Powell Less Hawkish… Threading a Fine Needle

Powell Less Hawkish… Threading a Fine Needle

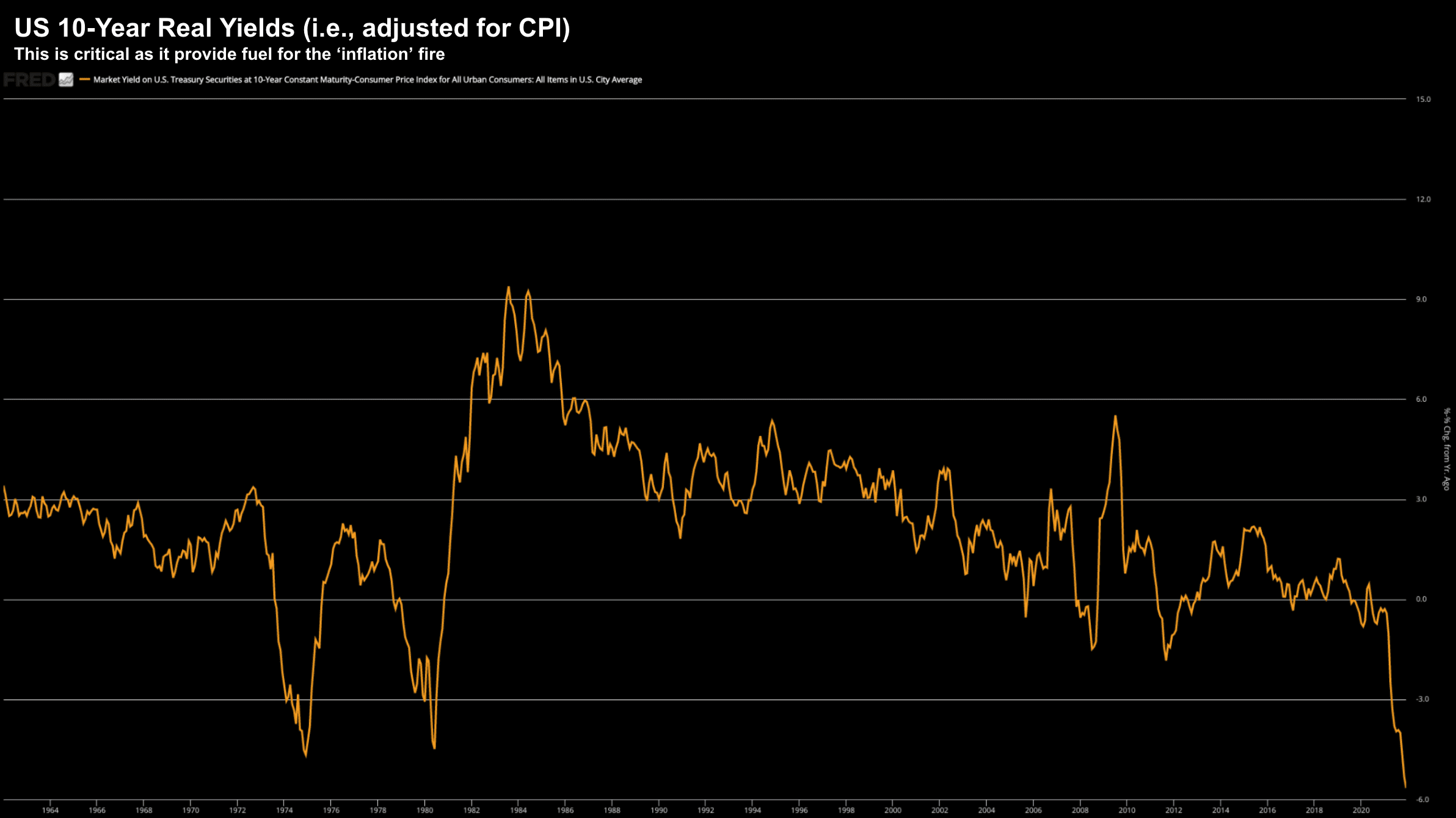

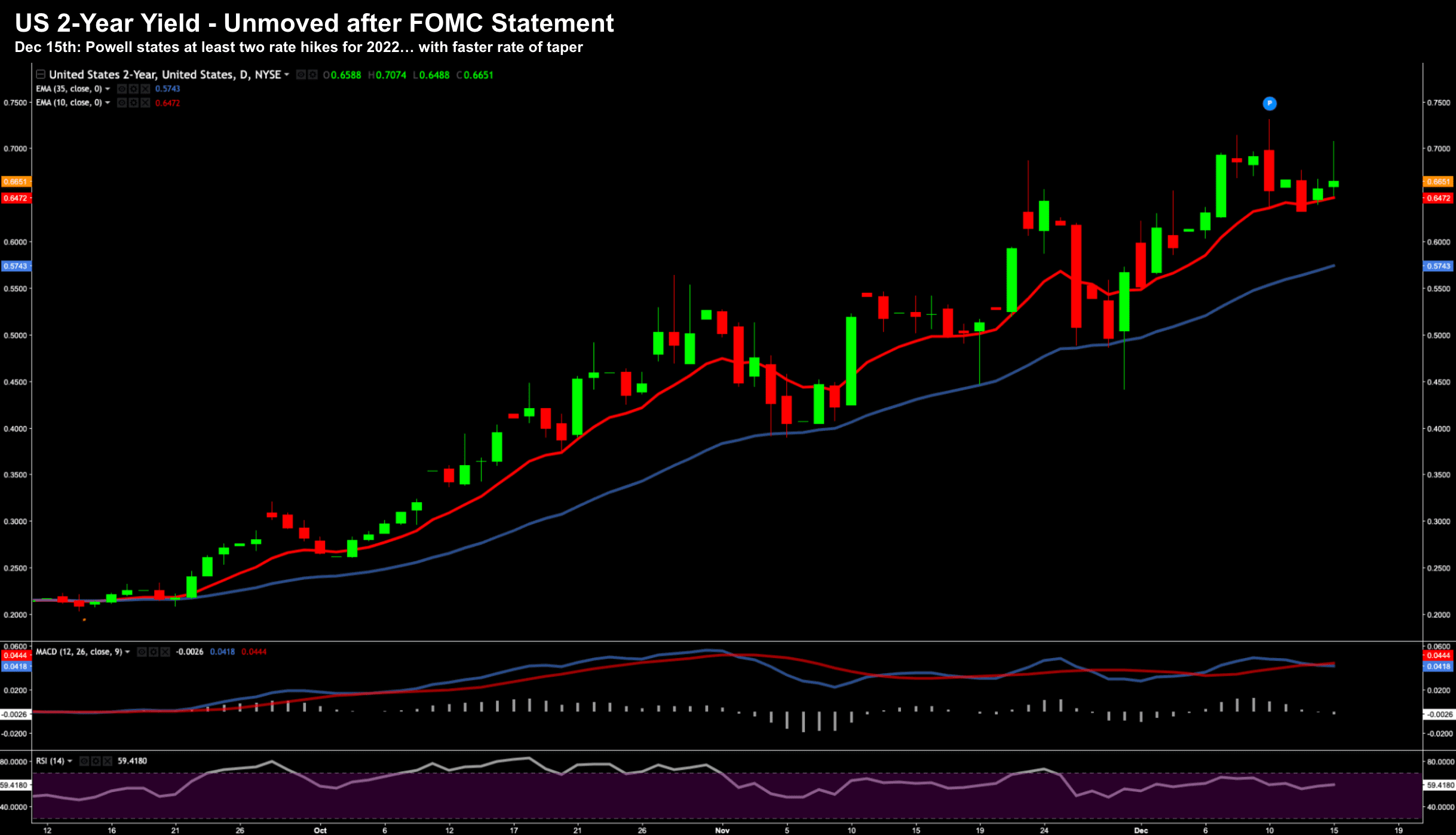

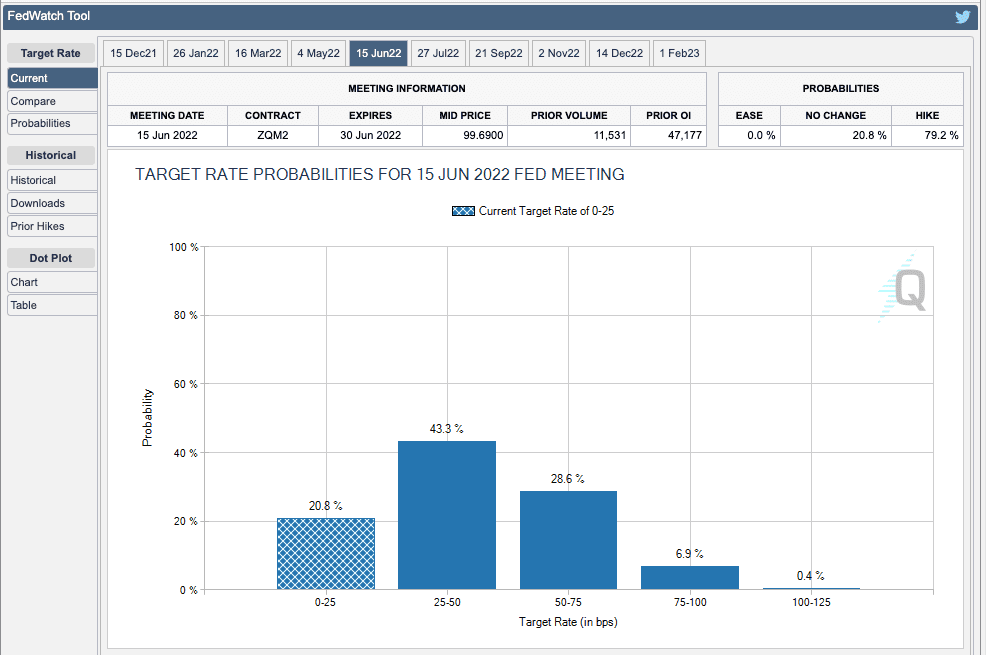

