The Pendulum Swings

The Pendulum Swings

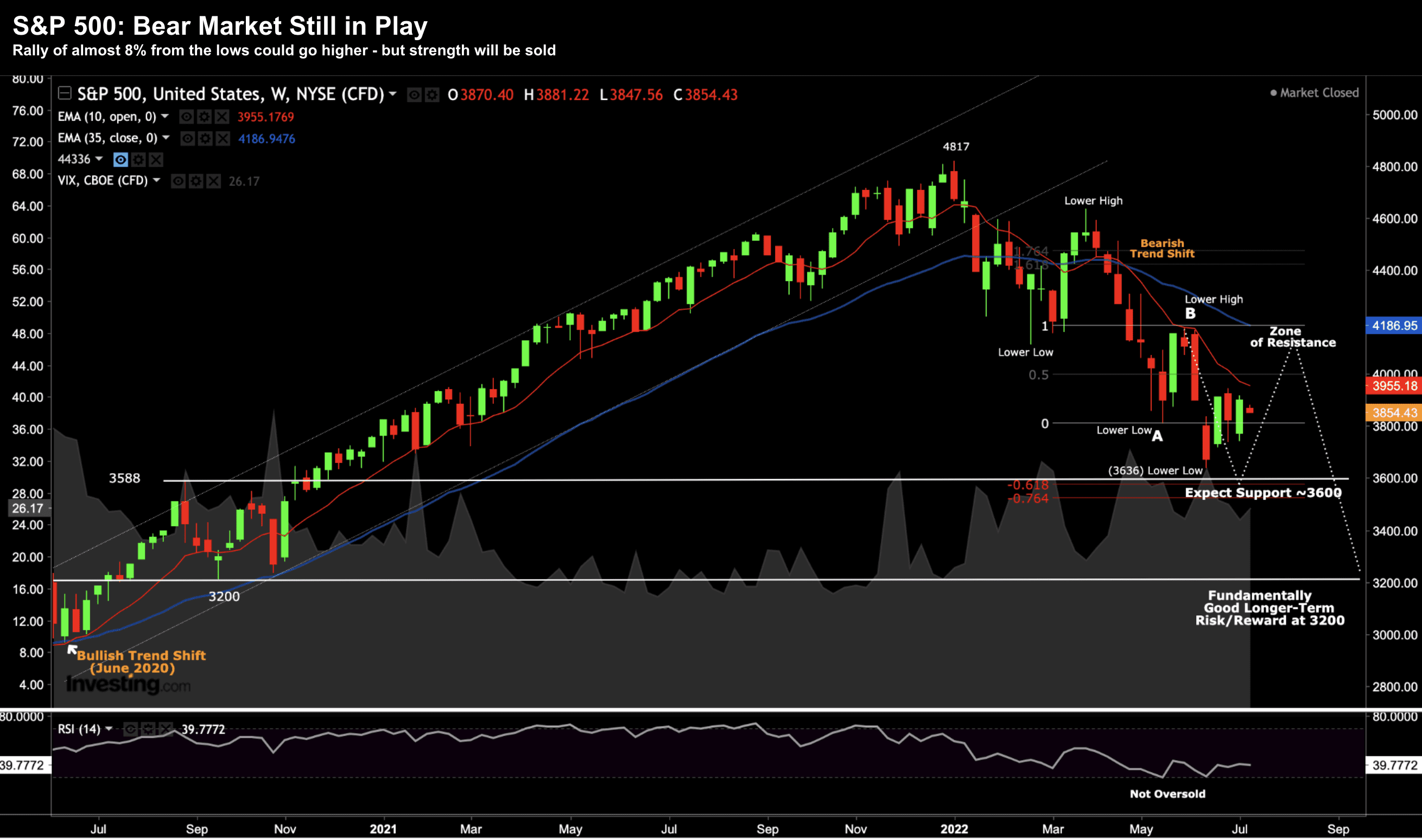

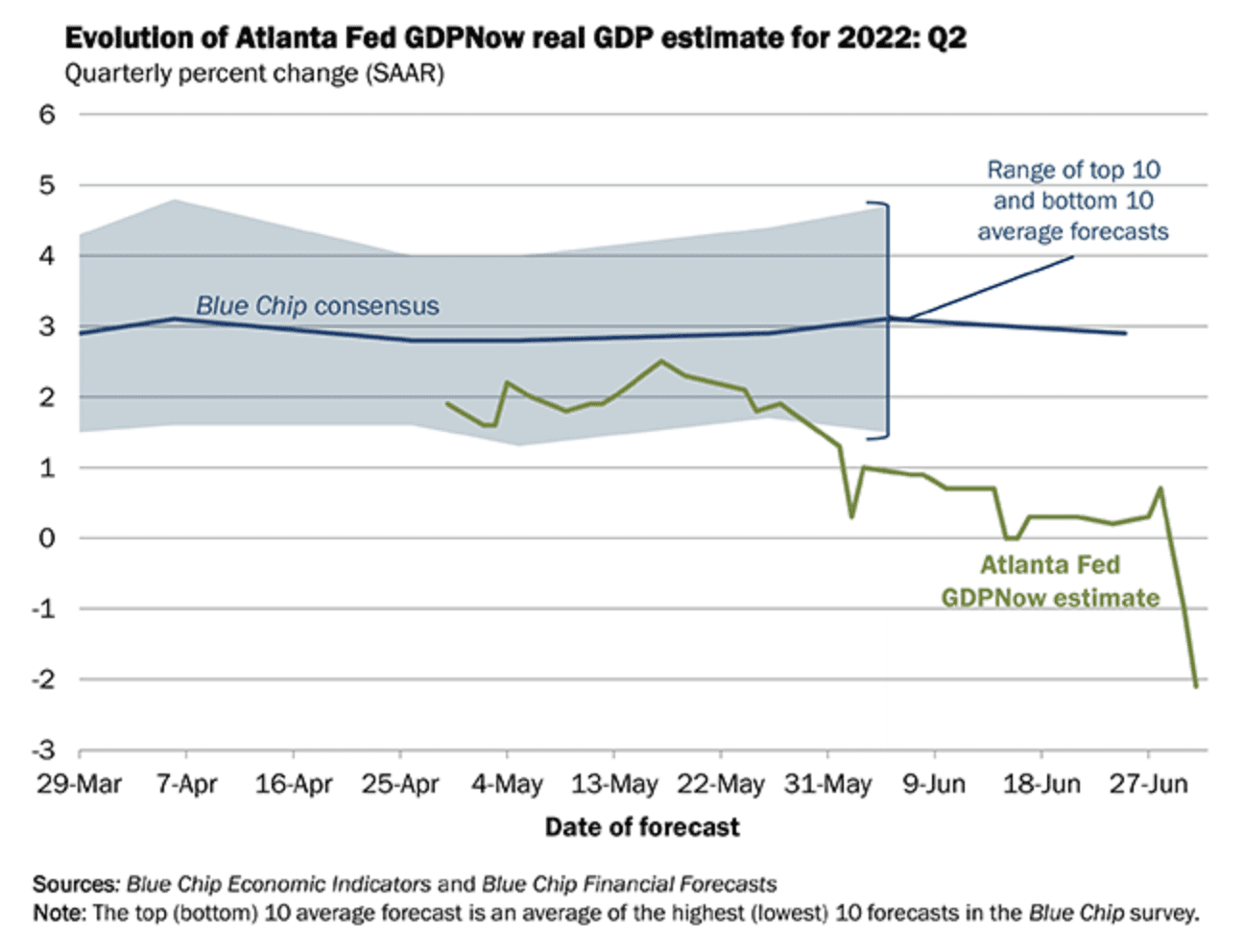

When things are going well and prices are high, investors rush to buy, forgetting all prudence. Then, when there’s chaos all around and assets are on the bargain counter, they lose all willingness to bear risk and rush to sell. And it will ever be so - Howard Marks