When Will the Next Recession Hit?

When Will the Next Recession Hit?

The market is afflicting the comfortable... and discomforting the afflicted. What felt like a relief rally Wednesday abruptly turned negative to end the week....

When Will the Next Recession Hit?

When Will the Next Recession Hit?The market is afflicting the comfortable... and discomforting the afflicted. What felt like a relief rally Wednesday abruptly turned negative to end the week....

No Recession Risk. But there’s a $4T Elephant in the Room. How to Play It

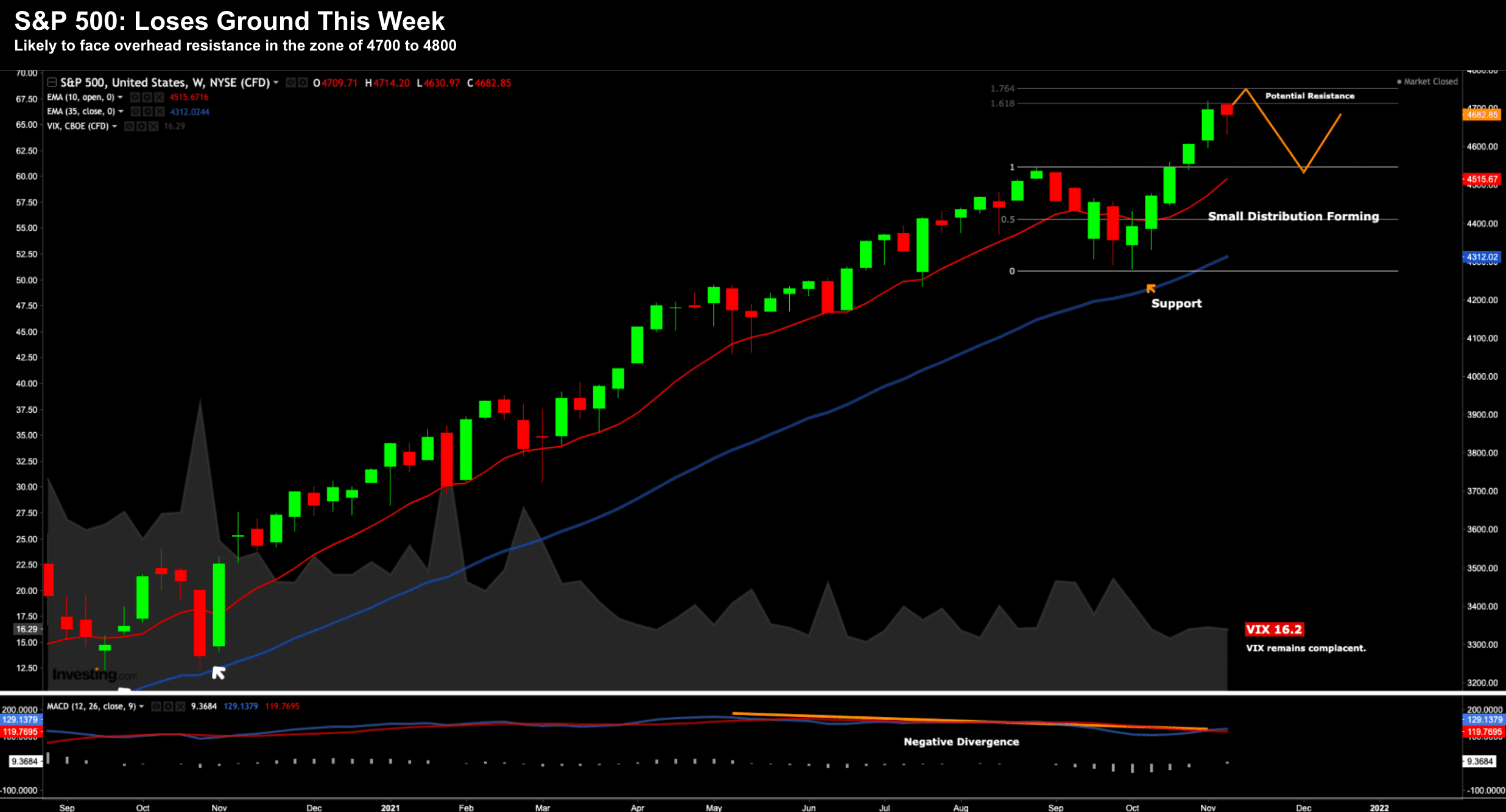

No Recession Risk. But there’s a $4T Elephant in the Room. How to Play ItMarkets continue to climb the so-called 'wall of worry'. The S&P 500 put in its first negative week since the week ending Sept 17th. From mine, I think the market finds technical resistance around this zone (e.g. 4700 to 4800).