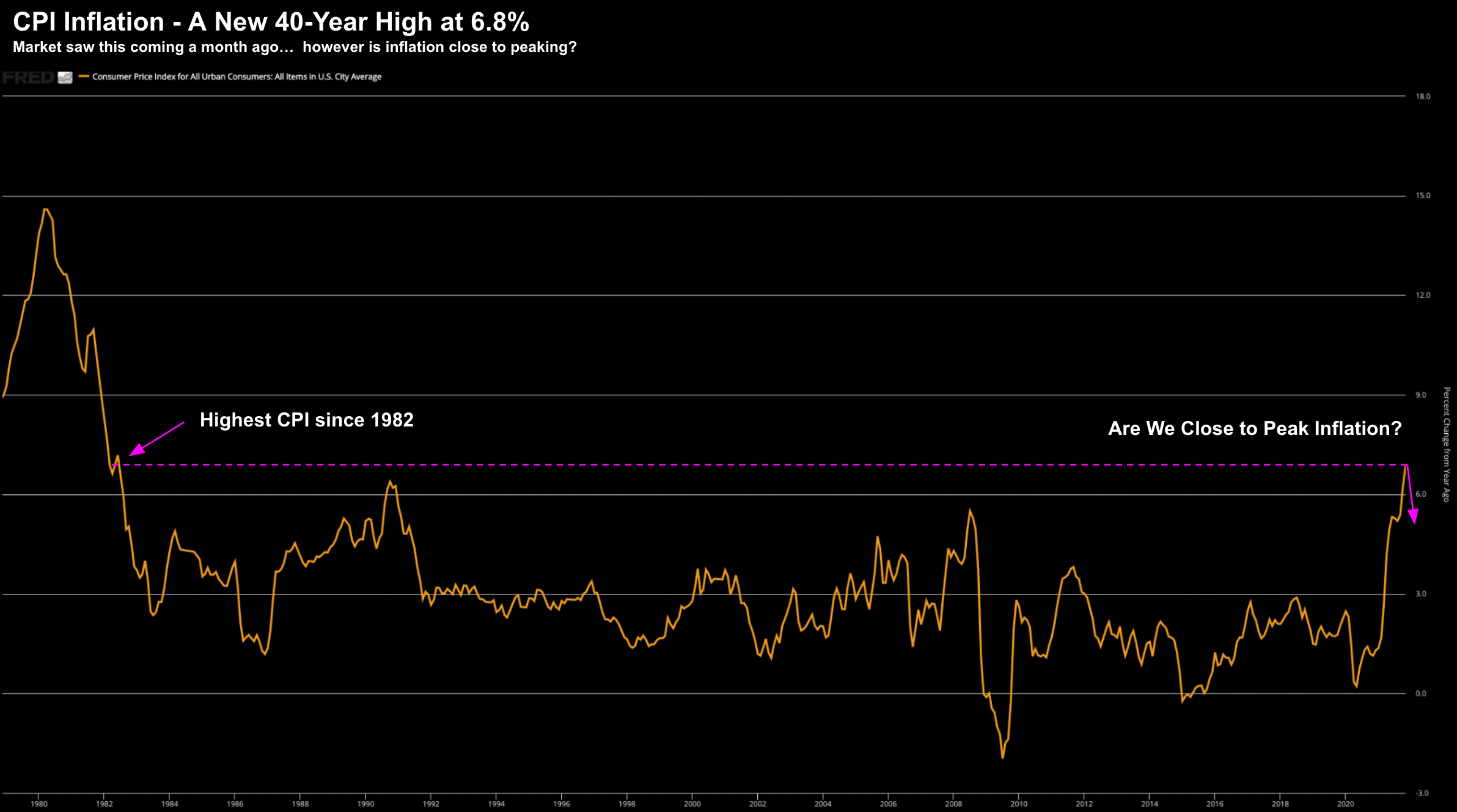

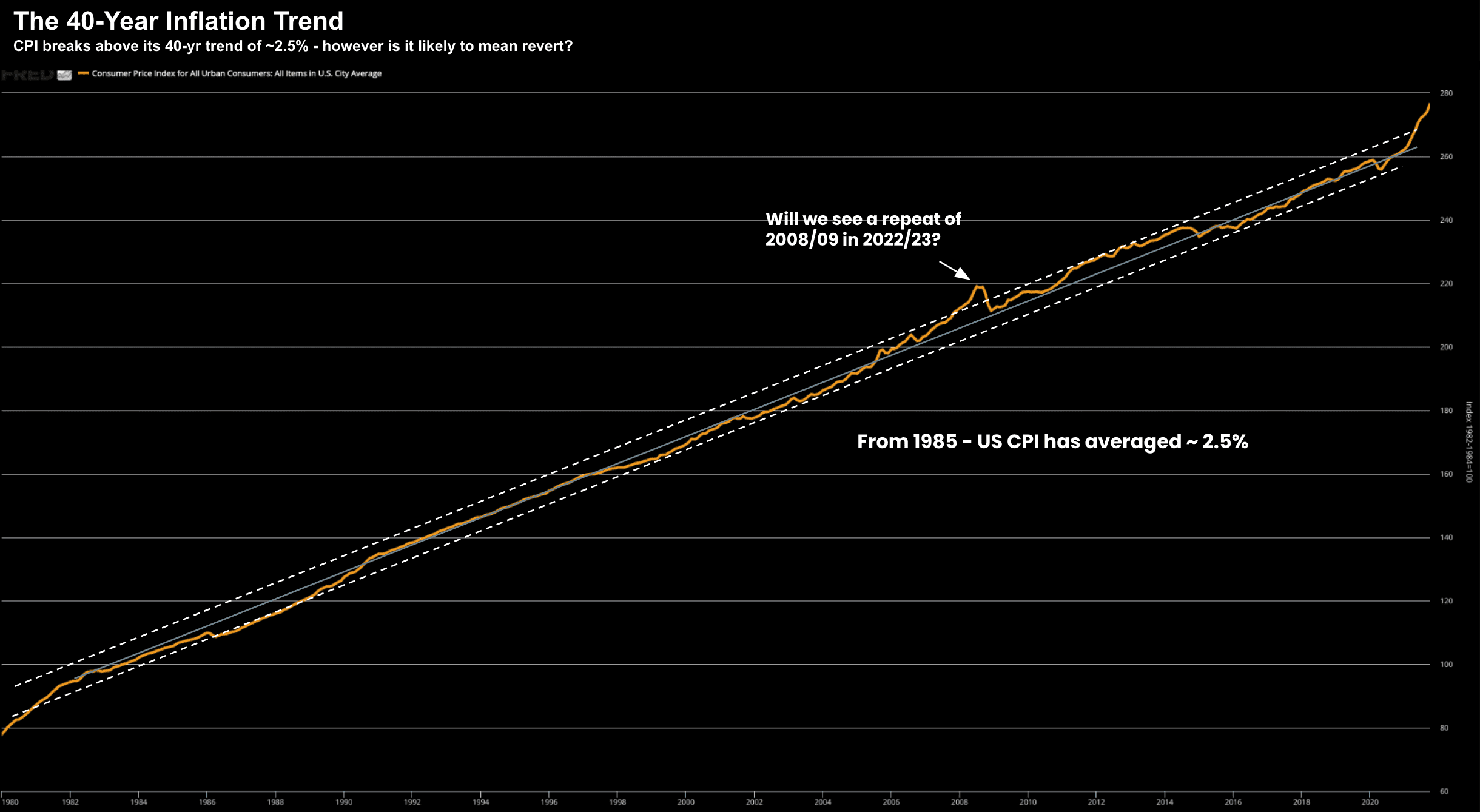

