Massive Bond Exodus to Start ’22

Massive Bond Exodus to Start ’22

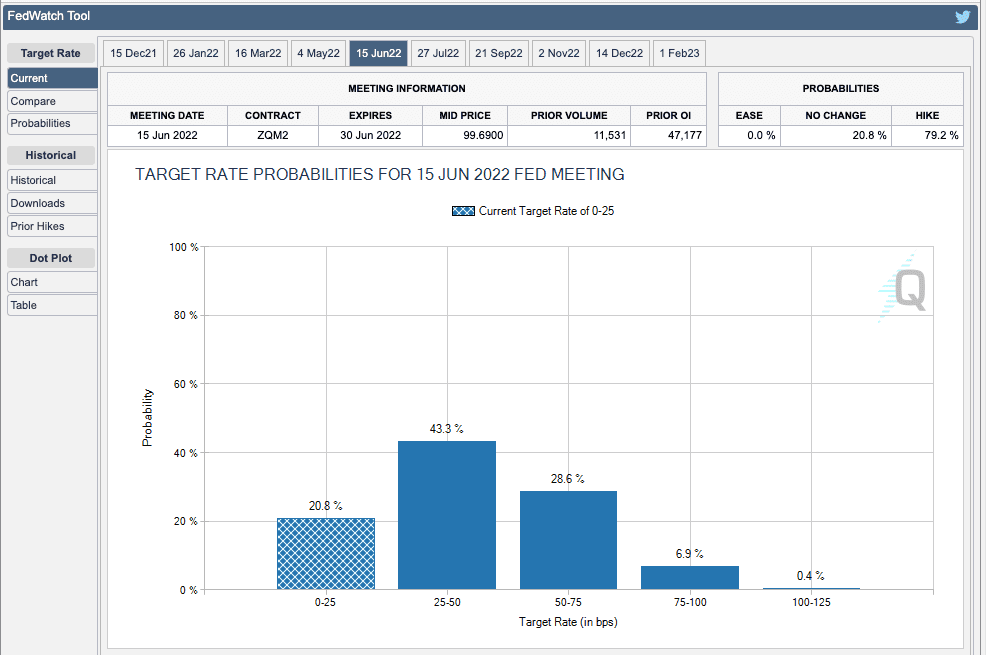

