Will a US Debt Downgrade be a ‘Bearish’ Catalyst?

Will a US Debt Downgrade be a ‘Bearish’ Catalyst?

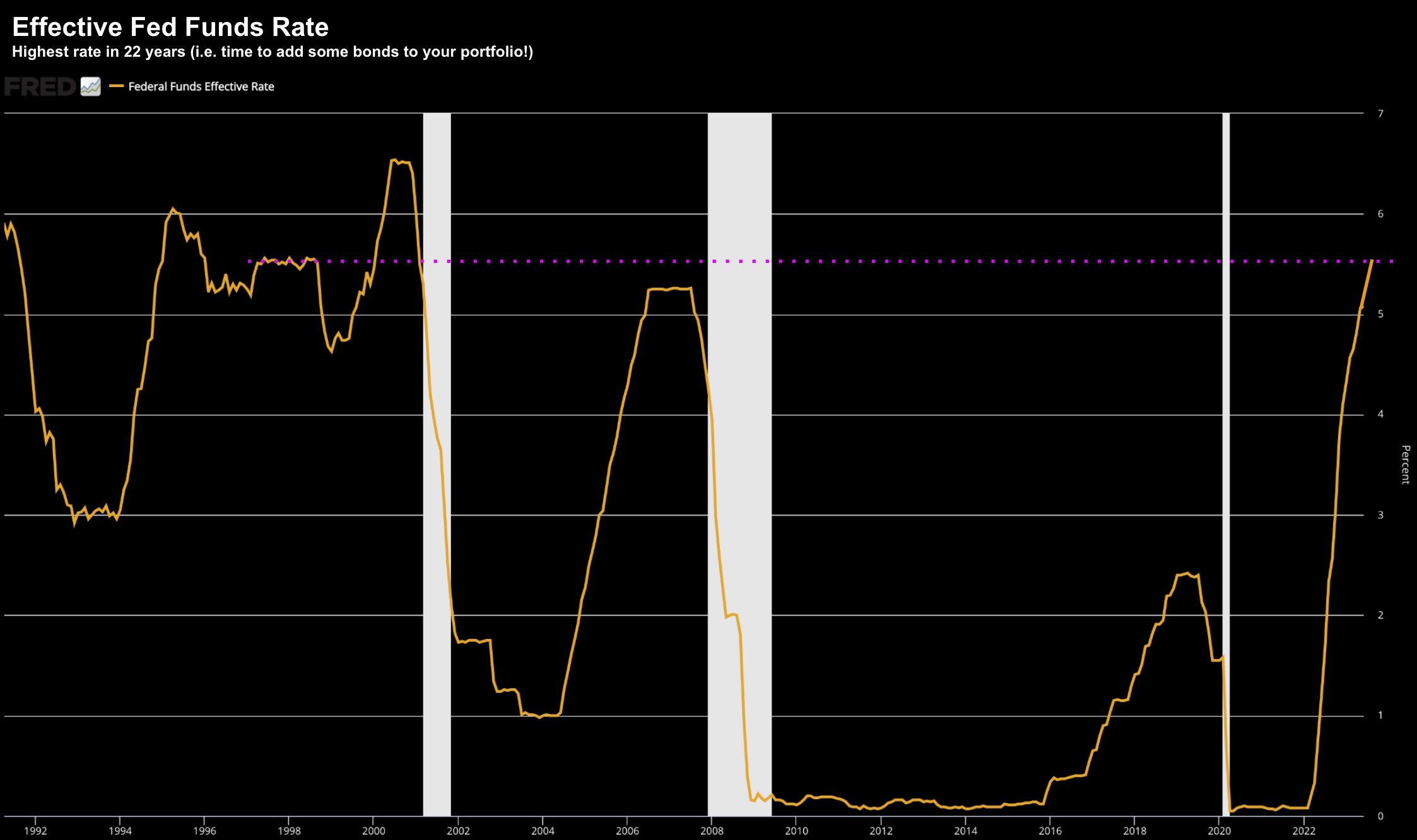

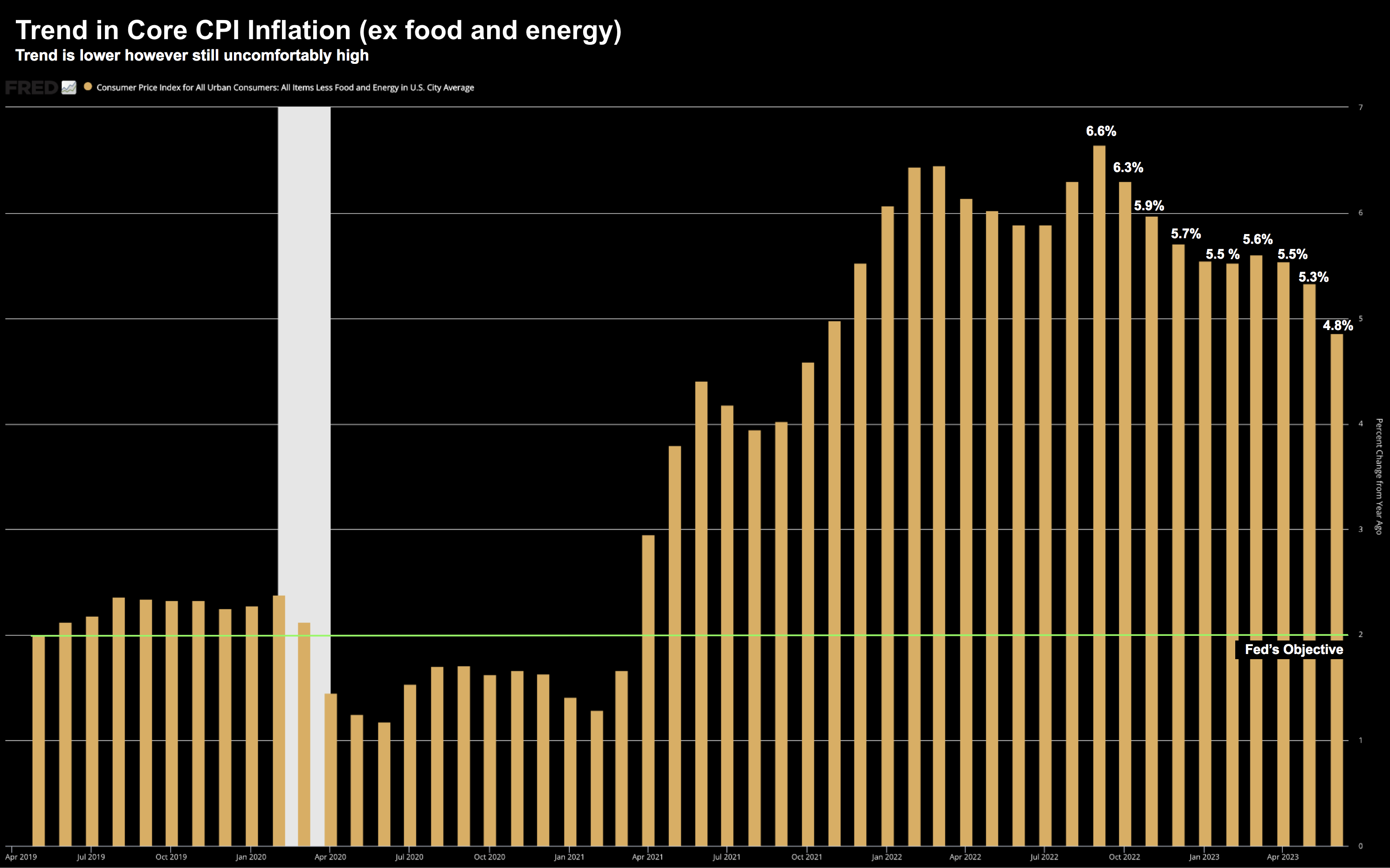

Earlier this week, Fitch Ratings downgraded the U.S.' credit rating. Stocks slipped a little on the news and bond yields ticked higher. The US 10-year treasury yield is now north of 4.10%. Fitch cited “expected fiscal deterioration over the next three years” and an erosion of governance. Hard to argue. Fiscal restraint is not one of the government's strengths. But this isn't entirely new news. For example, the credit agency placed the nation’s rating on watch in May following a near-default after members of Congress butted heads over raising the debt ceiling. However, this put the wheels in motion....