Fed’s Balancing Act for 2025

Fed’s Balancing Act for 2025

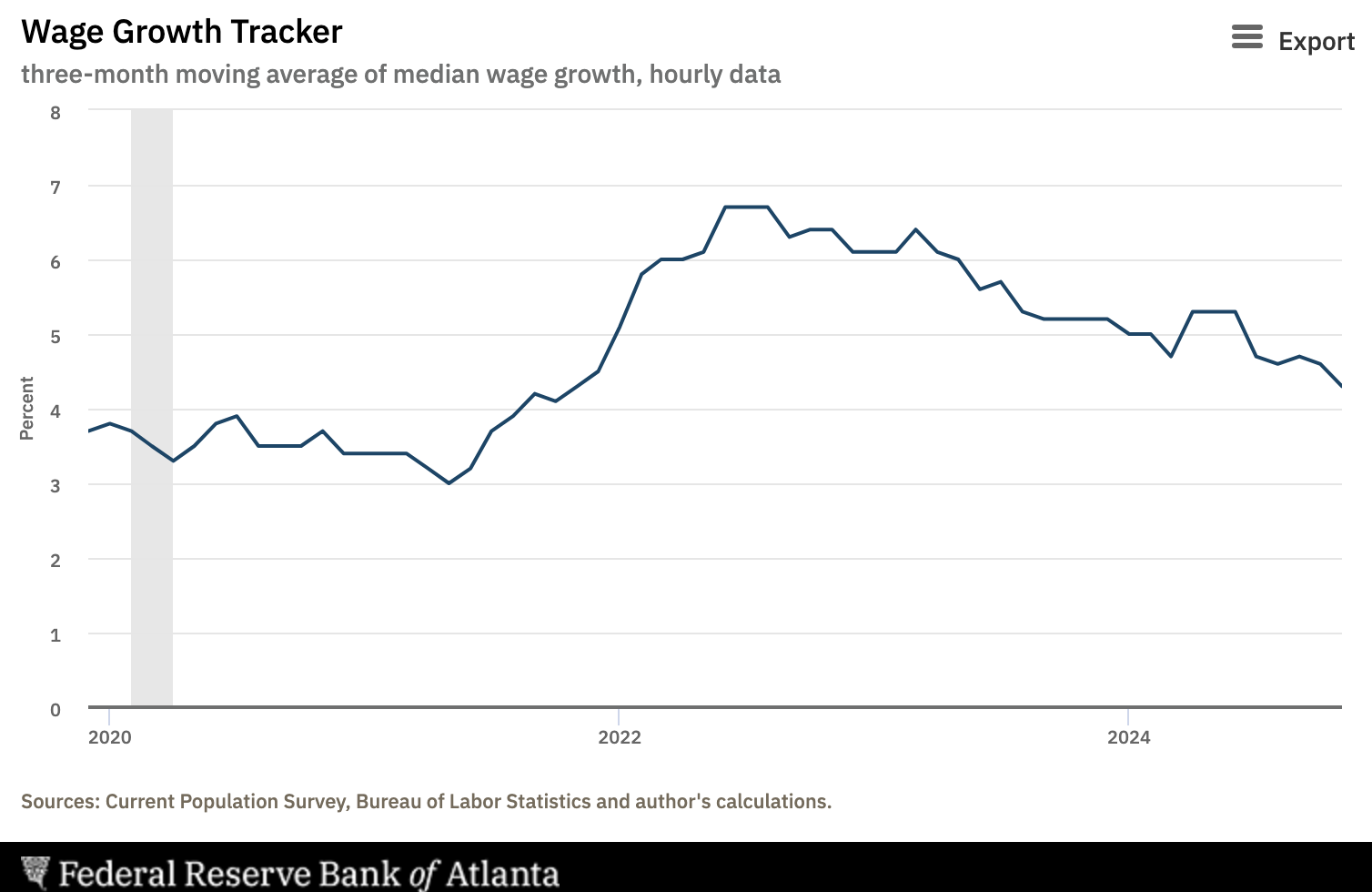

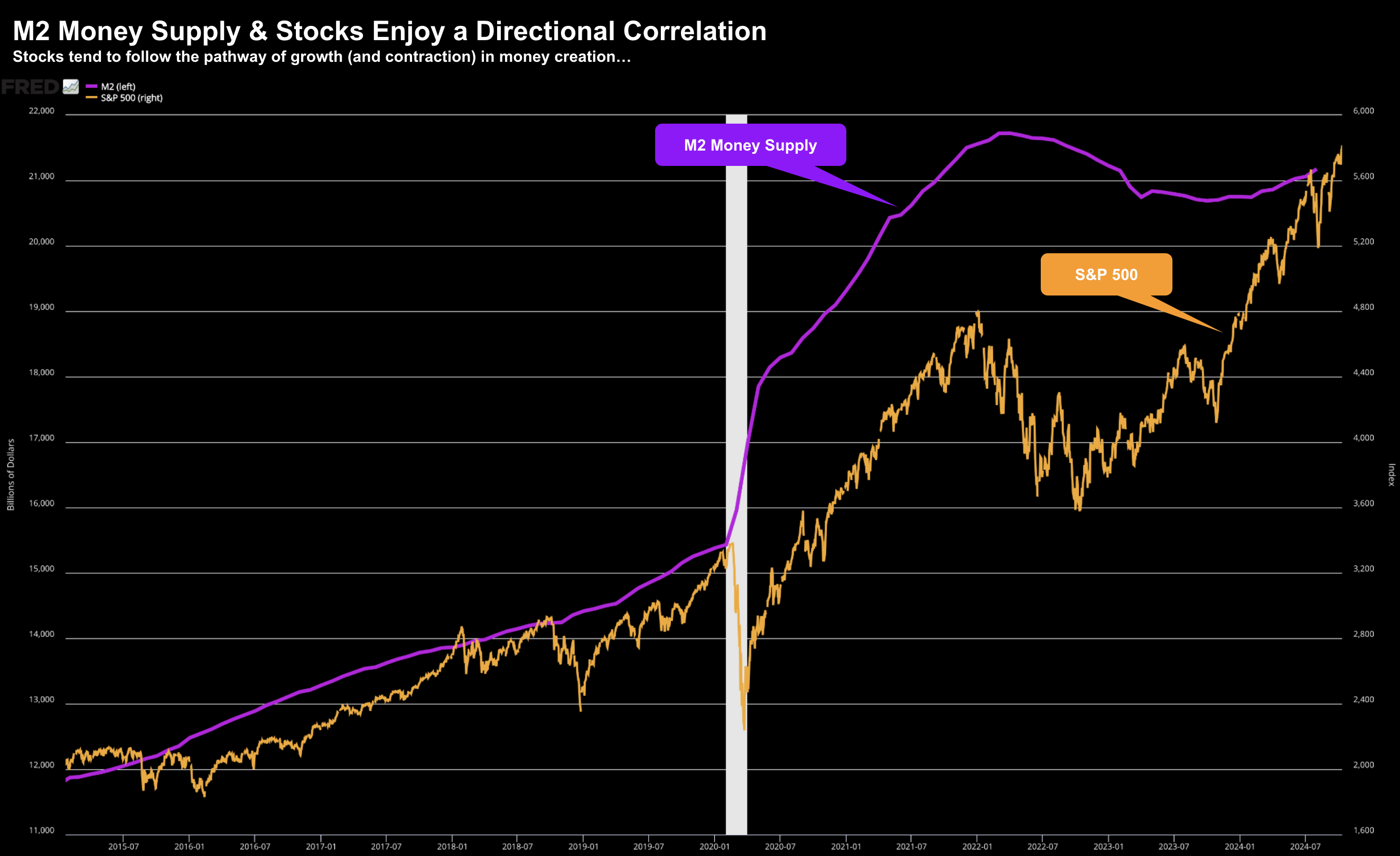