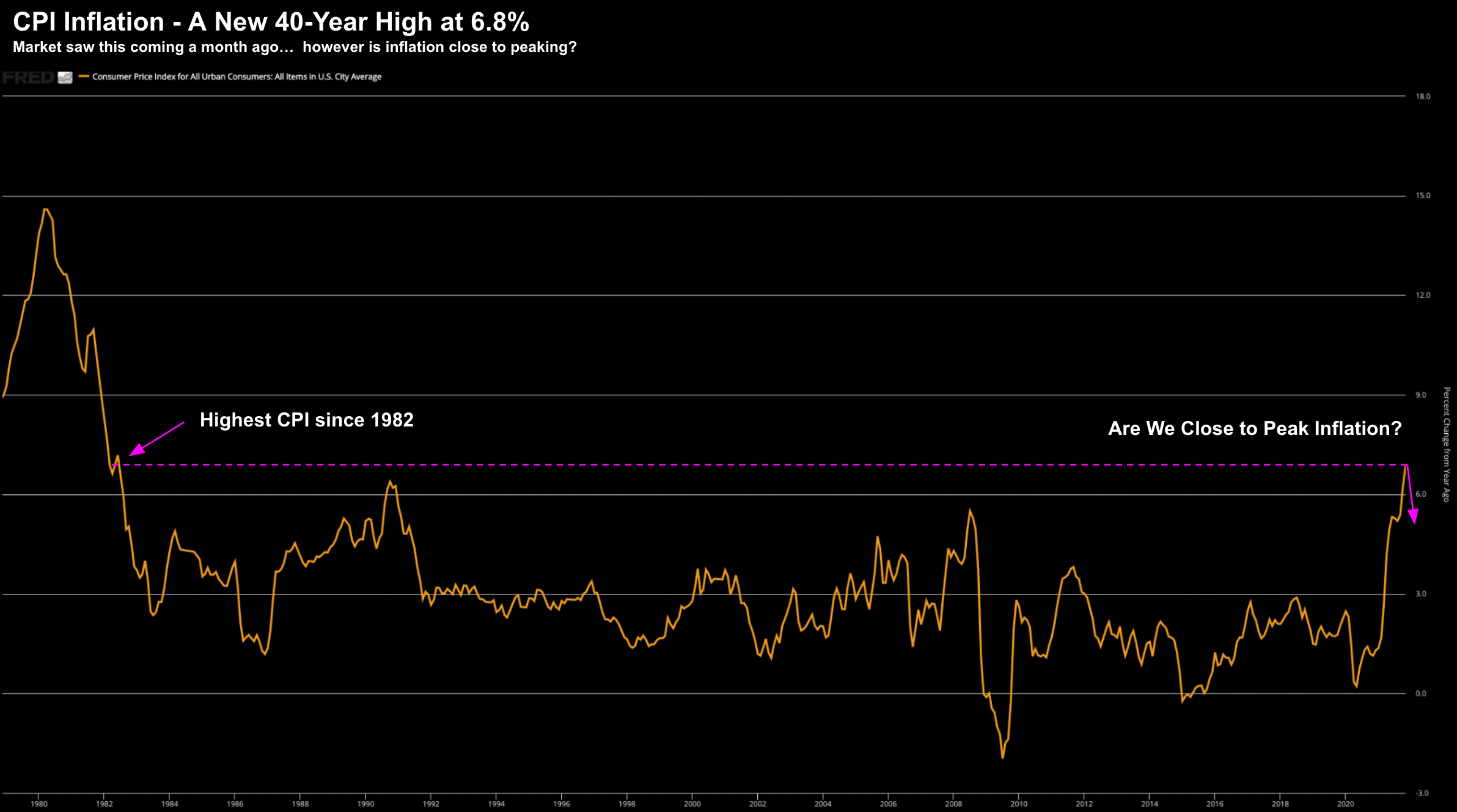

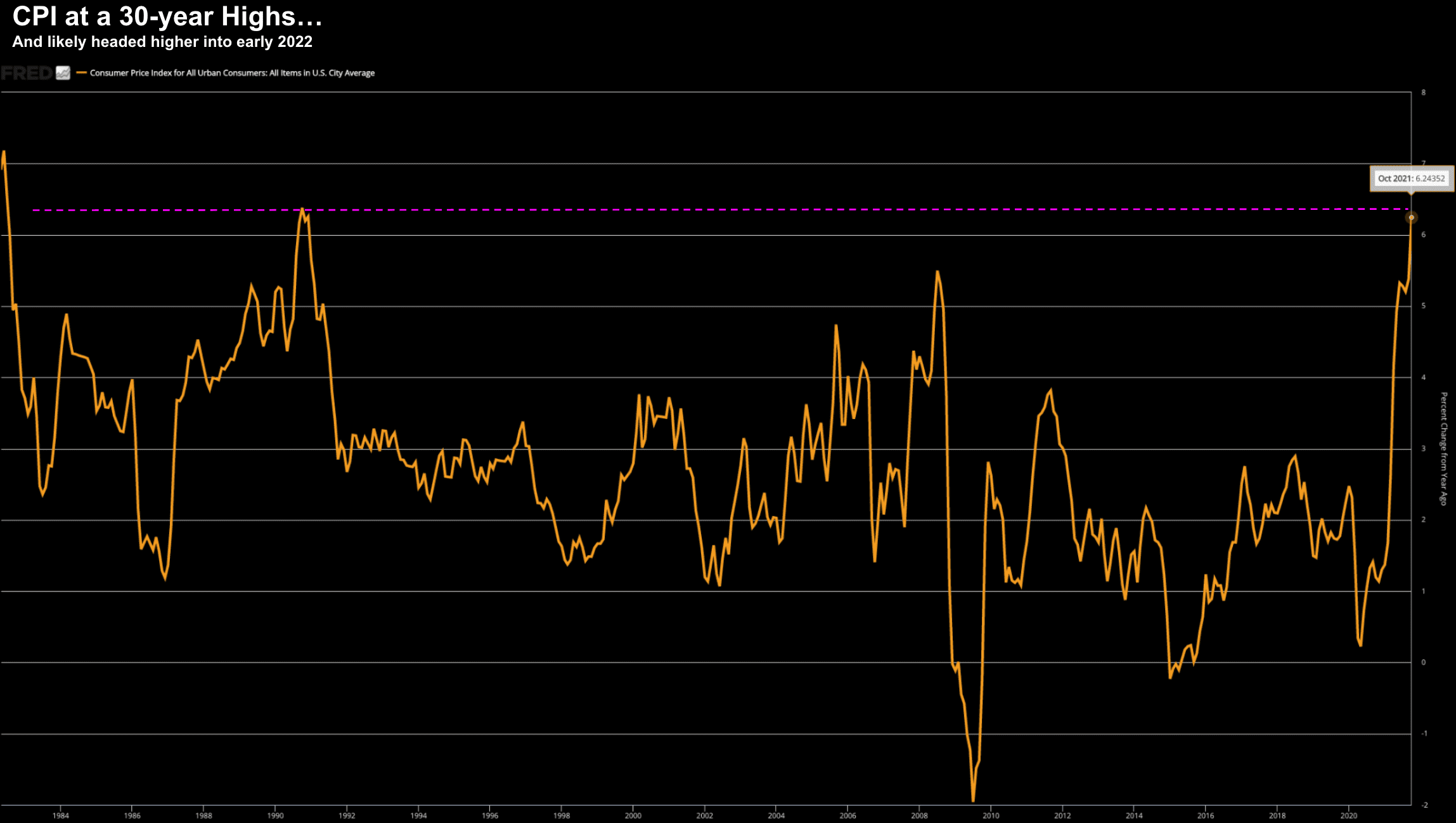

