More Tricks than Treats?

More Tricks than Treats?

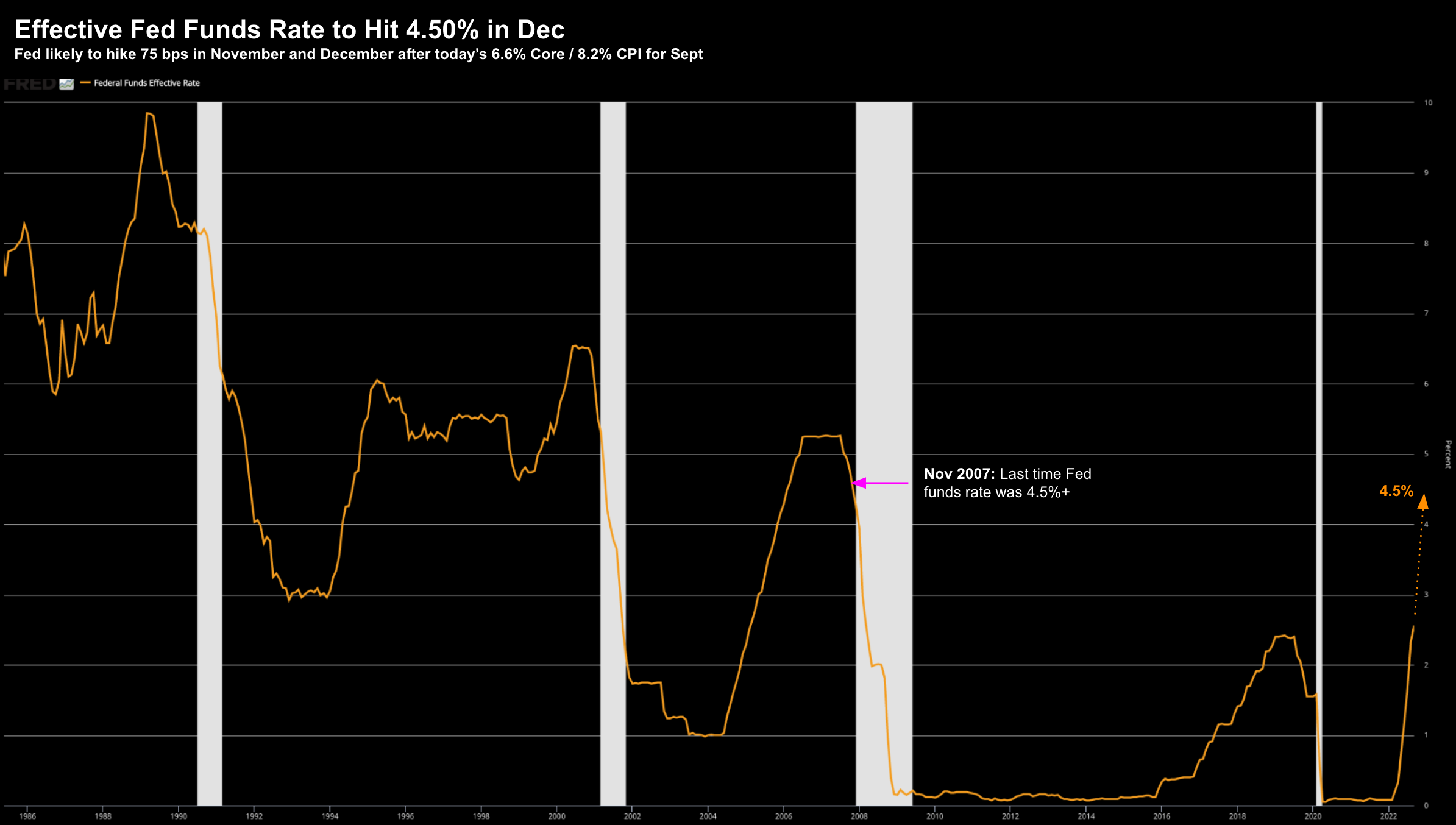

