Fed Gets Green Light… Market Thinks Otherwise

Fed Gets Green Light… Market Thinks Otherwise

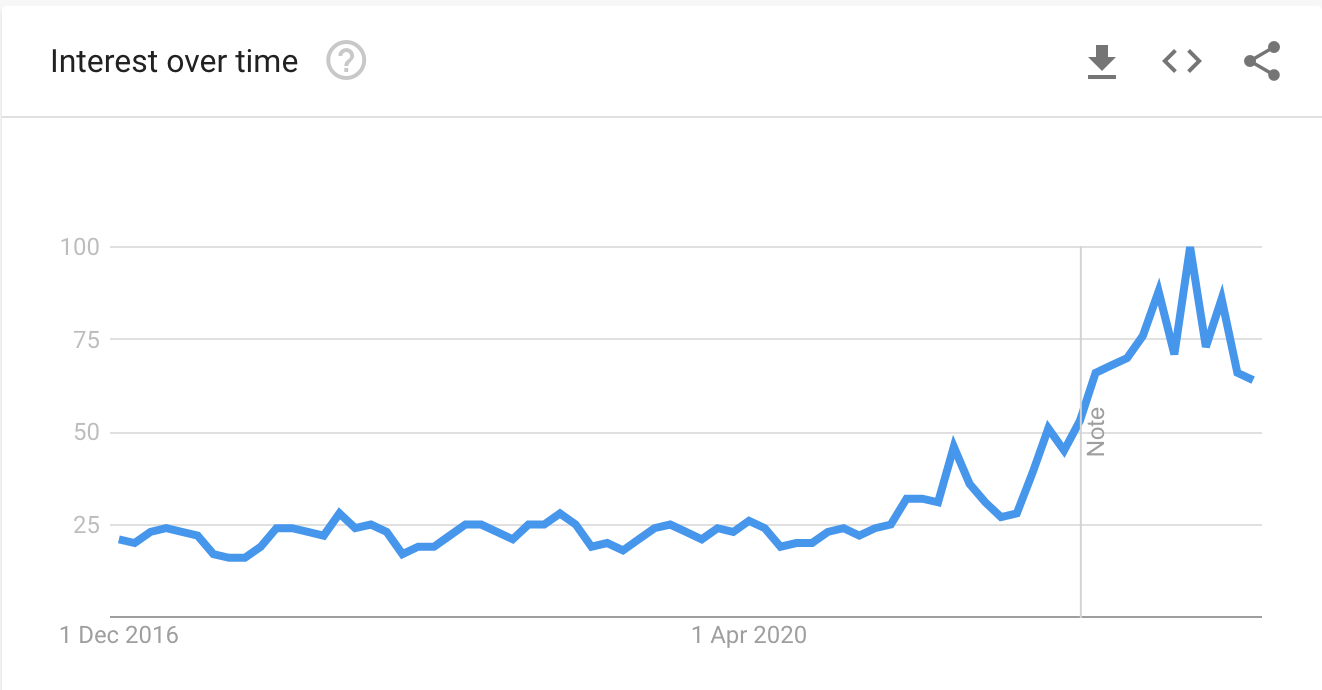

