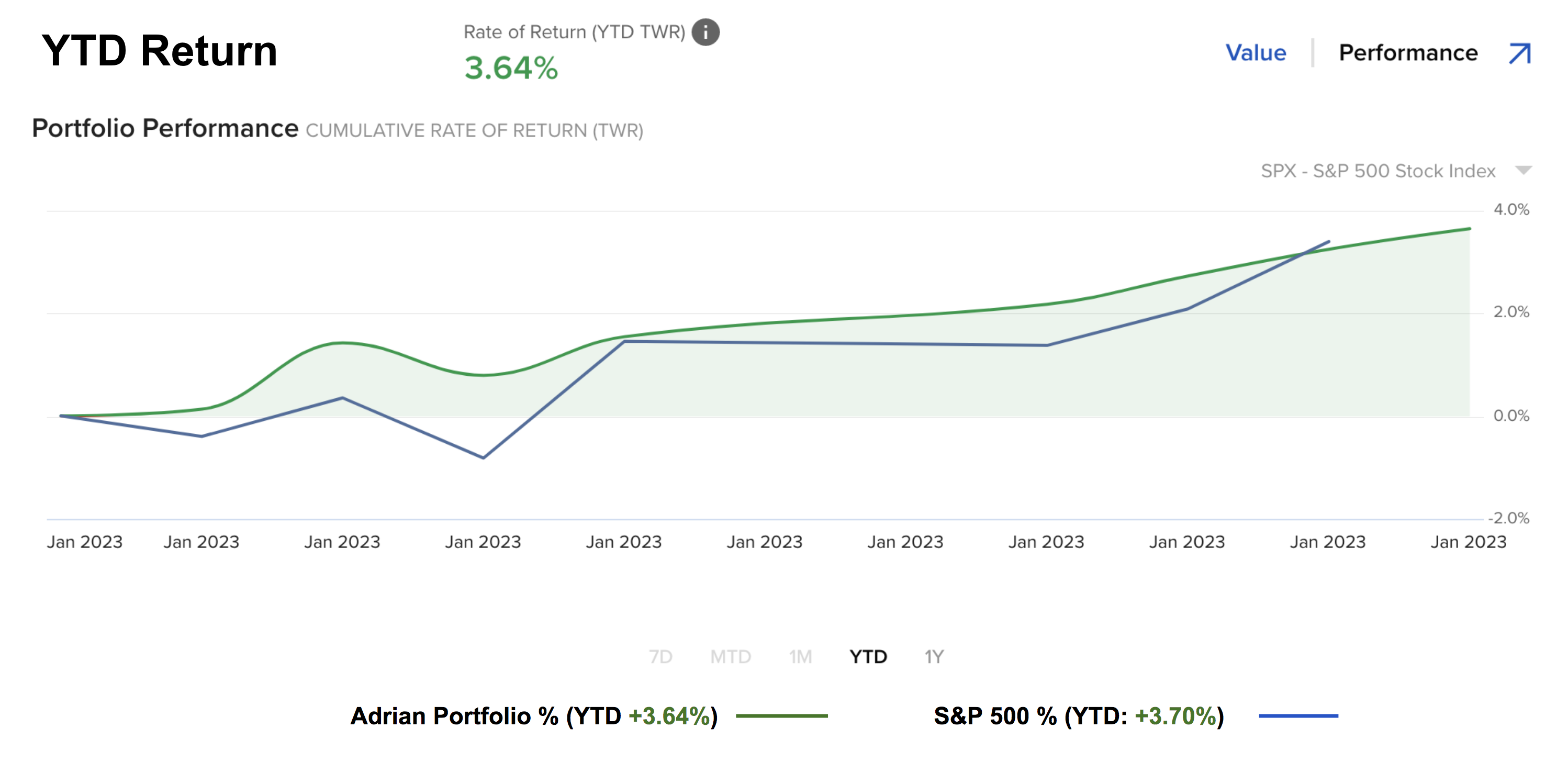

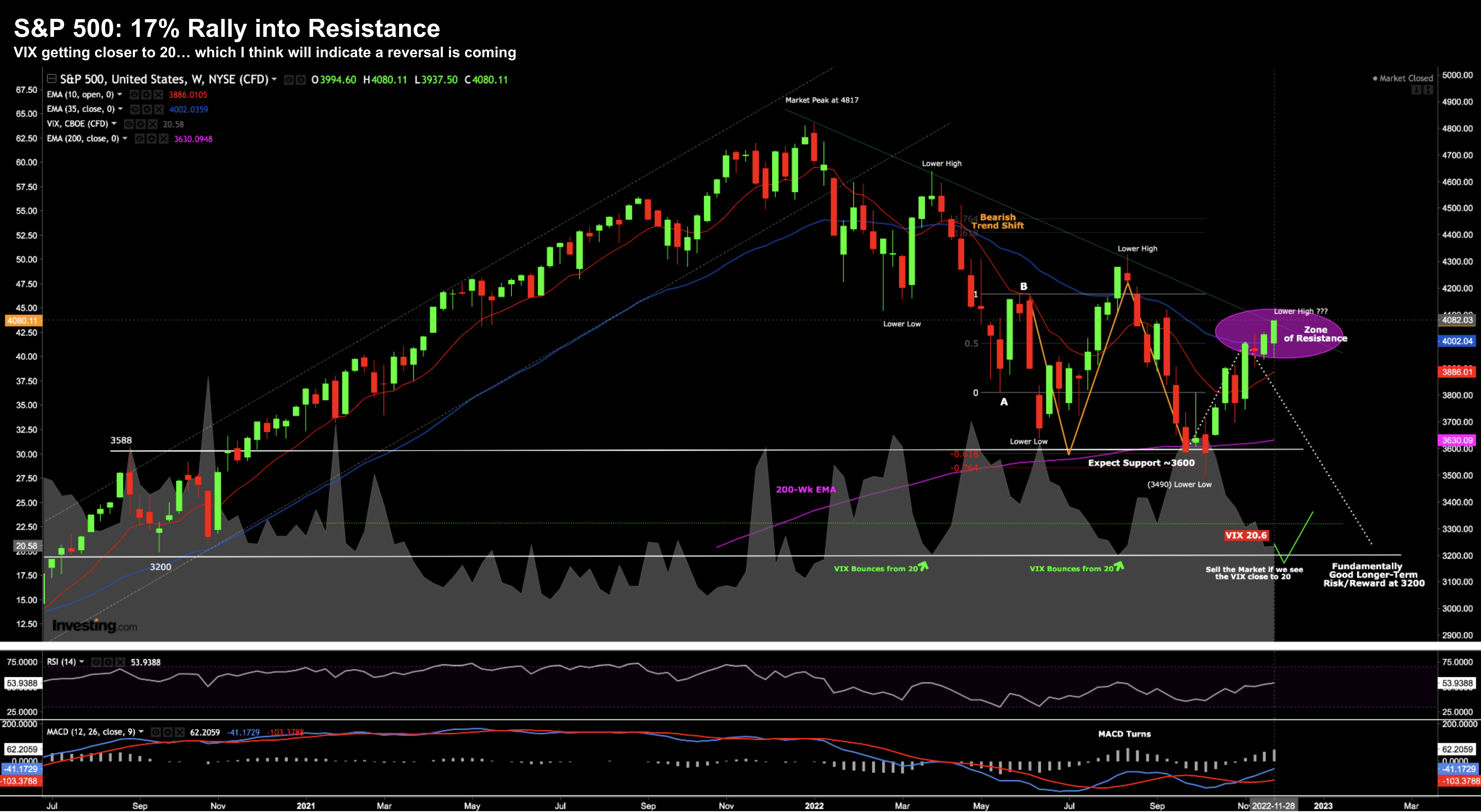

Powell Leans Dovish – Sending Stocks Higher

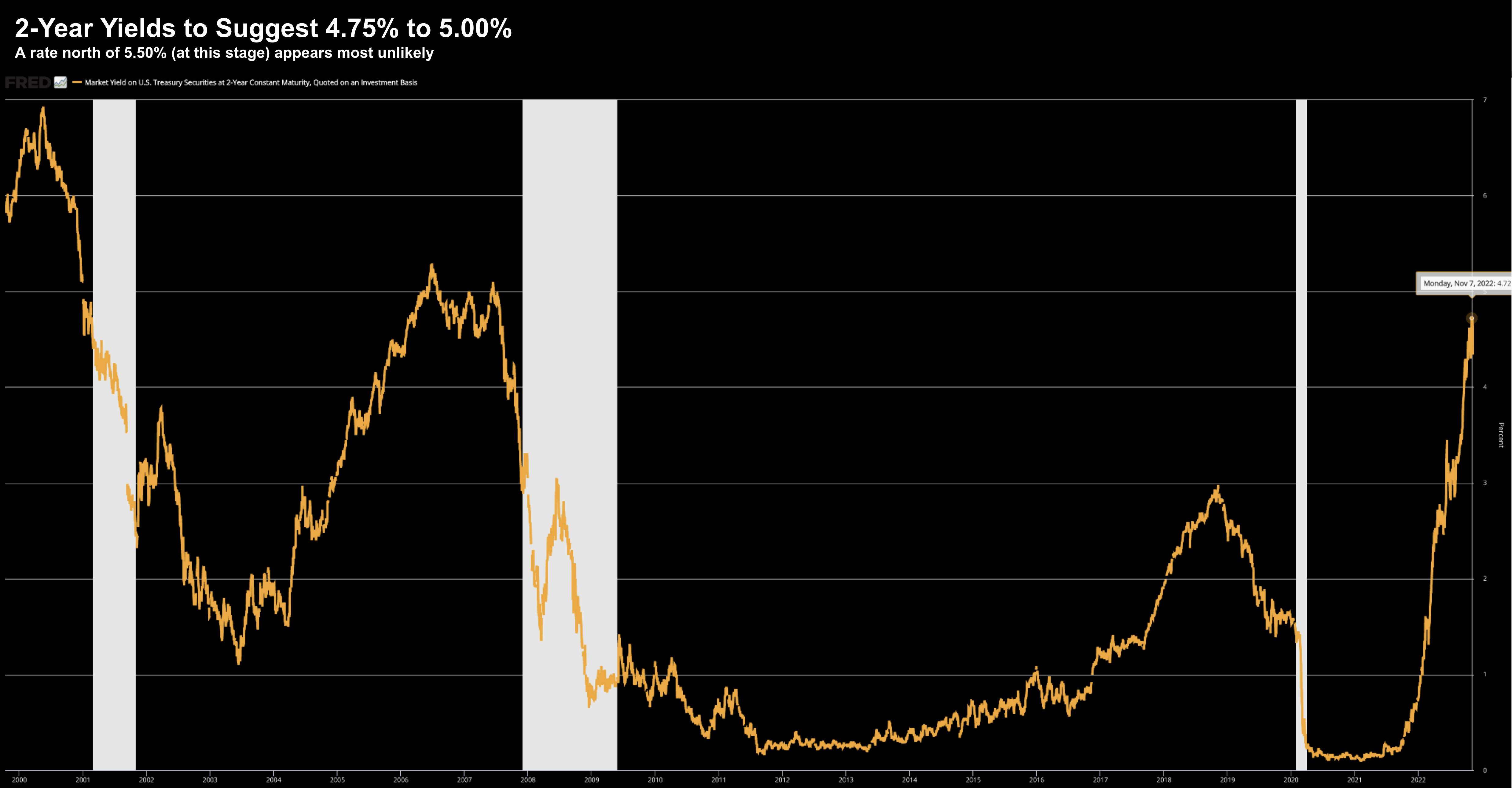

The market was worried about an overly hawkish Fed heading into the Feb FOMC meeting. However, Fed Chair Powell appeared to lean the other way... hinting at dovish tones. New language like 'disinflation' were introduced... suggesting the cash rate may not need to get to 5.0%. It didn't take much for stocks to rally as a result...