Why Did Buffett Add to SiriusXM?

Why Did Buffett Add to SiriusXM?

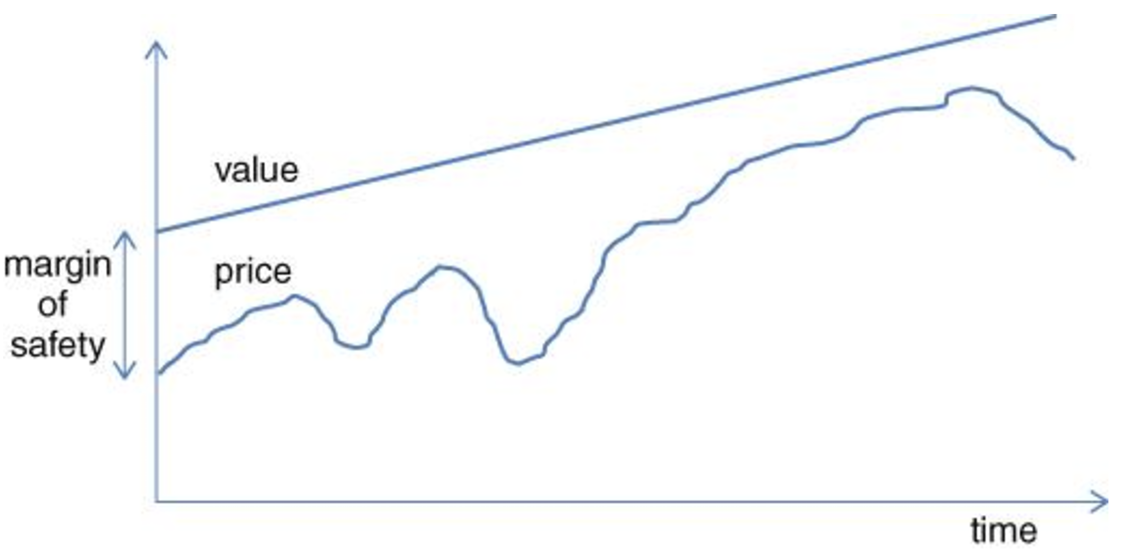

Recently Warren Buffett increased his stake in SiriusXM (SIRI) to over 32% of all available stock. However, with the company losing subscribers - where revenue and earnings in decline - why would the Oracle of Omaha increase his ownership? Two reasons: (a) first its return on invested capital and free cash flow; and (b) the value offered. This post explains both the quality and value arguments for Buffett choosing to increase his exposure to this unloved stock...