Cycles: Your Advantage over the Average Investor

Cycles: Your Advantage over the Average Investor

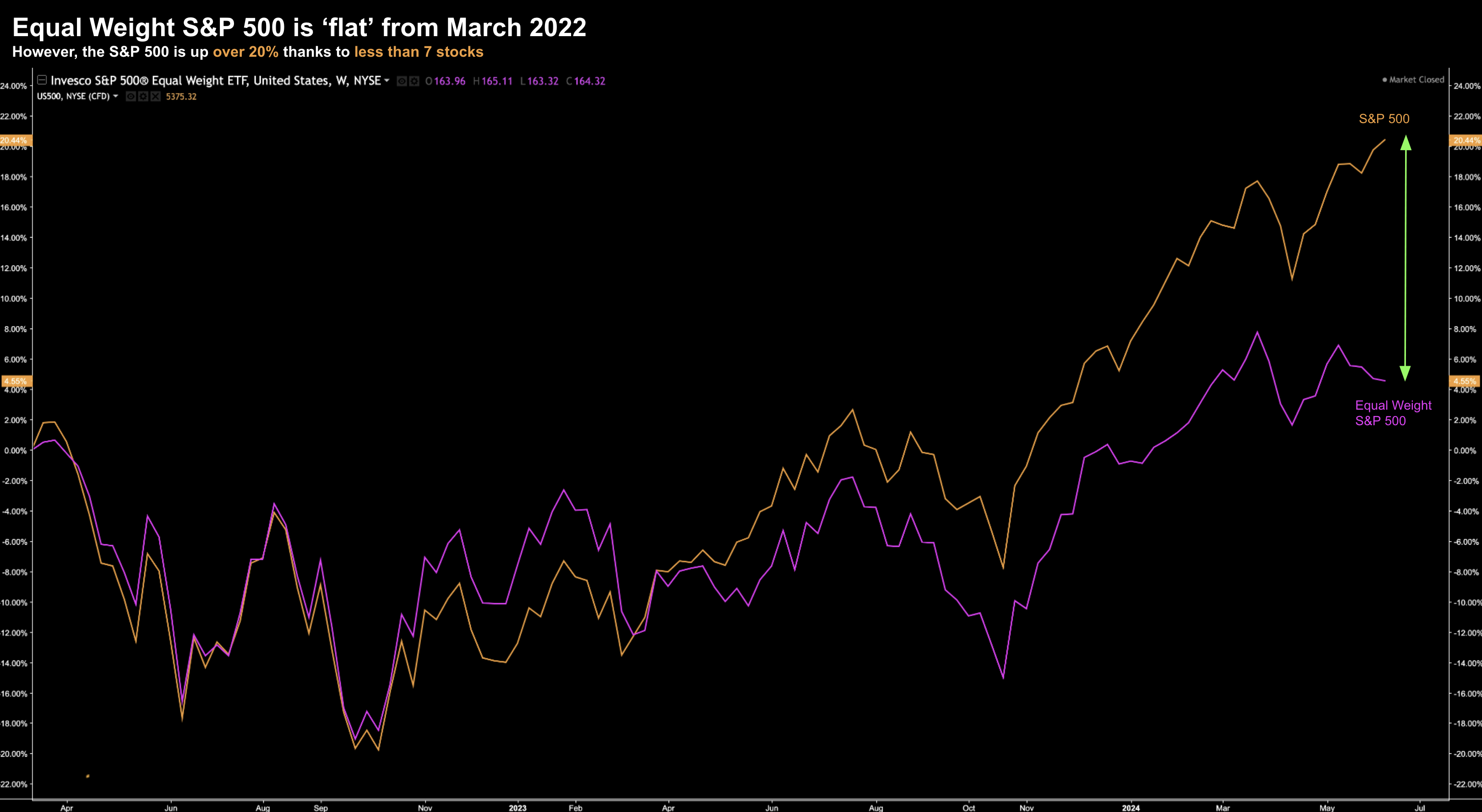

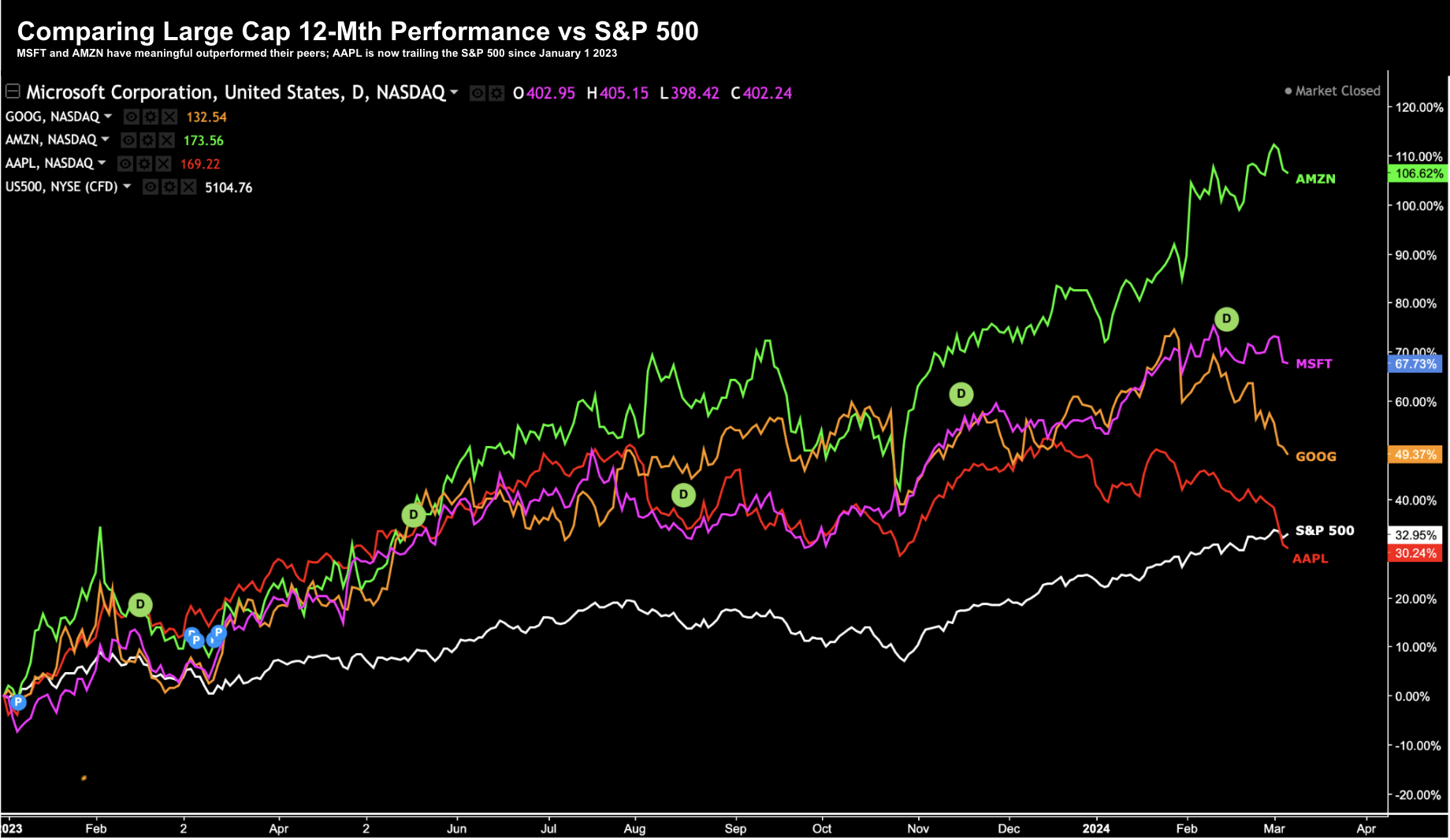

