Fed’s Inflation Gauge Hits Fresh 30-Yr High

Fed’s Inflation Gauge Hits Fresh 30-Yr High

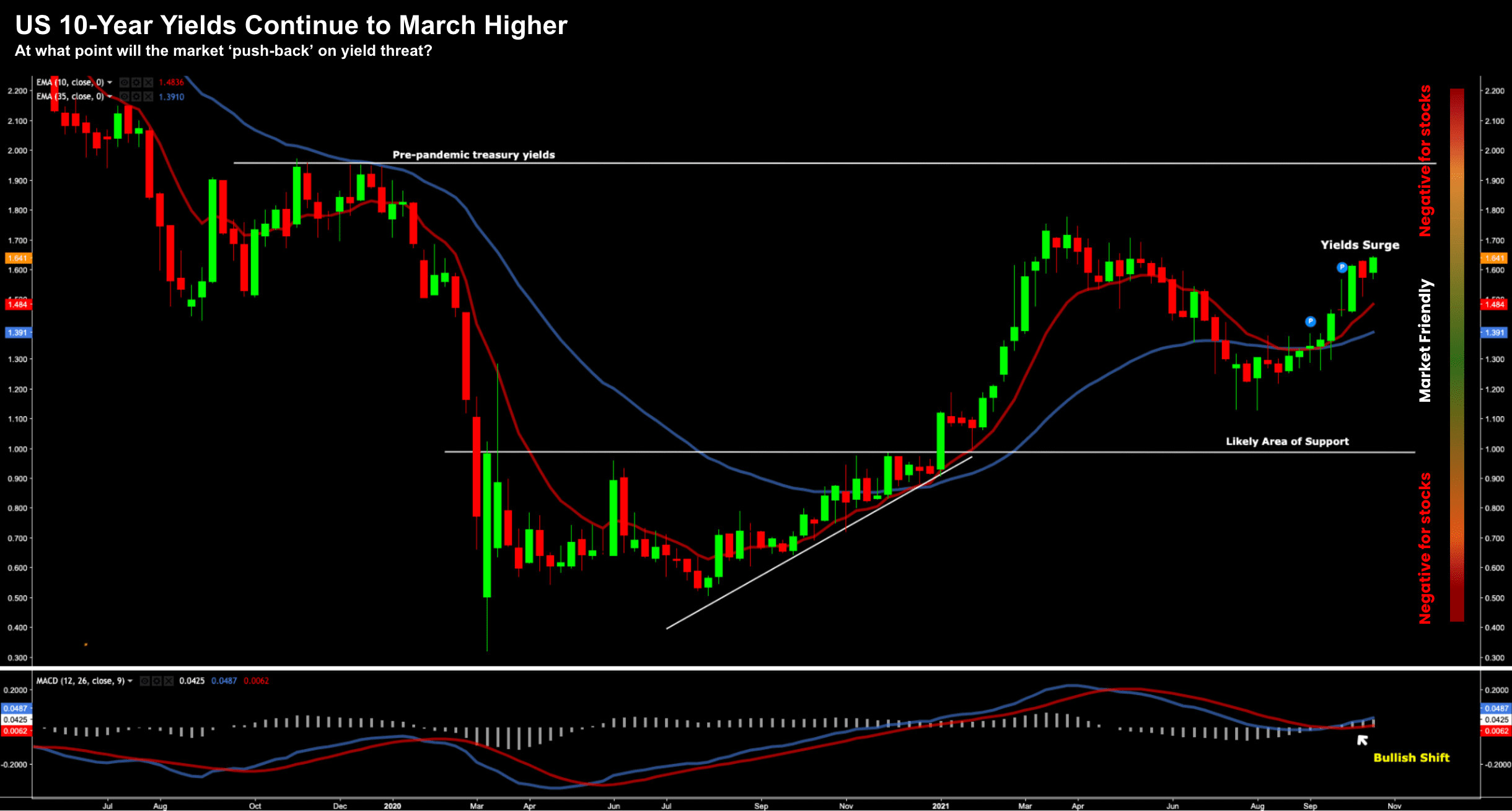

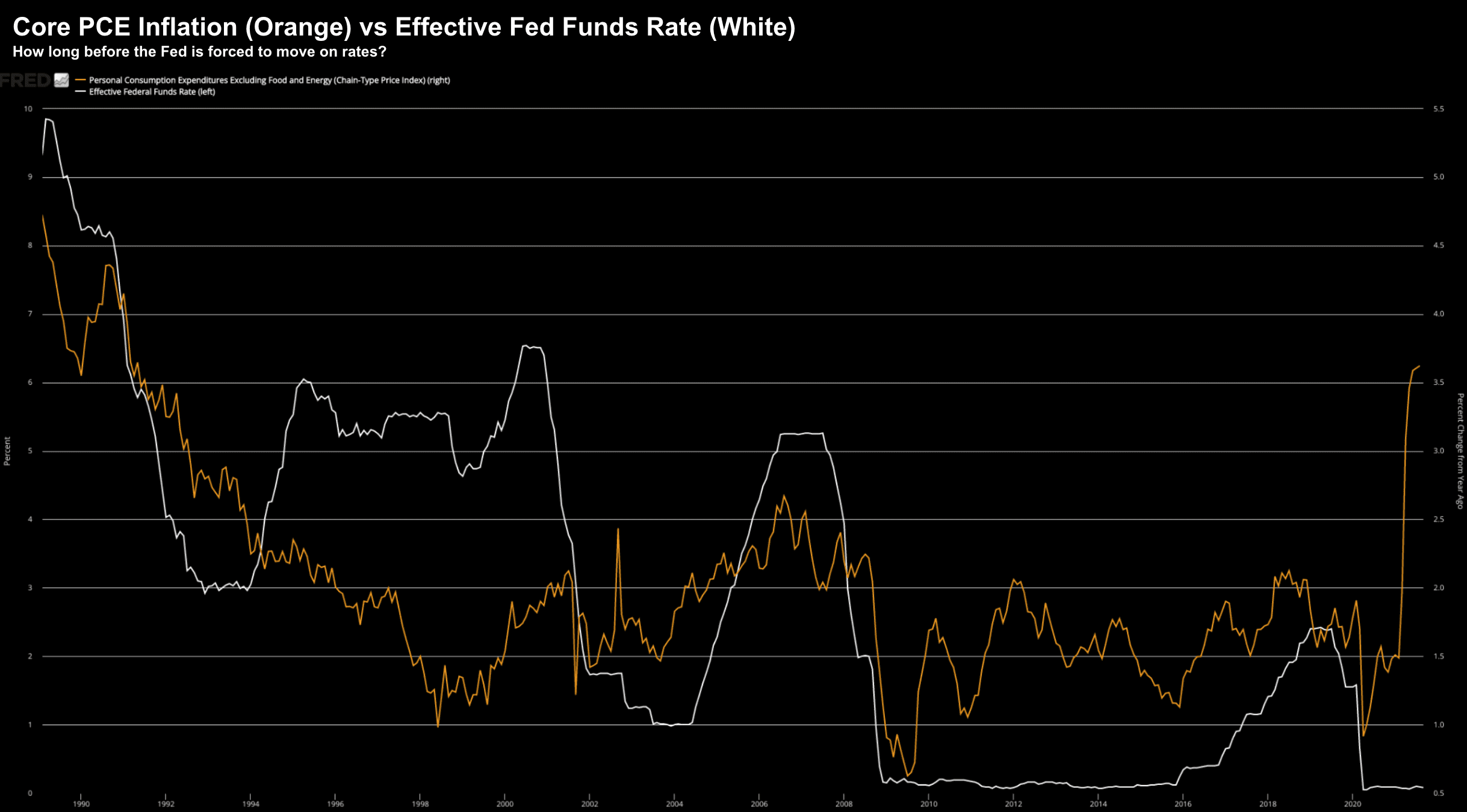

