Oil: Headed Back to $100?

Oil: Headed Back to $100?

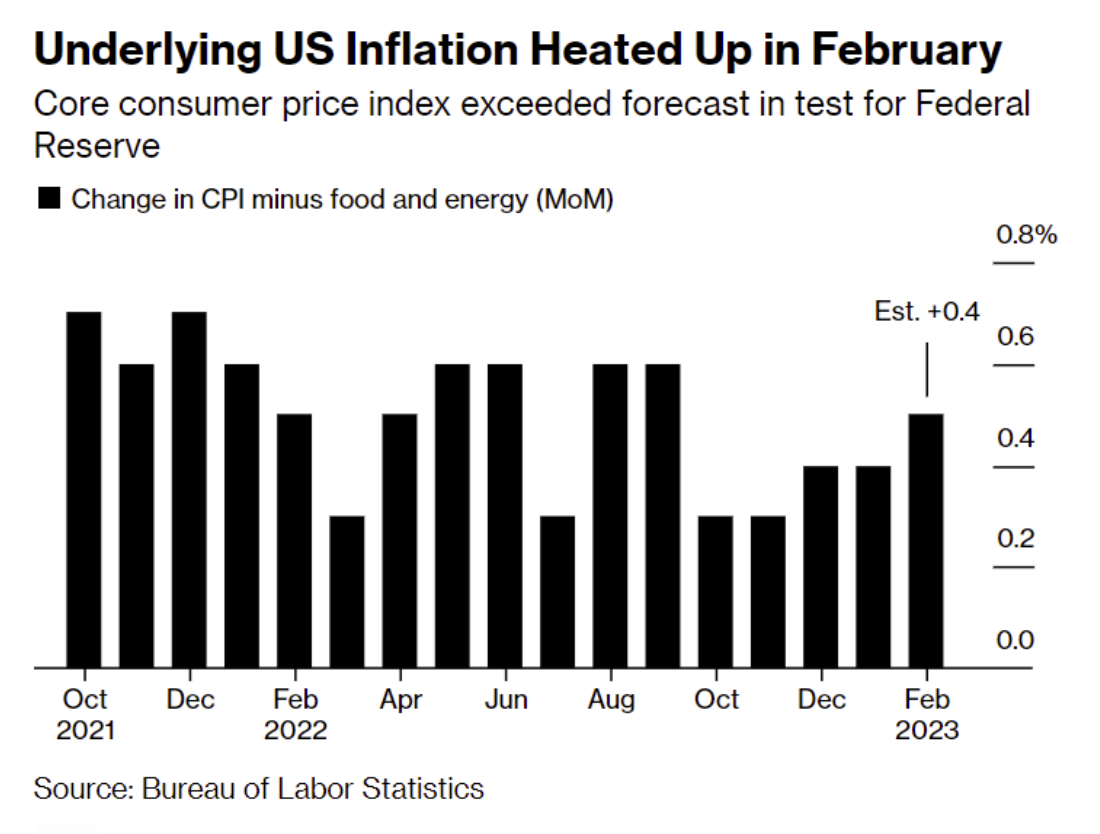

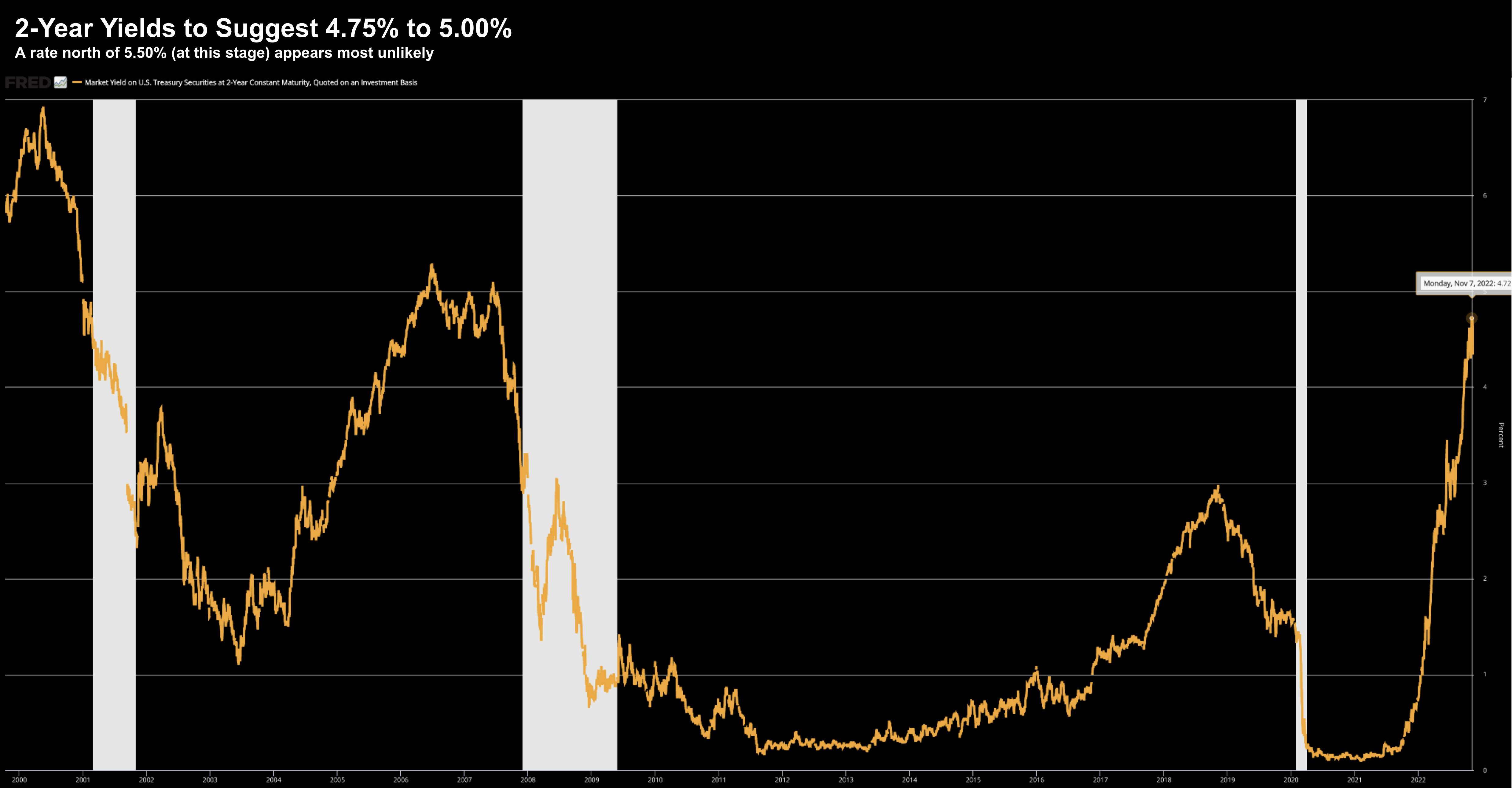

November last year I felt there could be an oil supply shock in 2023 - sending the price back over $100. This week OPEC+ surprised the market by announcing cuts of 3.7M barrels of oil per day - around 4% of global supply. The price of WTI surged back above $80. I think we go higher from here... which won't help Jay Powell's fight with inflation.