Will Powell Heed Volcker’s Wisdom?

Will Powell Heed Volcker’s Wisdom?

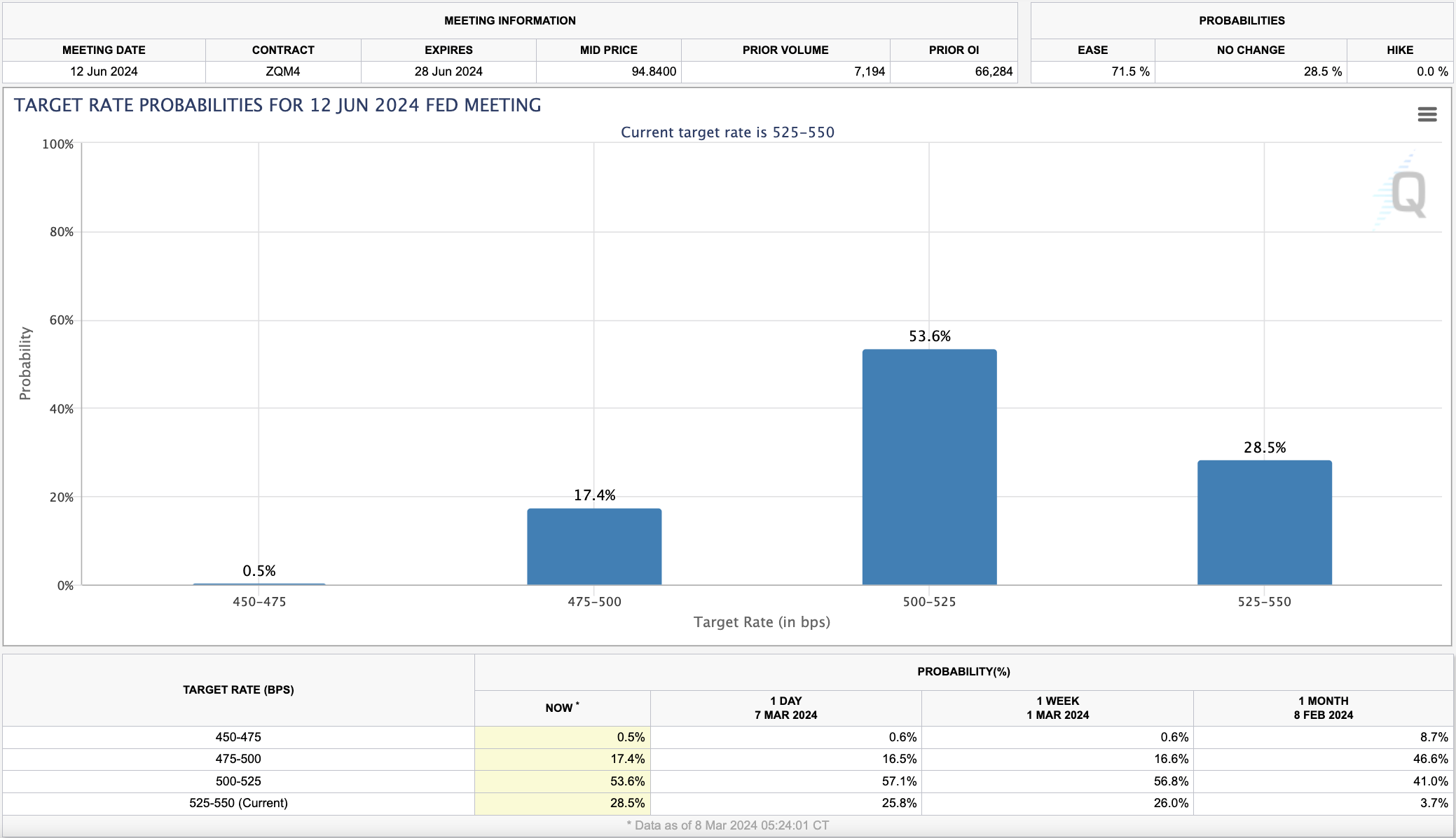

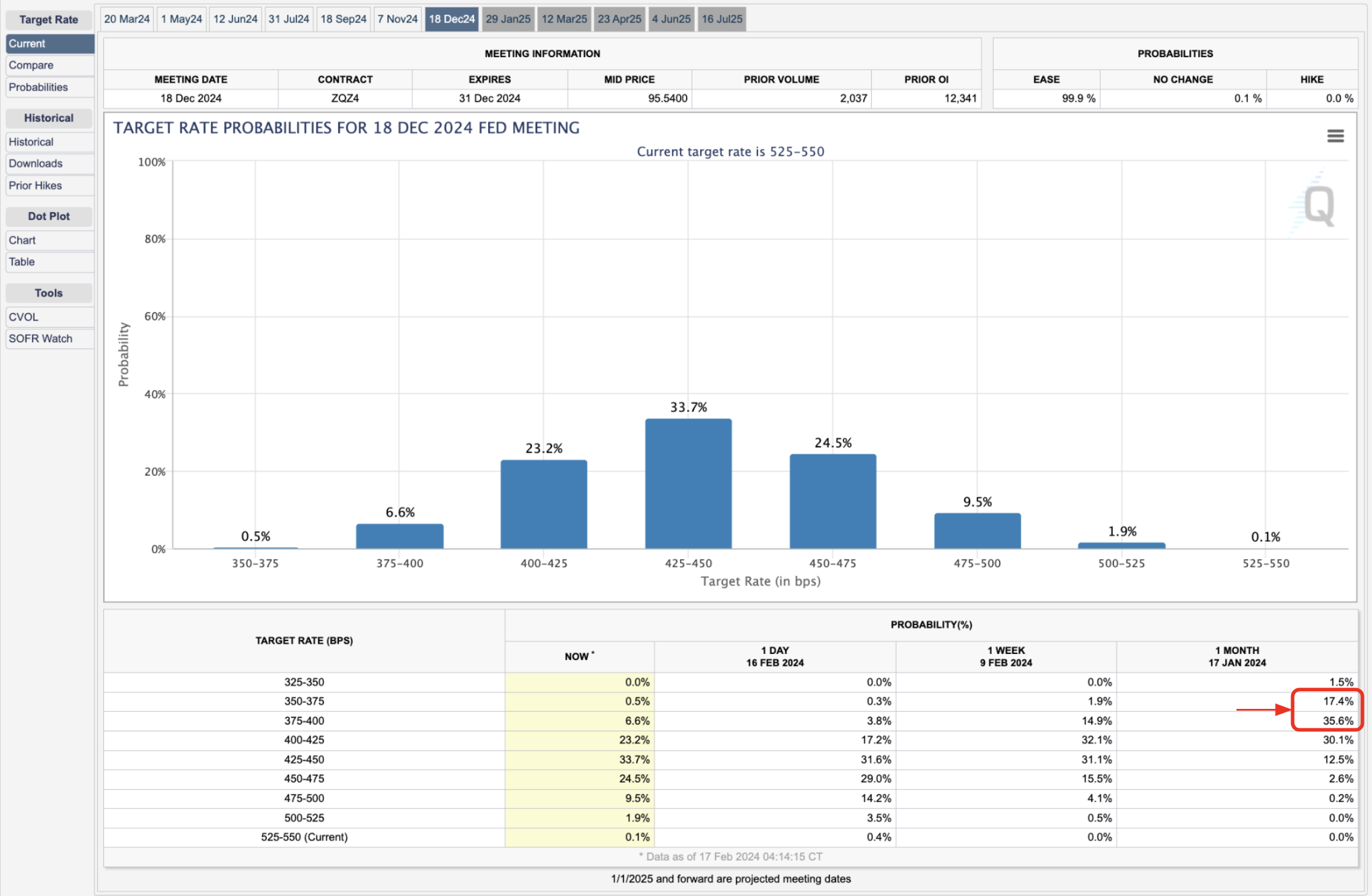

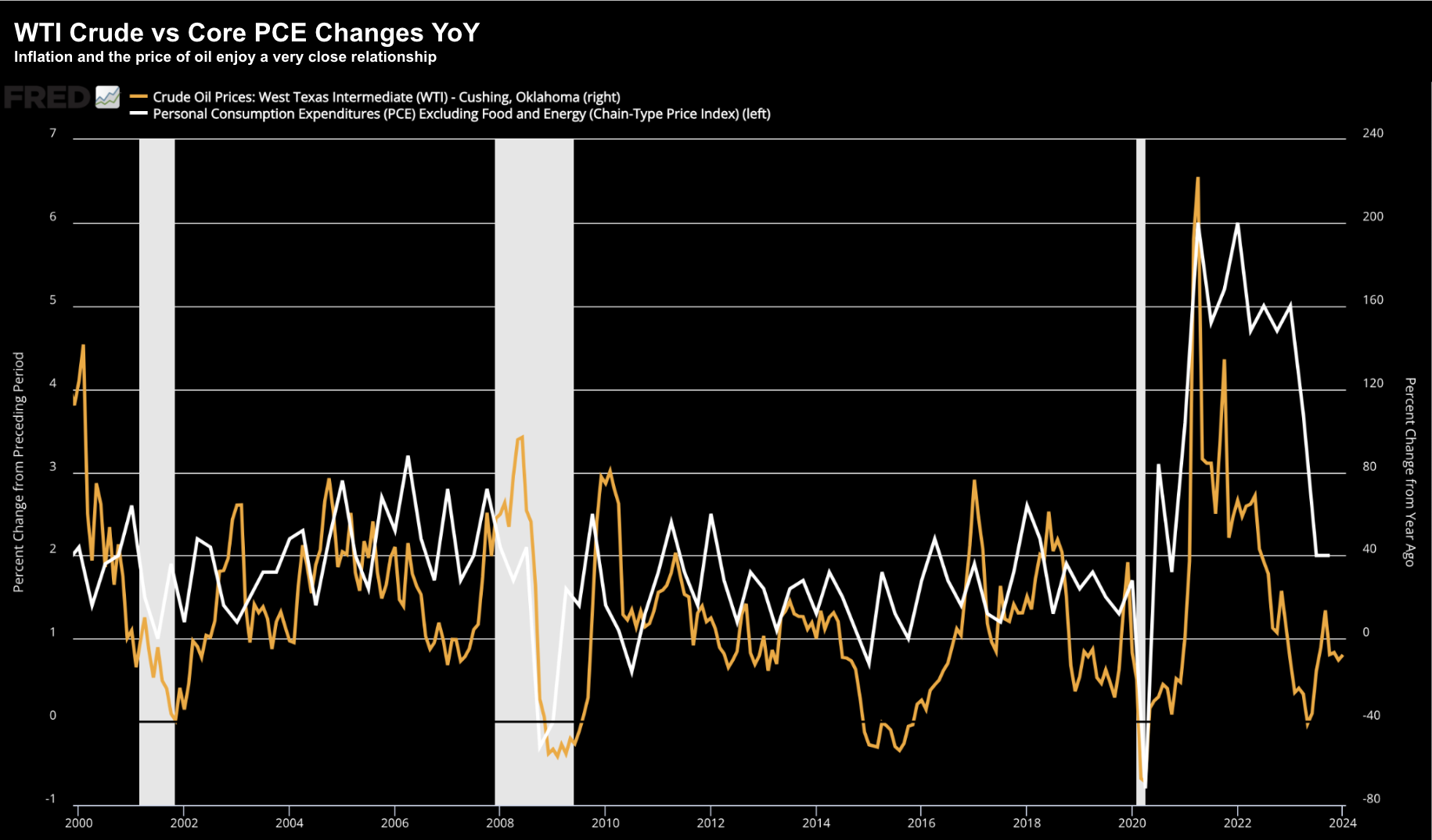

Next week Fed Chair Jay Powell will deliver the FOMC's March statement on monetary policy. Interest rates are not expected to change - however his sentiment might. When we last heard from Powell - he was dovish - igniting a rally in risk assets. However, with inflation heating up and a tight job market - Powell may perform another pivot. Markets expect three rate cuts this year - those expectations might be dialed back to just two.