For Now, A Slowing Economy is Good News

For Now, A Slowing Economy is Good News

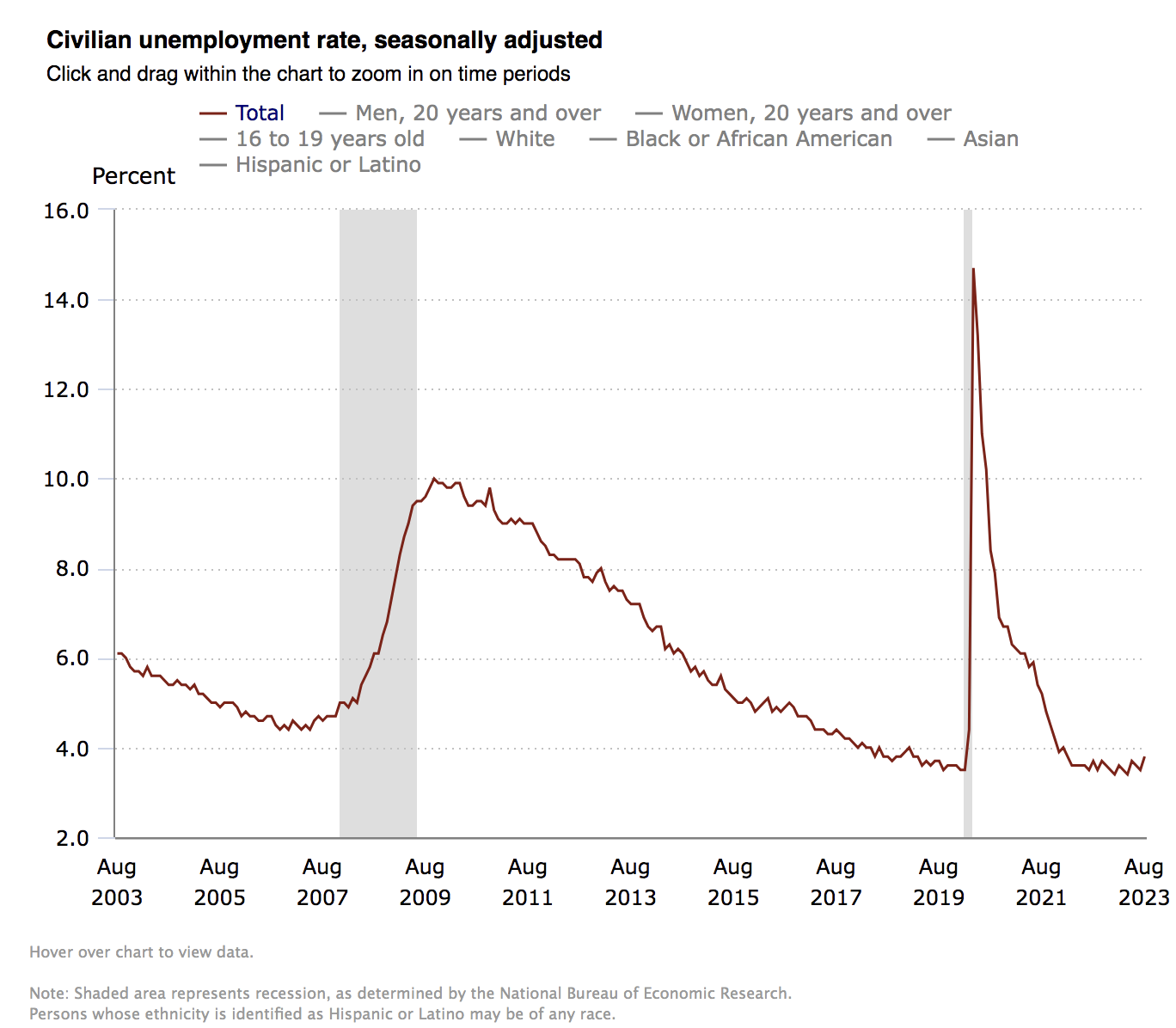

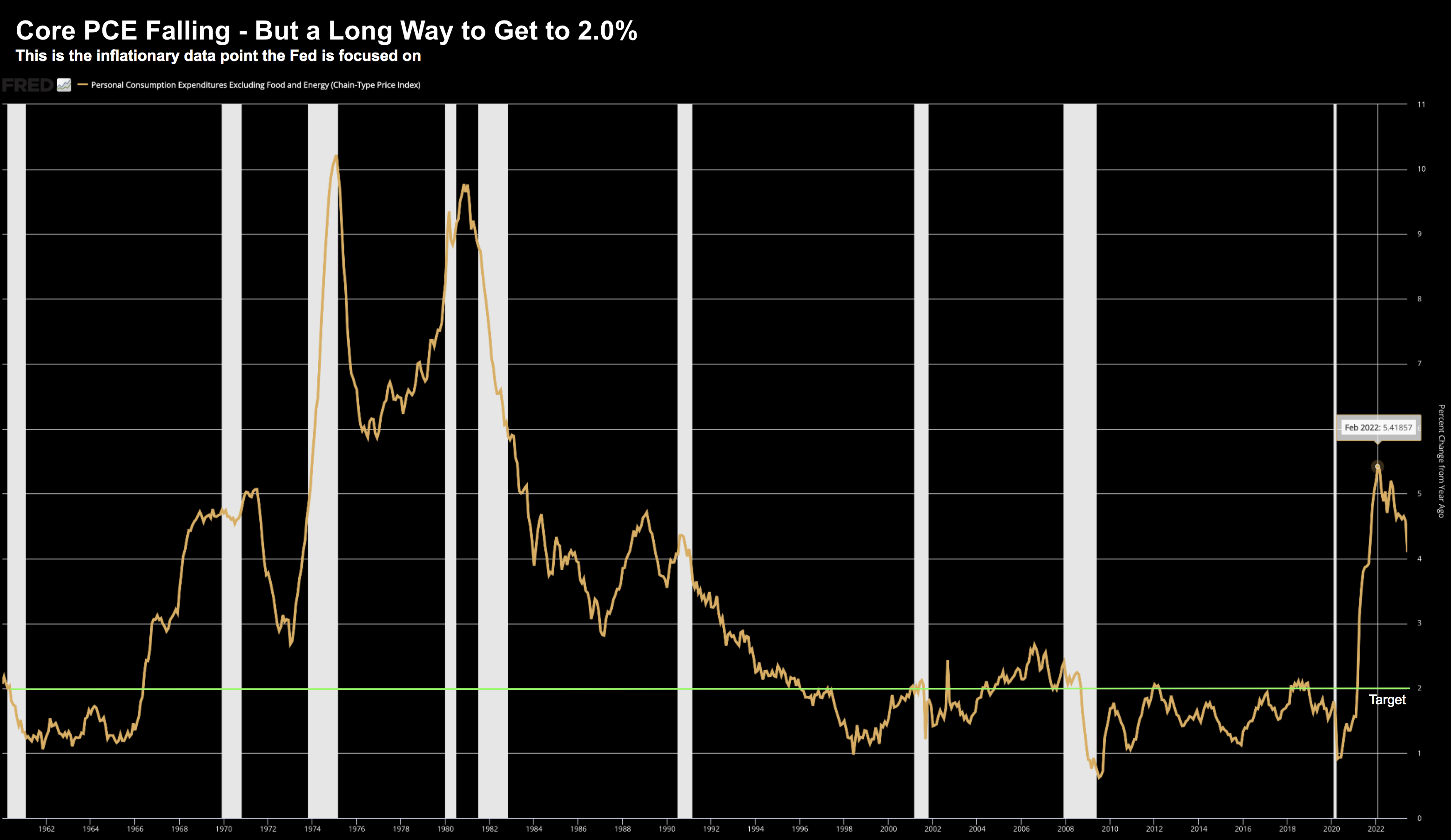

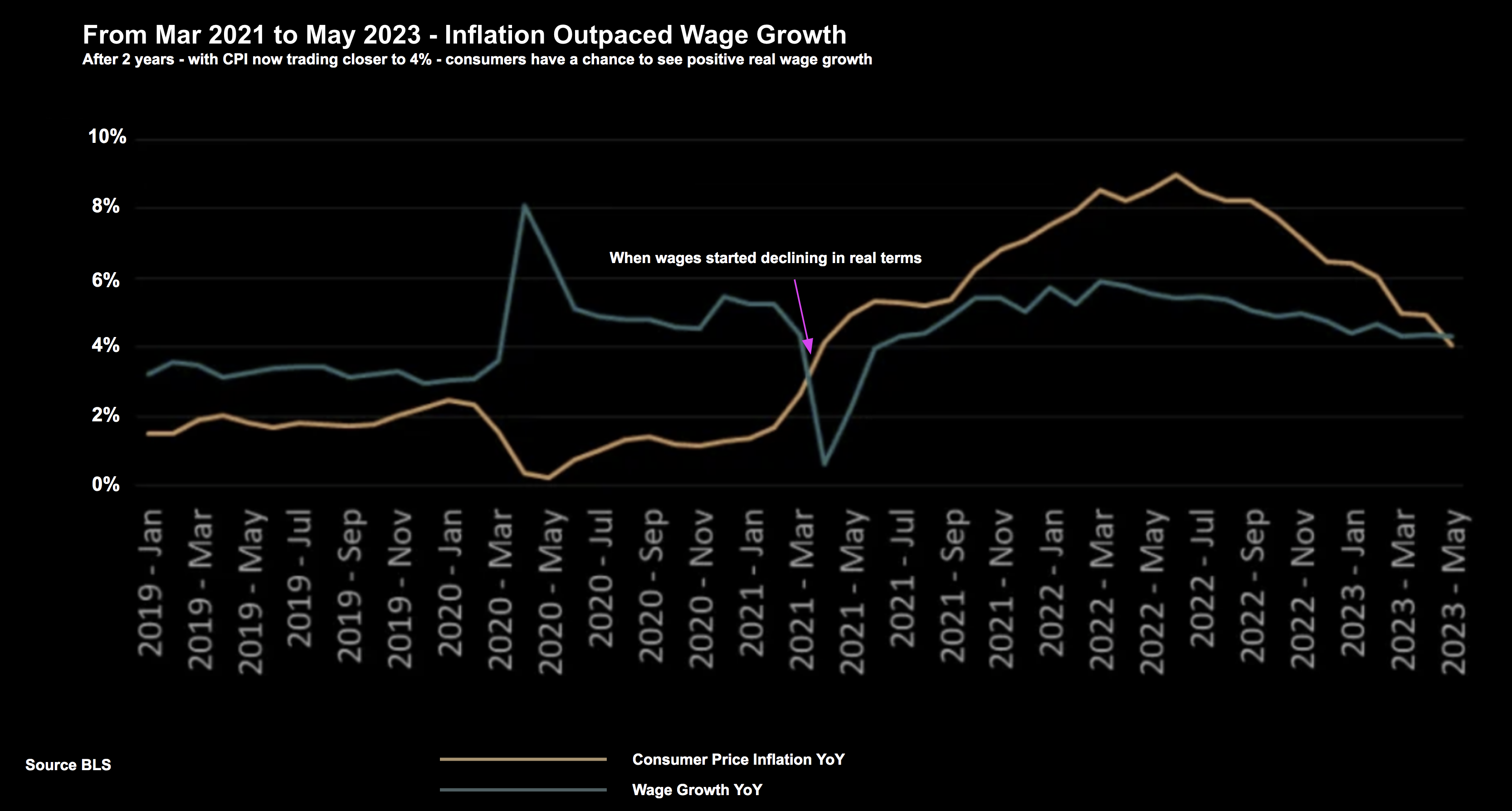