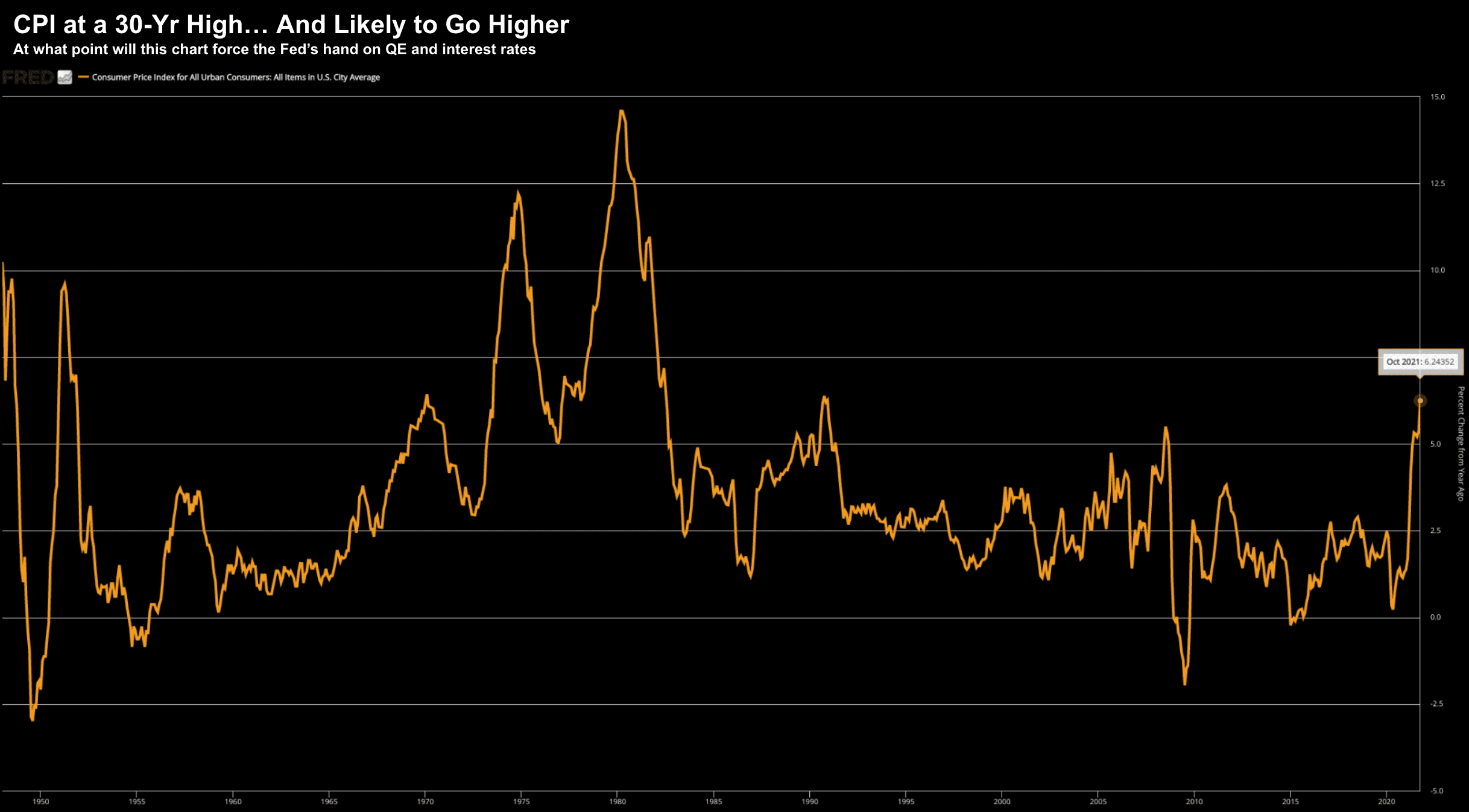

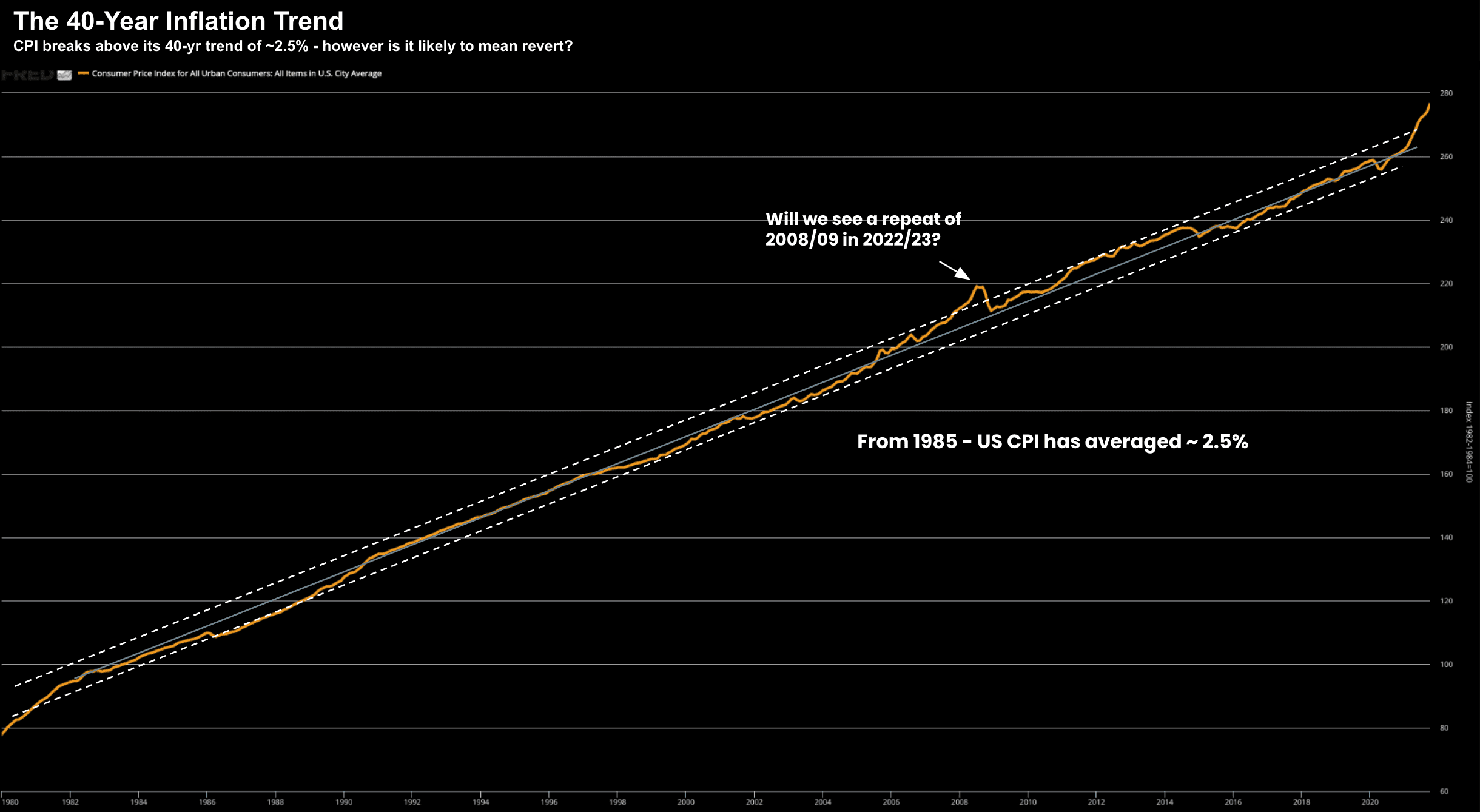