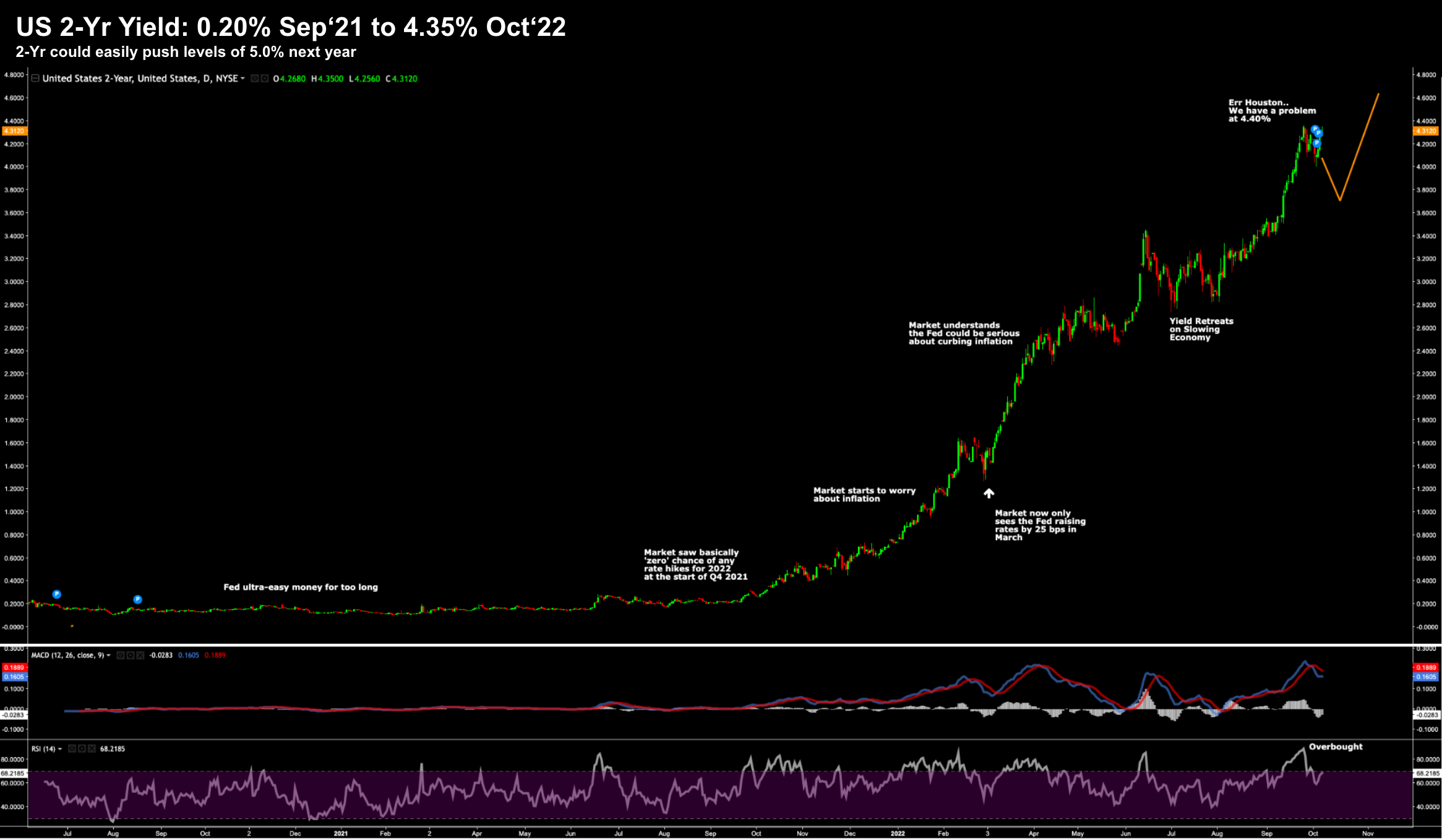

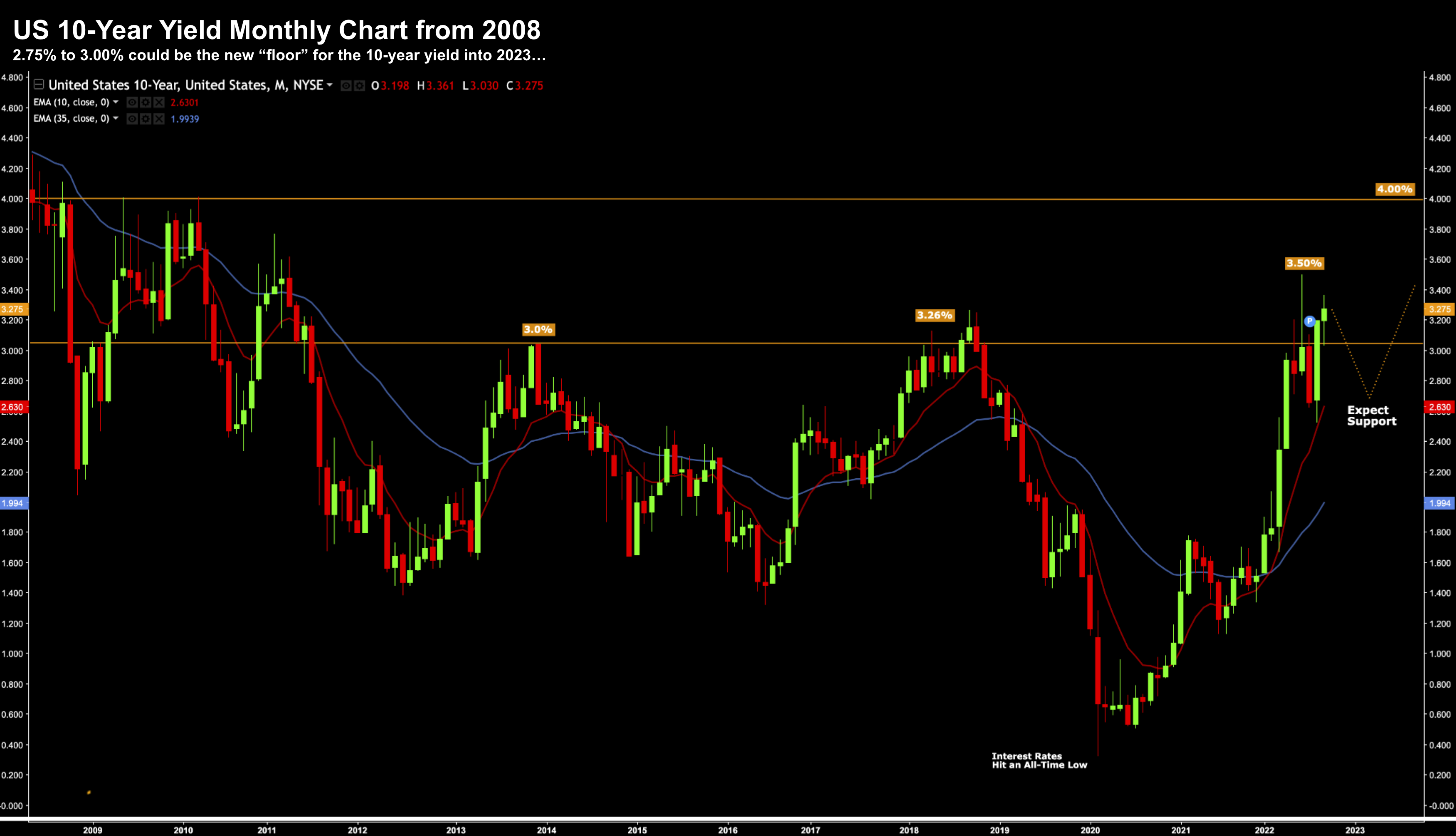

