Worst 6-Months to Start a Year Since 1970

Worst 6-Months to Start a Year Since 1970

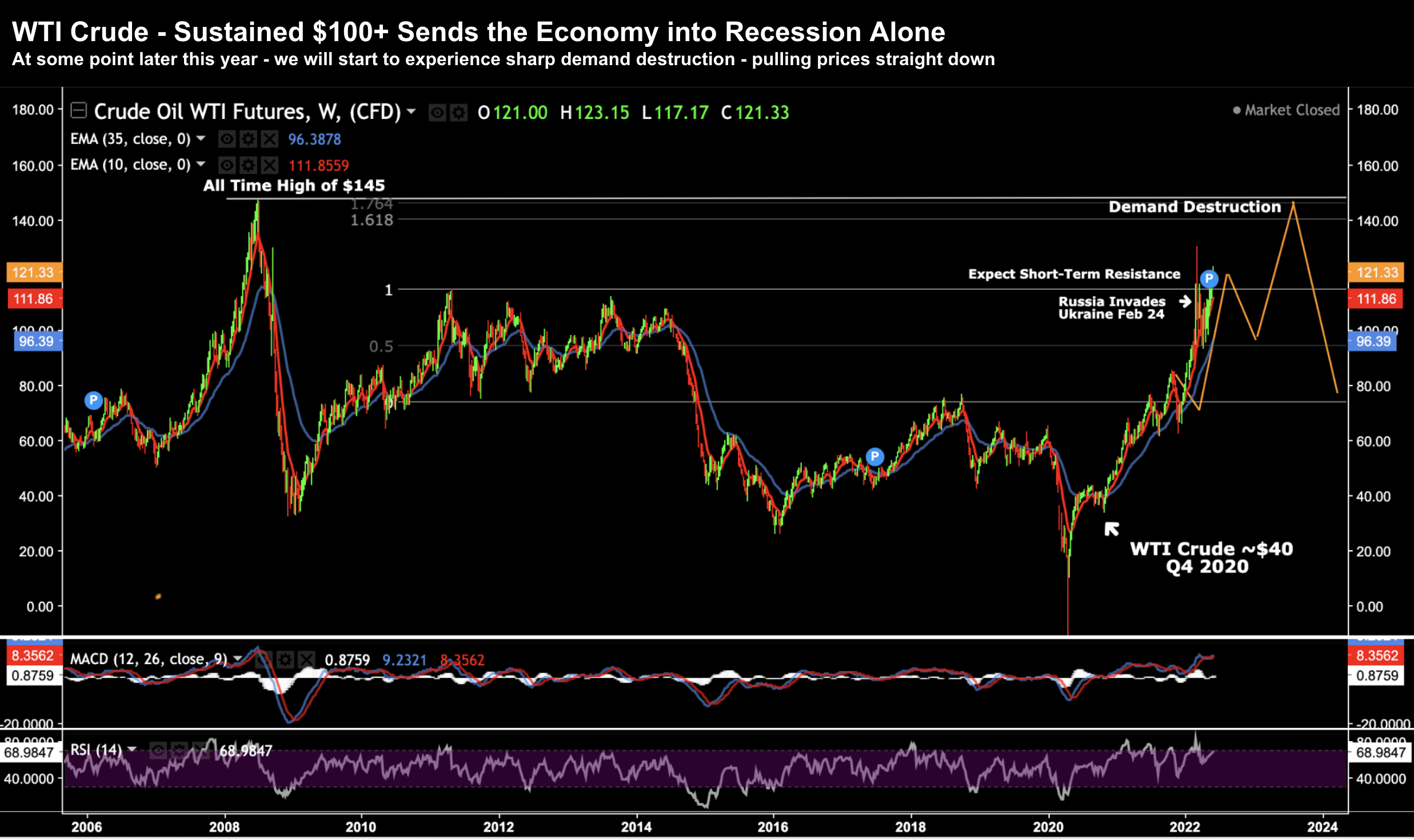

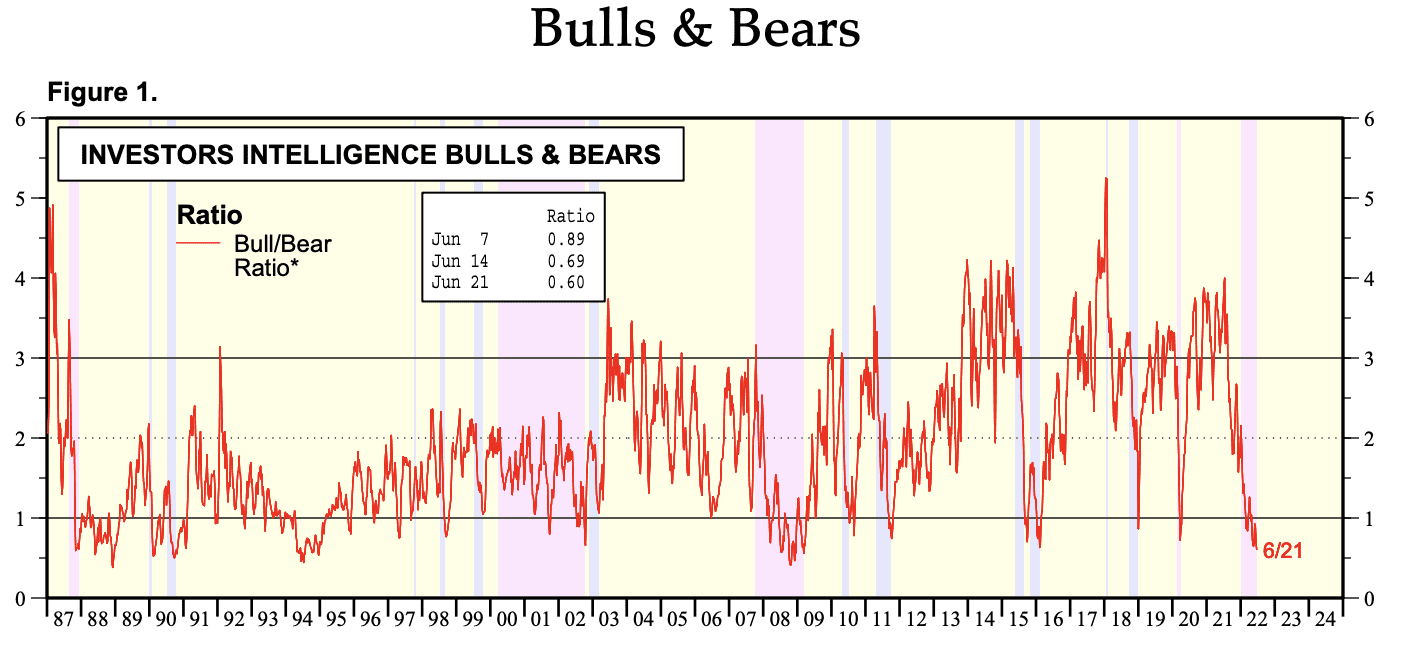

It's becoming increasingly likely we will see a recession next year (maybe before). And there's one thing that every recession has in common post 1950 -- aggressive Fed tightening into a slowing economy.