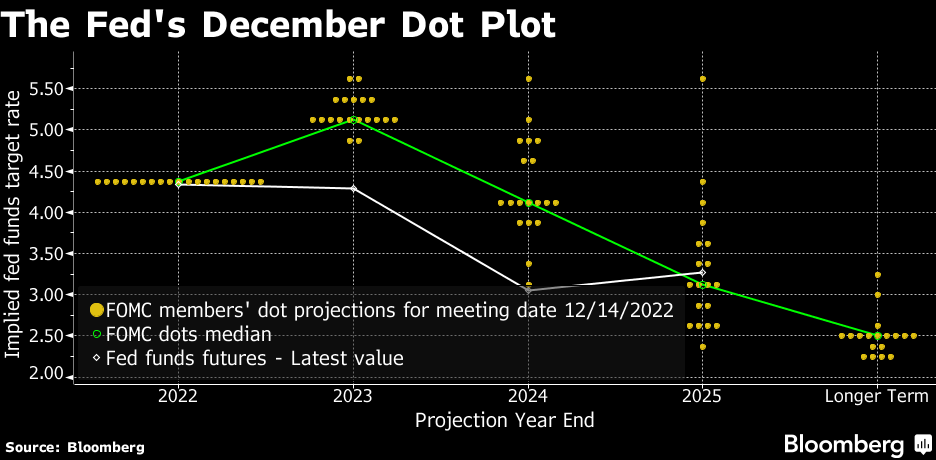

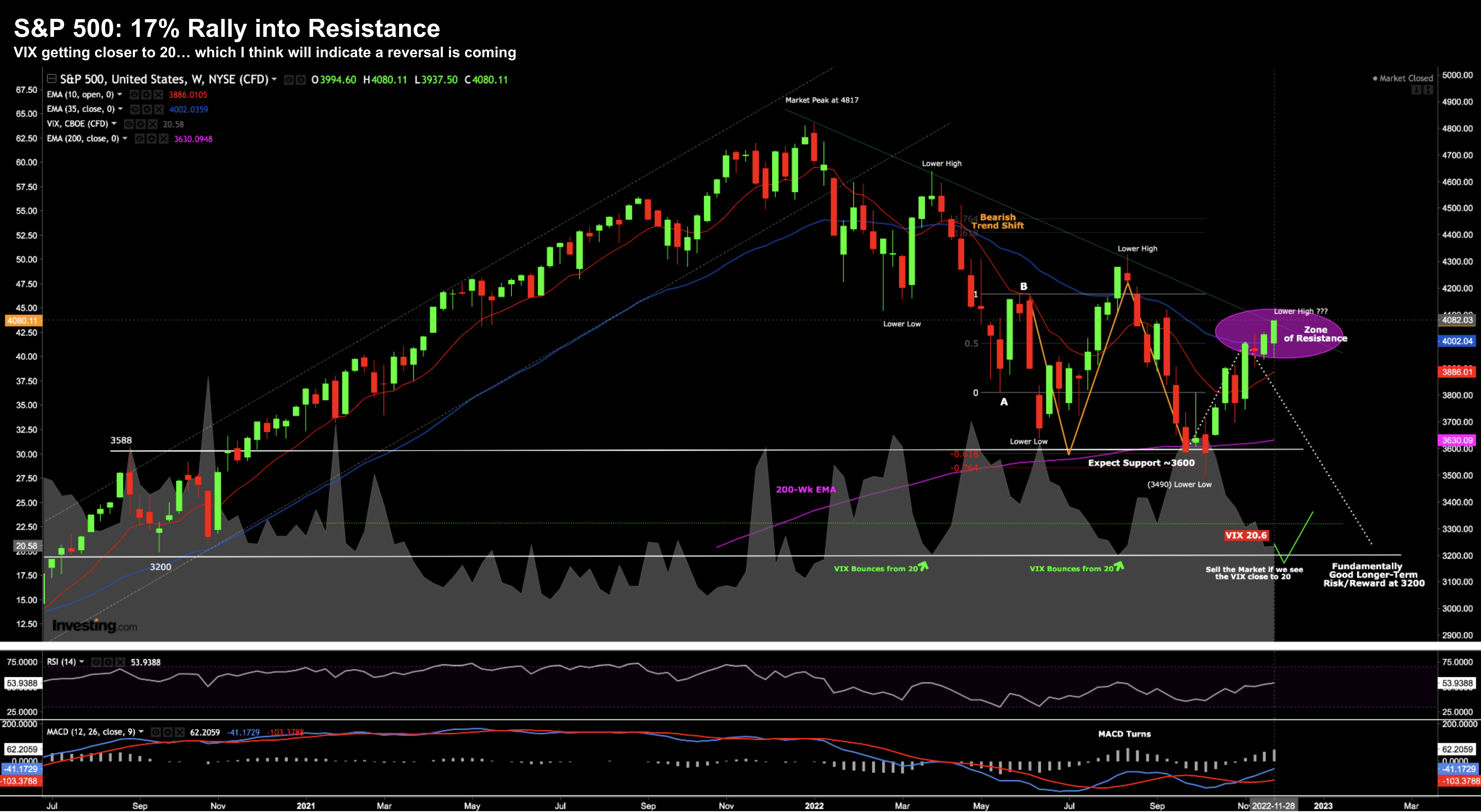

