Yield Curve: Recession Dead Ahead

Yield Curve: Recession Dead Ahead

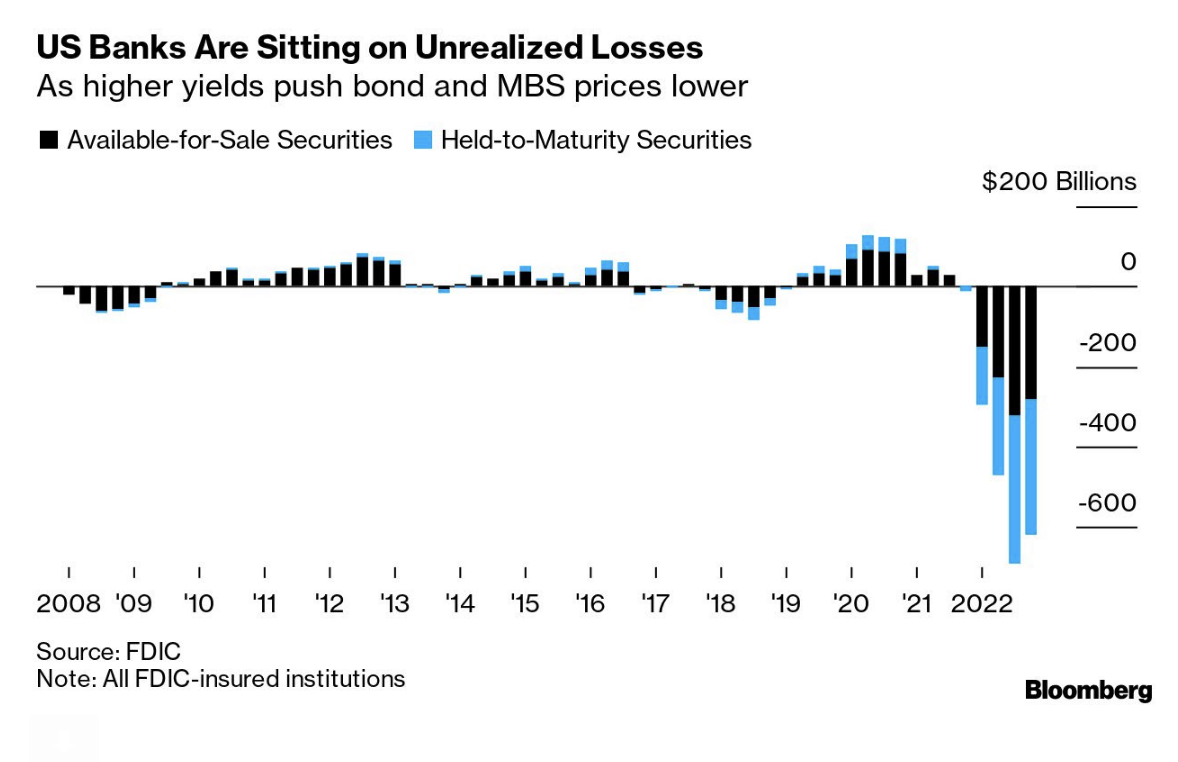

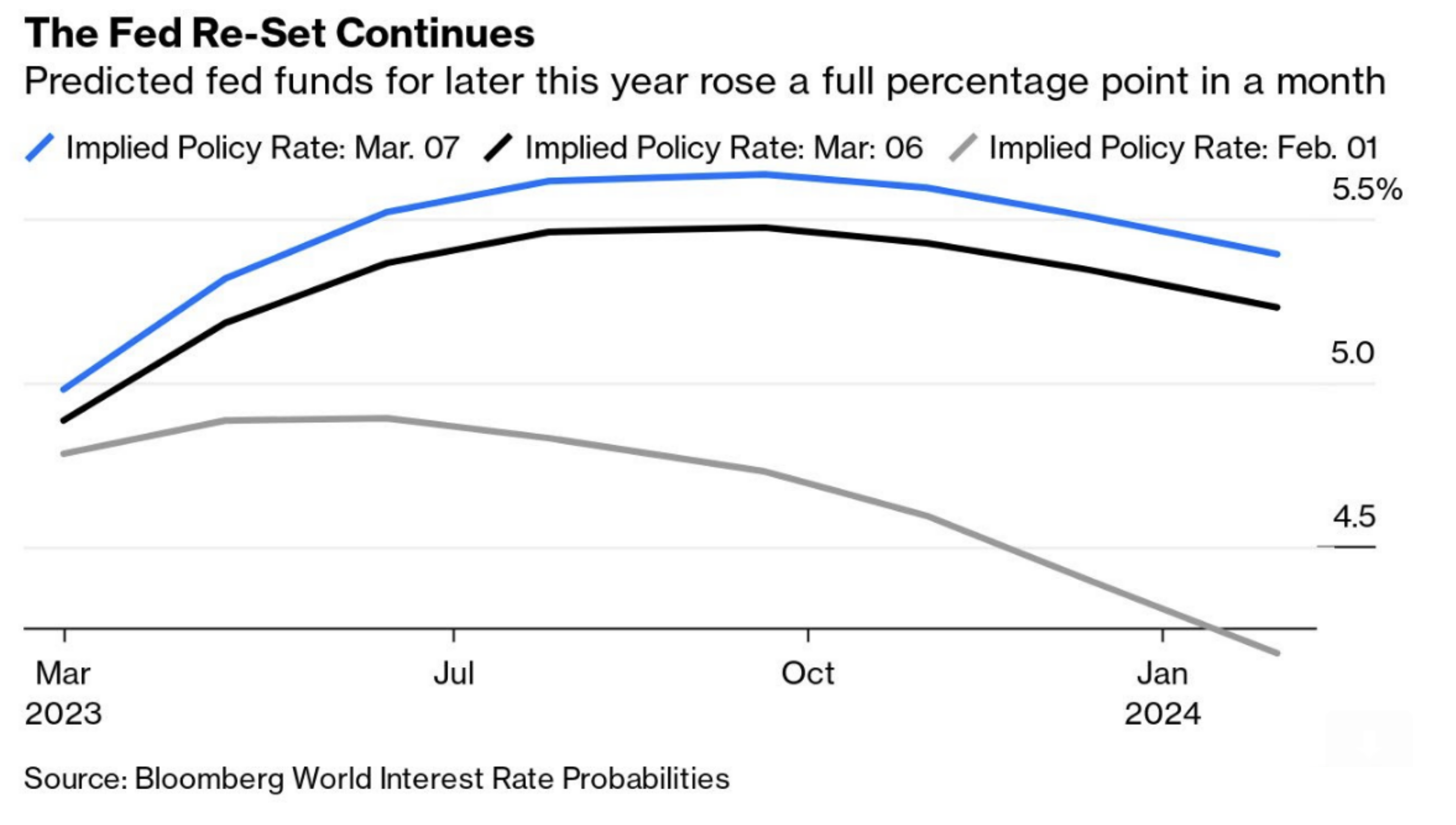

2-year bond yields are cratering. Rarely - if ever - have we seen them fall 150 basis points in just three weeks. This signals the bond market sees aggressively rate cuts from the Fed this year. But what would cause this? A recession? Some kind of credit crisis? I can tell you it won't be because inflation is back to the Fed's target of 2%. What's more, the yield curve has steepened sharply. This isn't good... and if history is any guide... a recession is likely within 12 months.