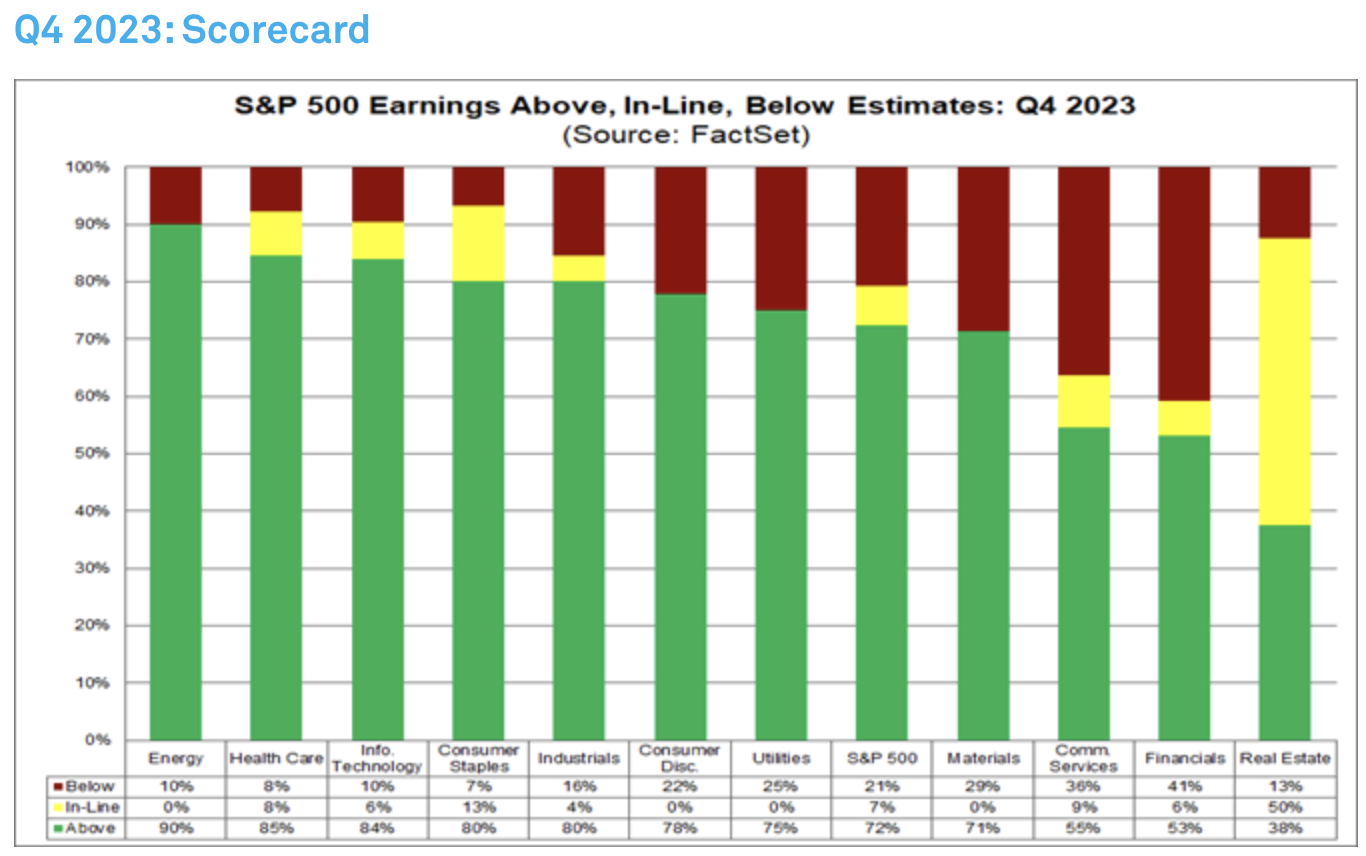

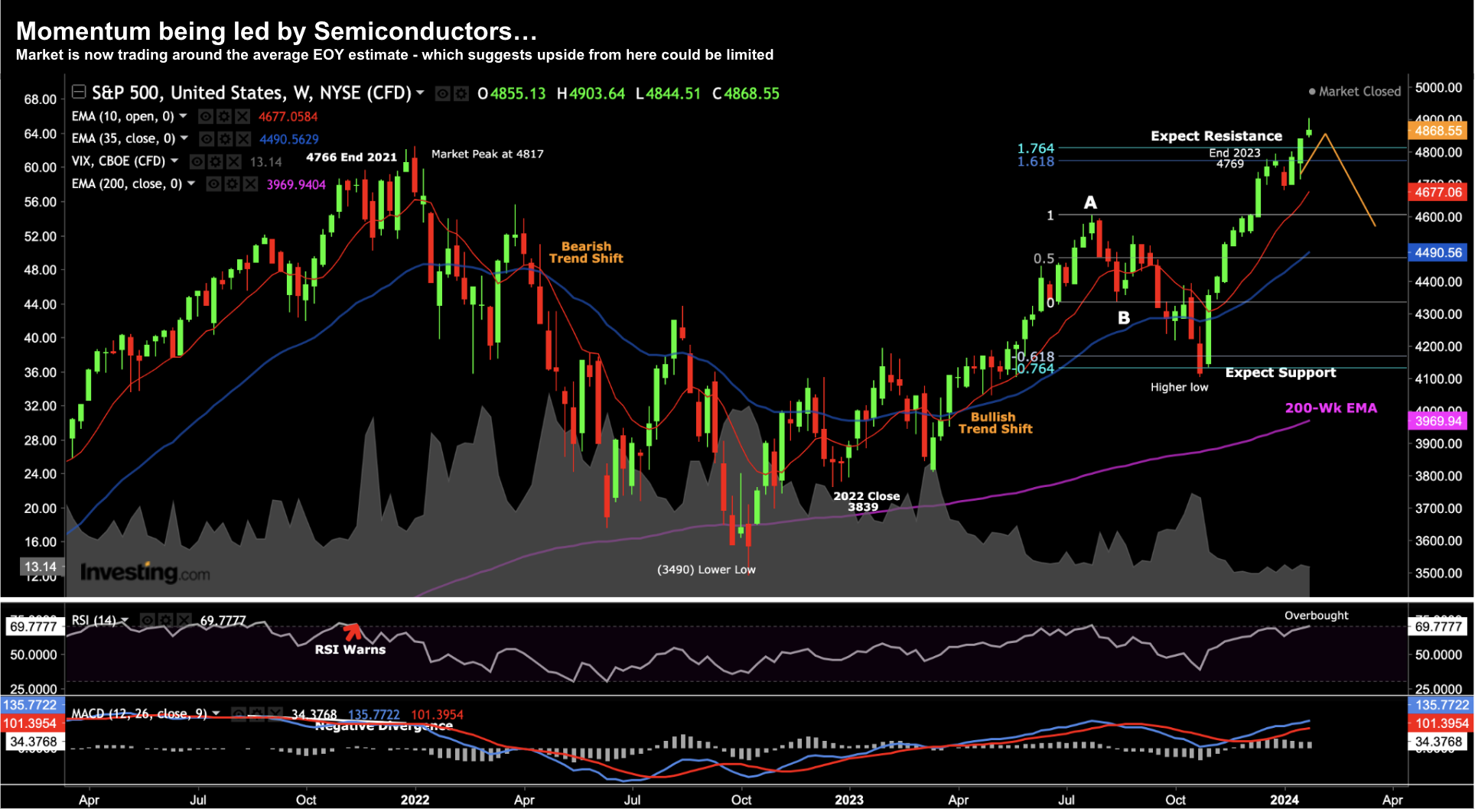

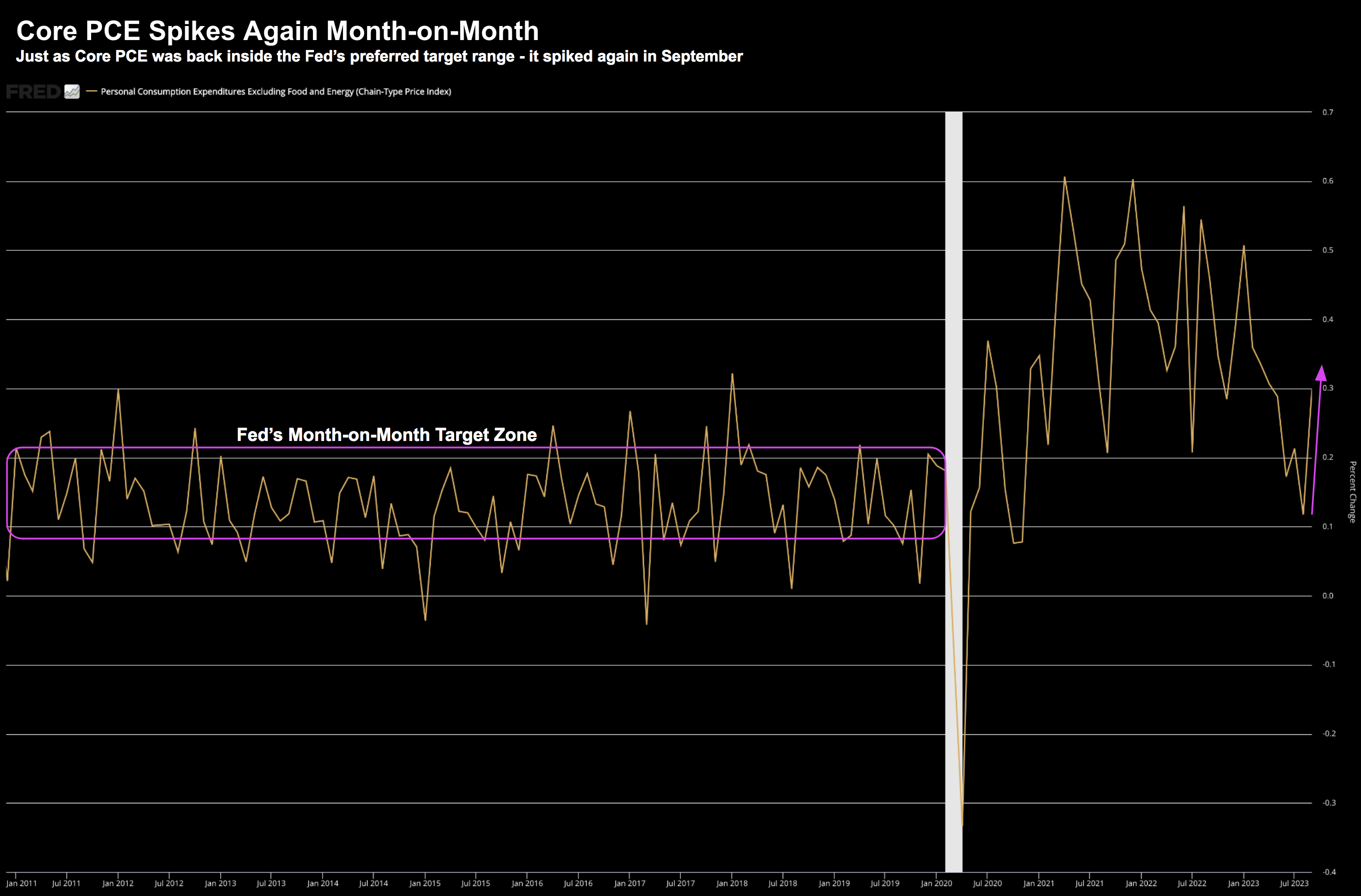

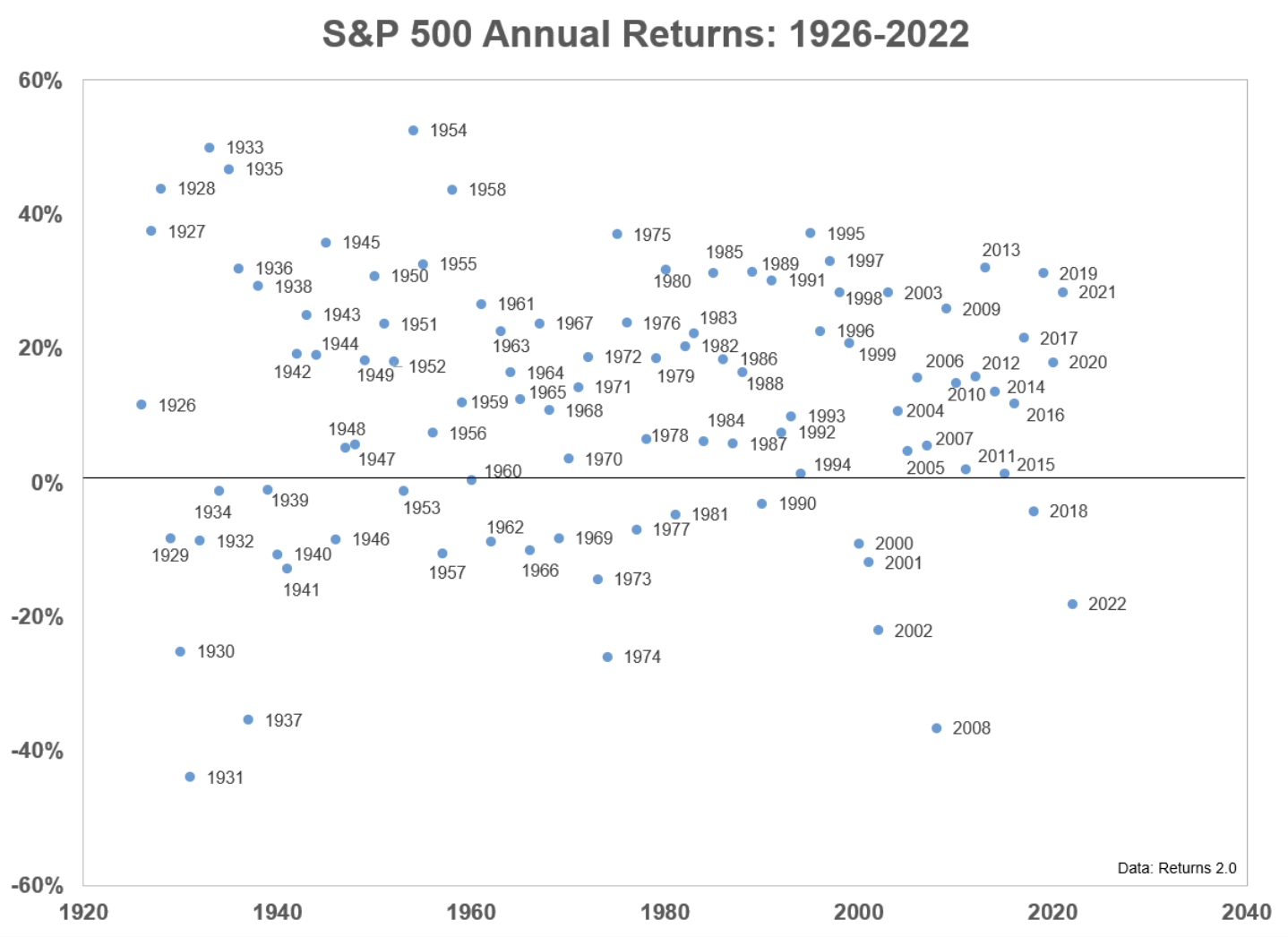

