Markets Waking Up to Fed Reality

Markets Waking Up to Fed Reality

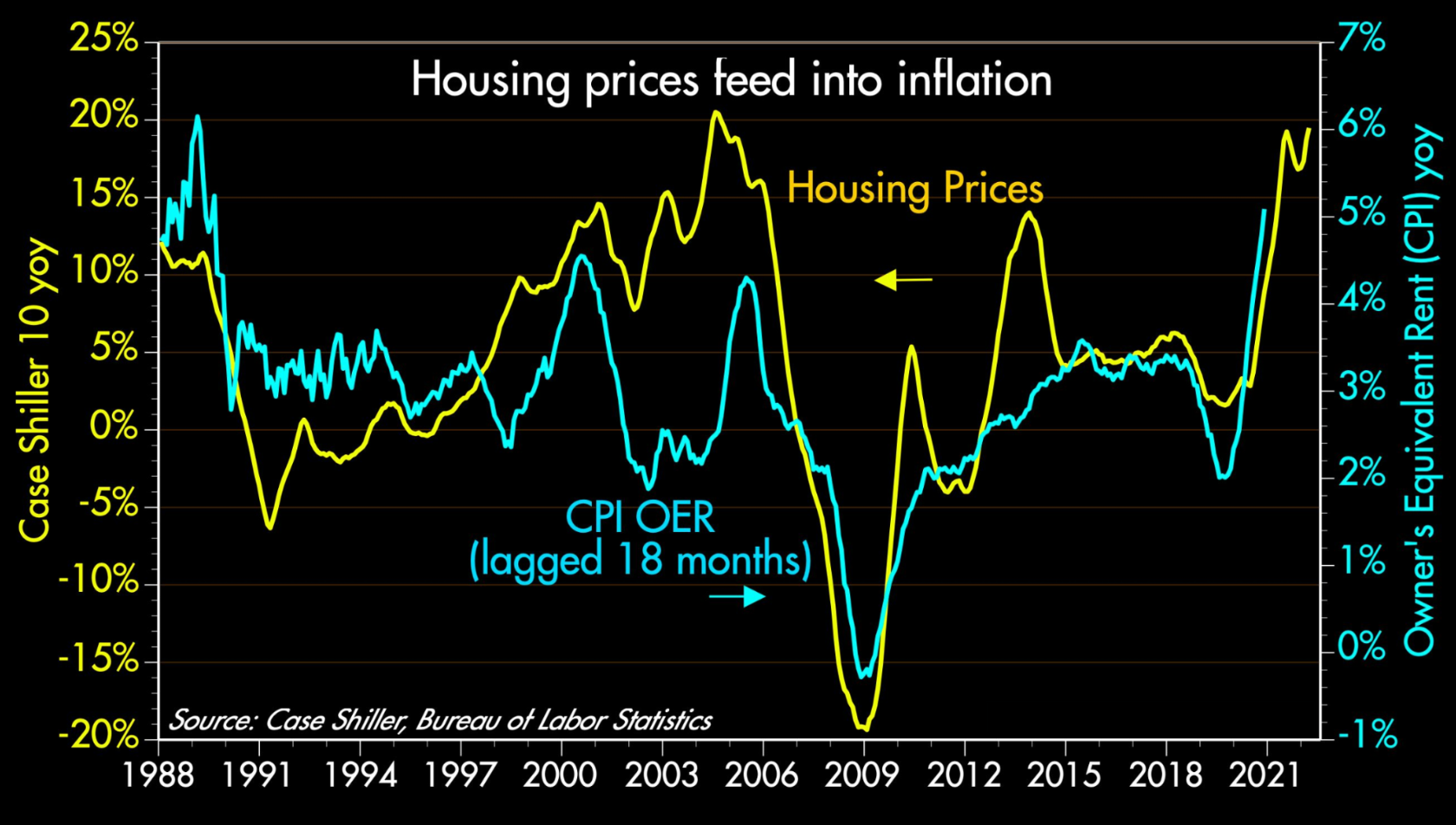

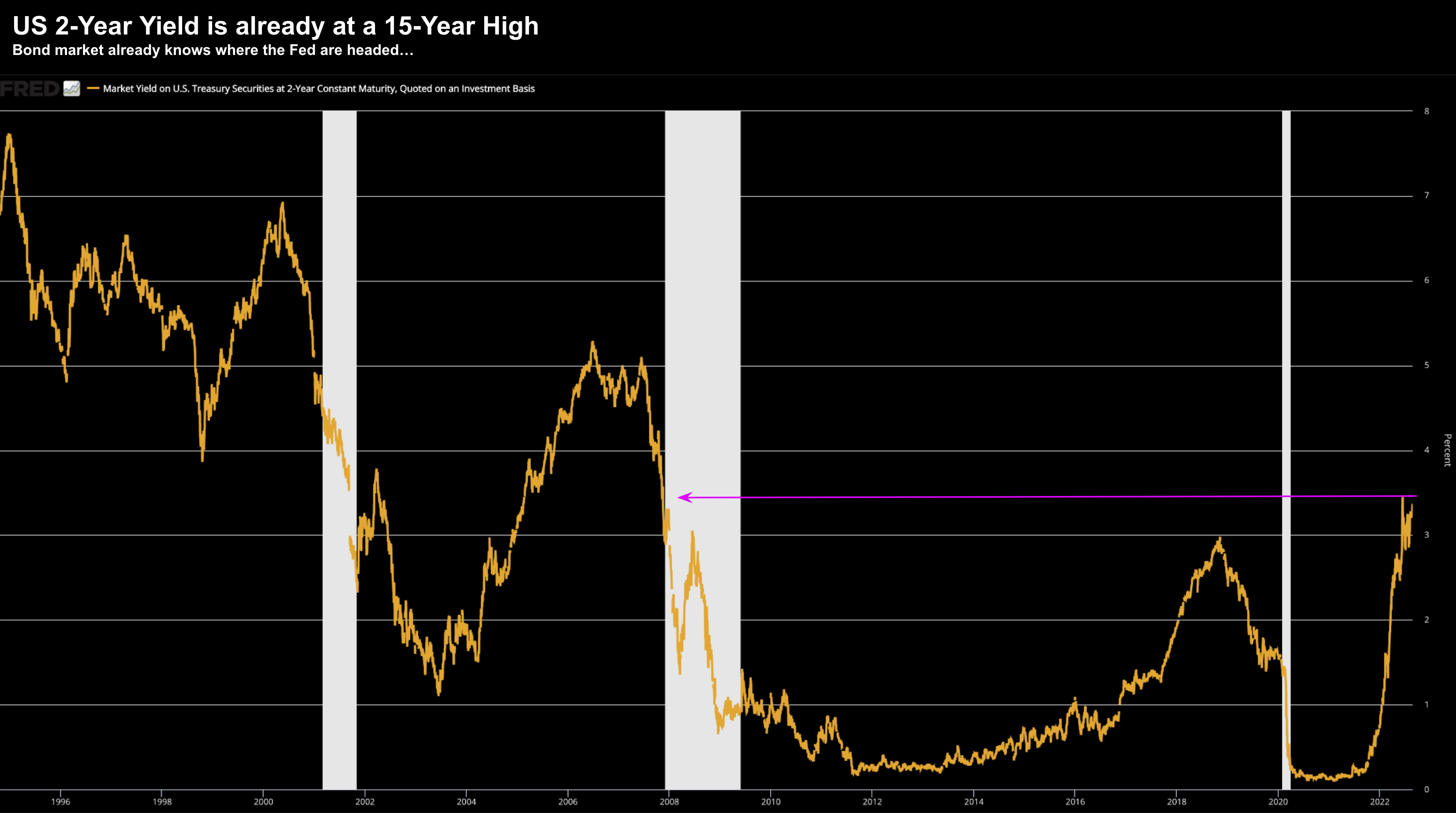

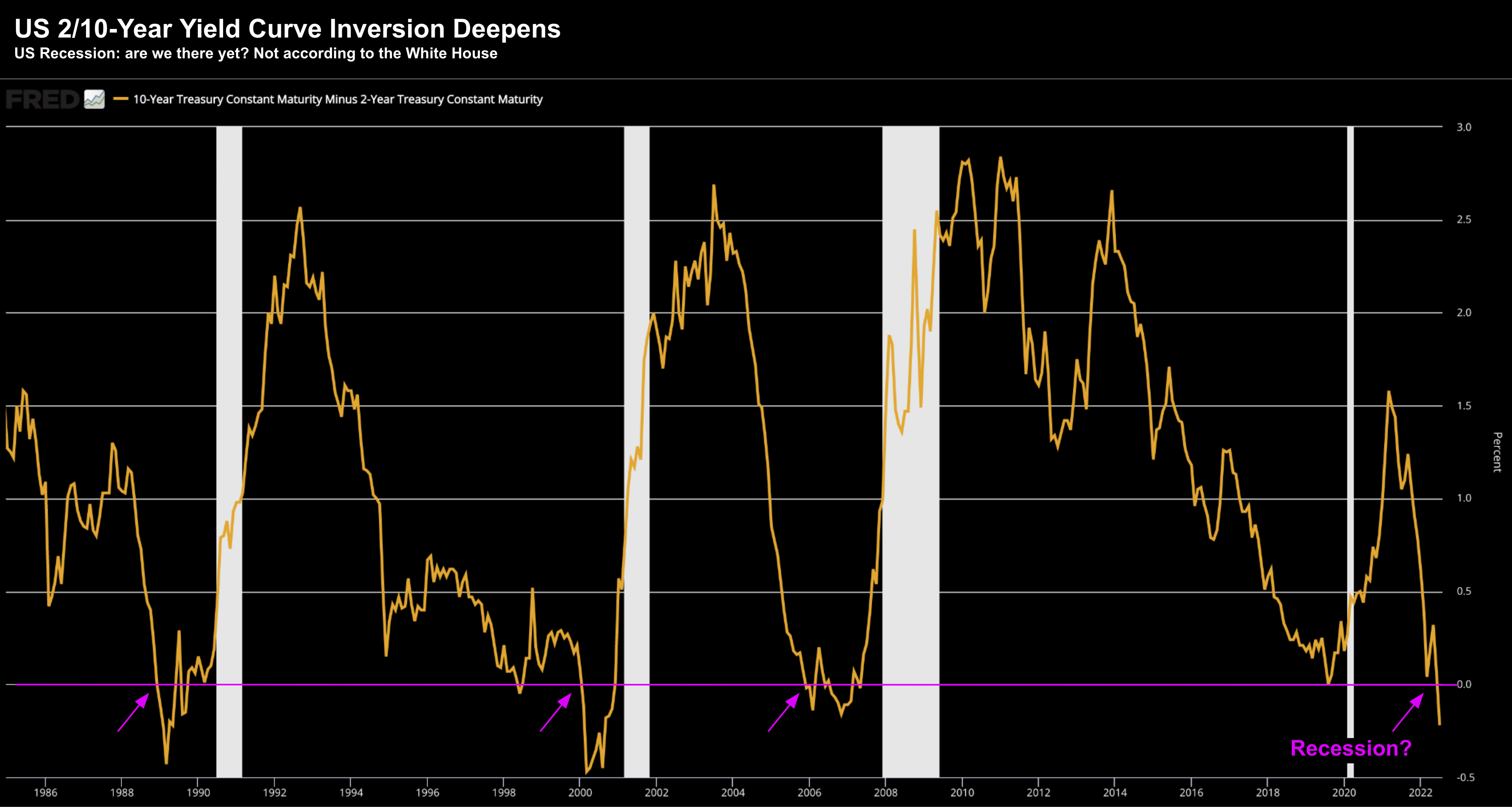