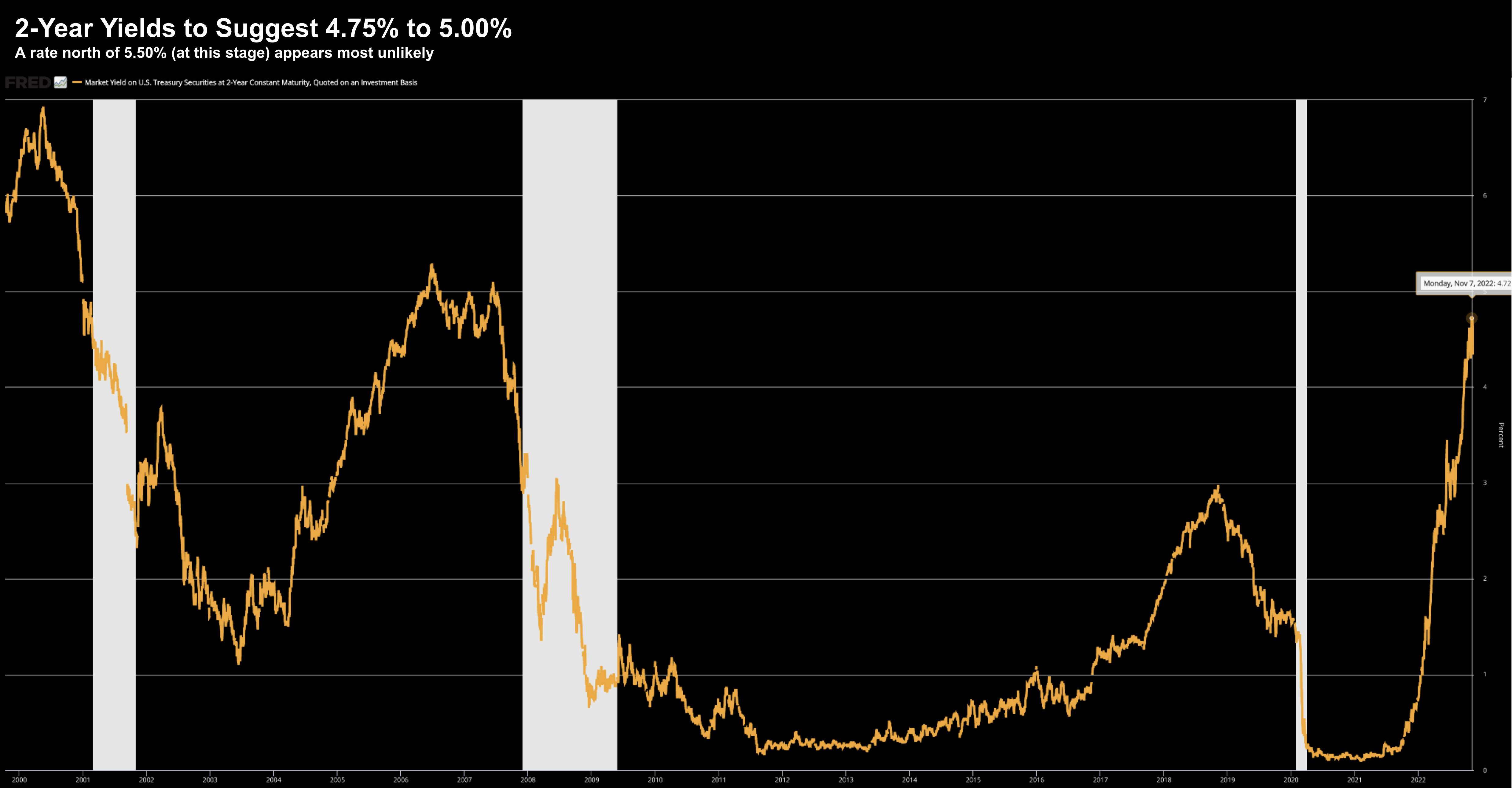

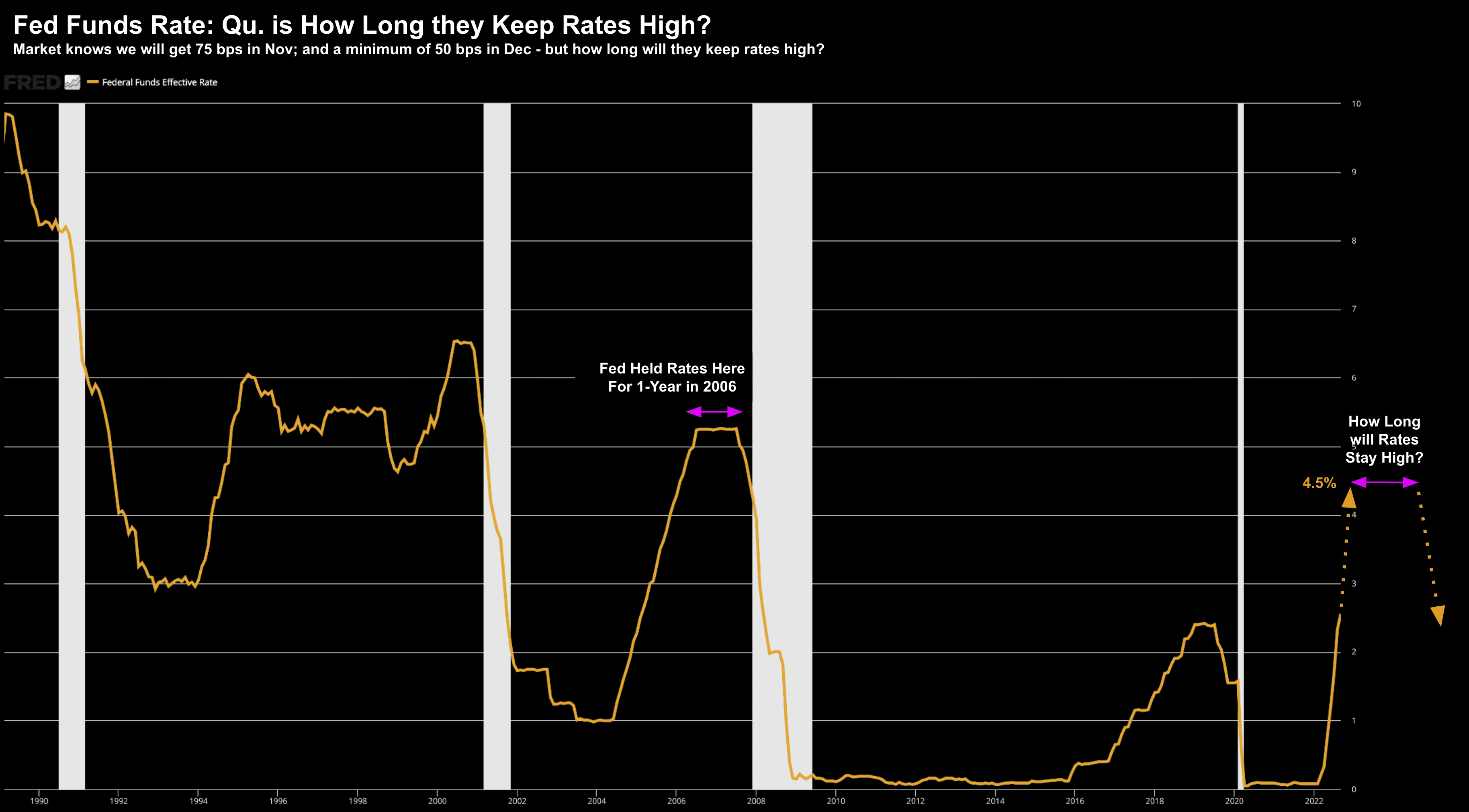

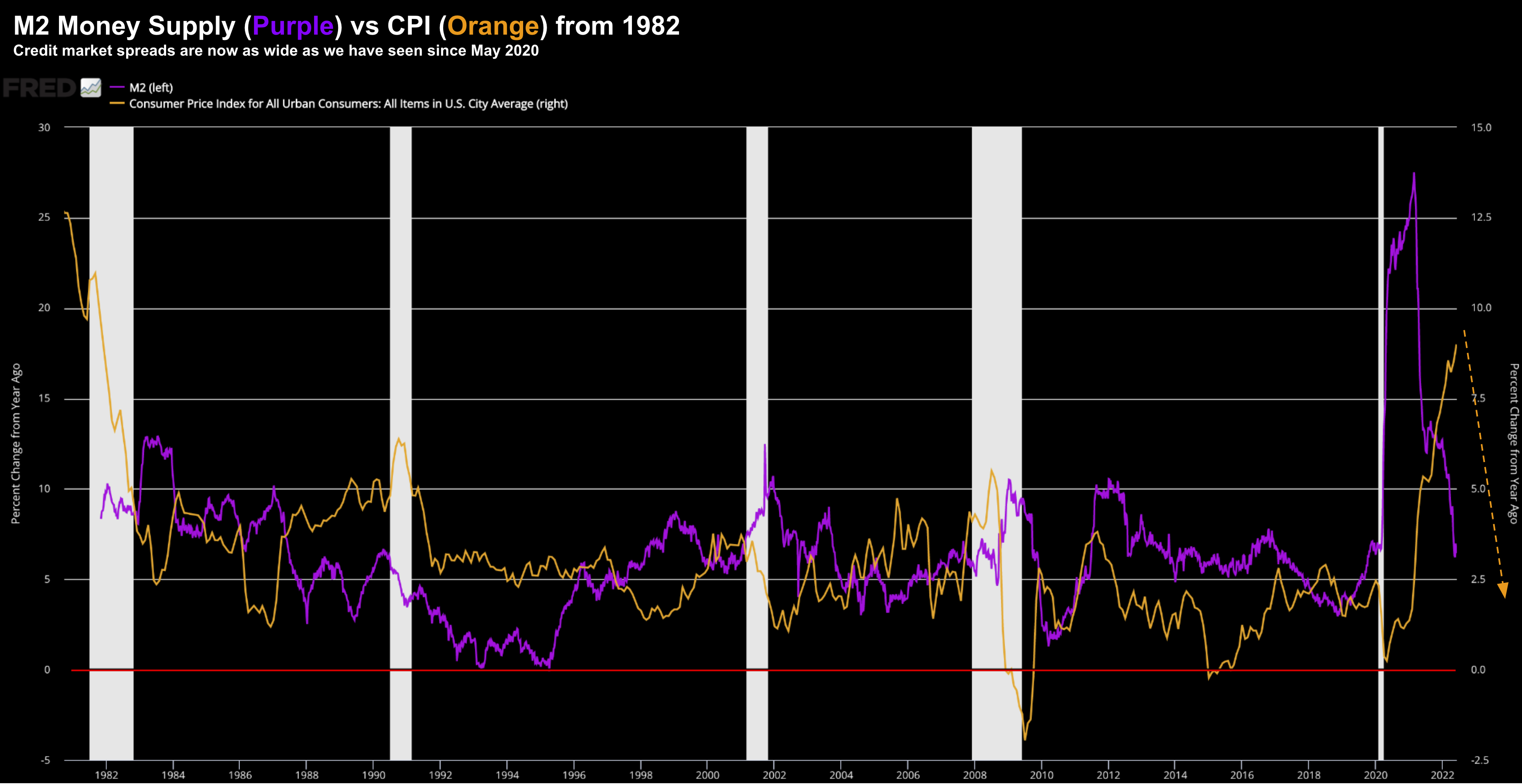

