Swoooosh

Swoooosh

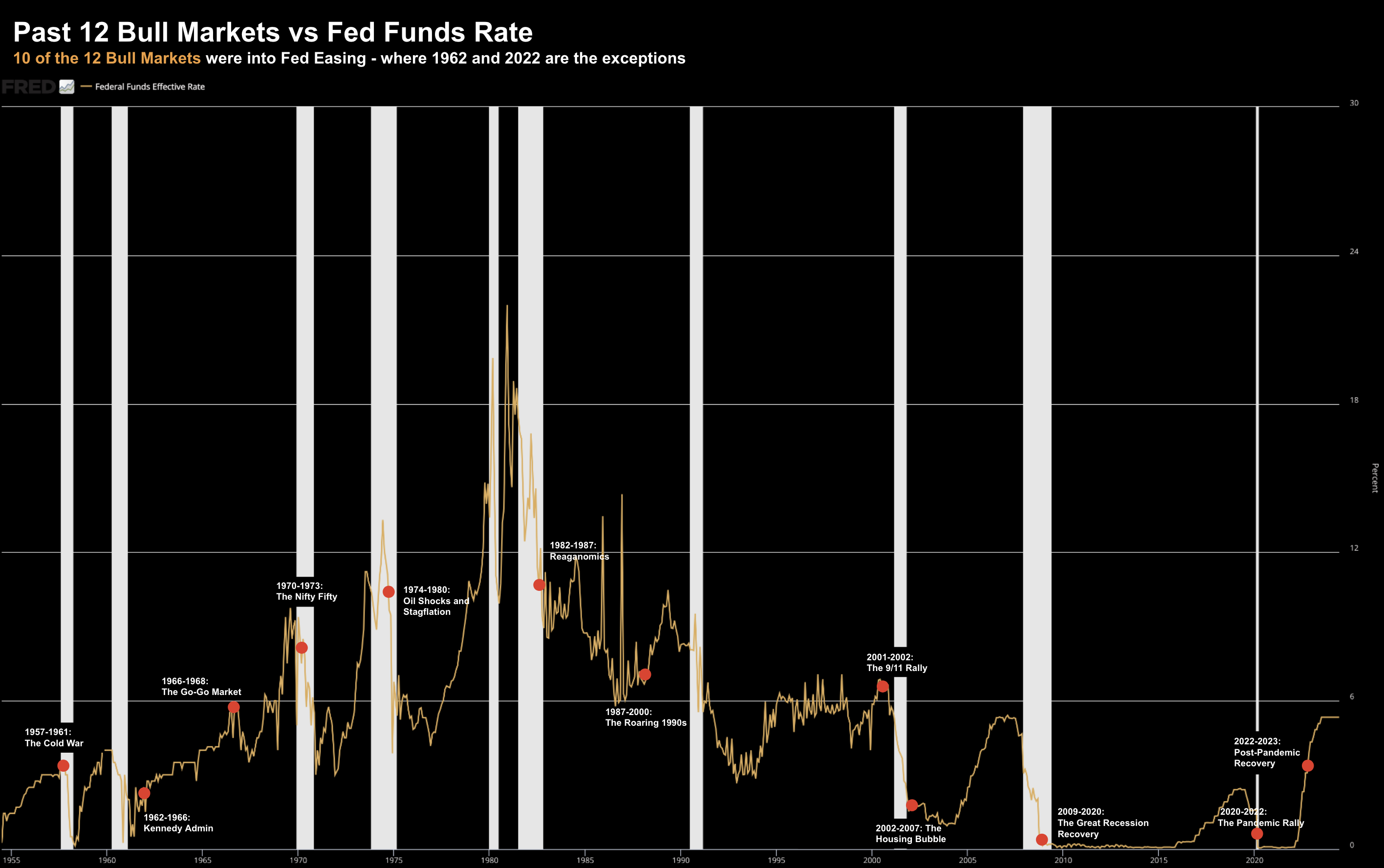

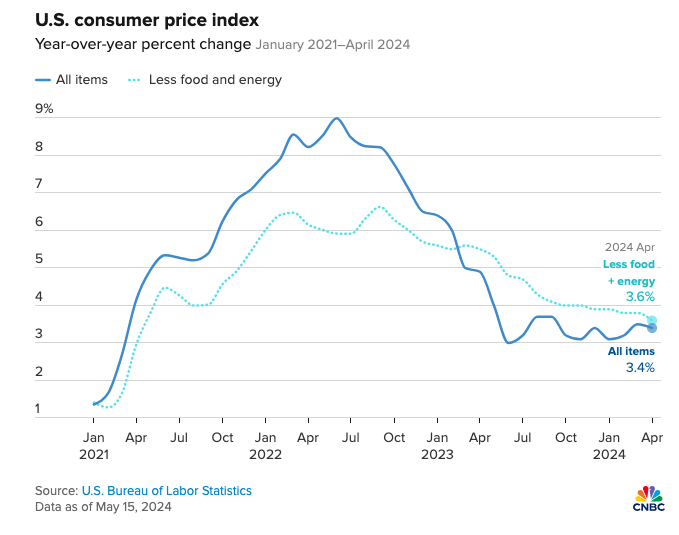

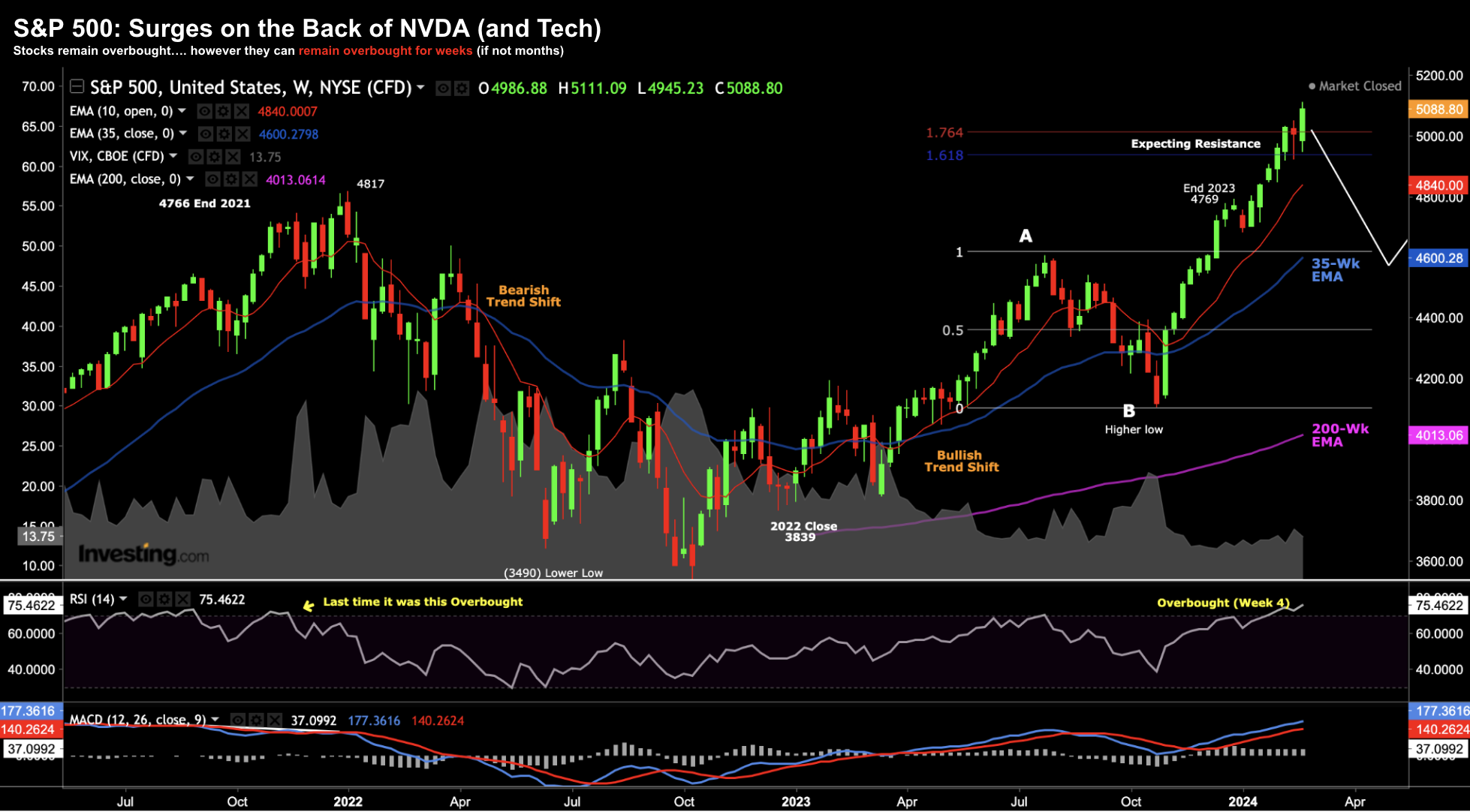

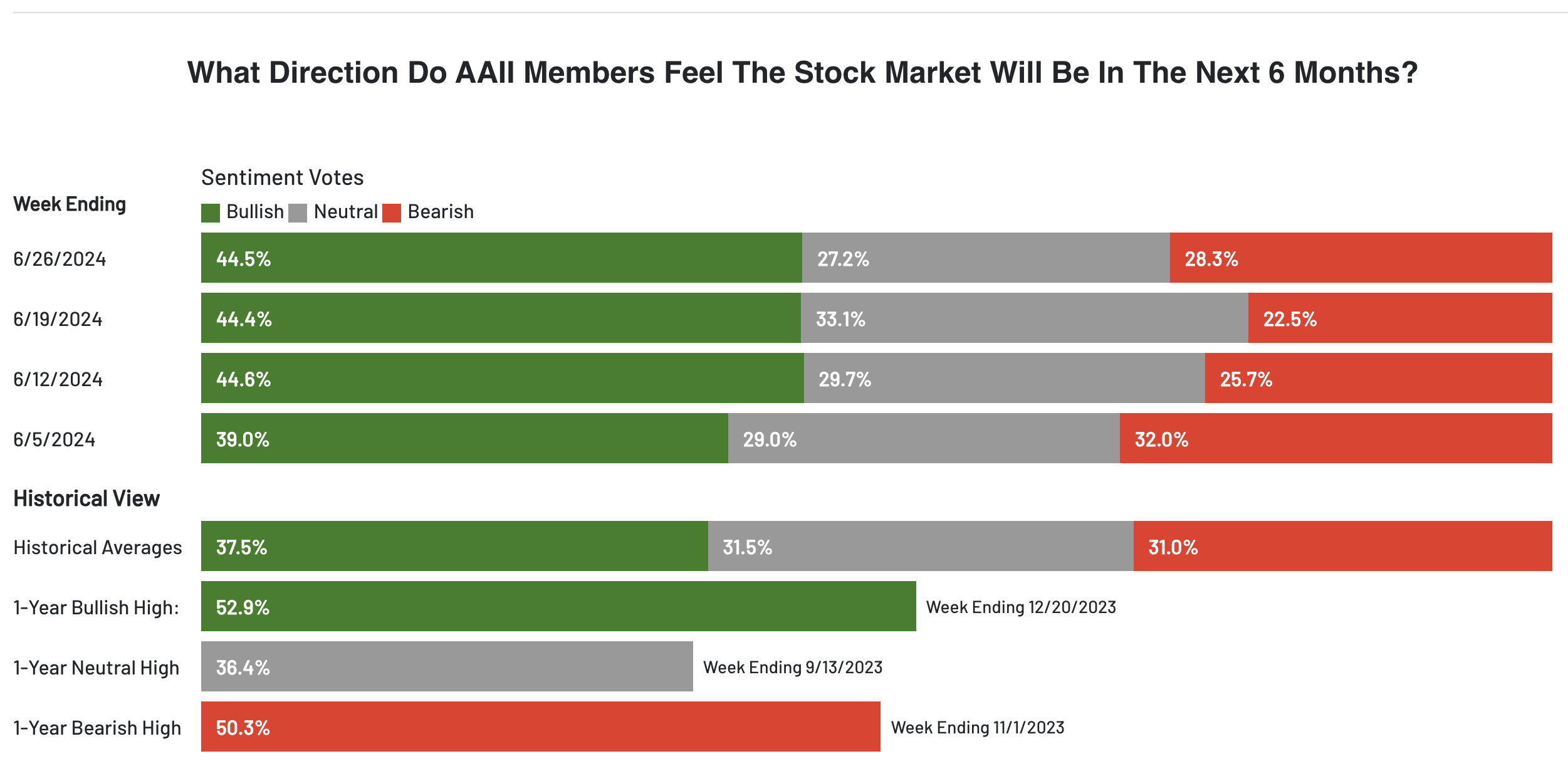

Is the market overconfident? Does it only see upside? What weight does it assign to the risks? And are the 'sirens' of perpetually higher prices too hard to ignore? One popular measure of confidence is the weekly AAII Investor Sentiment Survey. As at June 26th - 44.5% of all investors lean bullish - up from 39.0% June 5th. Analysts have also been busy hiking their S&P 500 targets for year end - with the average now around 5400. But not all analysts are aligned. Separately, we look at the record 20% one-day decline in Nike... they are warning of sales declines next year. Is this a great long-term (3-year) opportunity; or a signal to stay clear?