Markets Rally as Economy Slows

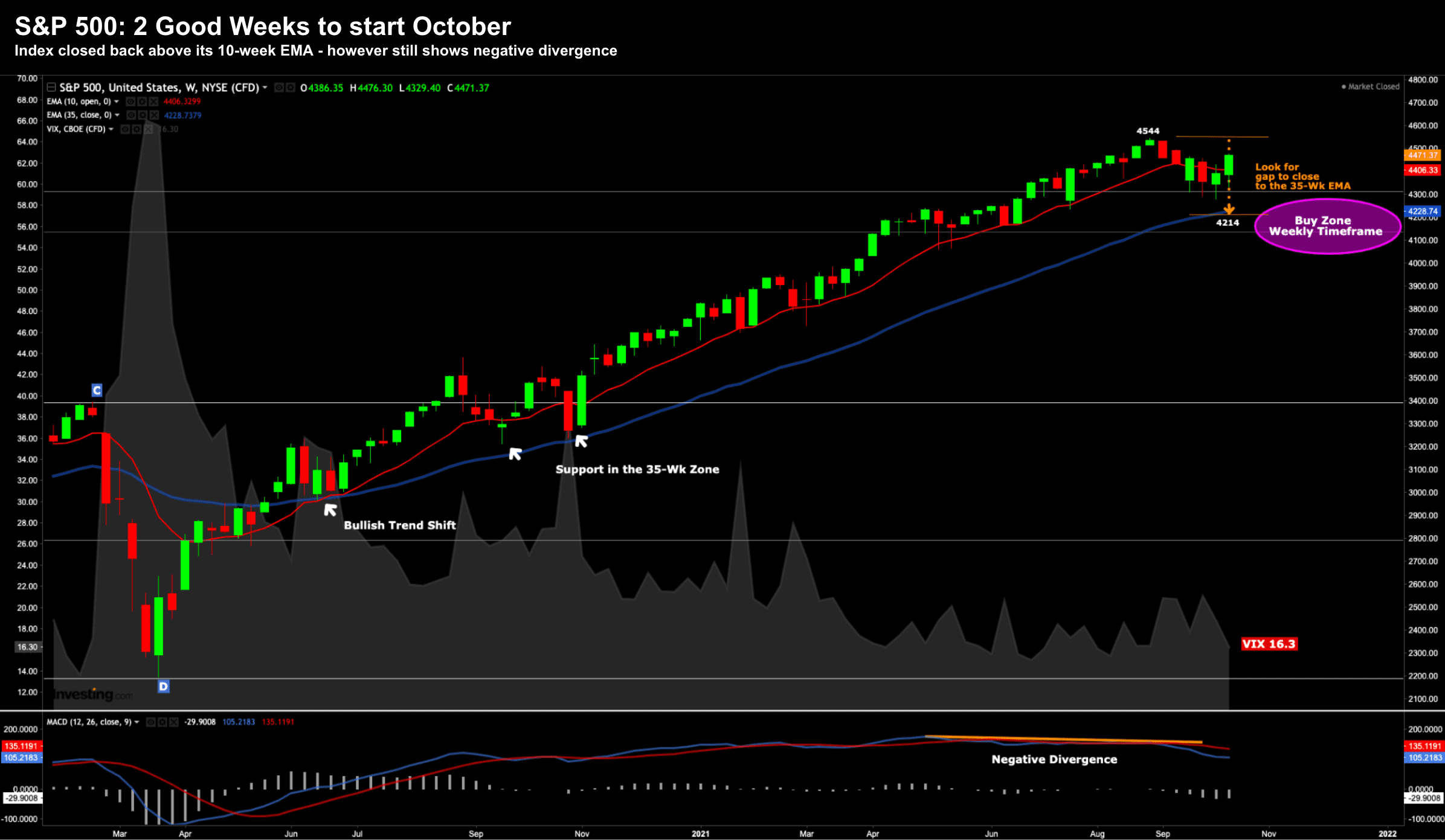

Markets Rally as Economy SlowsMarkets have a "Q4 spring" in their step. After a bit of a September swoon - the most volatile month of the year (on average) - has started well... higher prices look likely

Jobs Disappoint (again)… But Yields Rise

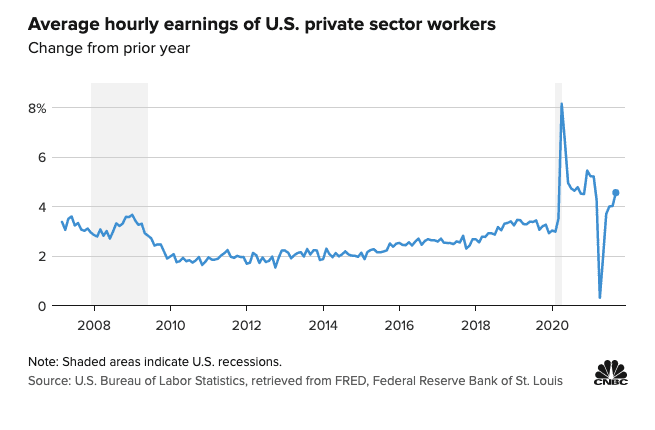

Jobs Disappoint (again)… But Yields RiseThere are two monthly data 'prints' (above all others) which are said to shape the Fed's timing on any imminent taper: (1) employment; and (2) inflation. Re the former - hiring in the U.S. fell far below expectations last month, with employers adding just 194,000 jobs versus the expected 500,000

