Global Bond Markets Warn

Global Bond Markets Warn

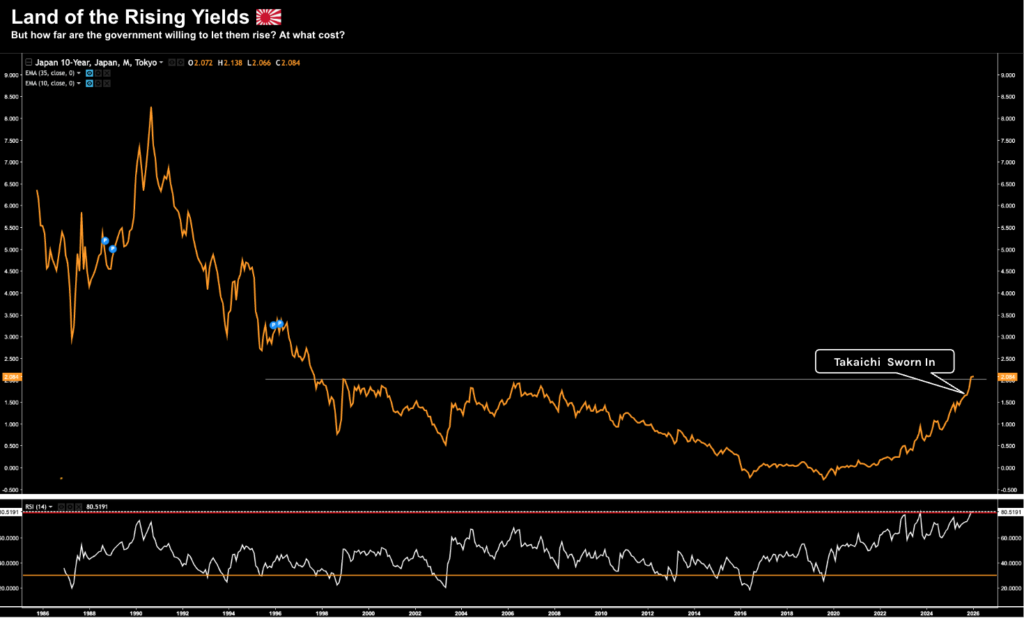

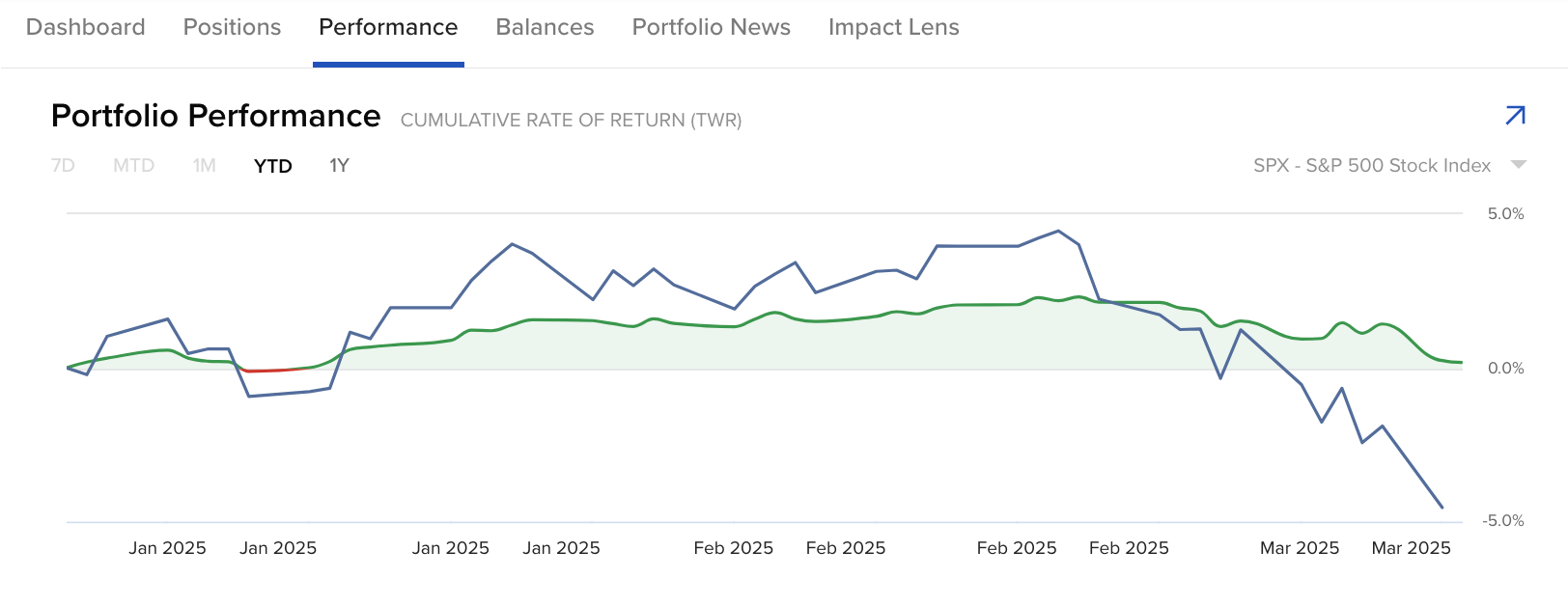

U.S. equities just suffered their worst session since October, but tariffs and geopolitics may be a sideshow. The real source of market unease lies beneath the surface — in global bond markets. From Tokyo to U.S. Treasuries, long-dated yields are rising sharply, challenging years of monetary suppression. When bond vigilantes stir, markets begin to question fiscal credibility, not headlines. And history shows those moments rarely stay contained for long.