Rate Hike History Lesson: Bottoming is a Process

Rate Hike History Lesson: Bottoming is a Process

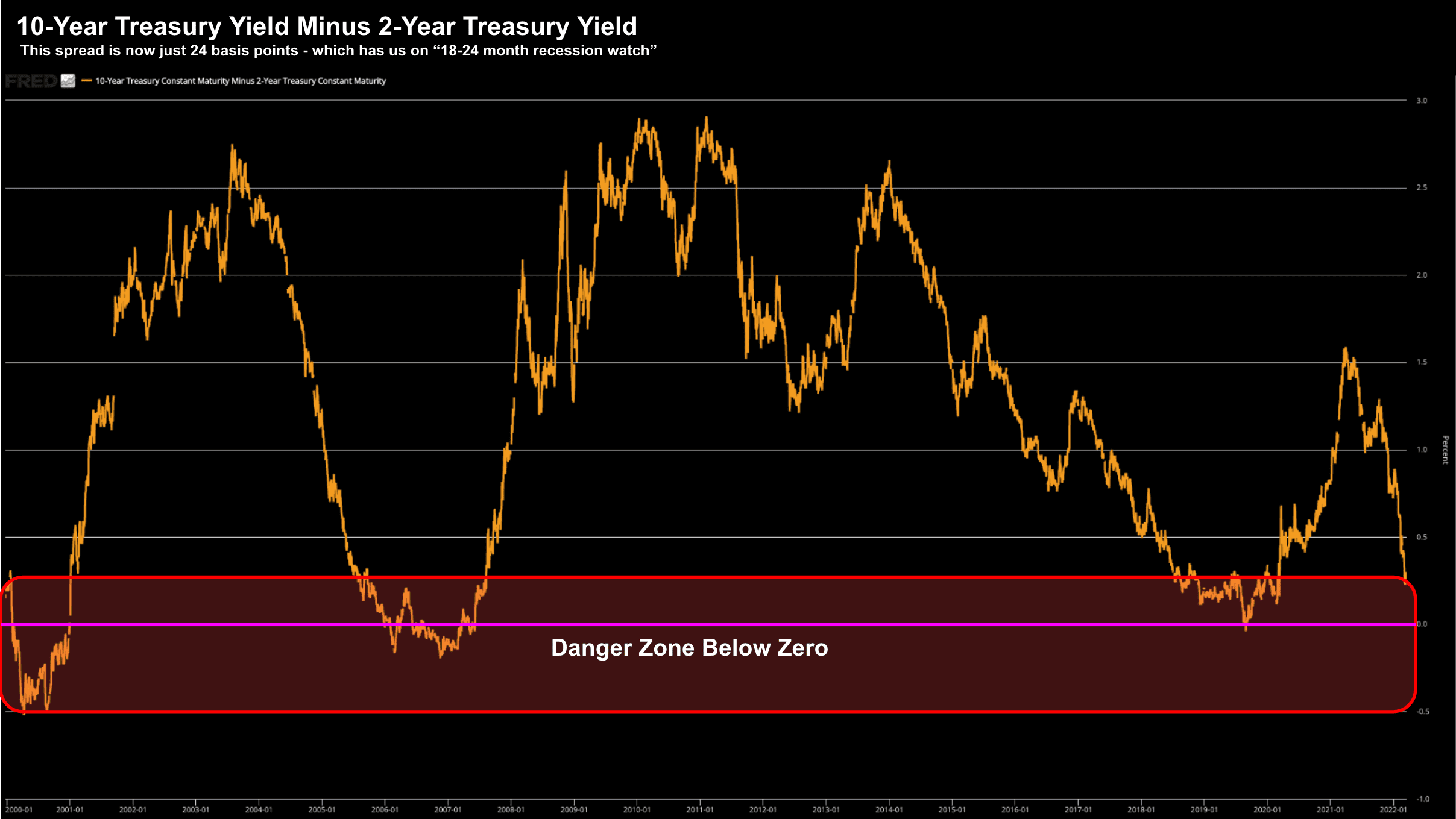

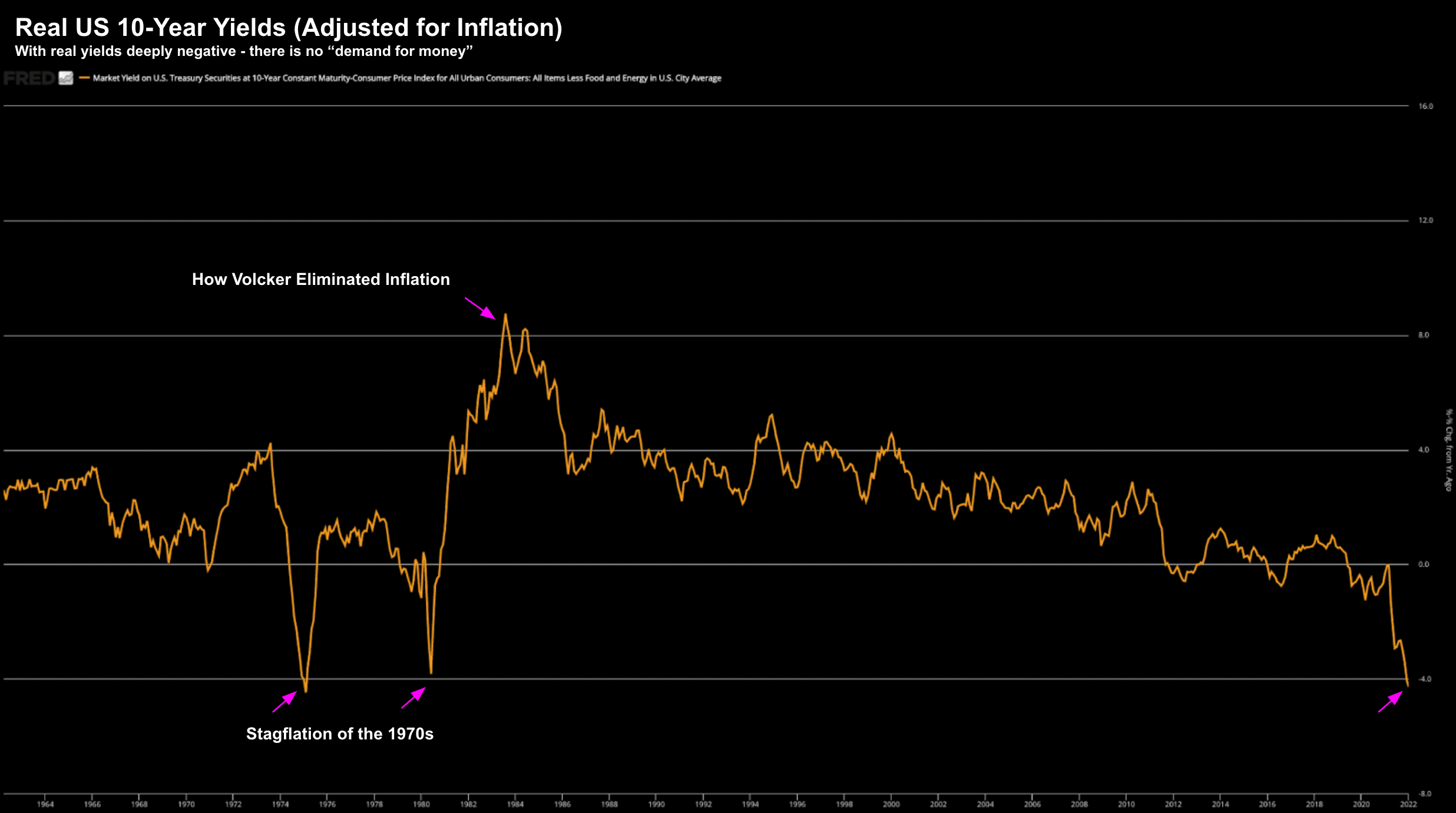

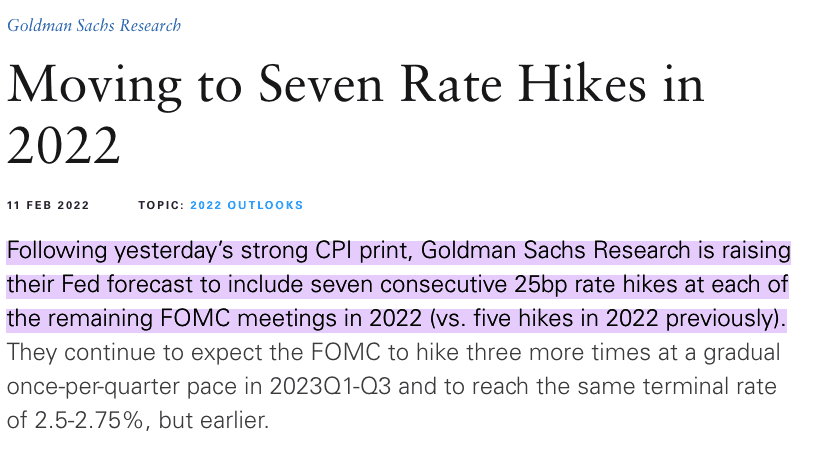