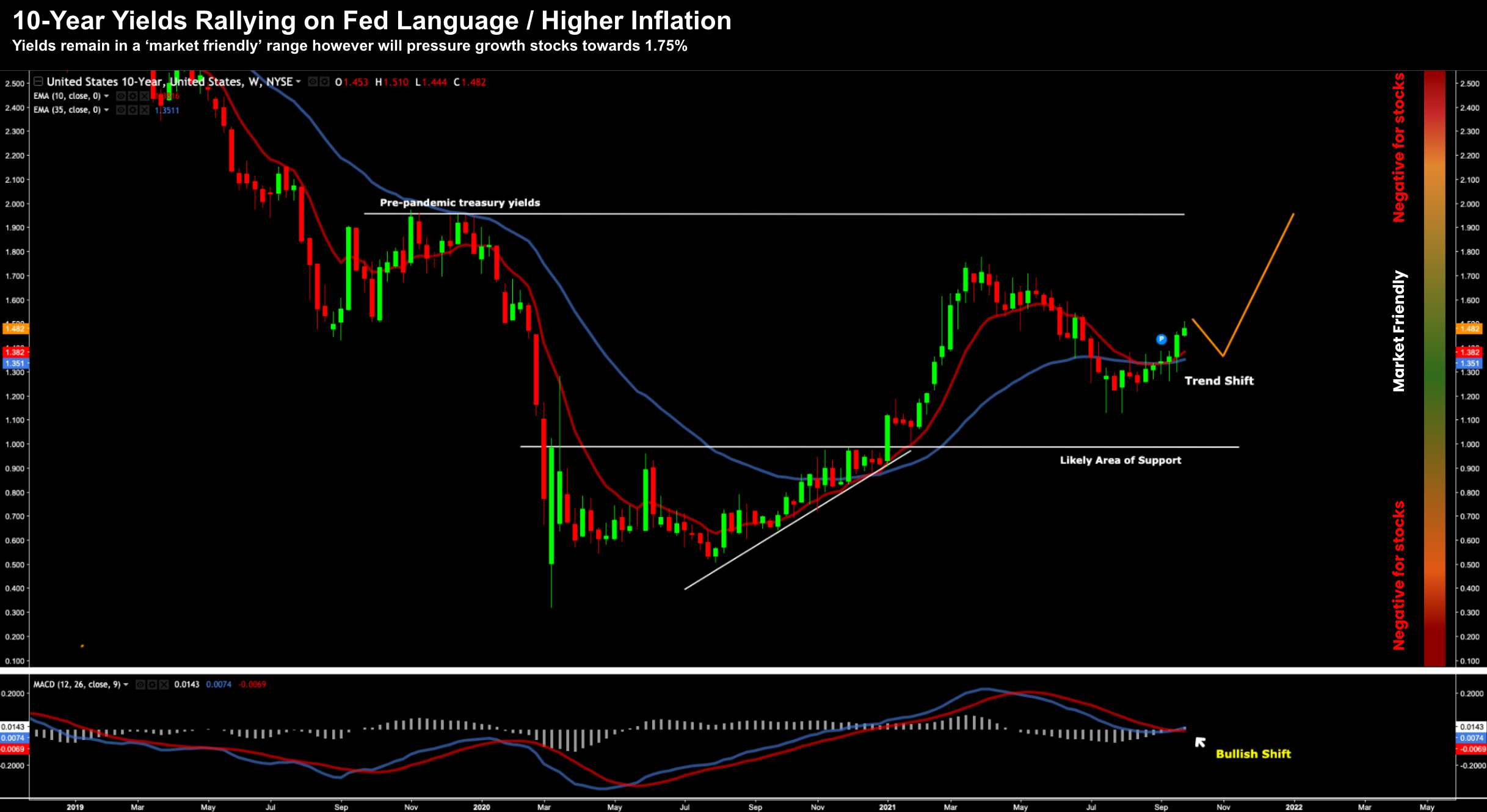

10-Year Bond Yields Jump… Sectors to Avoid

10-Year Bond Yields Jump… Sectors to AvoidKeep your eye on bond yields. The US 10-year was up 19 bps as bond investors started to price is stickier inflation - and the possibility of the Fed being forced to move sooner than expected. Yep... lock it in