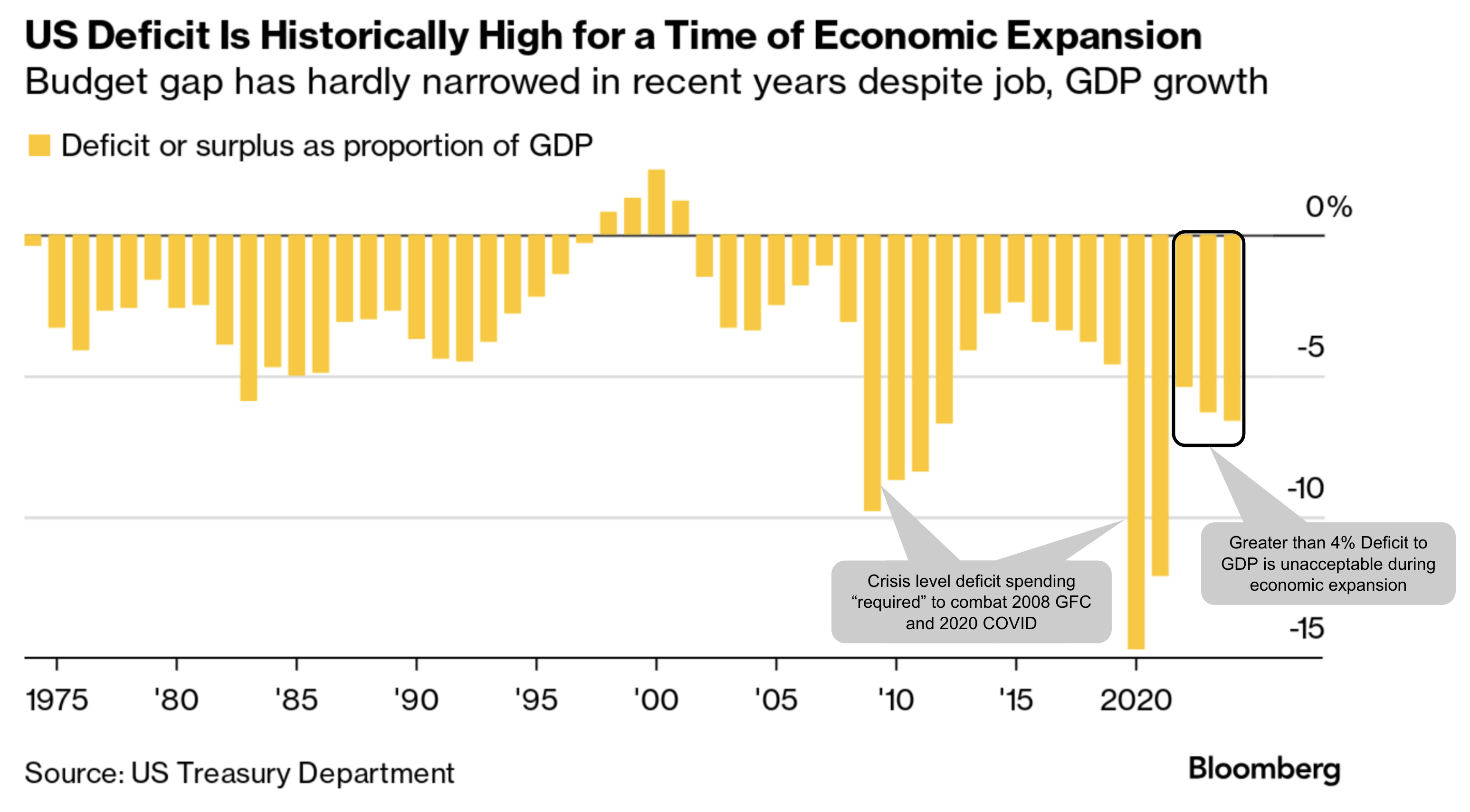

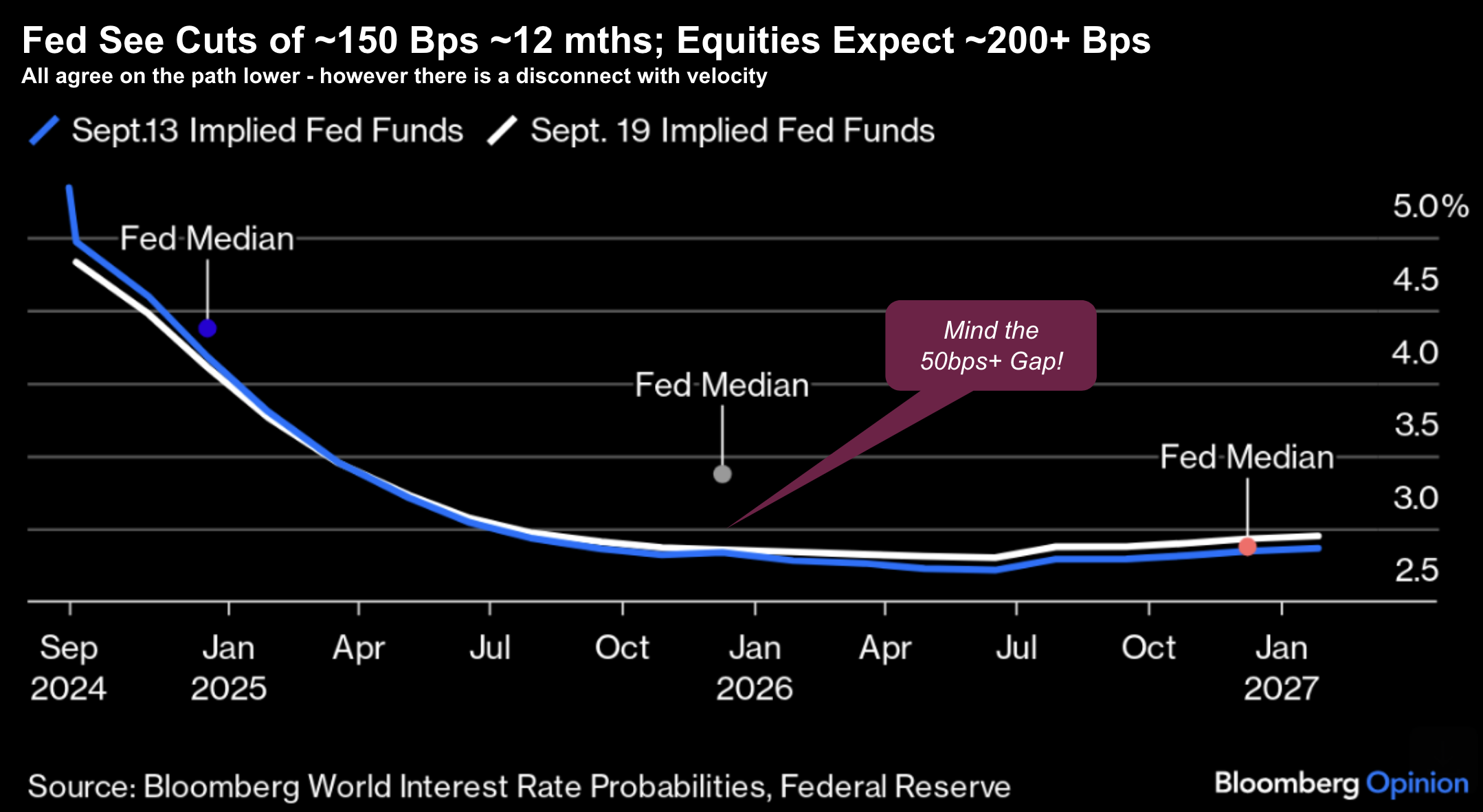

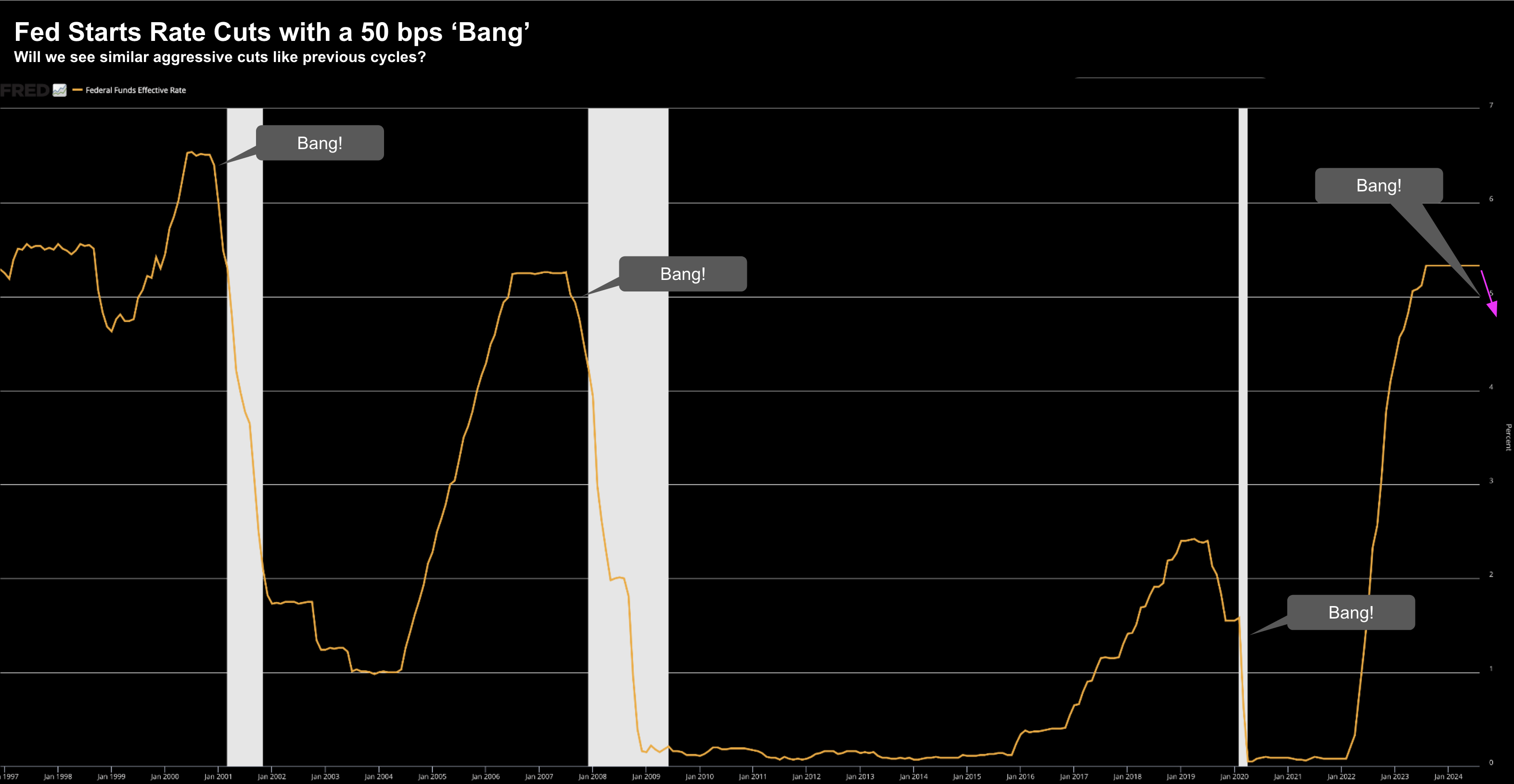

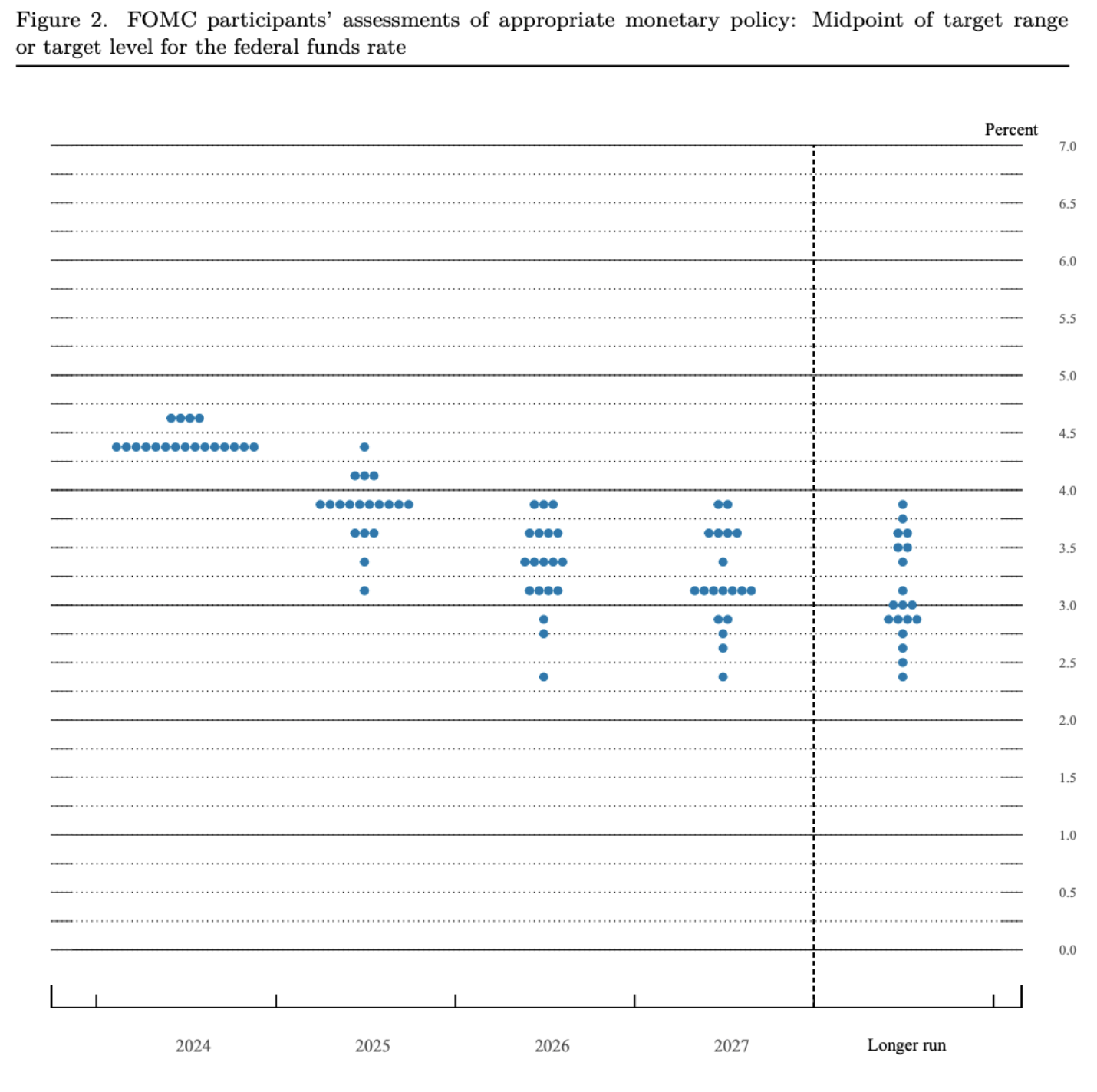

2025 will not be without its challenges for both investors and central baks. For example, if we consider: monetary and fiscal policy risks; likely introduction of tariffs and price increases; geopolitical risks as global central banks navigate U.S. policy; a stronger US dollar with a rising 10-year treasury yield; ongoing debt and deficits concerns; the risk of stubborn inflation (notably services); and a weakening employment picture - this presents a complex web of related variables or risks. How are markets pricing this in? For now they remain complacent - trading at record highs - at near 22x forward earnings.