Big Tech Earnings on Tap… as Bond Yields Jump

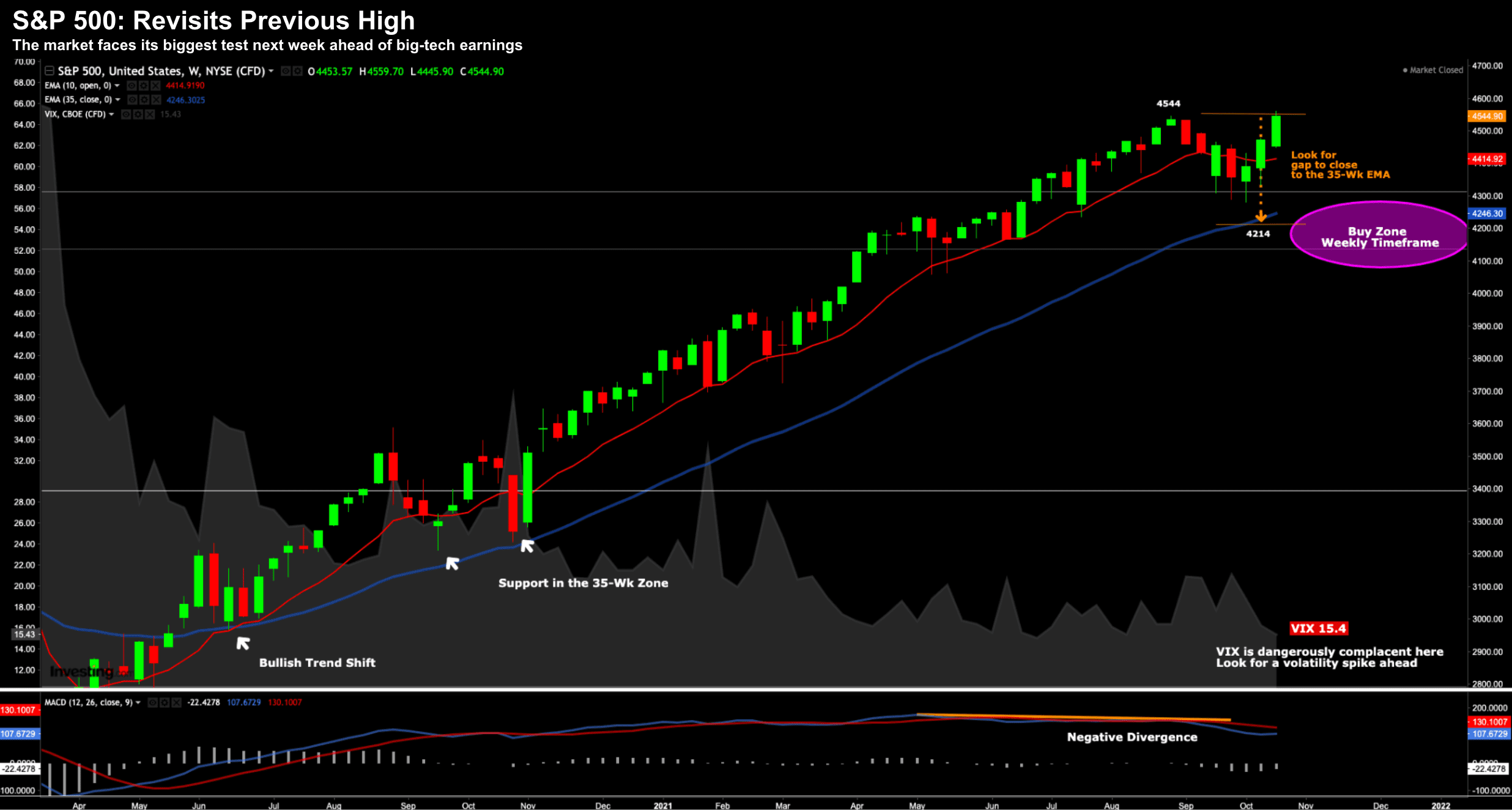

Big Tech Earnings on Tap… as Bond Yields Jump

Earlier this week I said bond yields are now calling Jay Powell's bluff. My take is bonds sense higher inflation ahead (at least for next year). And as we know - 'bond markets are typically early... but generally right'...