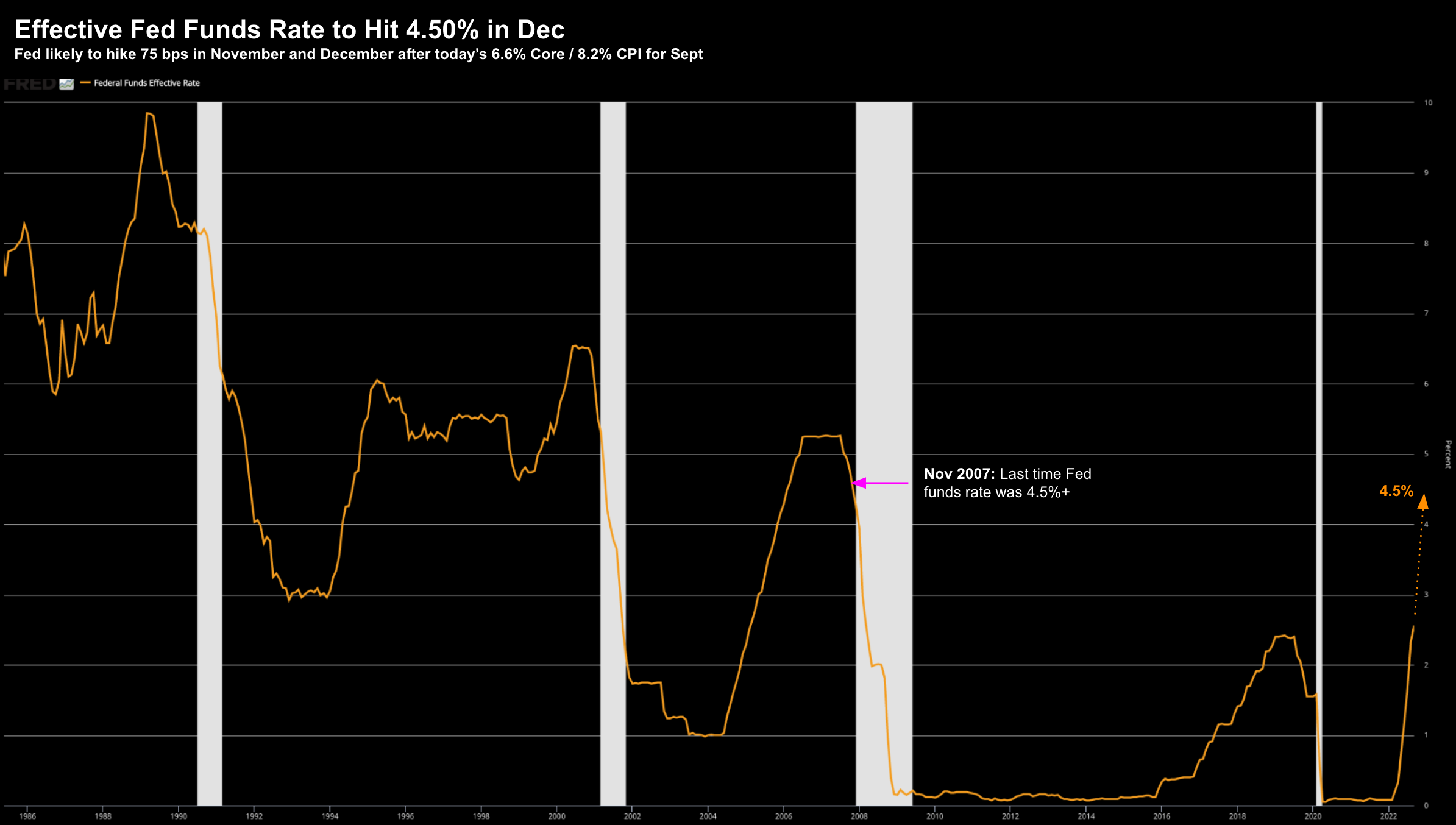

The market ripped higher on news of a softer-than-expected wage inflation report. But haven't we seen this script before? Markets have a recent history of front-running the Fed... only to be bitterly disappointed. From my lens, nothing in this print changes the script for the Fed. And markets are not set up to hear that...