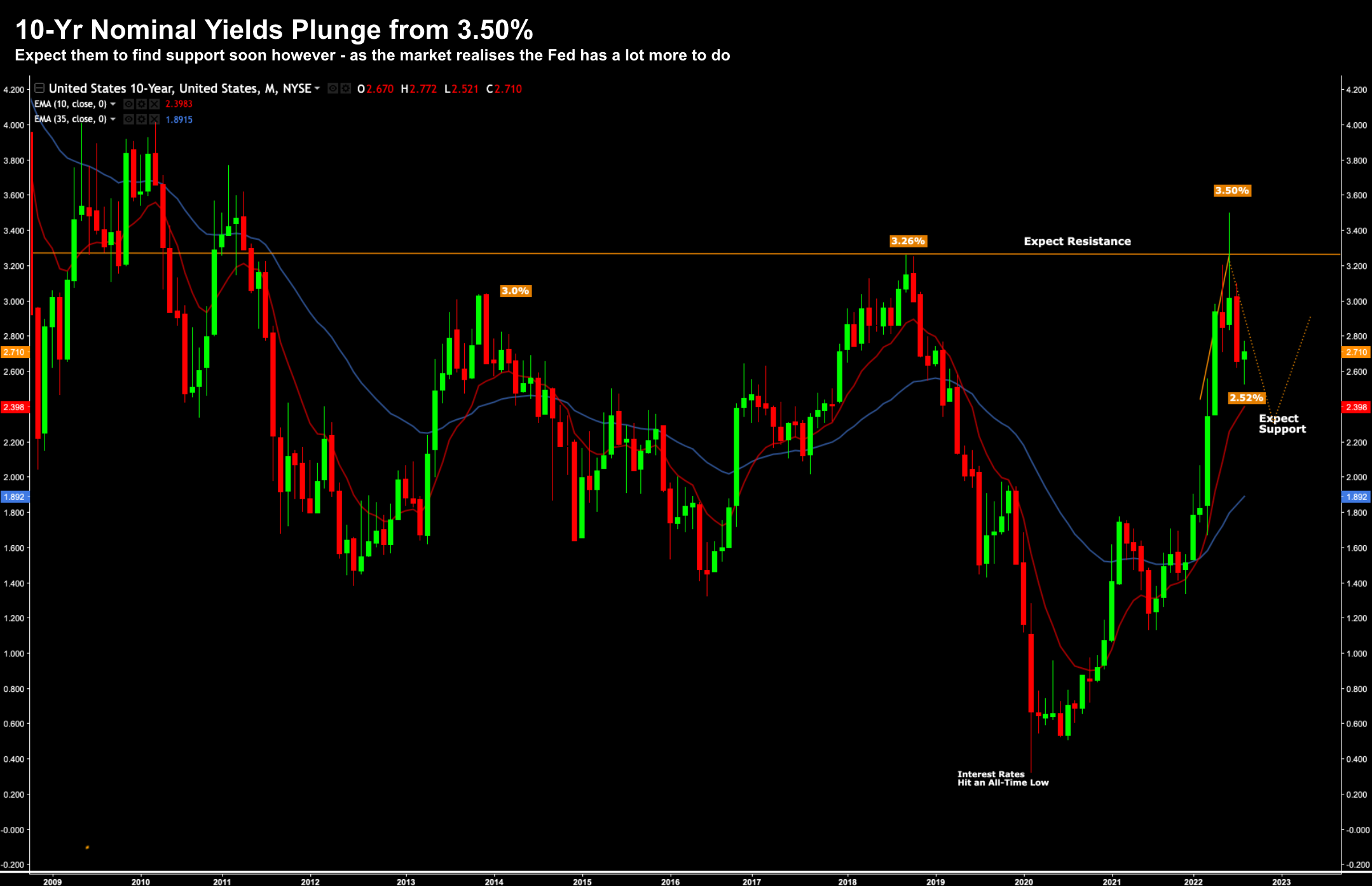

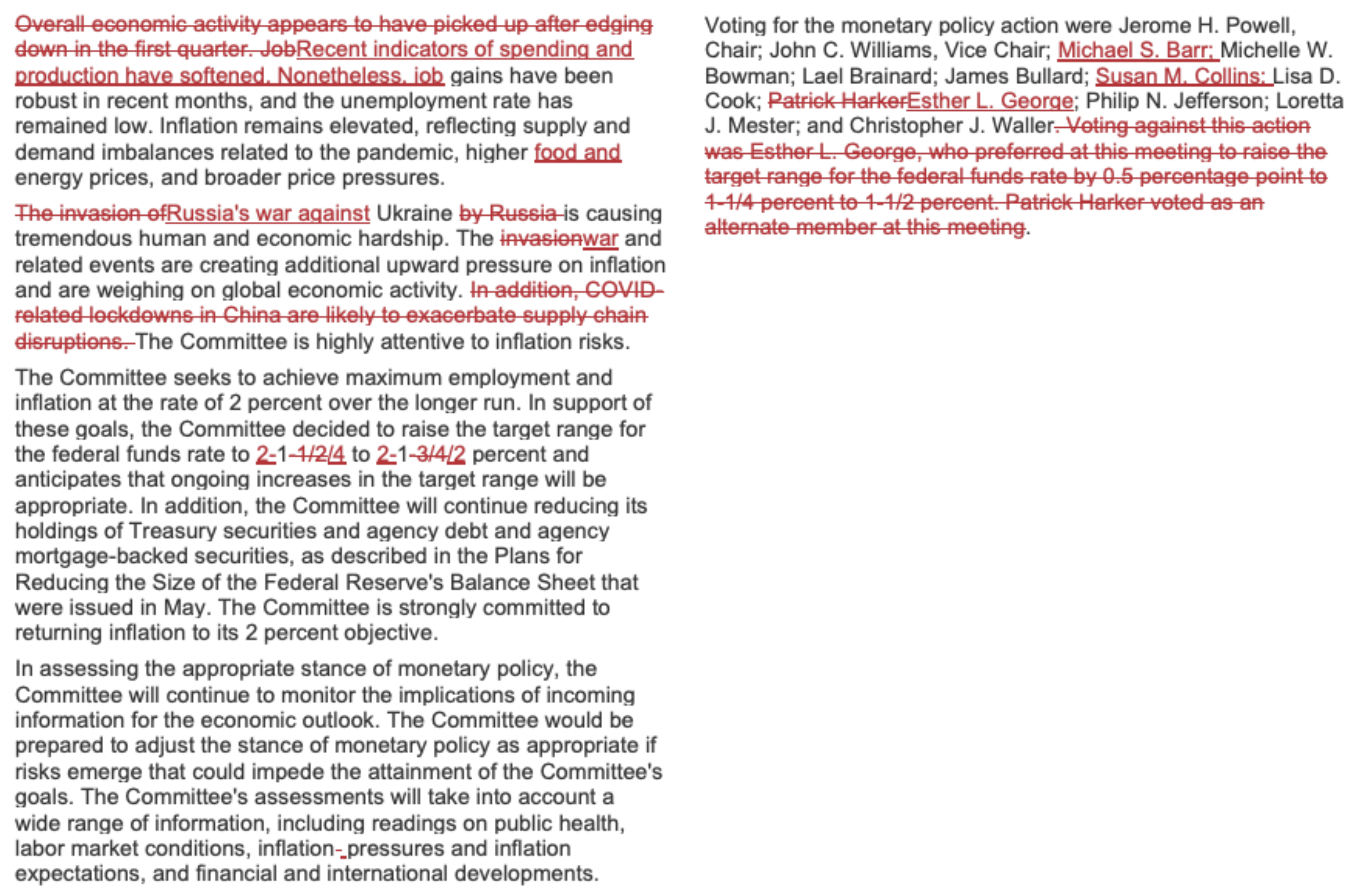

