Inflation: Here Today… Gone Tomorrow?

Inflation: Here Today… Gone Tomorrow?

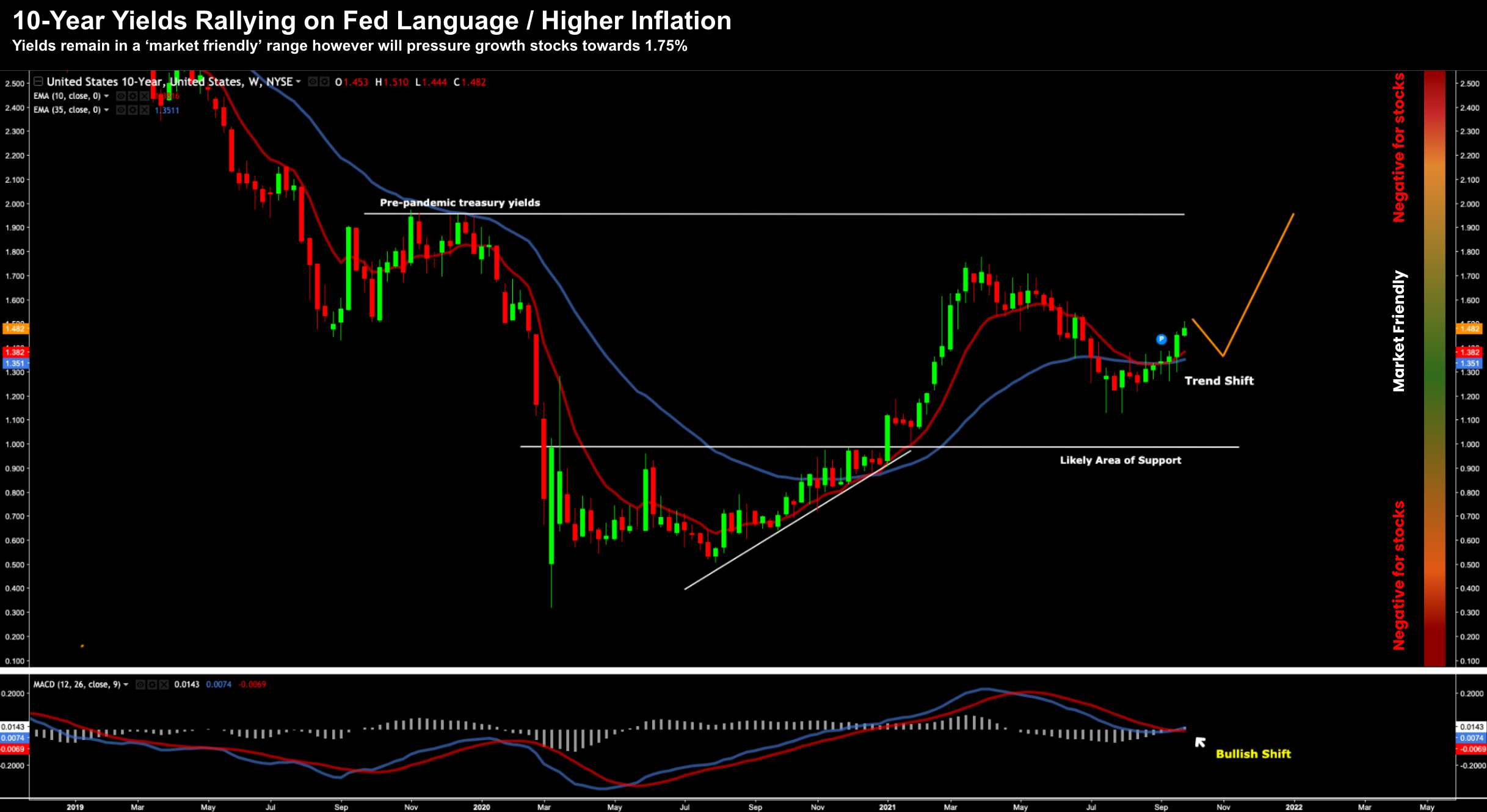

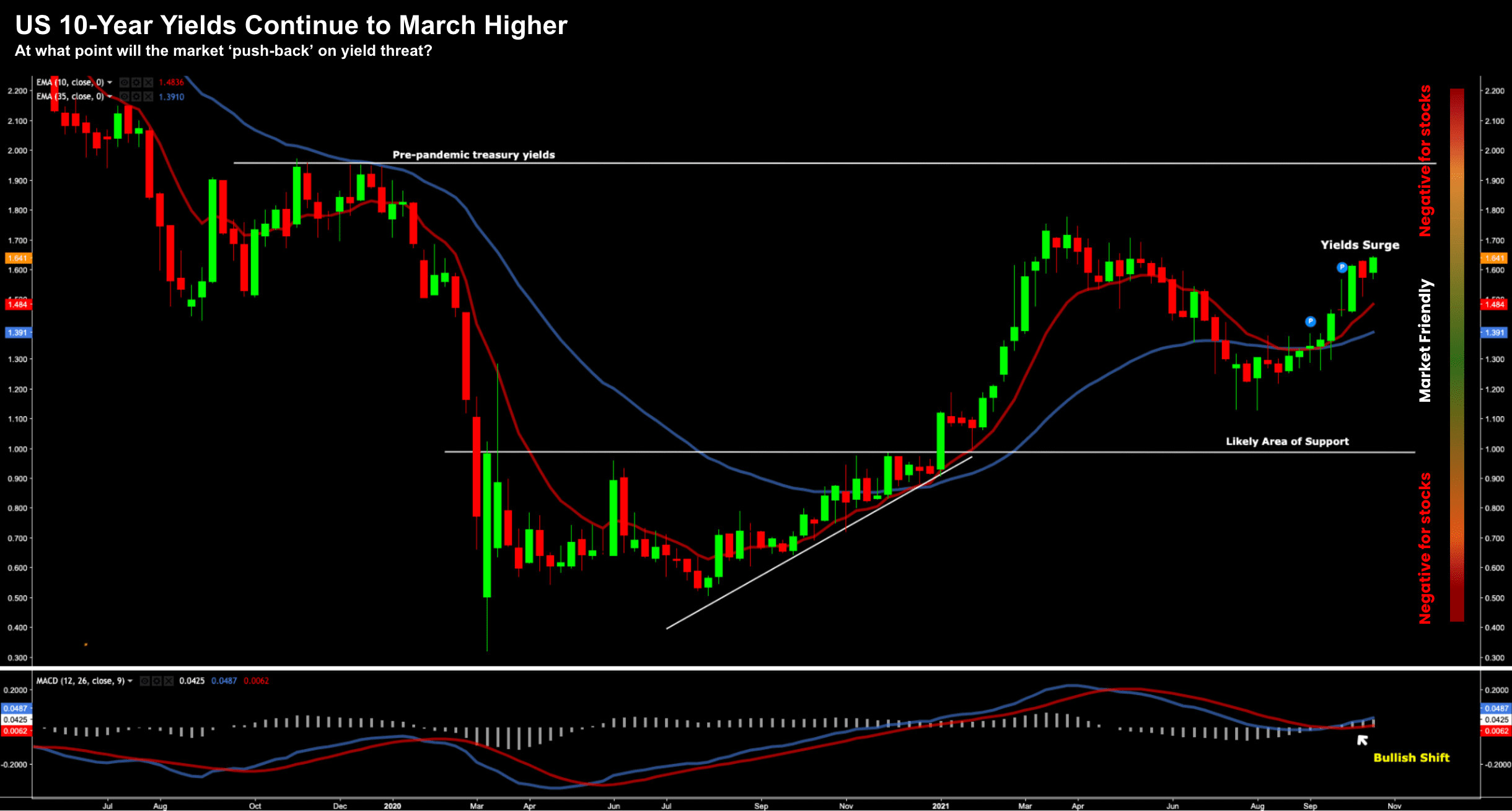

Rates are almost certain to rise... evidenced by what we see with the 10-year yield and break-even rates.

As a result, when rates do rise, this will temper demand. However, it will do nothing to ease the supply bottlenecks across the world.