CPI Exceeds 9% YoY – Fed to Stay the Course

CPI Exceeds 9% YoY – Fed to Stay the Course

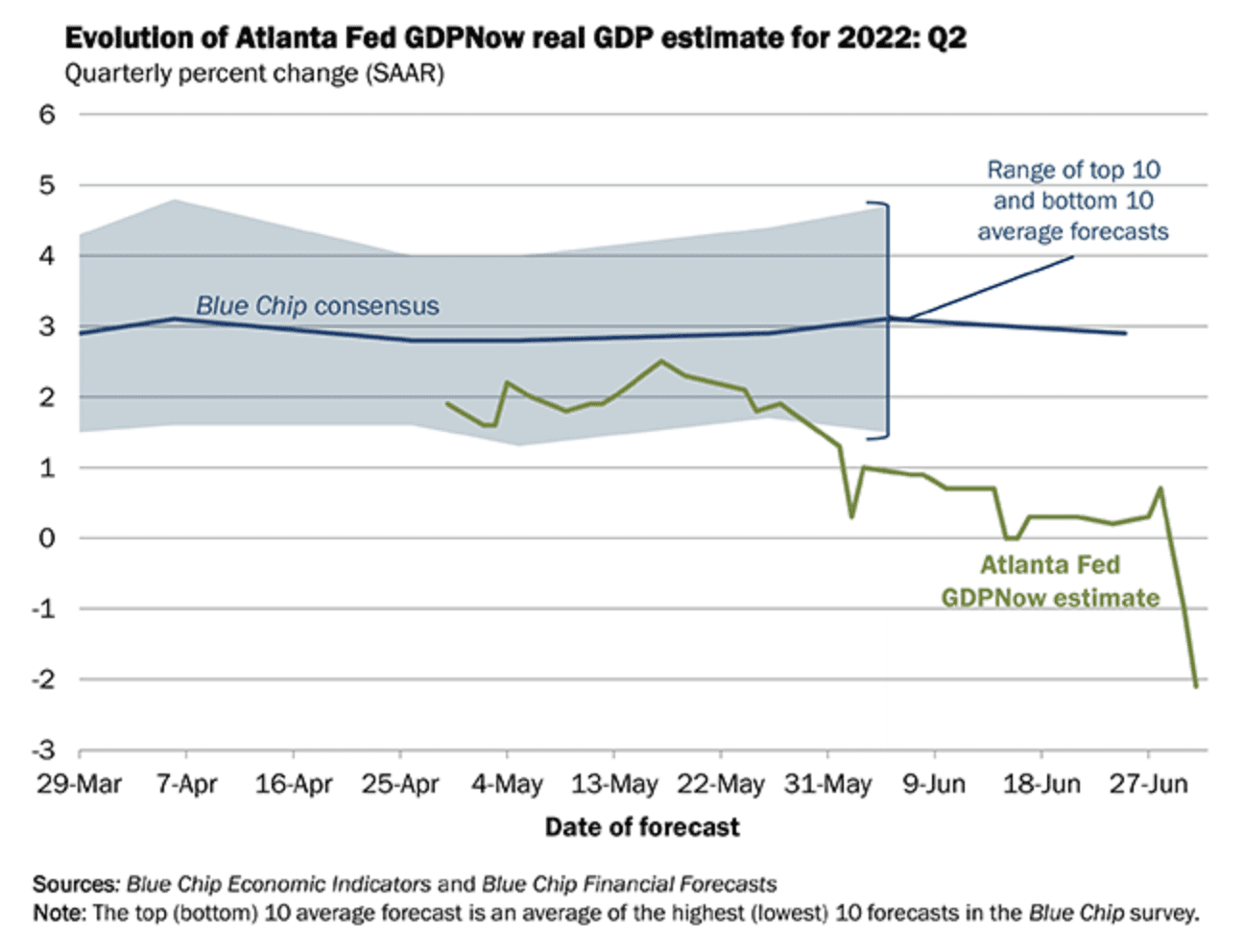

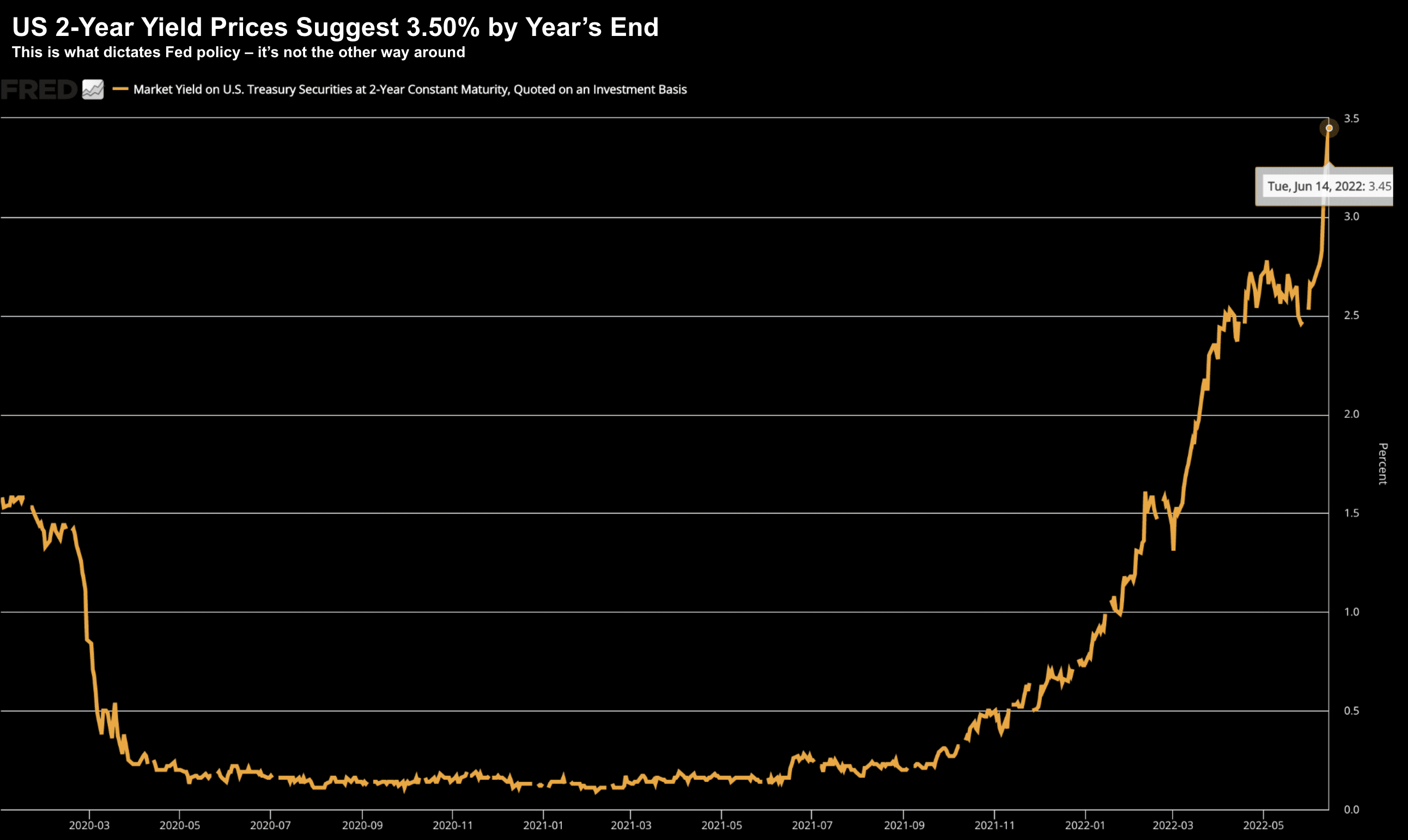

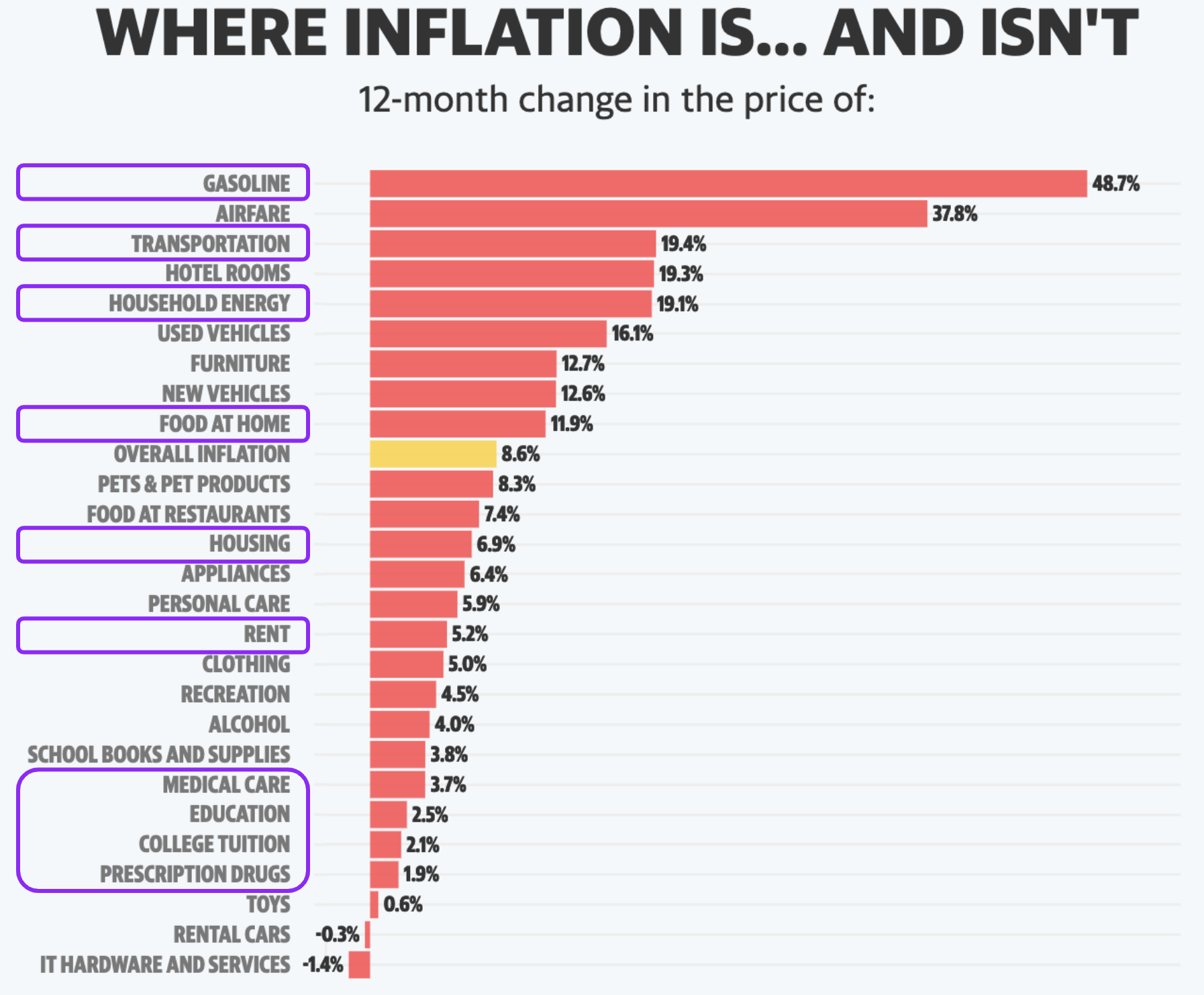