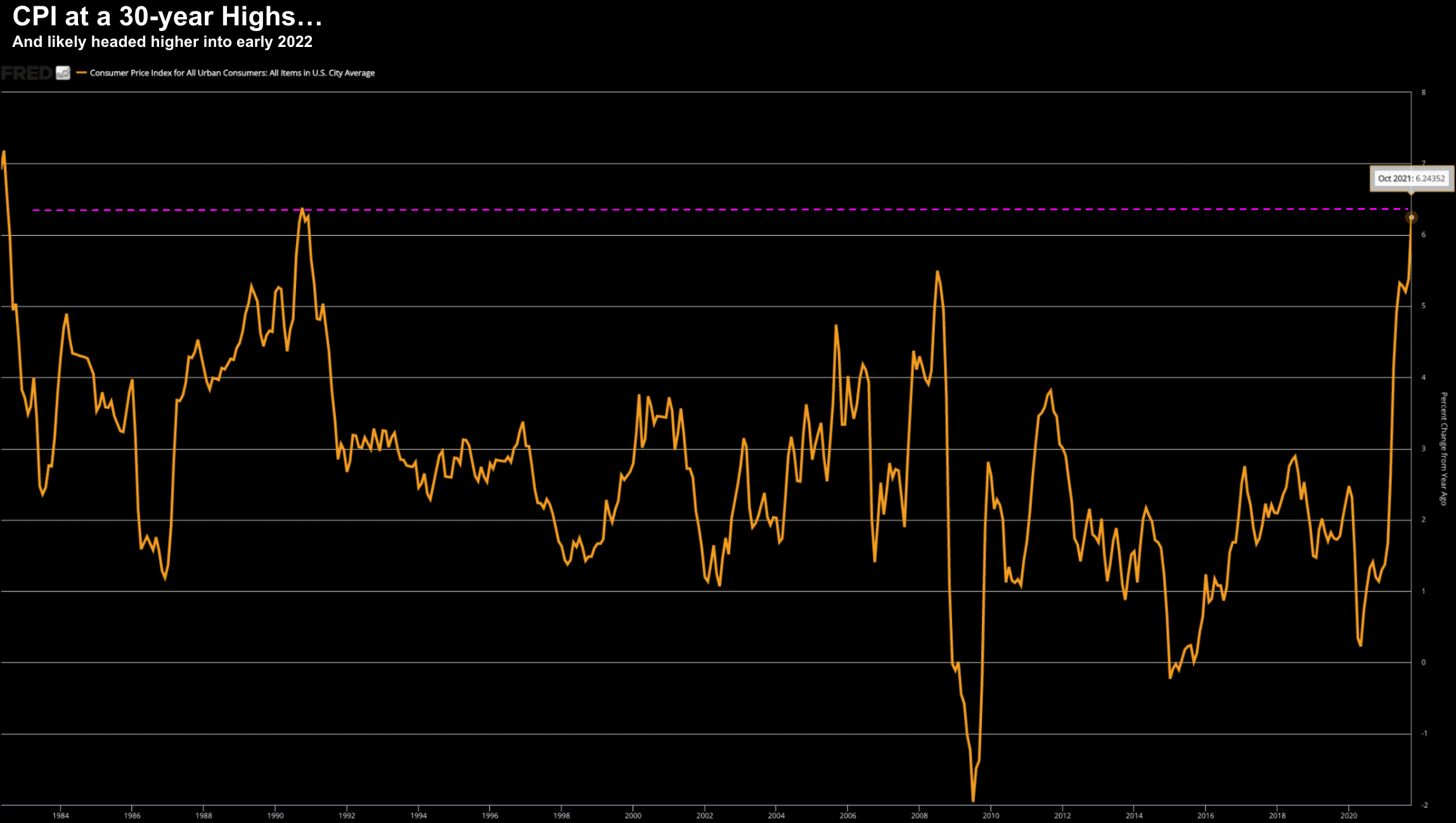

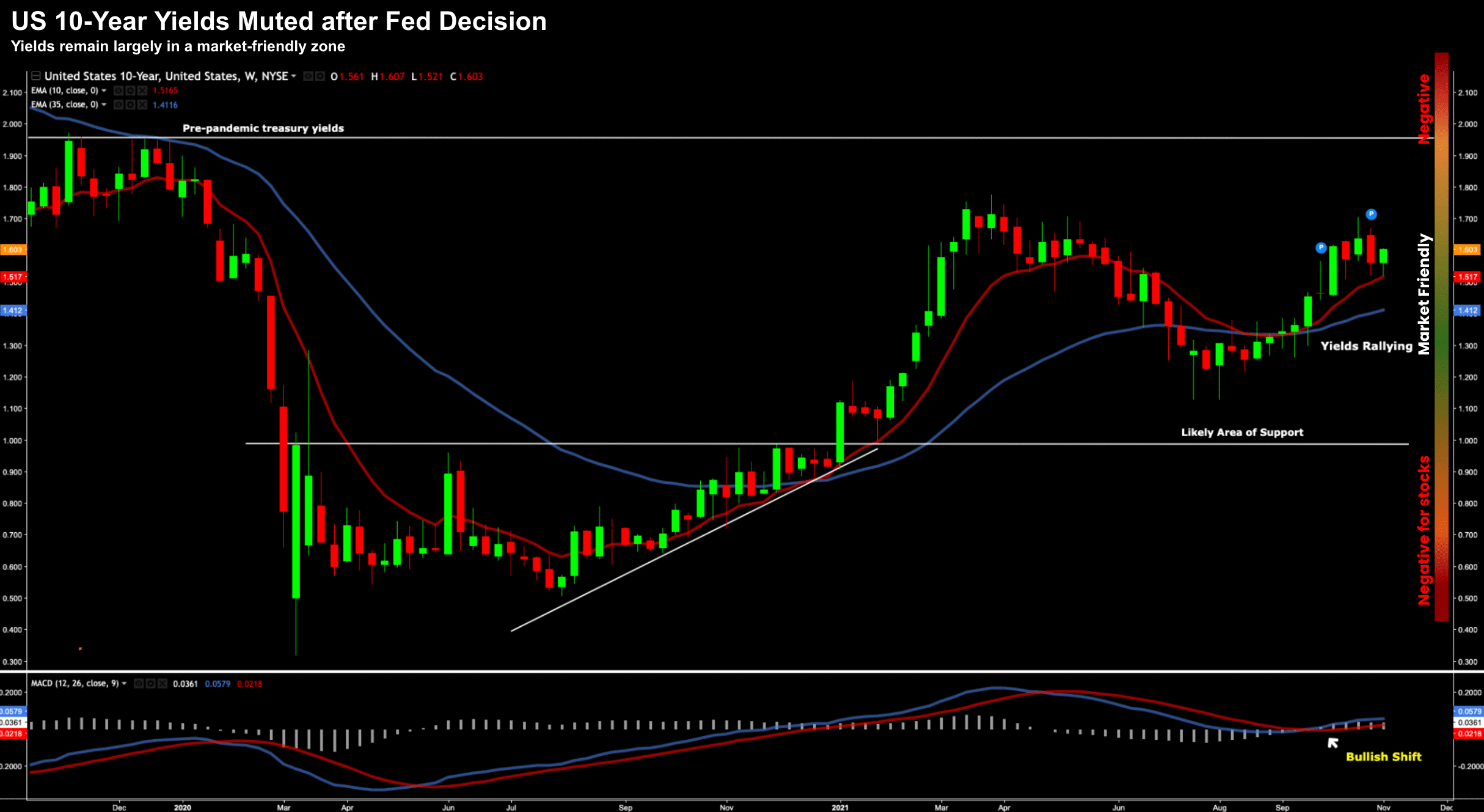