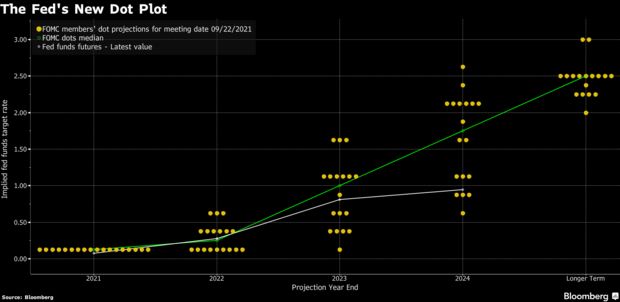

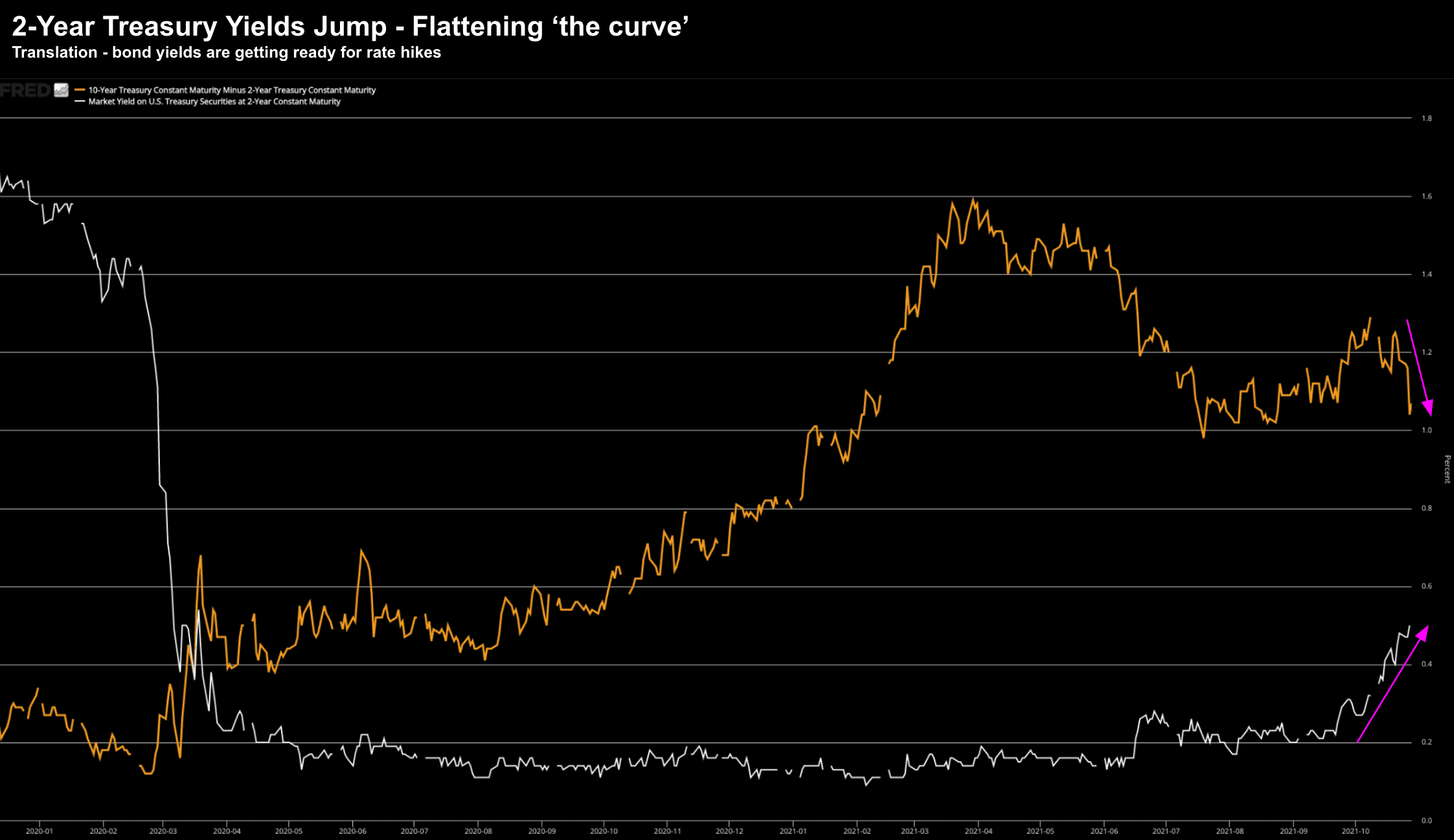

Inflation is ripping higher and the Fed are acting like a dear in the headlights. All the whilst, today marks the sixth consecutive quarter in which the bottom-up EPS estimate increased during the first month of the quarter... a record. There's a lot of cheap money around - but it's coming at a cost; i.e. inflation