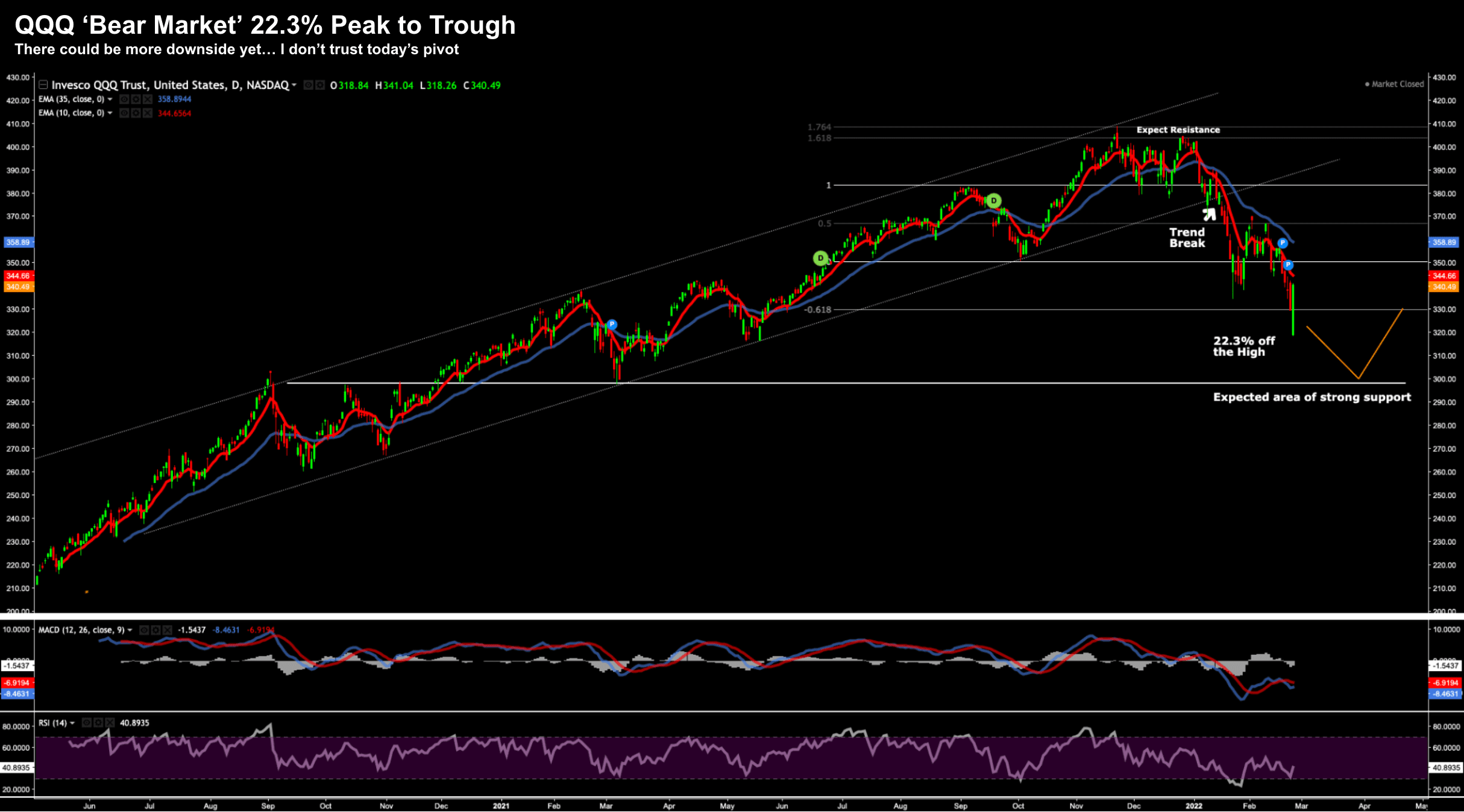

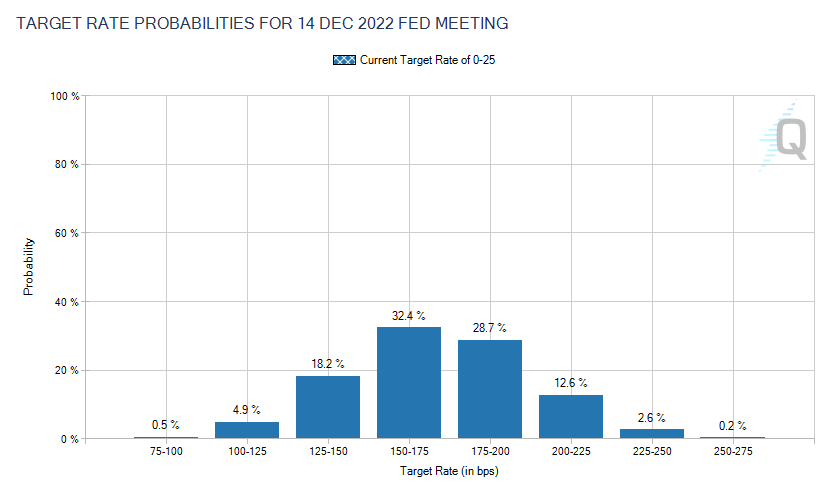

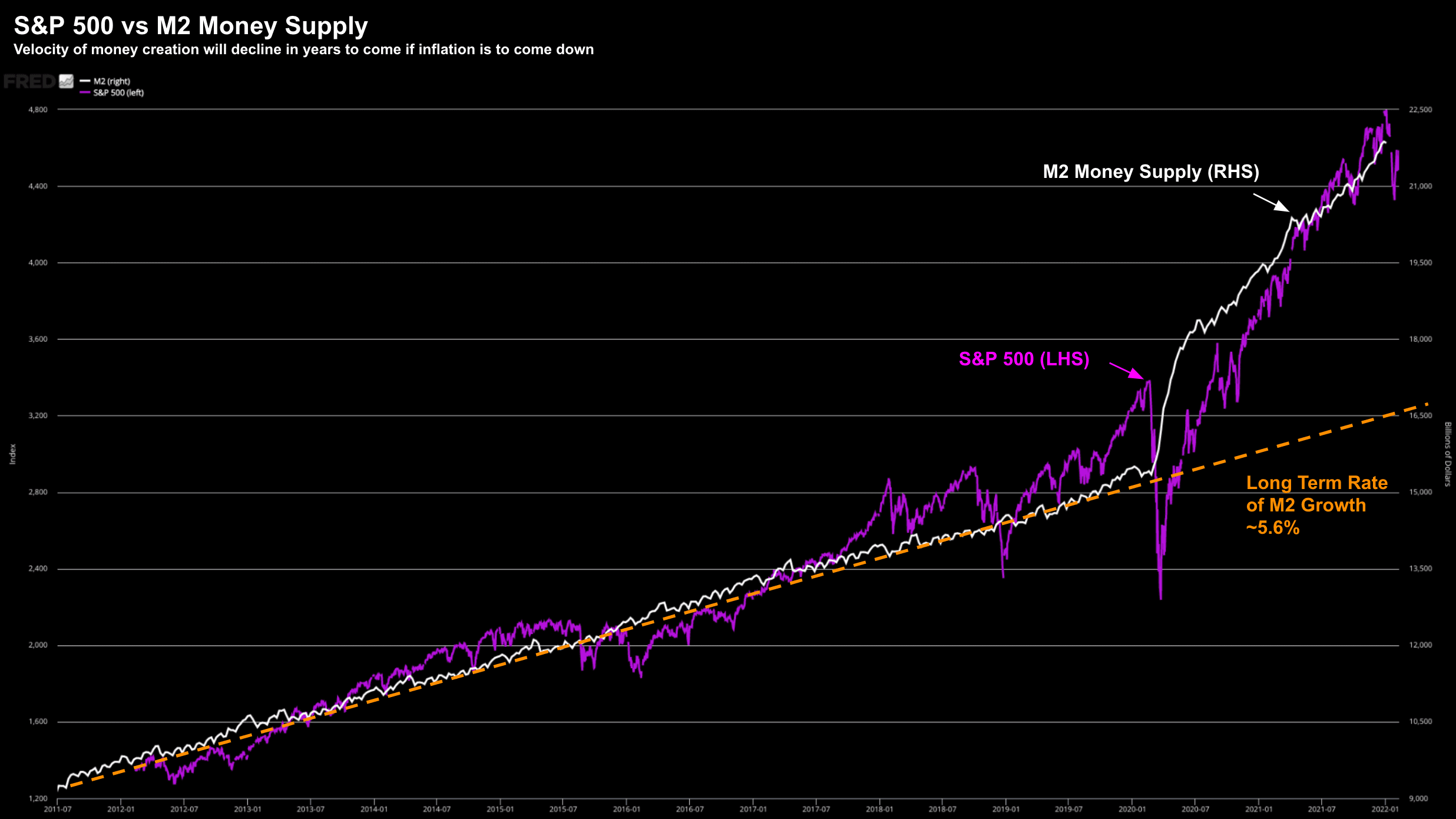

