Is Bad News finally Bad News?

Is Bad News finally Bad News?

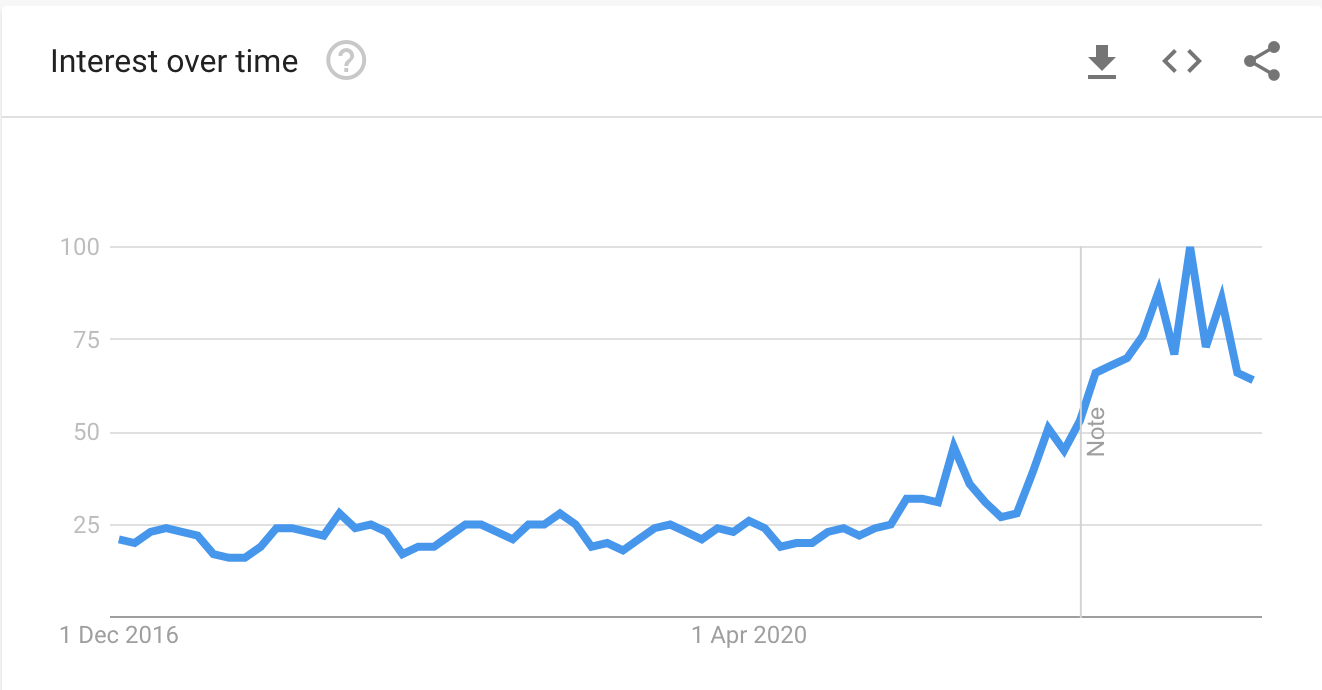

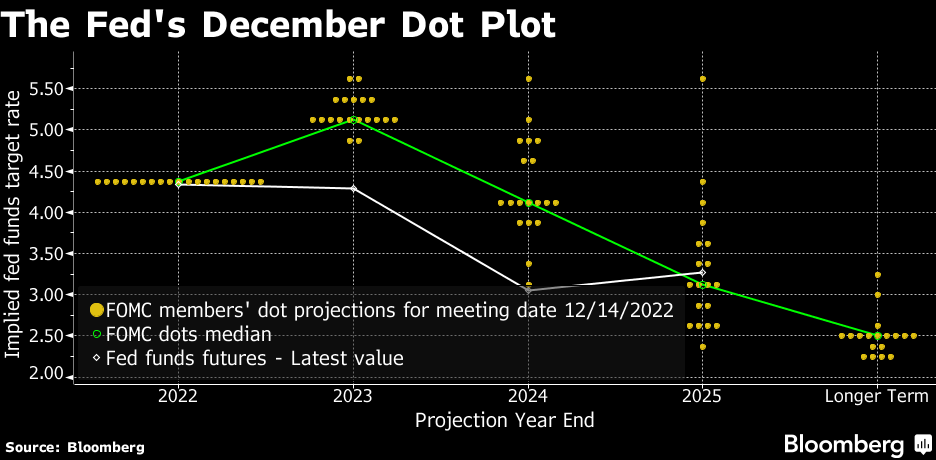

Soft landing? That's the market consensus. I am not buying it. For example, retail data for December was horrible - it's third straight month of declines. Are US consumers tapped out? Their savings rates are now at all time lows? Keep your eye on credit quality - how is that looking?