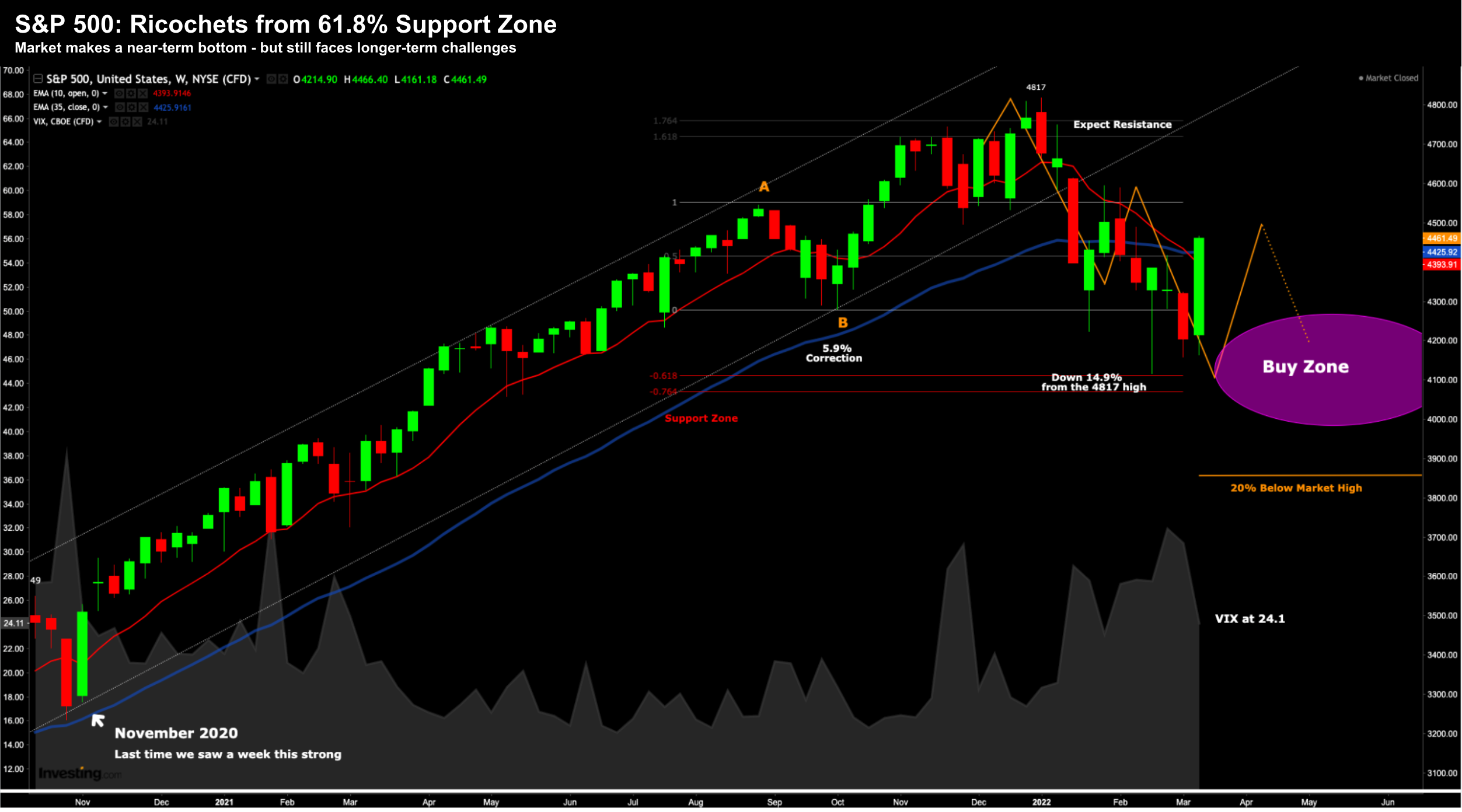

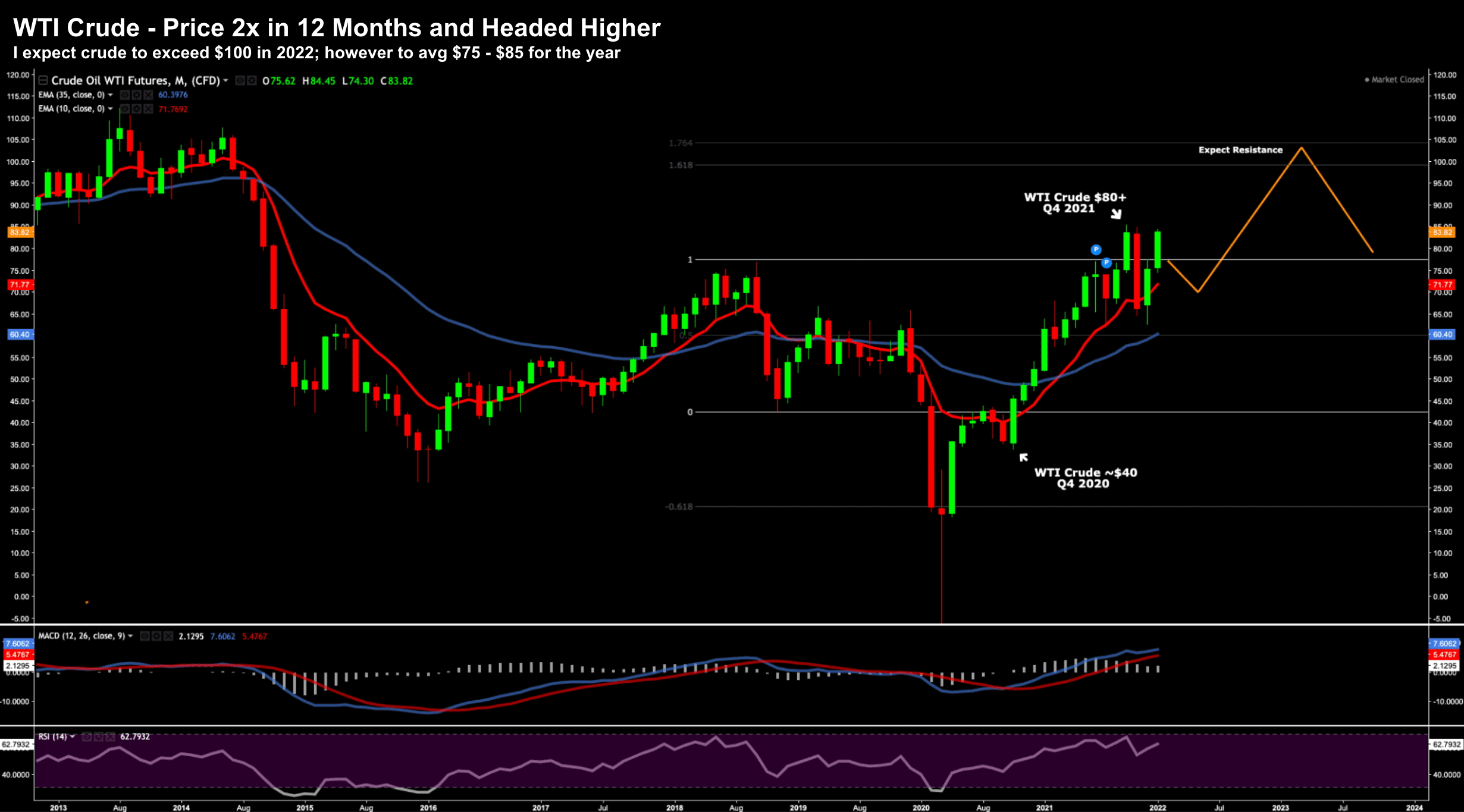

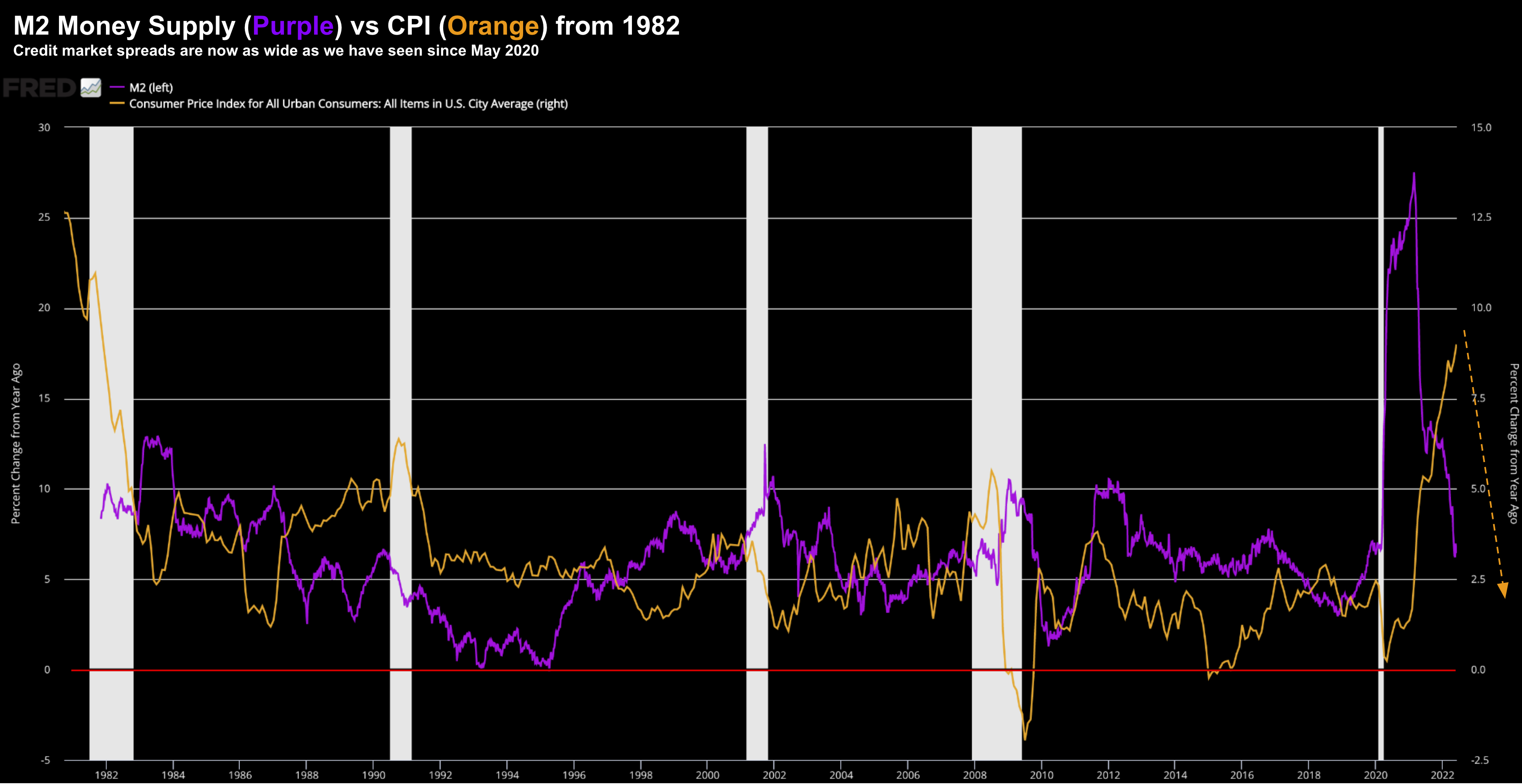

The market is up around 11% from its recent lows. Its rallying on the hope of a dovish Fed. My advice is tread carefully... you might get 'tricked' rather than 'treated' this Halloween. The upside does not handily outweigh the downside risks. Bear markets are known to do just that...