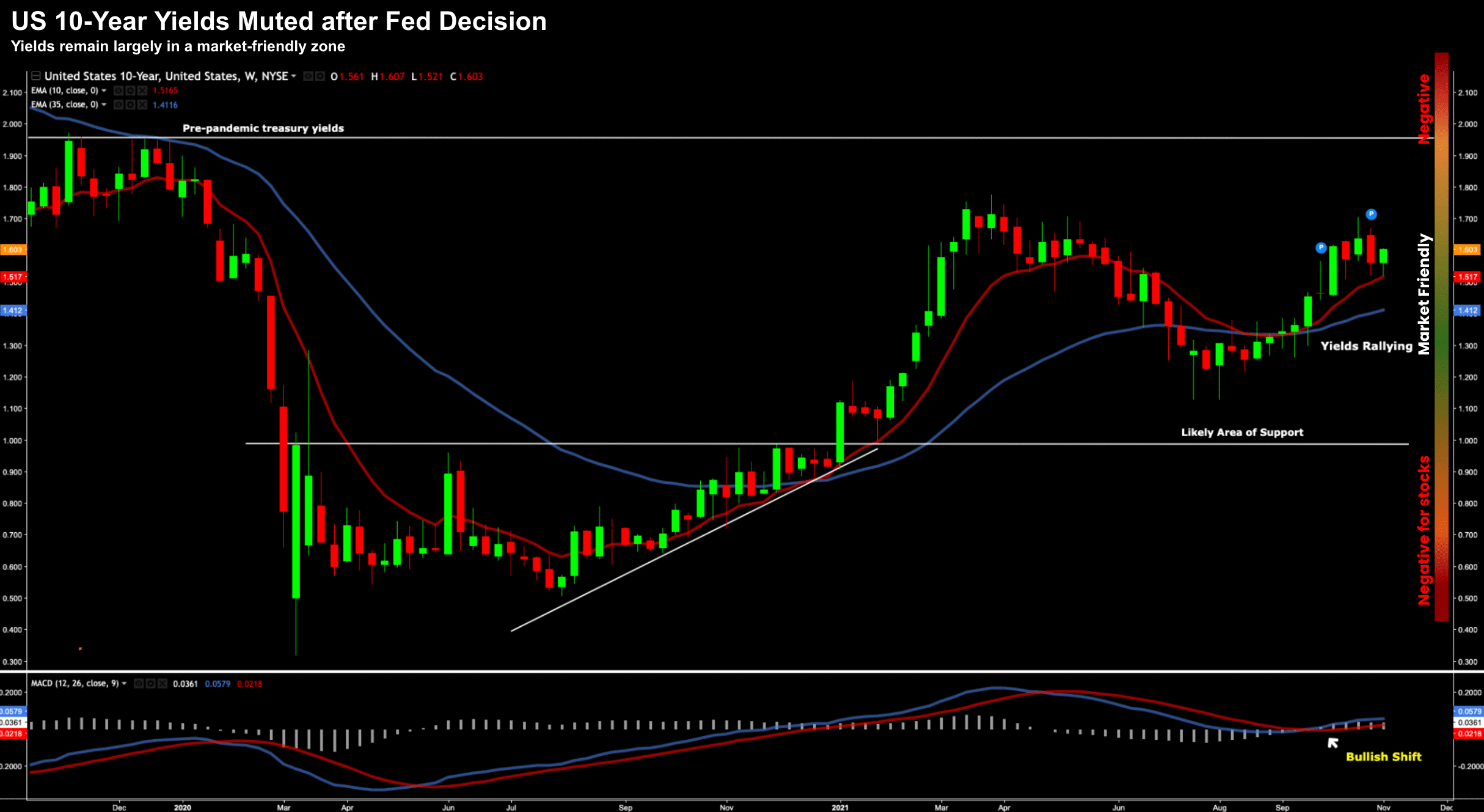

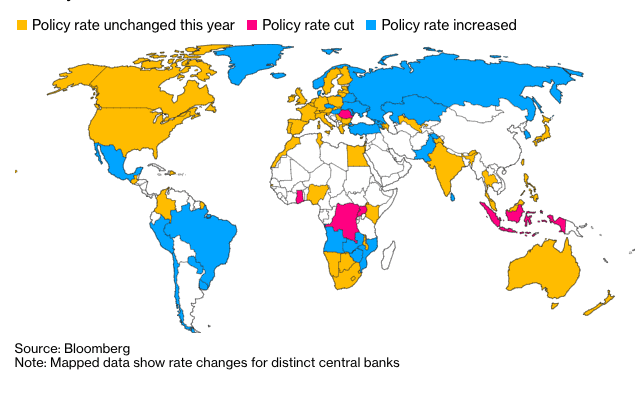

