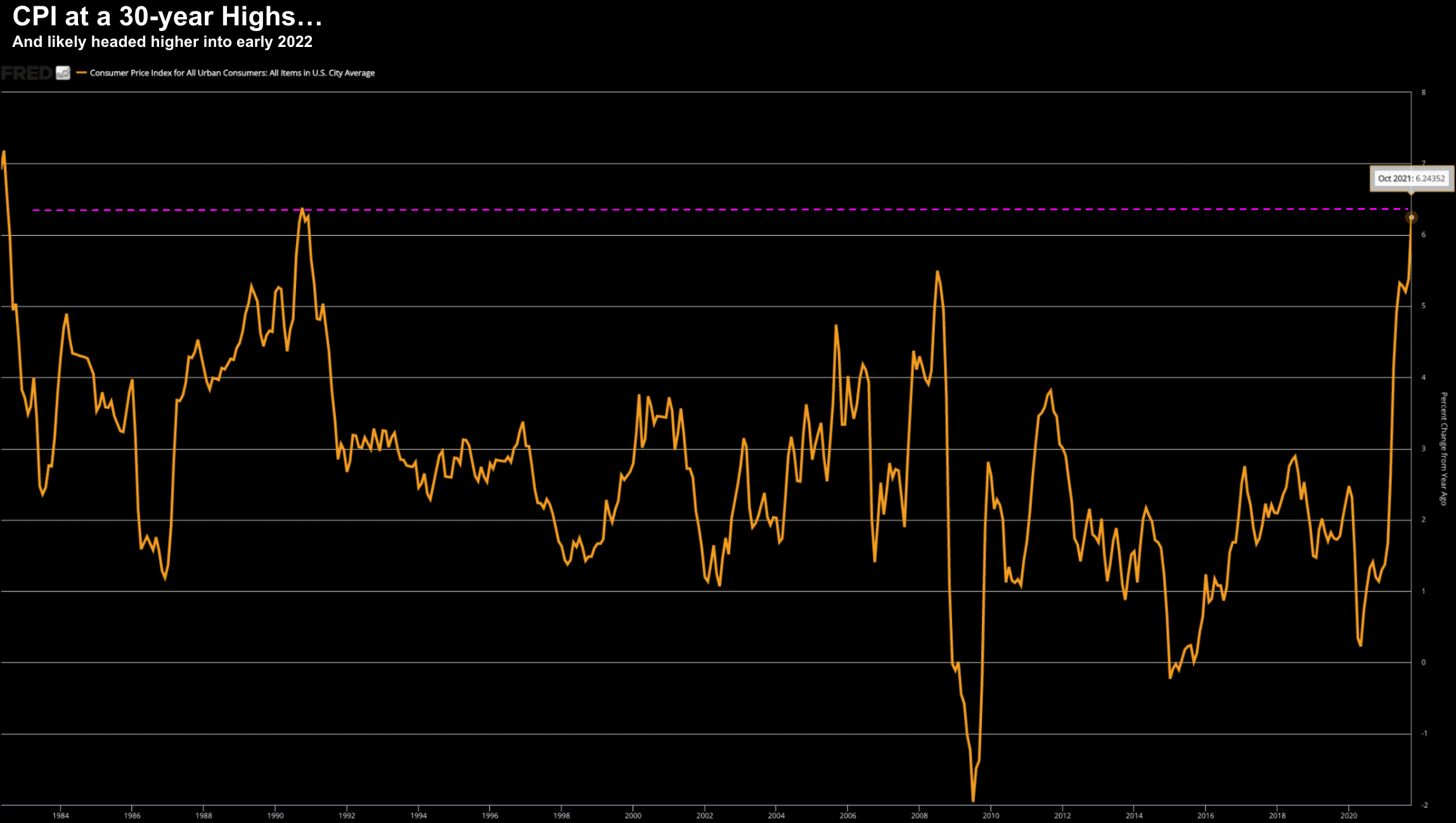

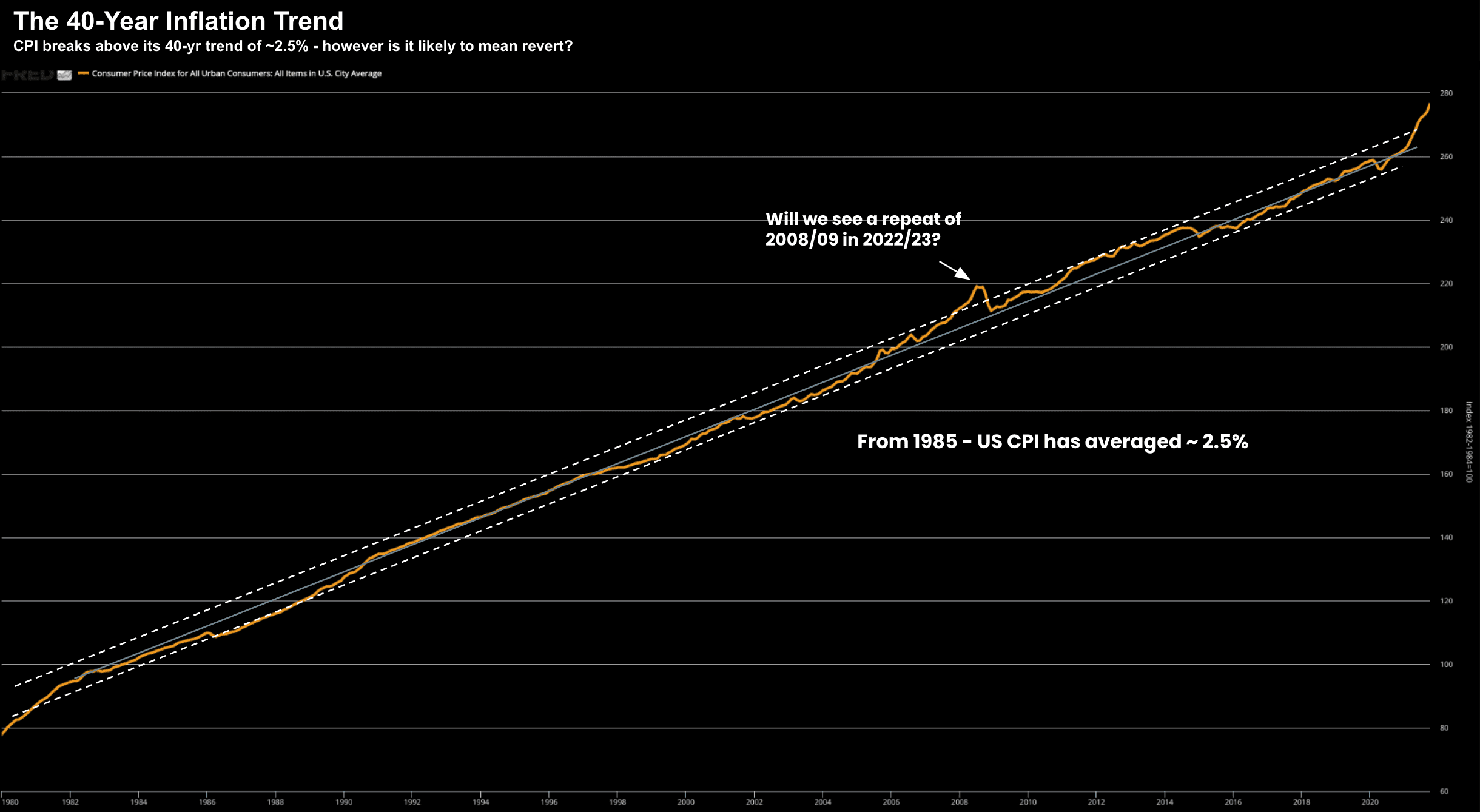

Is this 40-Year Inflation Trend Over?

Is this 40-Year Inflation Trend Over?