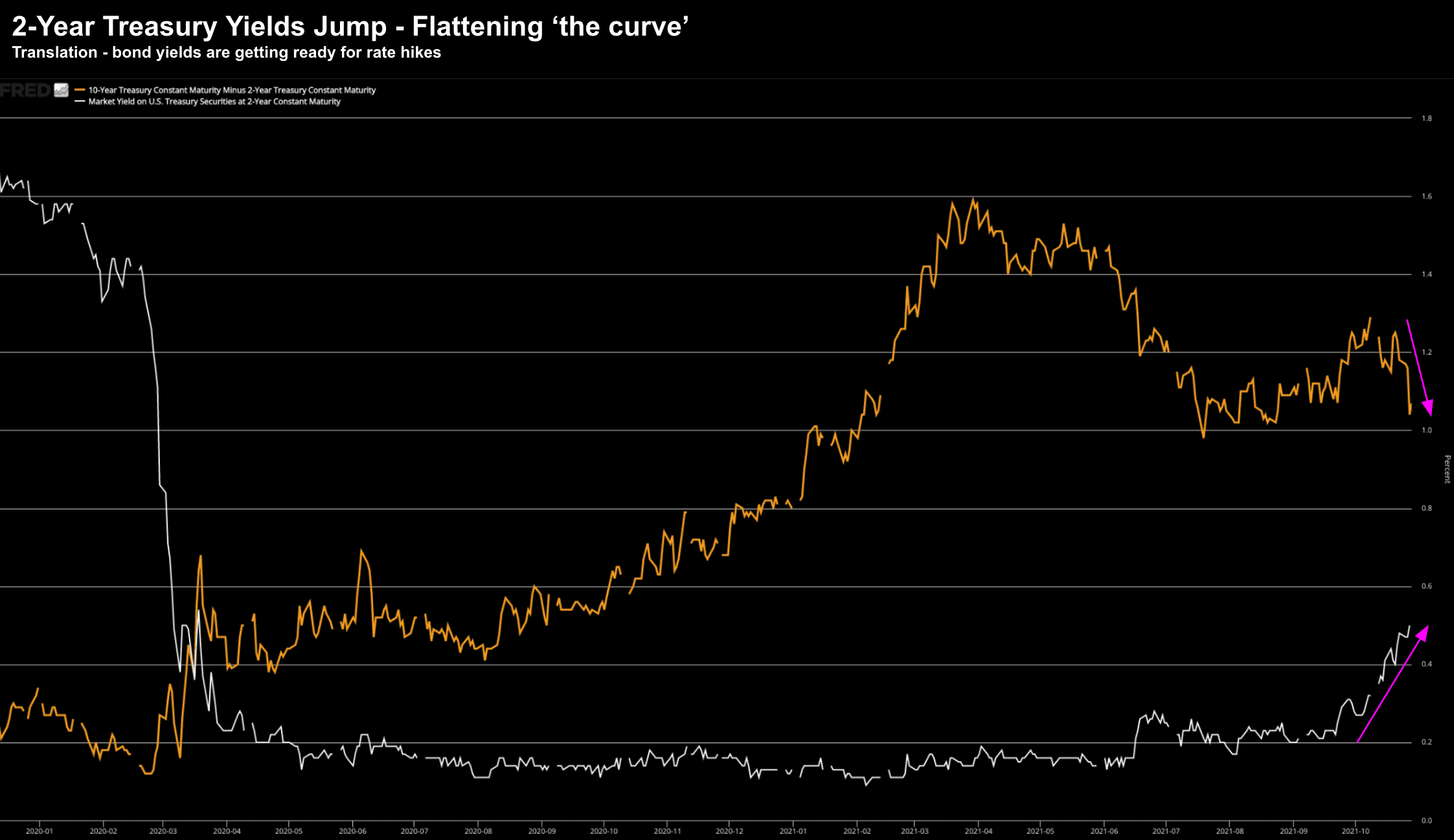

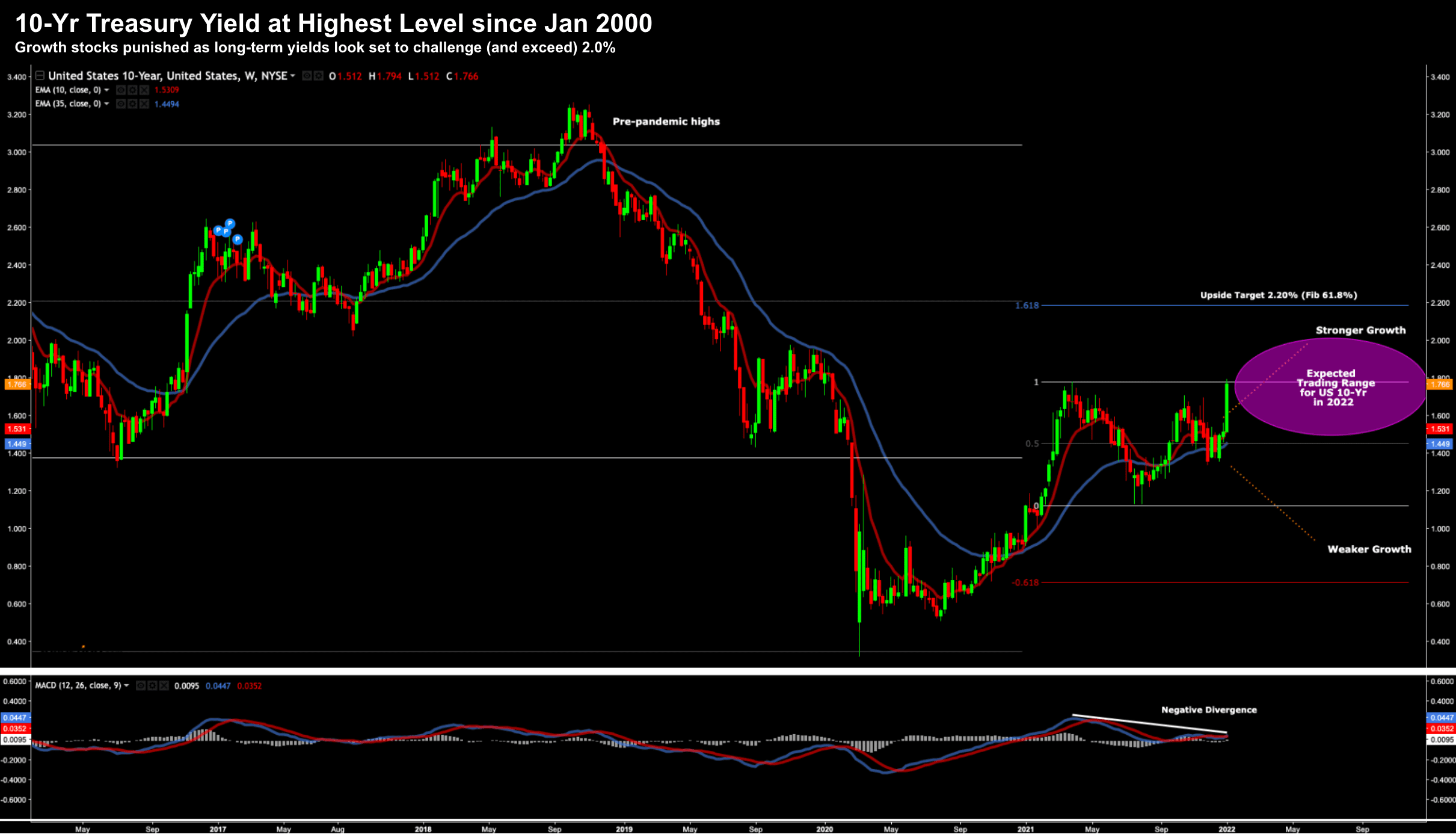

Whilst we are just one week into the new year - the selling in bonds has been nothing shy of ferocious. A combination of red-hot inflation (more to come with CPI this week) and a hawkish Fed has sent bond investors racing for the exits - sending yields (and rates) sharply higher.