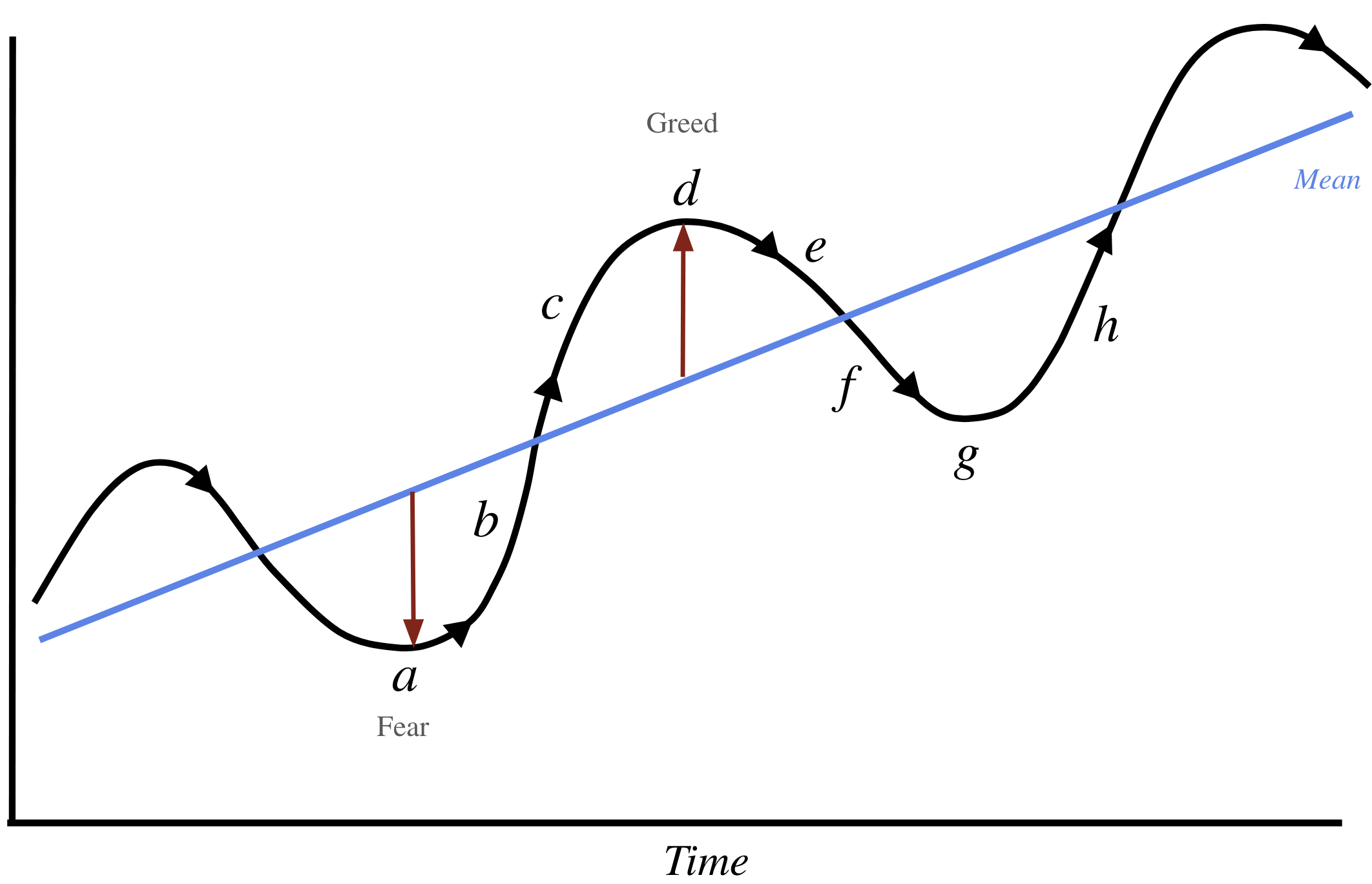

I made a decision to reduce my exposure to large-cap tech a few months ago. The decision wasn't an easy one... these are great stocks. For example, did I sell prematurely? The answer will be more obvious in 6-12 months when the cycle has had sufficient time to play out. For now (as was the case when I sold) - I think the downside risks meaningfully outweighed further upside gains. In this post, I explained how selling is a way of managing your risk. I was ensuring I banked the appreciable gains realized over the past few years. In light of the rotation out large-cap tech we've seen this week - I thought it was opportune to share some thoughts on (a) how I calibrate my portfolio in a changing environment; and (b) when to be aggressive and when to play defense. It all comes back to understand the economic cycle...