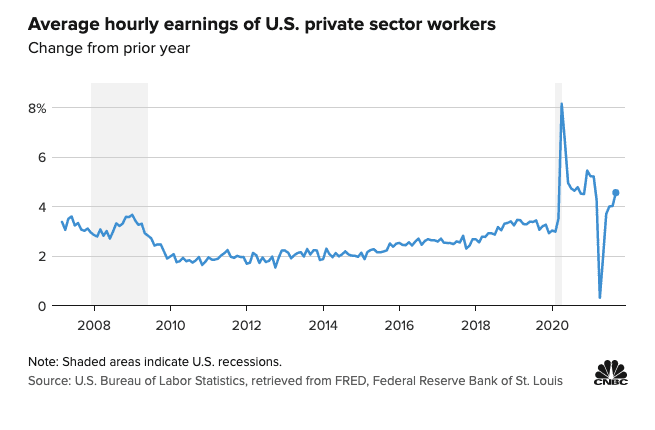

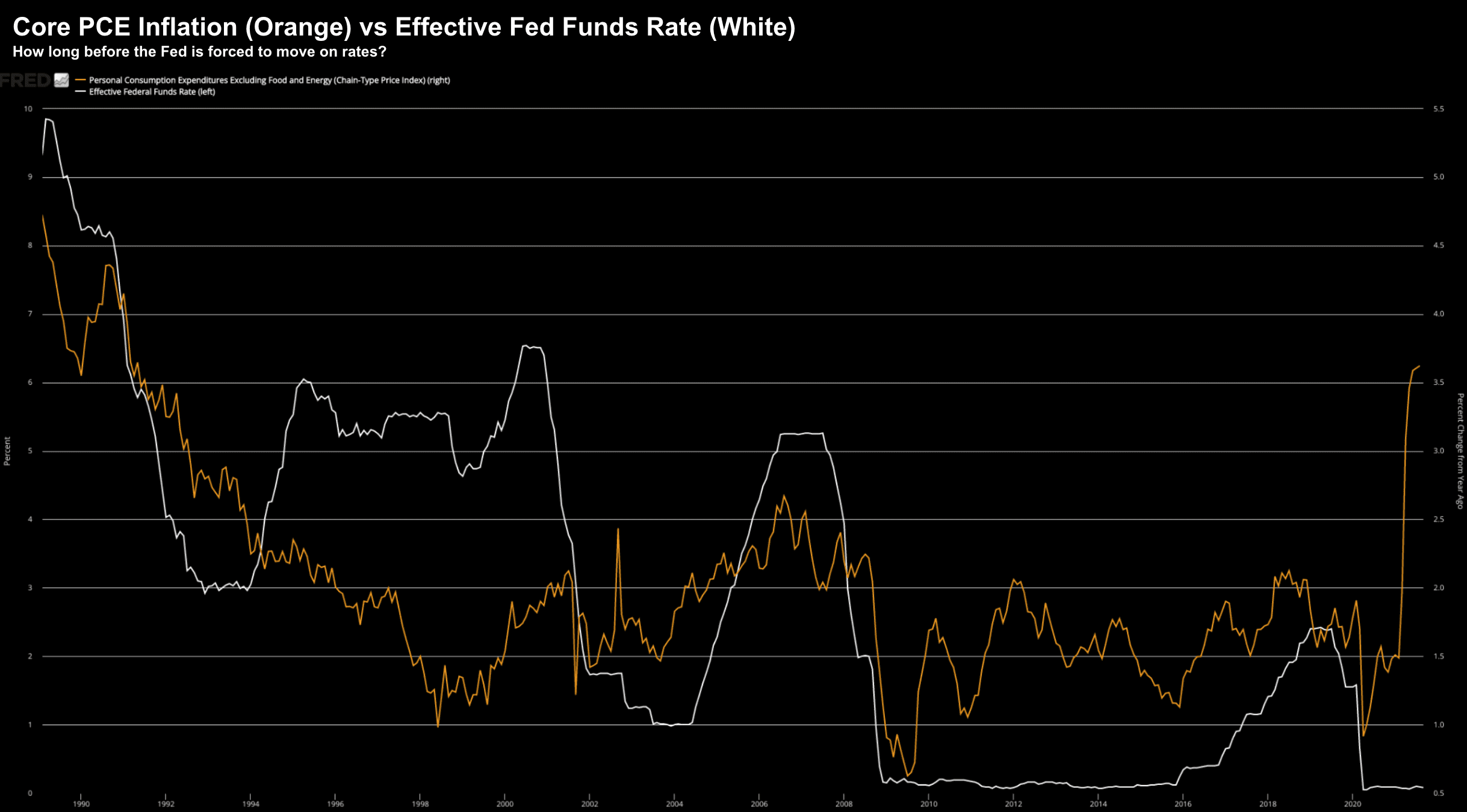

When it comes to inflation, I continue to pay attention to the 5-Year, 5-Year Forward expectations... which trade at a very modest 2.33%. And whilst inflationary pressure will not ease a great deal over the coming 12+ months (maybe longer) - beyond that the market sees mean reversion.