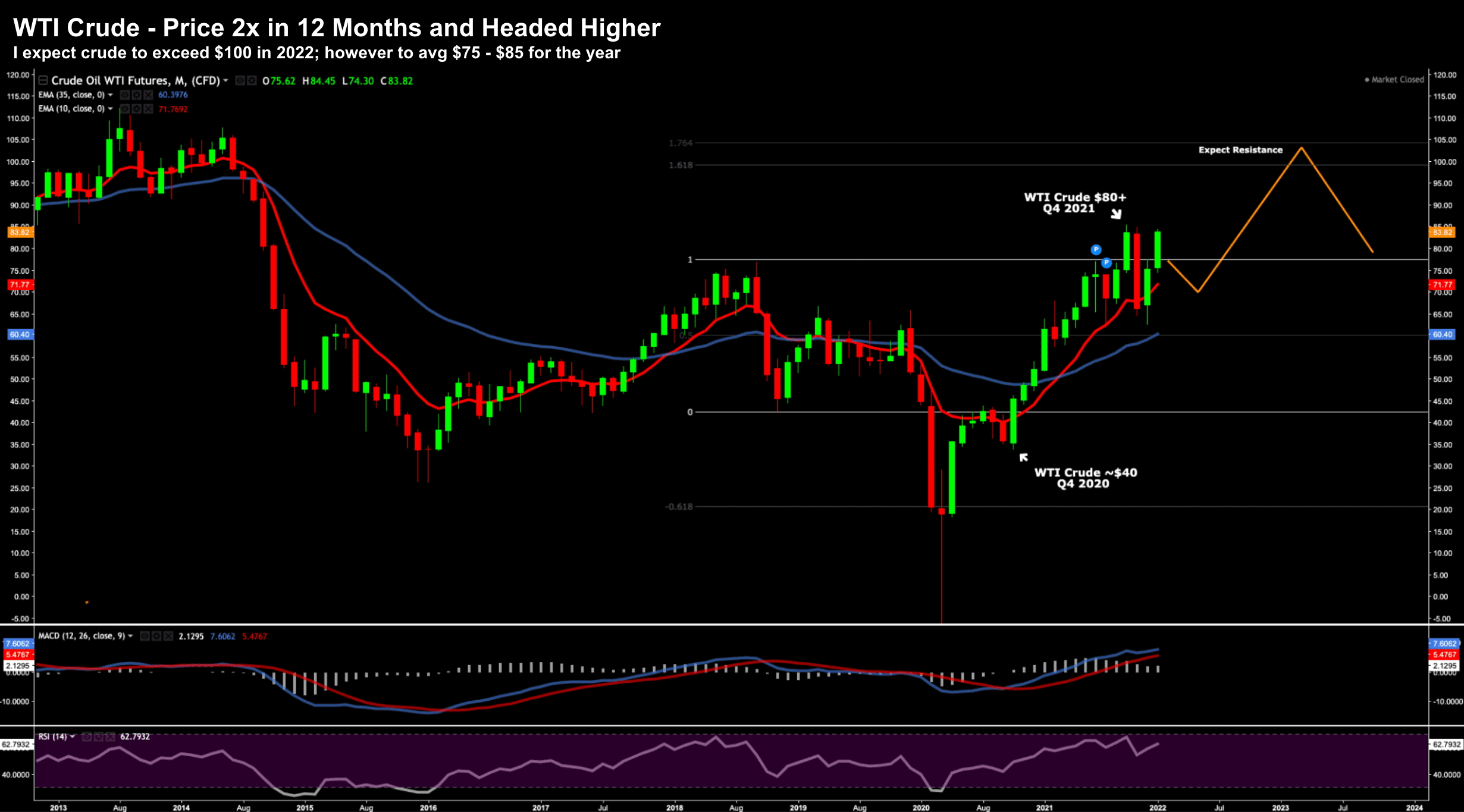

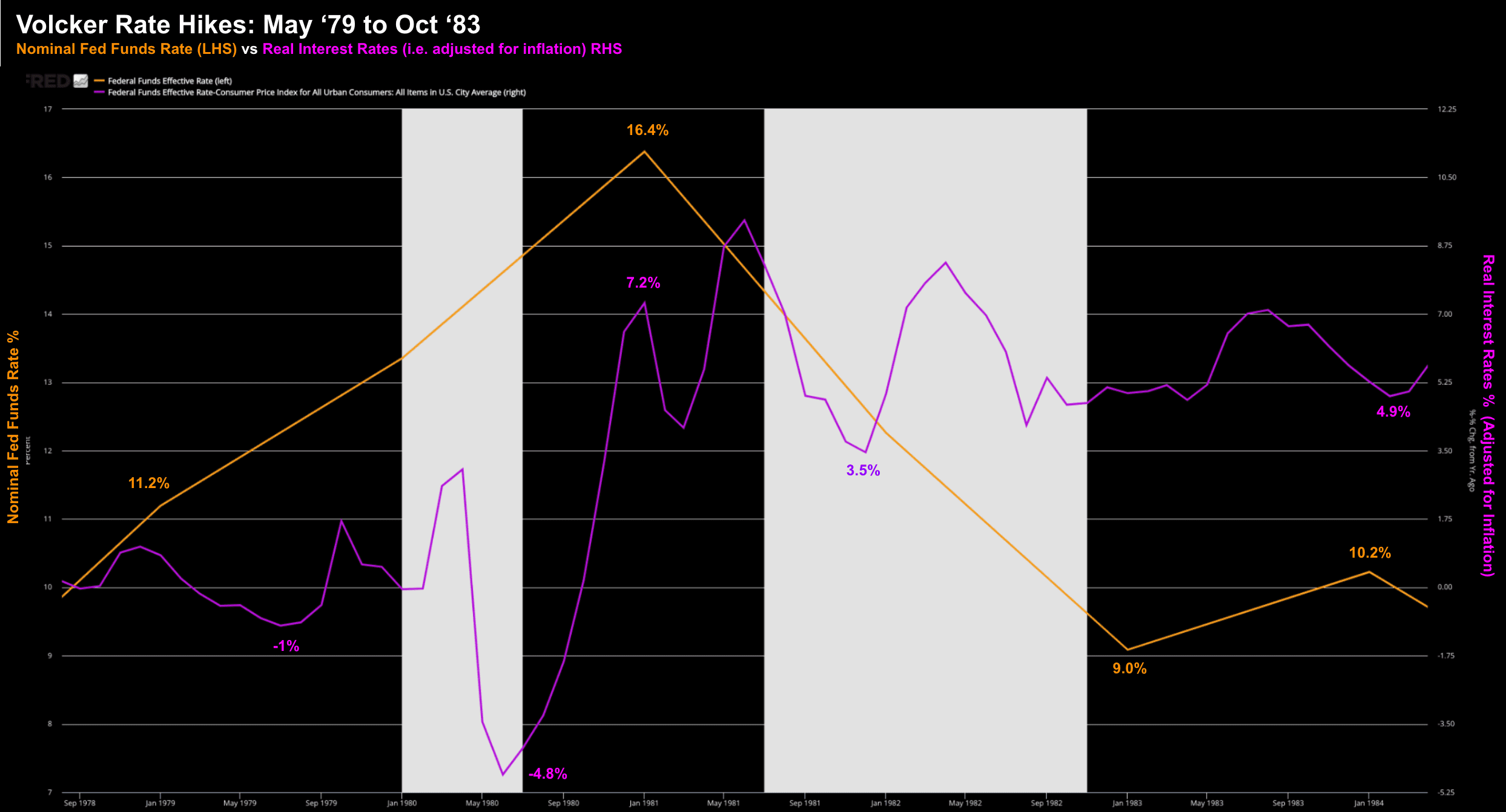

With the Fed set to raise rates as much as seven times this year - how safe is it to meaningfully increase your exposure to stocks Is there more downside to come? And is the bottom for 2022 now in? These questions (among others) are top of mind for most readers.