Bear Market Rally… For Now

Bear Market Rally… For Now

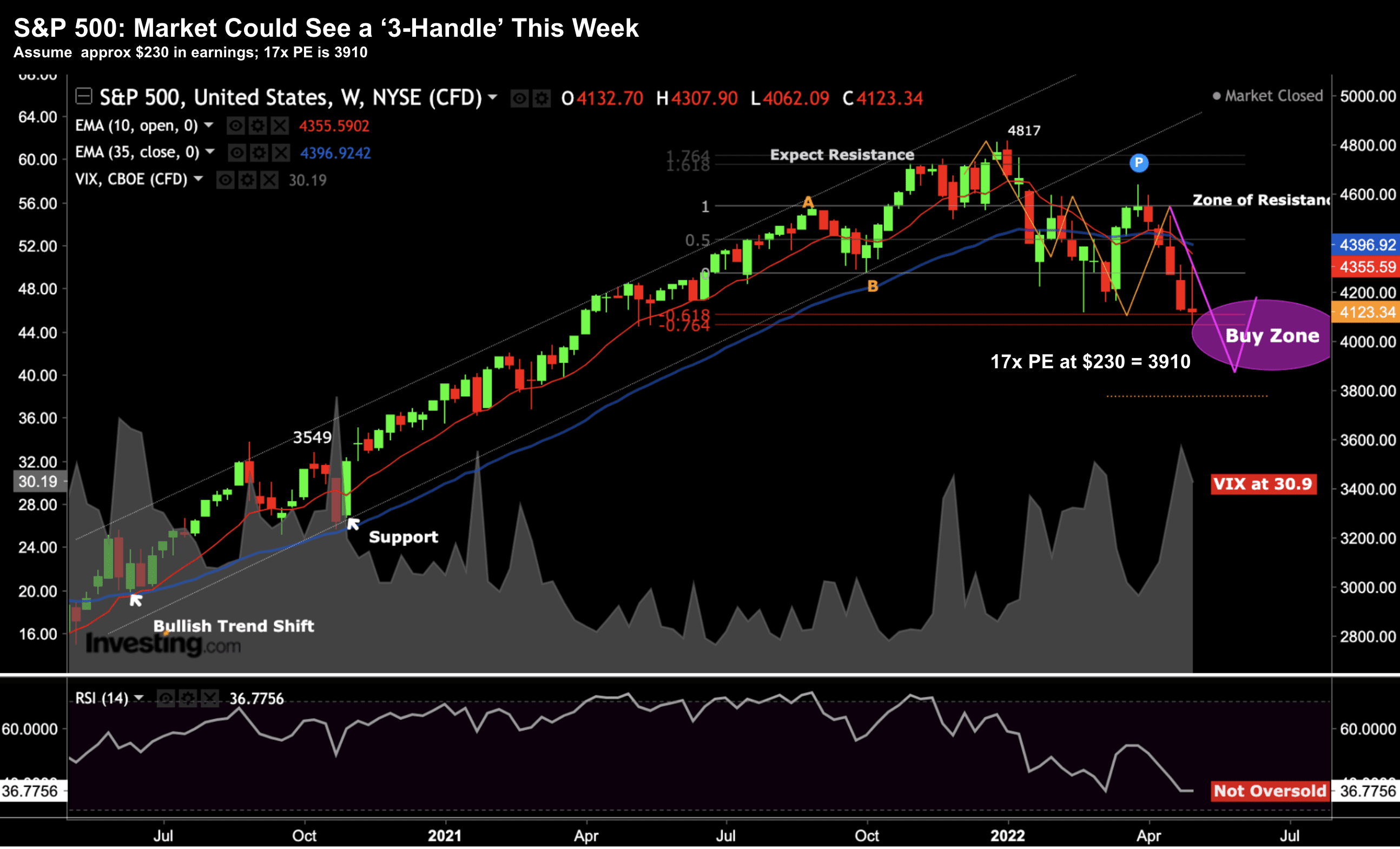

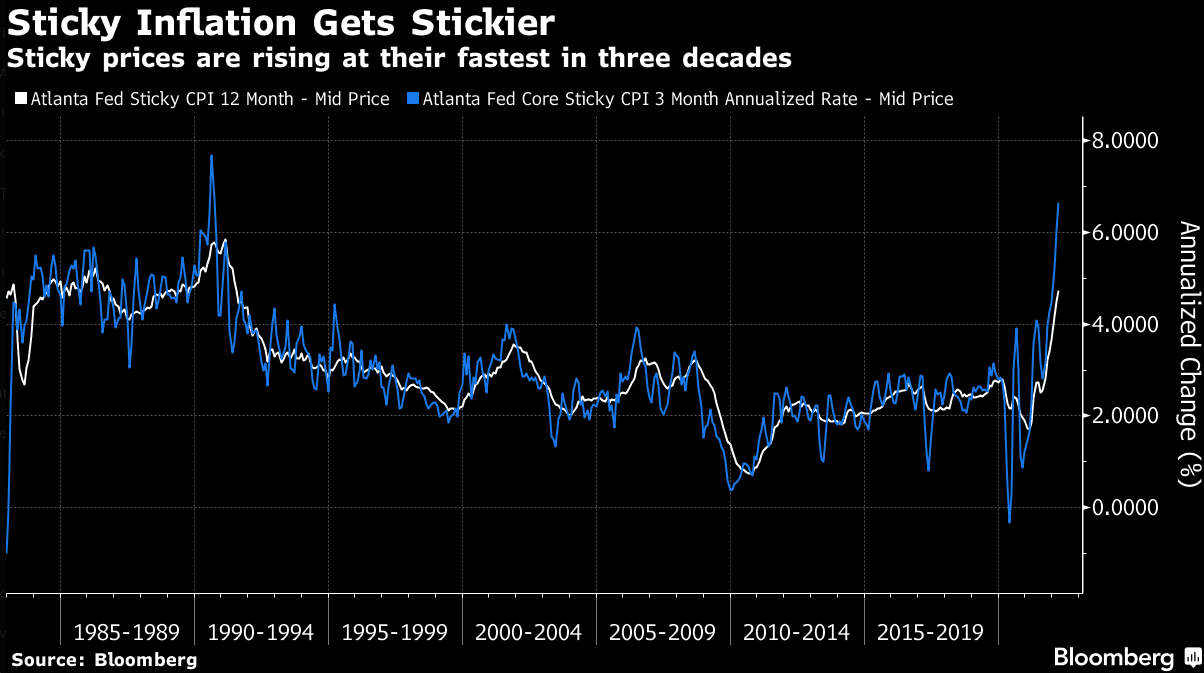

