The Inflation Puzzle: ‘Services’ Remain Sticky

The Inflation Puzzle: ‘Services’ Remain Sticky

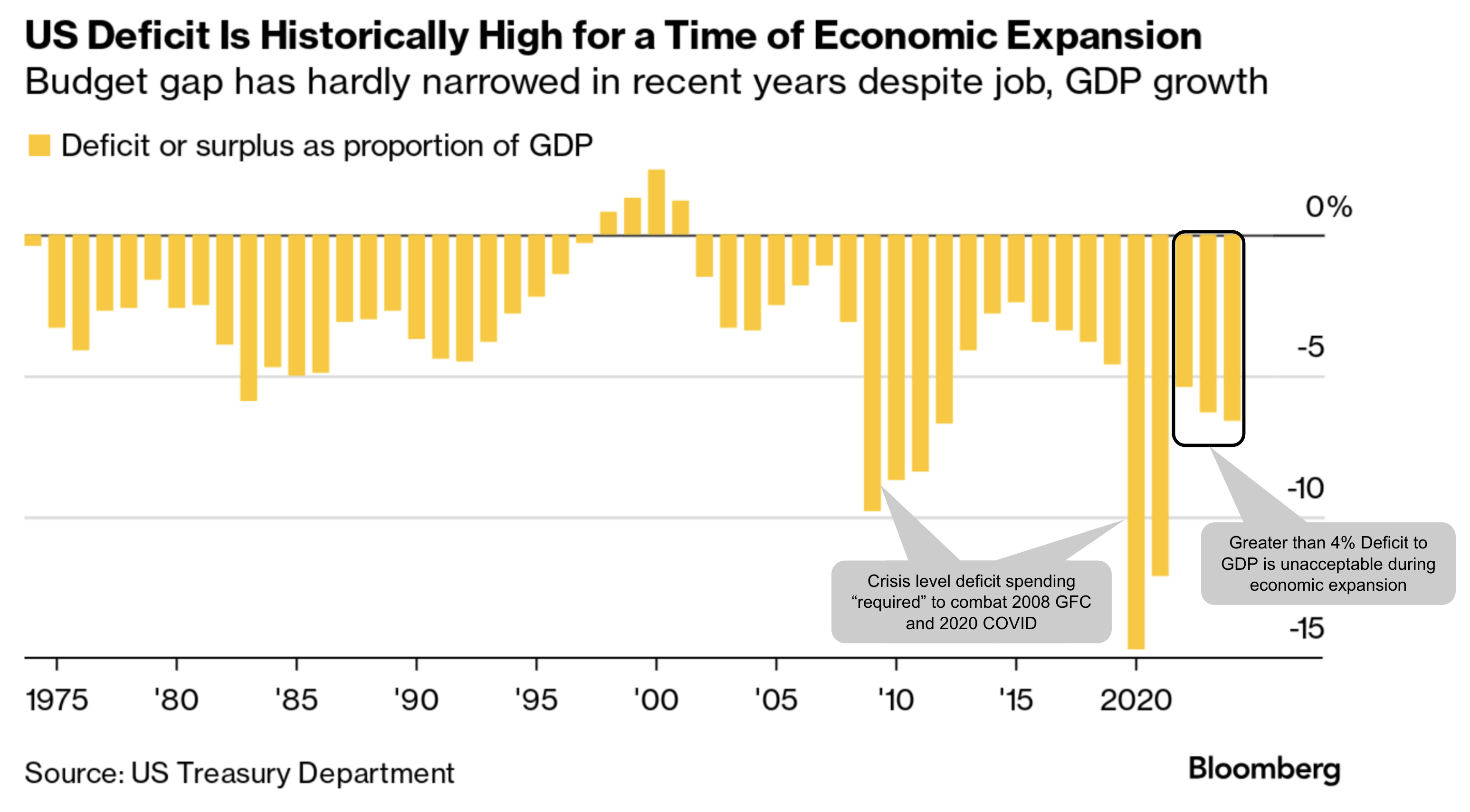

In a perfect world, inflation should be boring. Boring is good. However, when you inject an additional $6+ Trillion into the economy with far fewer goods being produced, inflation becomes a story. Last month's inflation report showed headline (and core) CPI ticked higher. However, what caught my eye was "supercore" inflation - something the Fed says is a good predictor of future prices. Suerpcore is services inflation less shelter. This was up 4.4% YoY - also moving higher. The reason: pressures with wage growth - which remains around 4.7% YoY