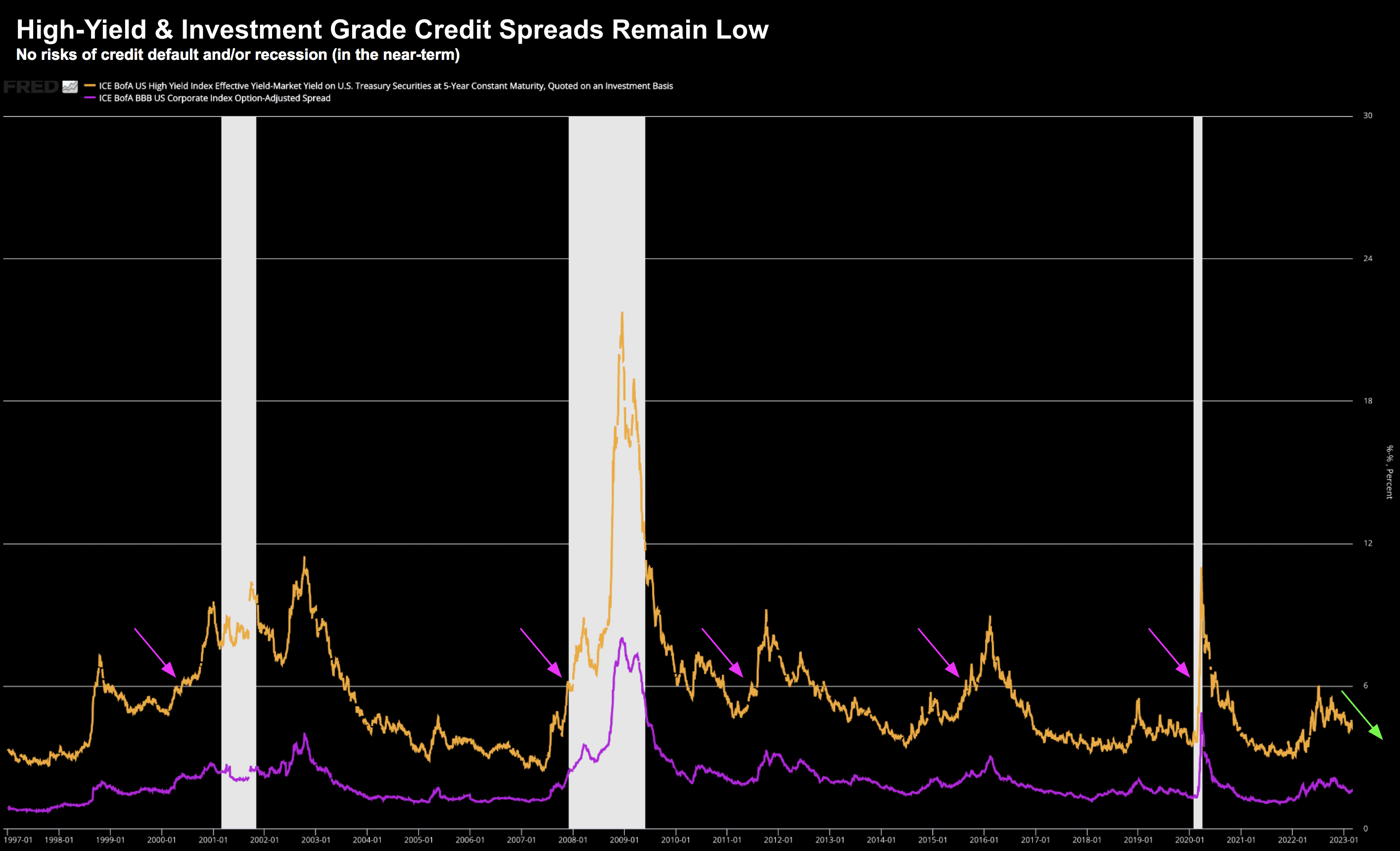

Surface Cracks Appear in Credit

Surface Cracks Appear in Credit

If there's one thing that keeps the US going... it's the availability of cheap credit. Love it or hate it - the US is a credit driven economy. If credit dries up - it's goodnight nurse. The US consumer now owes close to $1Trillion on their credit card - a 17% jump from a year ago and a record high. More than 33% U.S. adults have more credit card debt than emergency savings