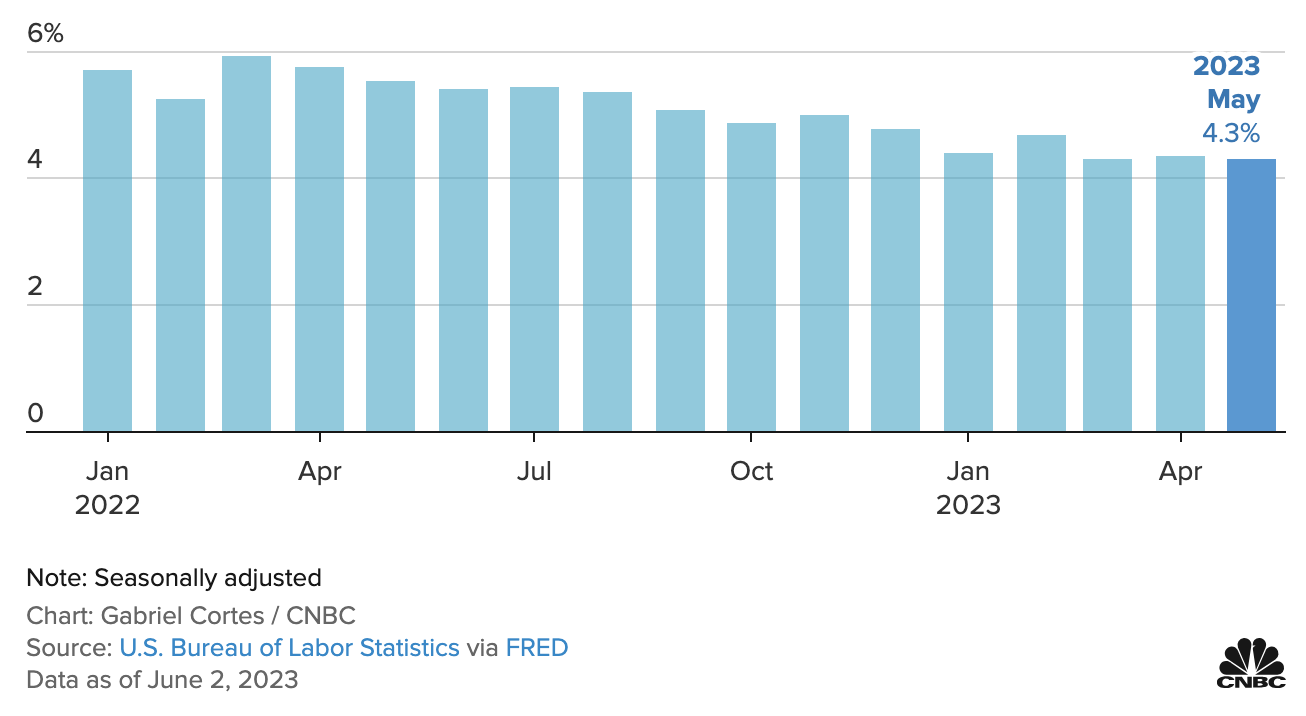

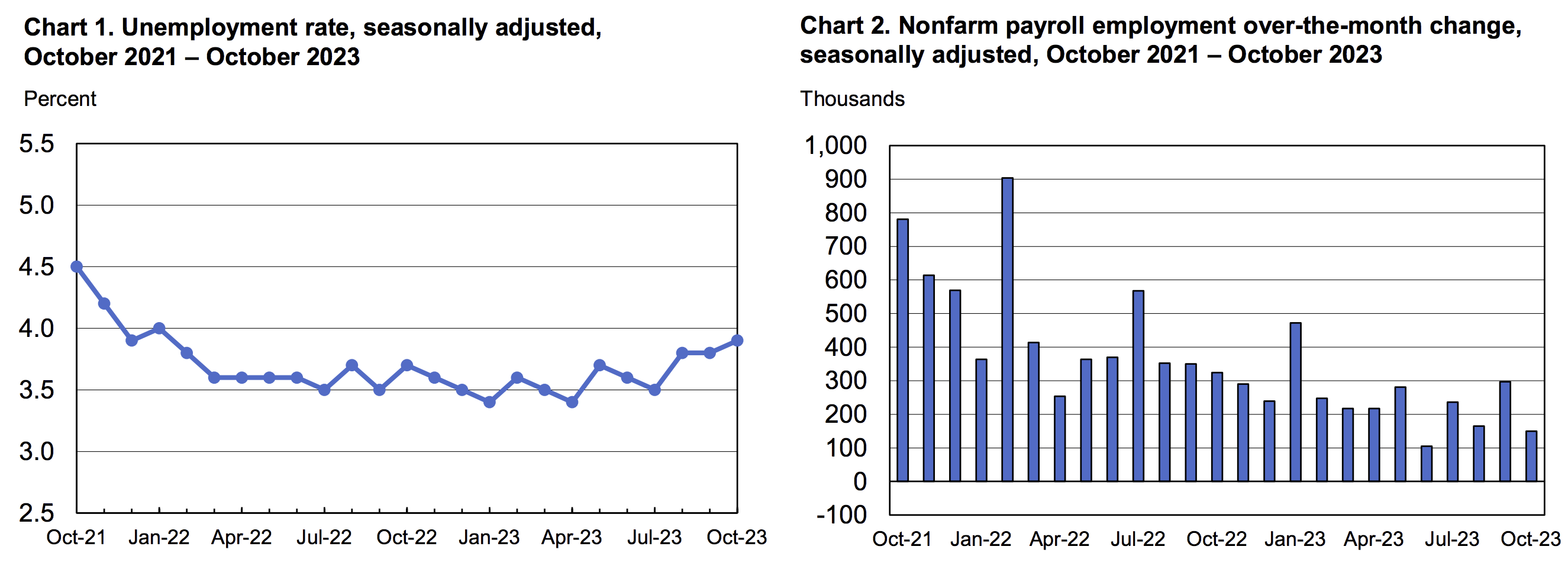

A weaker than expected October payrolls print sent stocks flying and bond yields sharply lower. The S&P 500 finished at 4358 - a whopping 5.9% for the week. It was the market's best week for the year. Renewed bullish enthusiasm was mostly due to investors betting the Fed is done. And that makes sense. For example, if employment, growth and inflation continue to soften - there's every possibility the Fed has hit its terminal rate. However there is a caveat. Not only will the Fed need softer economic data - they are hoping the bond market continues to keep financial conditions tight (i.e. bond yields stay high)