Inflation: How Hot is ‘Too Hot’?

Inflation: How Hot is ‘Too Hot’?

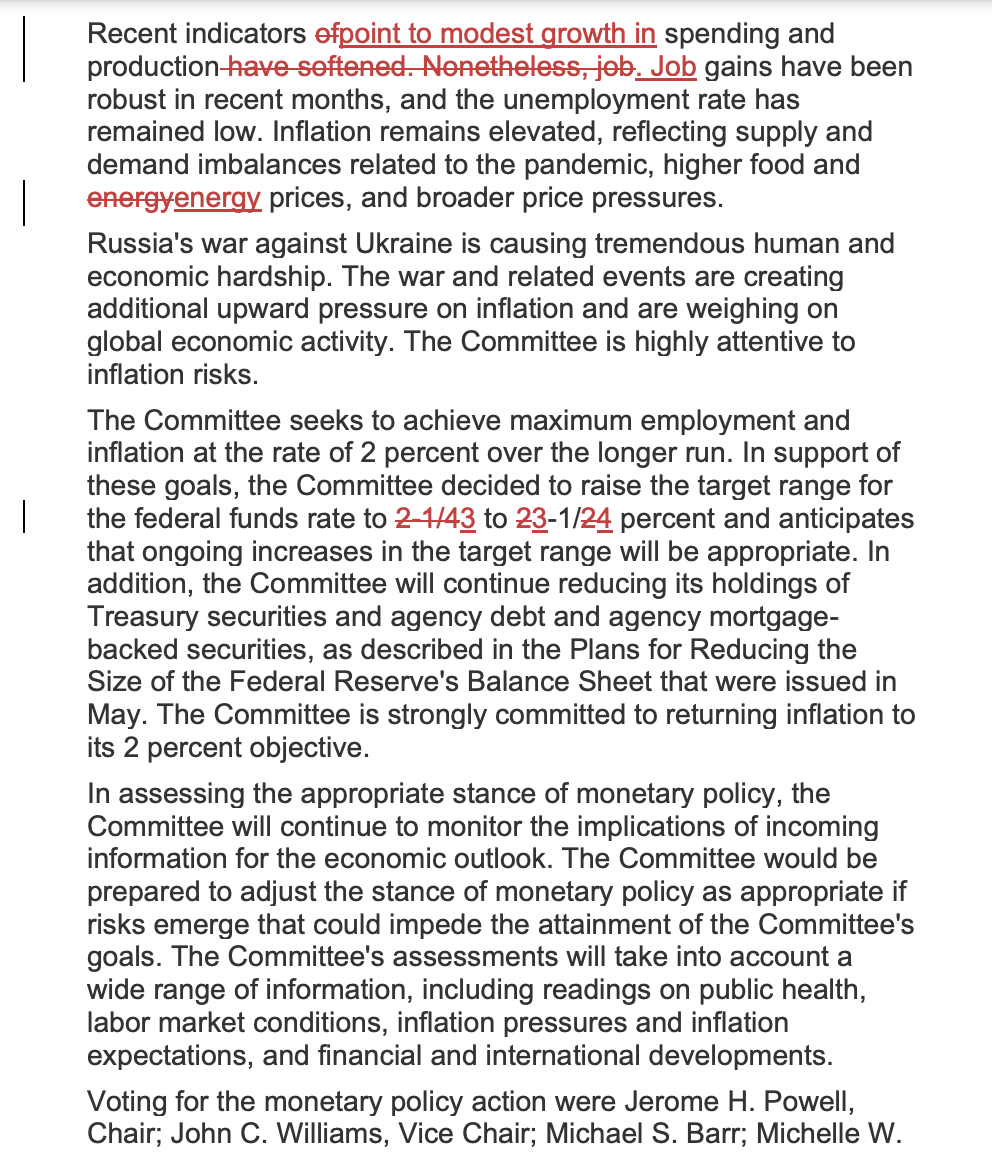

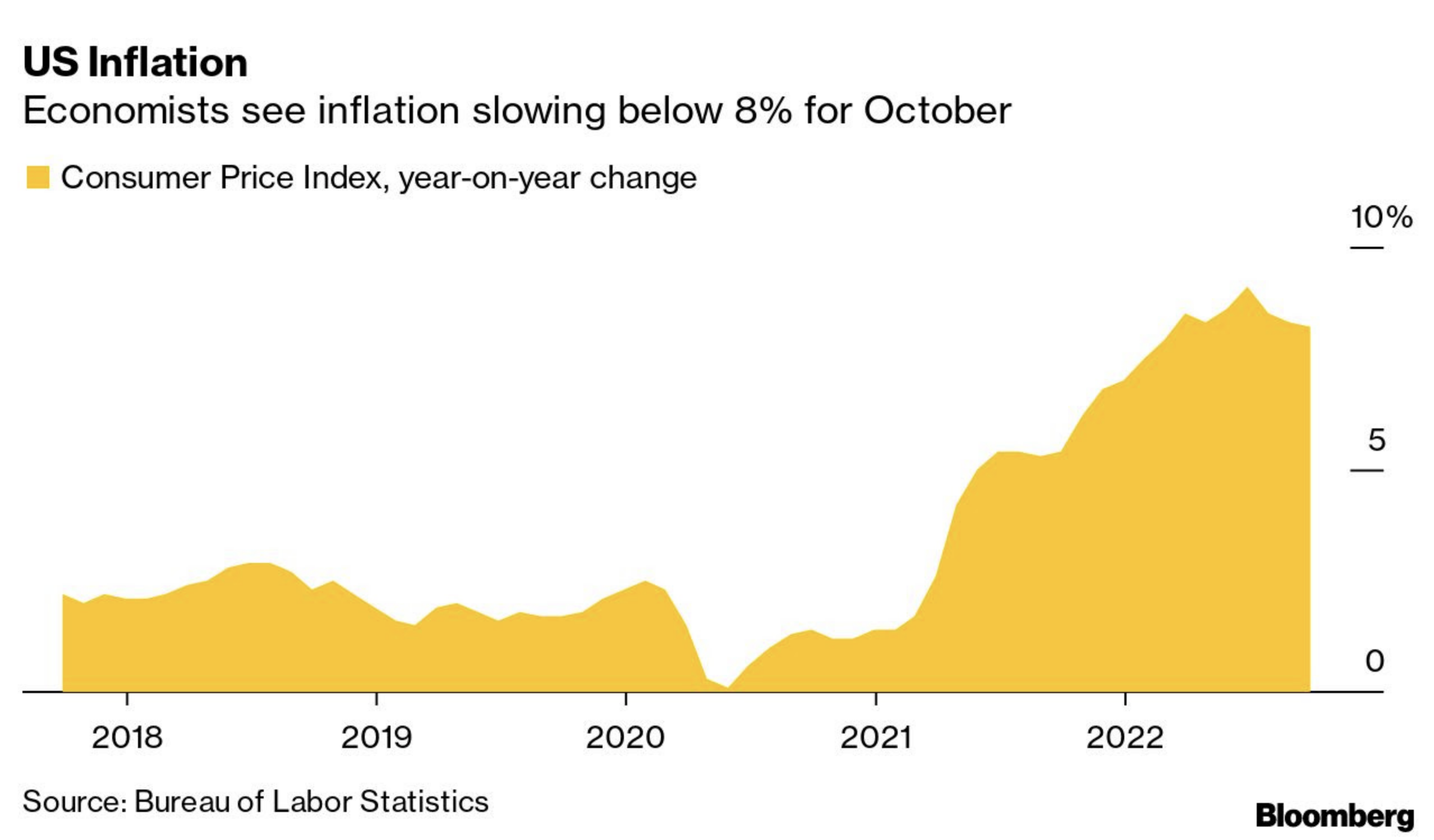

CPI for October is likely to come in hot... expect a high 7-handle. But how much is too hot? Anything north of 8% cements another 75 bps; however something closer to 7.7% may give some hope the Fed can tap the brakes.