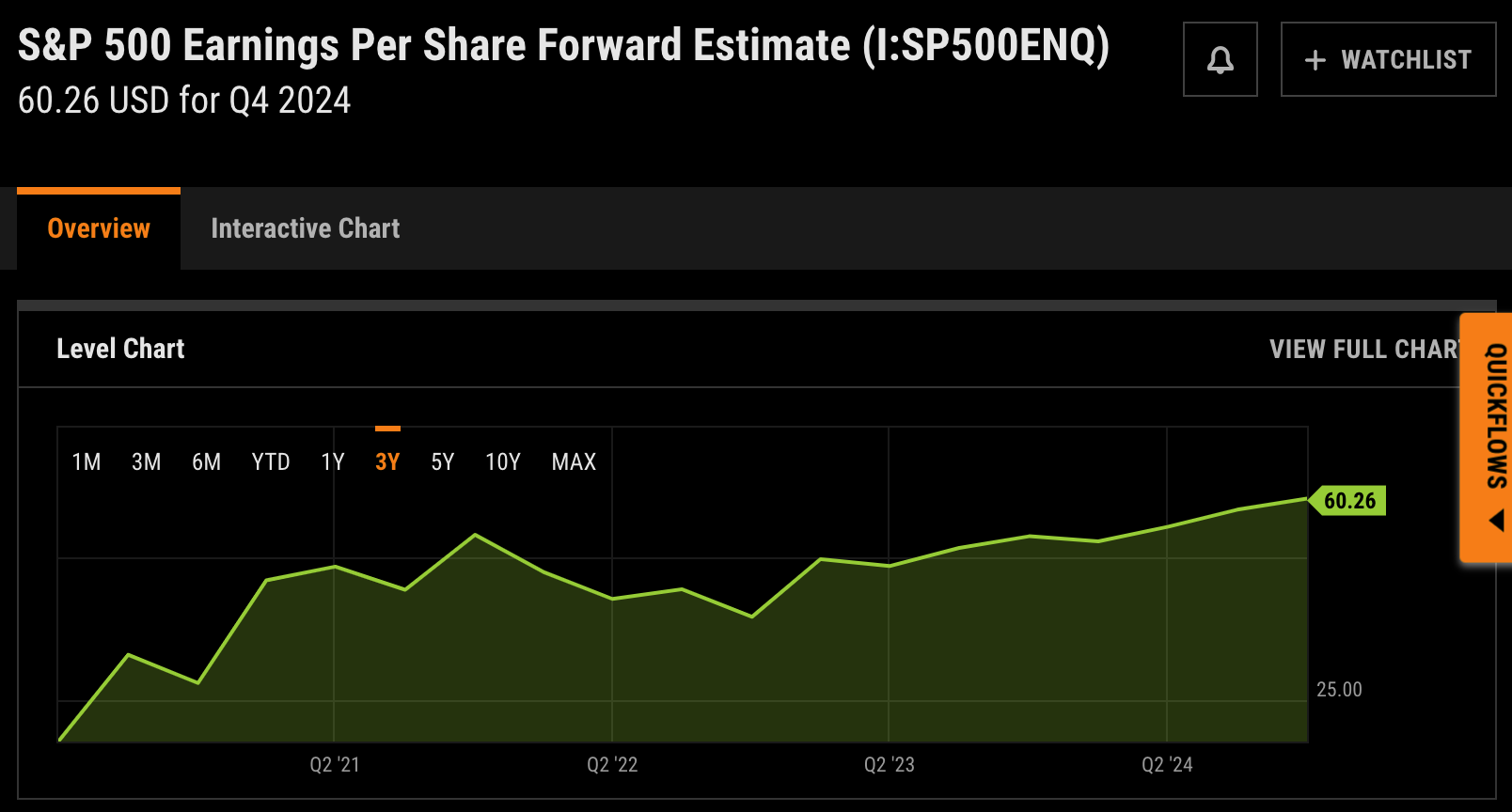

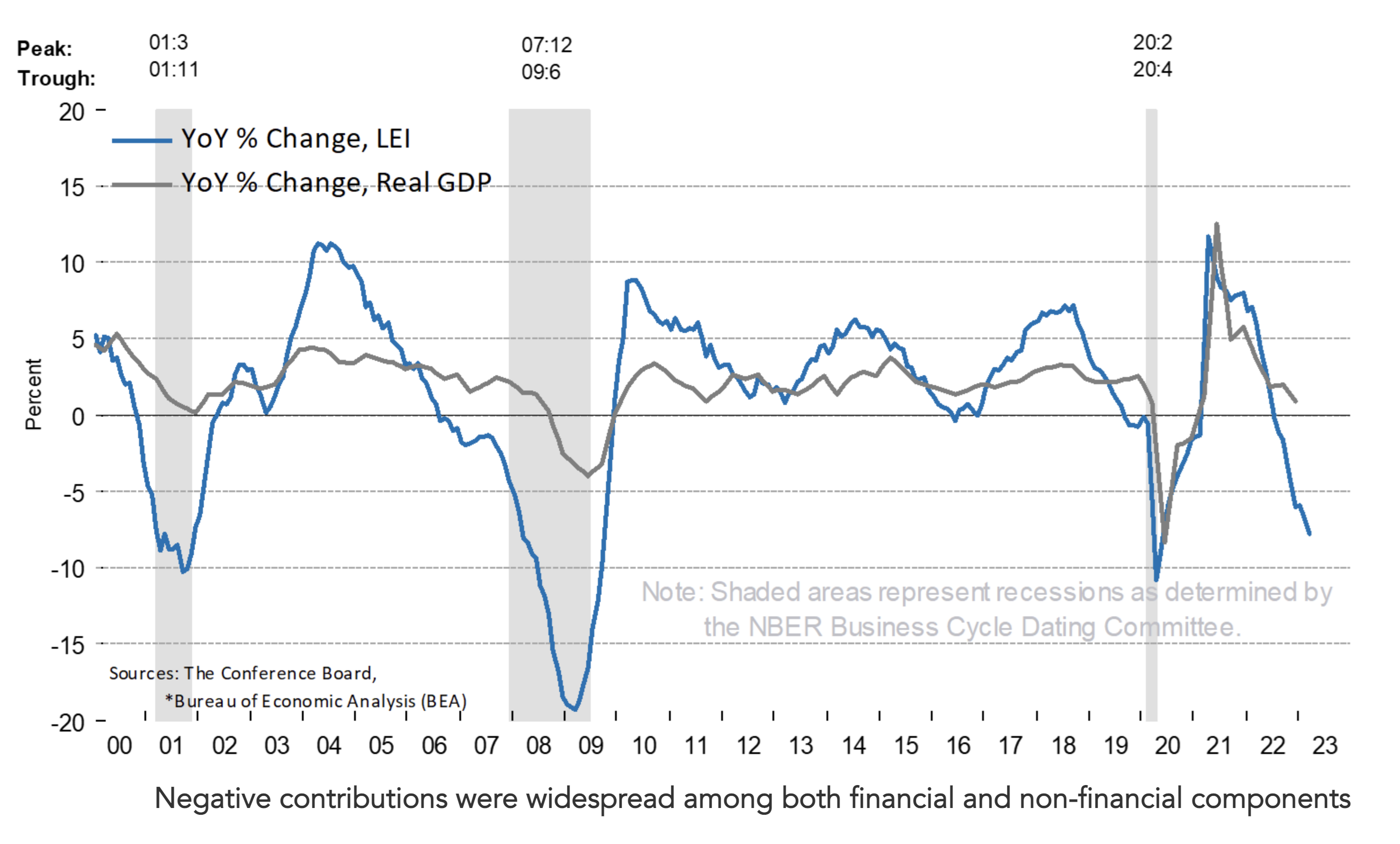

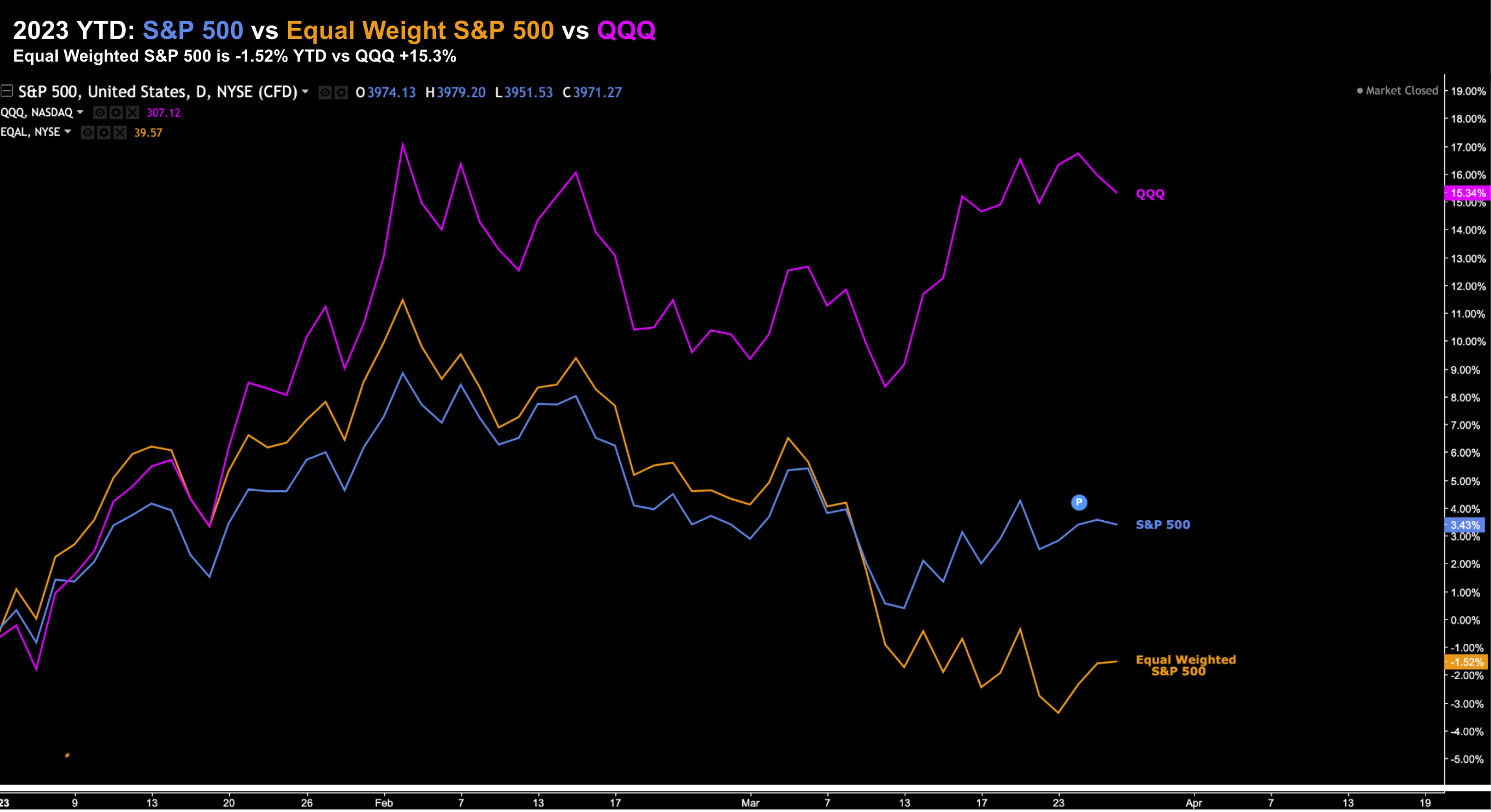