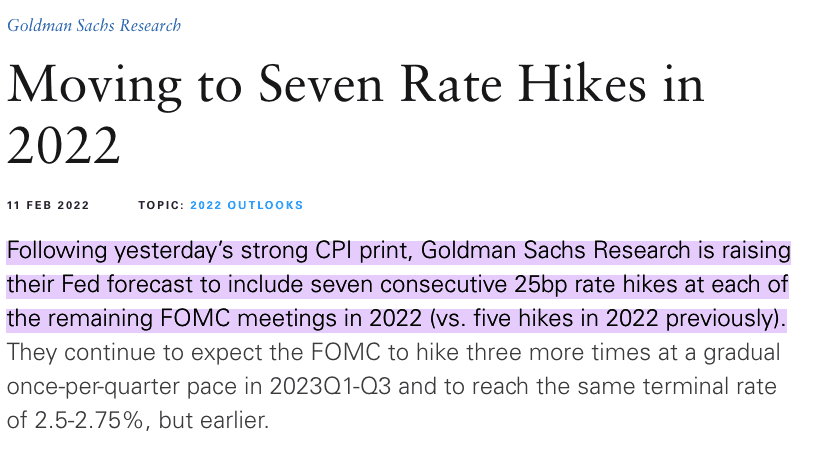

The Fed assured investors today that they will only raise rates 25 bps in March. However, they remain well 'behind the curve' on inflation... which could prove costly