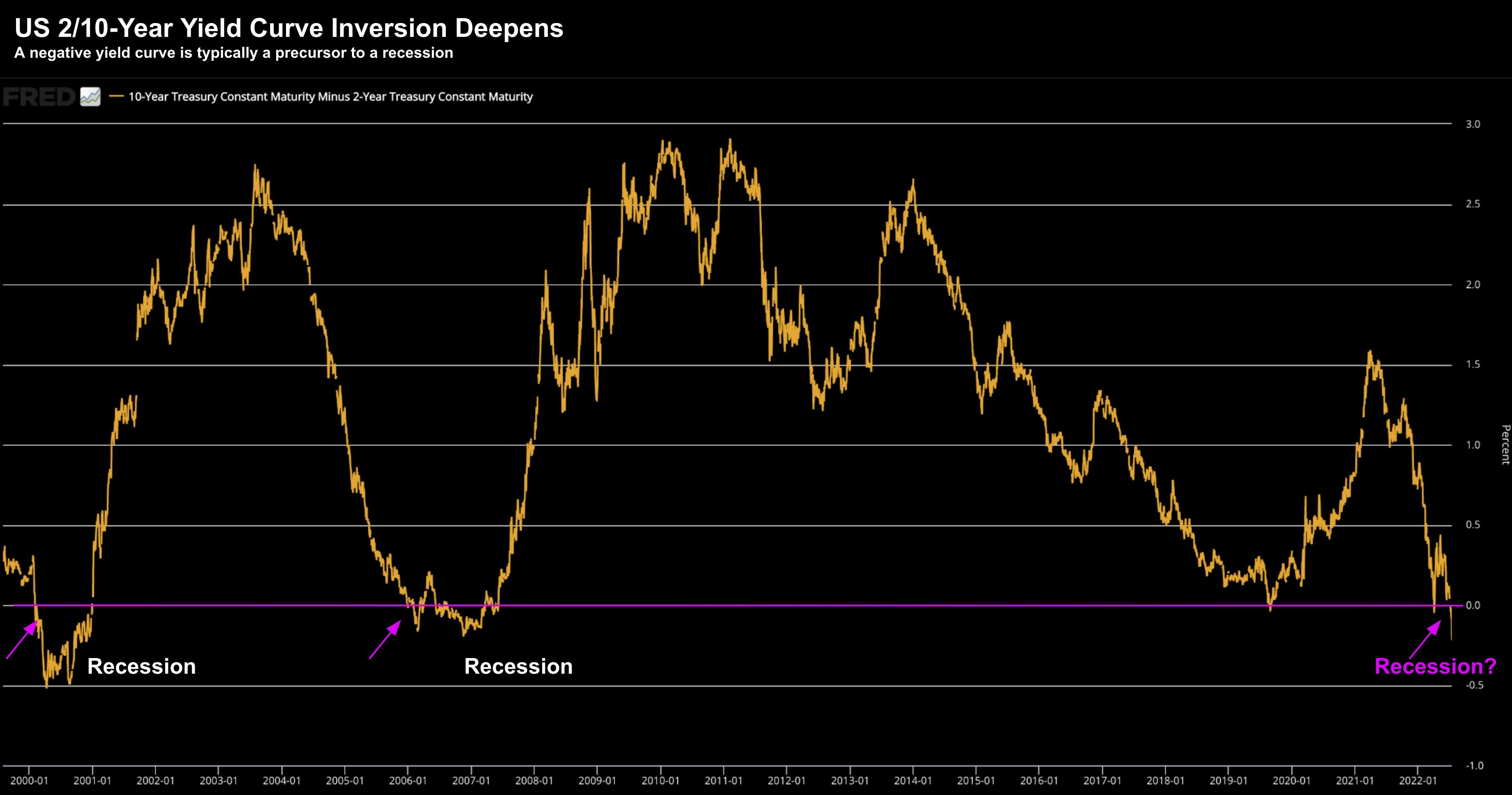

The market continued to work its way lower this week - waking up to the reality of the road ahead with respect to higher rates and inflation. However, some believe the Fed should pause immediately...