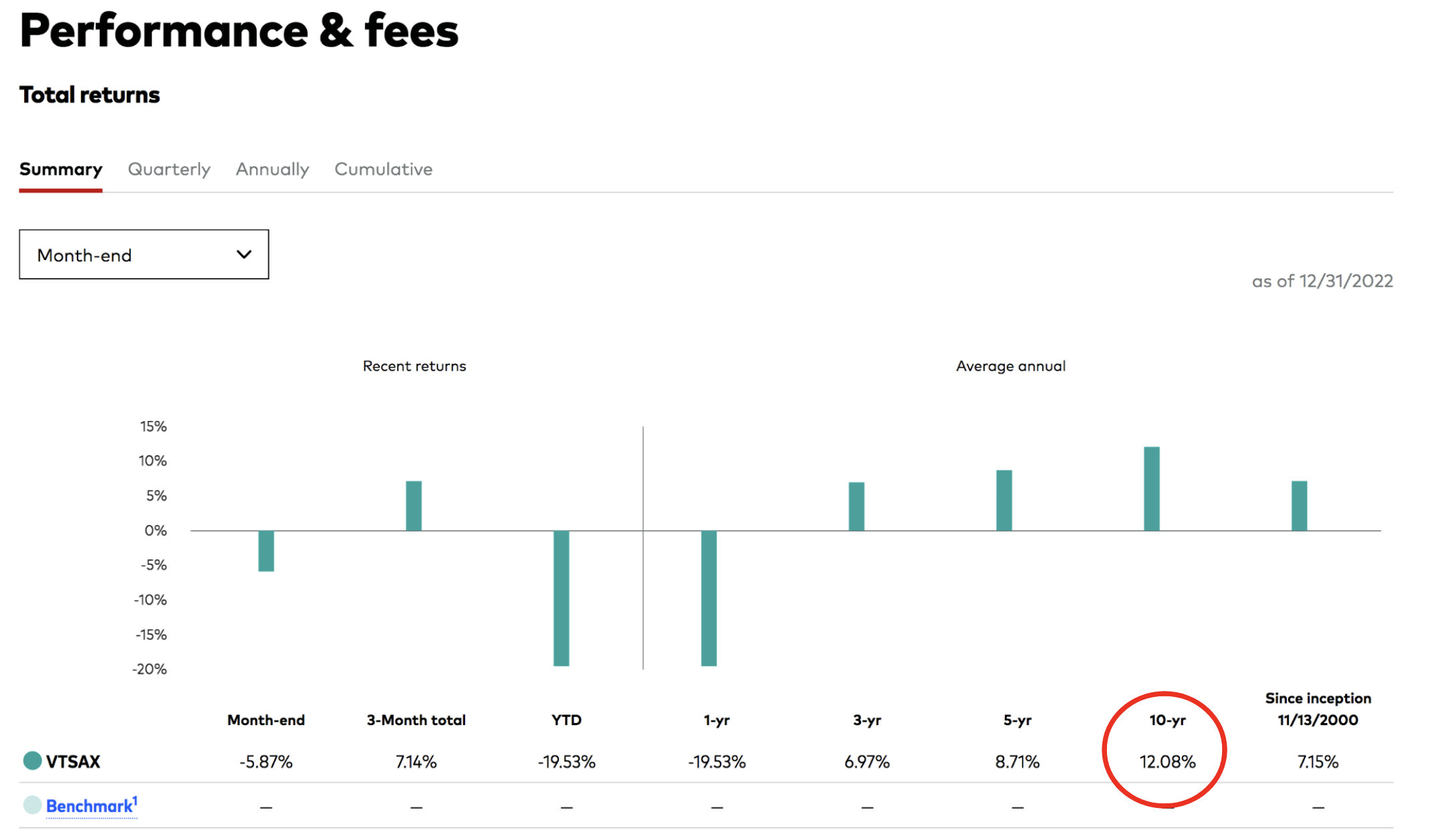

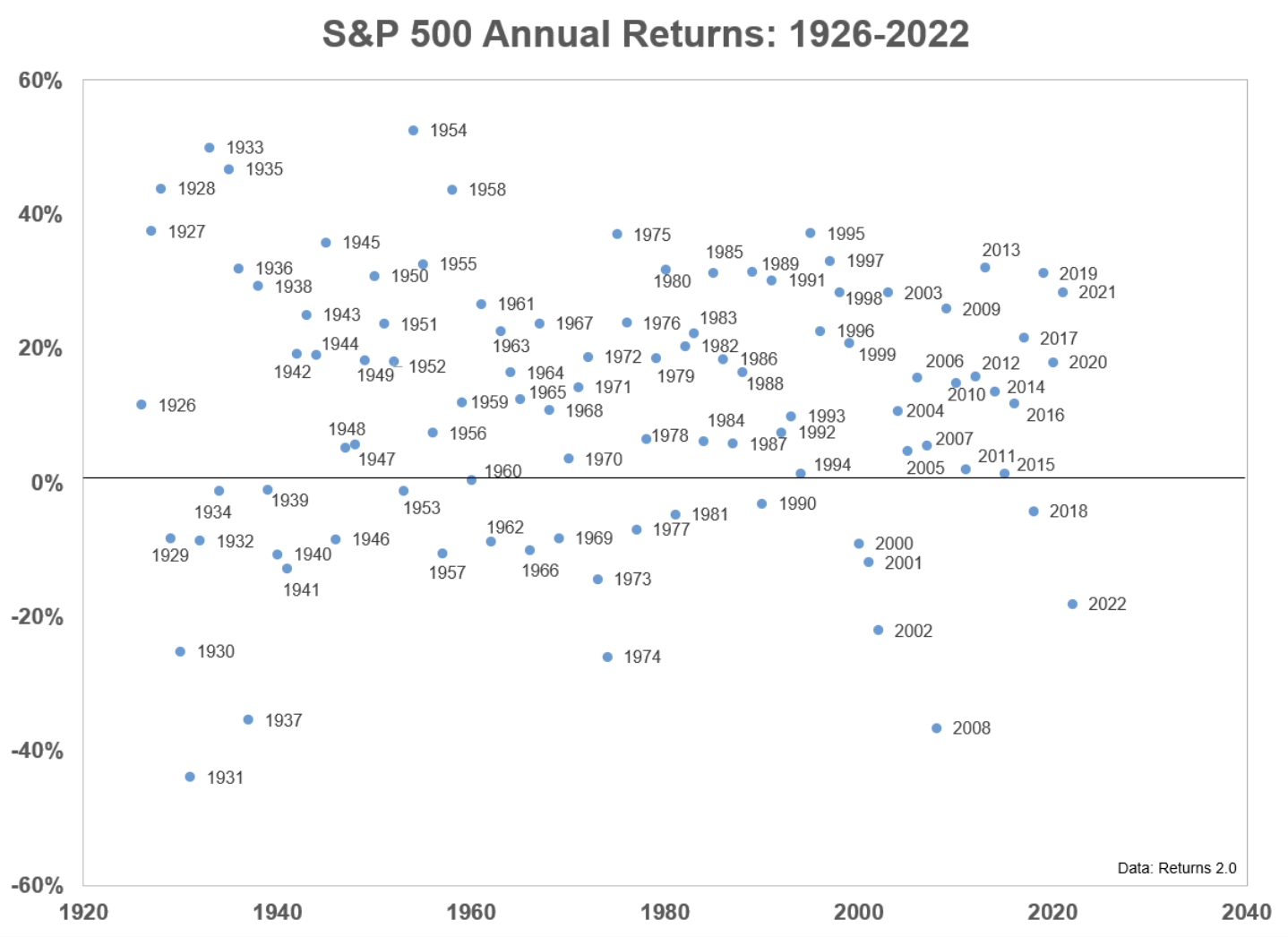

The S&P 500 has had a fantastic first 6 months of the year - up almost 15%. That's a welcomed relief from the miserable 2022. But are stocks now too expensive? What's the premium investors are being asked to pay? There are a couple of ways we can assess this. For example, we can compare the earnings yield against the risk free rate of return (currently around 5.5% and going up). And whilst it's always good to maintain some (long) exposure to the market - we need think carefully about how much (and where)