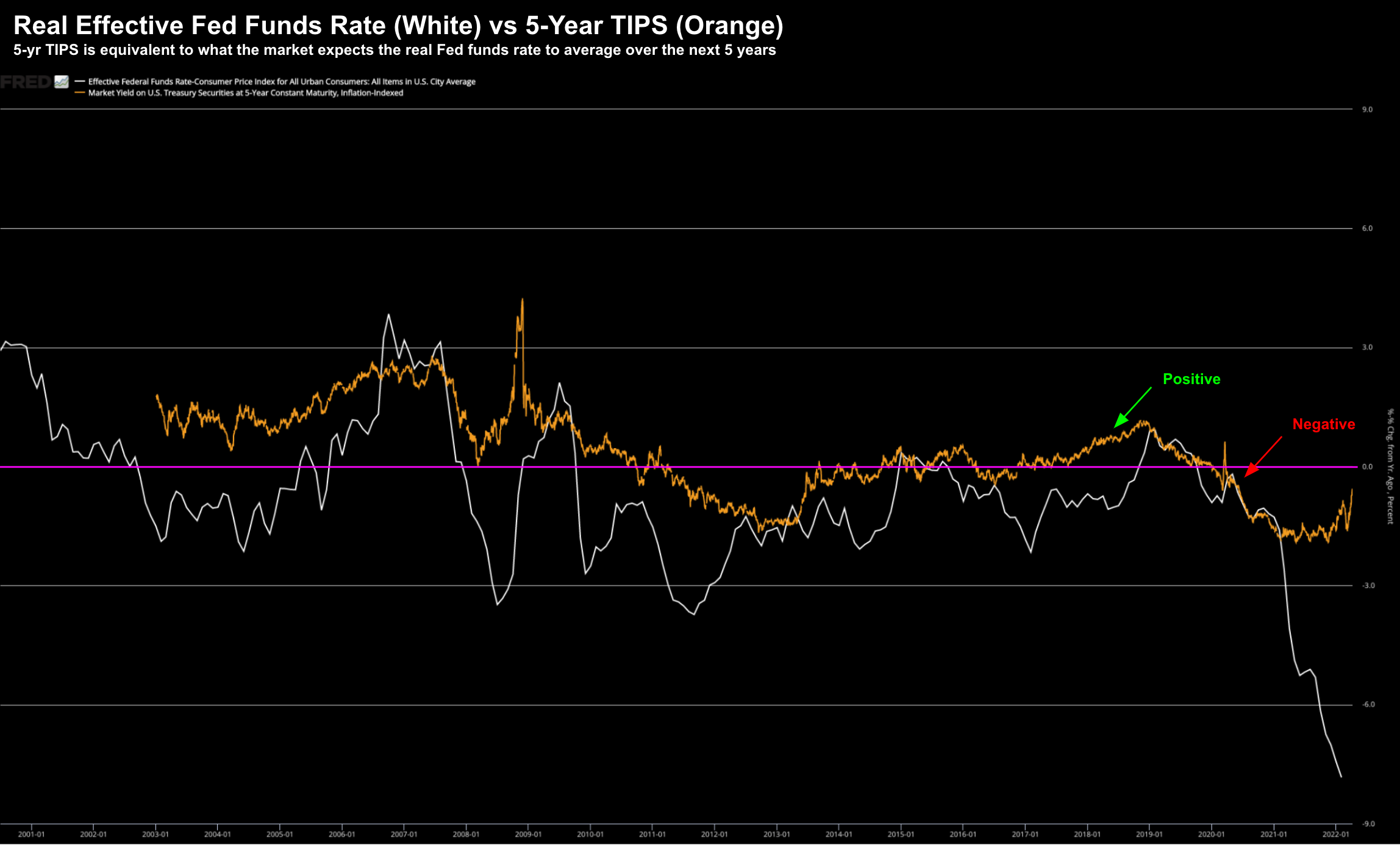

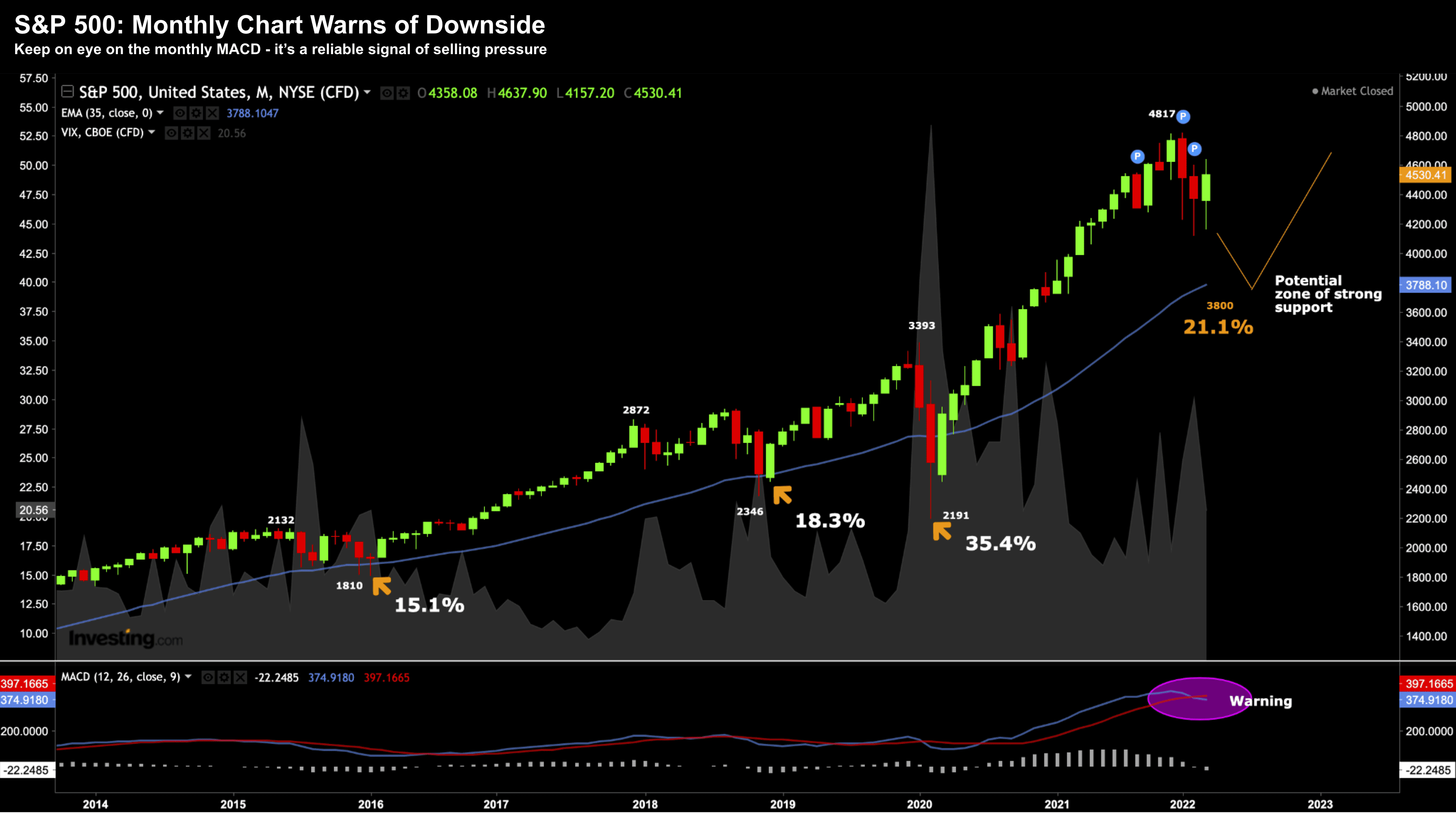

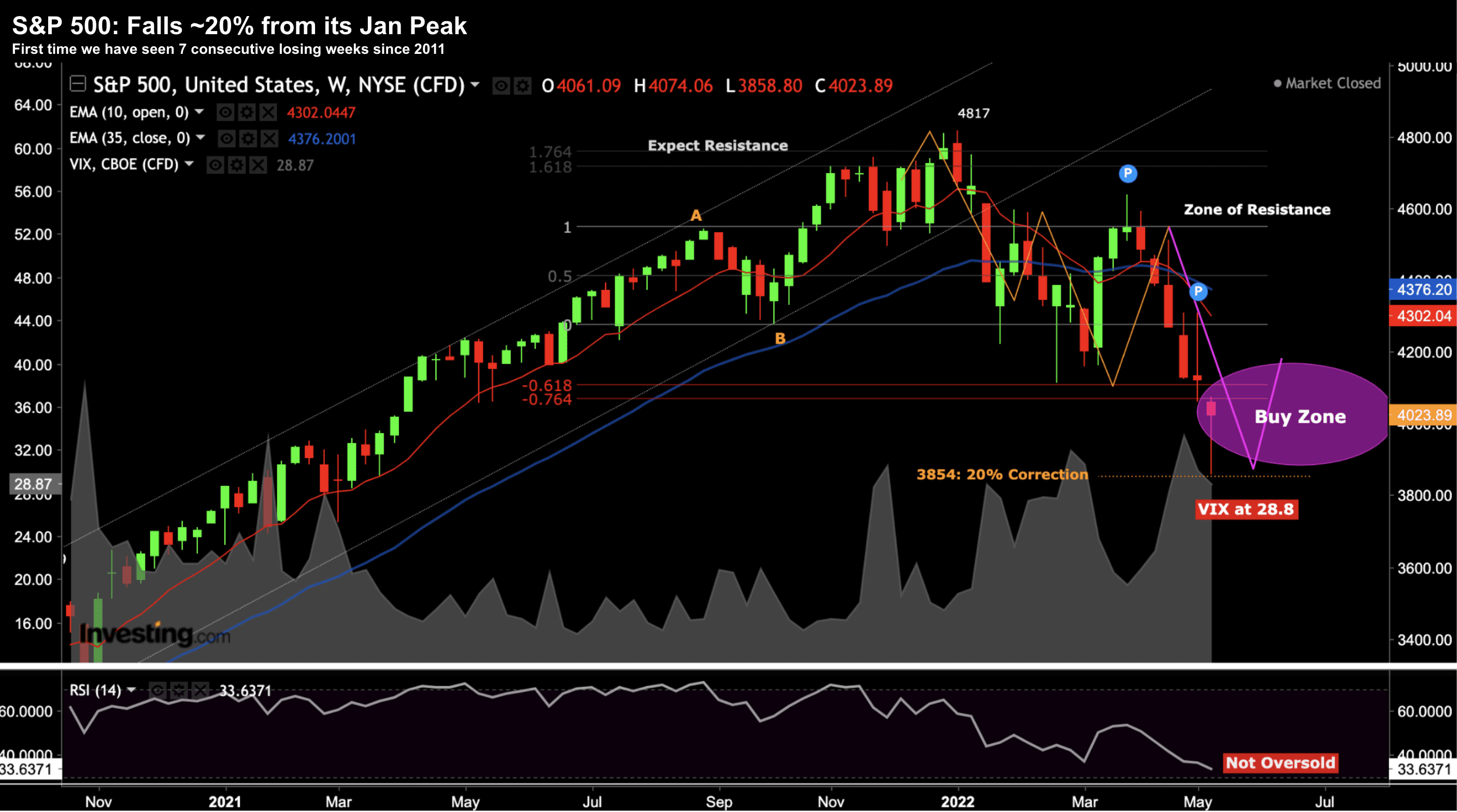

The S&P 500 has lost ground 7 weeks in a row. We have not seen that since 2011. At its low - we are 20% off the high. Is this the bottom? I don't think so. Whilst I expect a near-term rally - lower lows are possible this year.