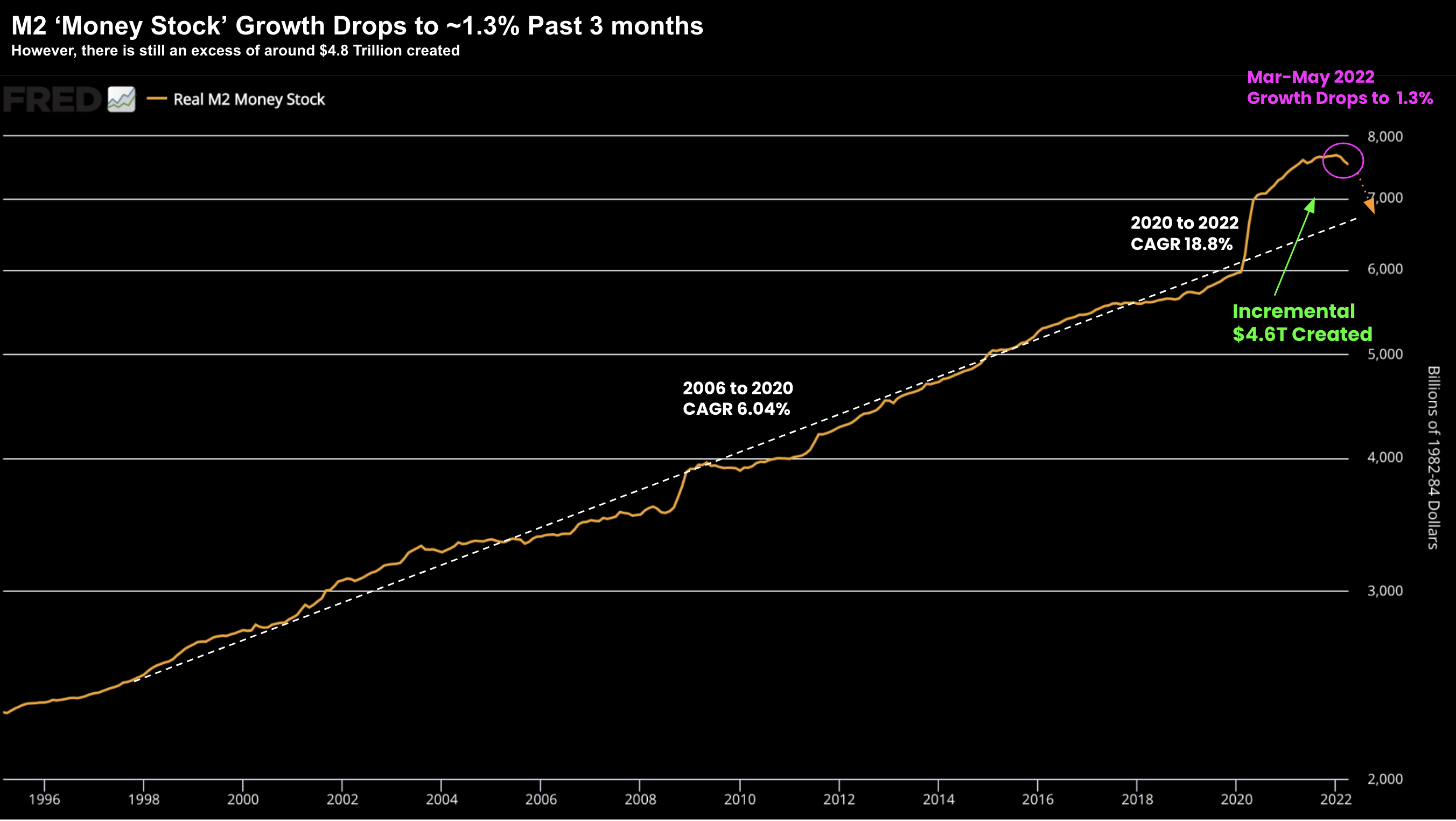

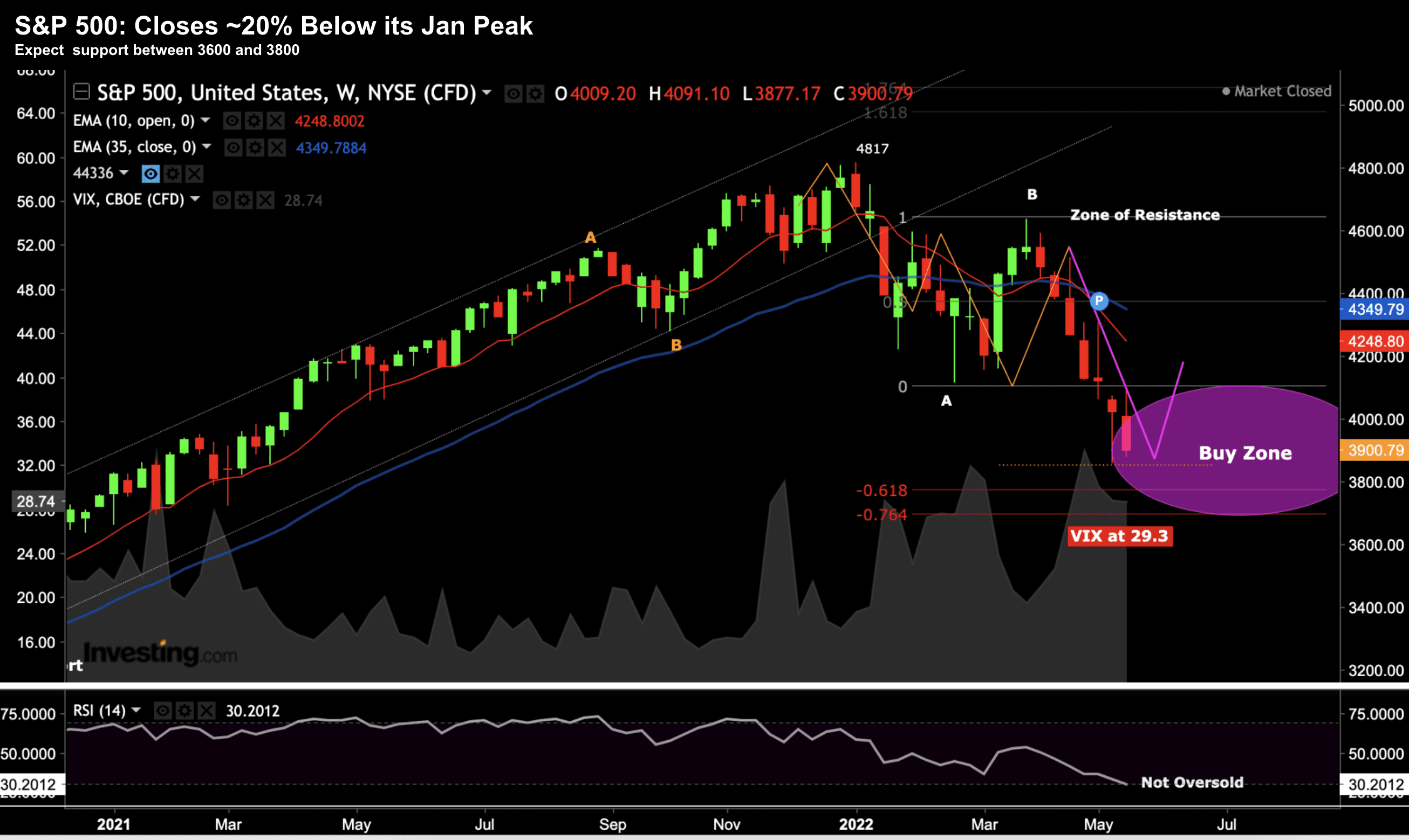

CPI for June was a white-hot 9.1% YoY. But should that be a surprise? Not really. What it does suggest is two consecutive rate hikes of 75 basis points... however most of that has been priced in.