What Did We Learn from NIKE?

What Did We Learn from NIKE?

NIKE's disappointing earnings today warned us a recession looms. And whilst the stock is 43% off its highs - it's not yet a buy. It's going lower.

What Did We Learn from NIKE?

What Did We Learn from NIKE?NIKE's disappointing earnings today warned us a recession looms. And whilst the stock is 43% off its highs - it's not yet a buy. It's going lower.

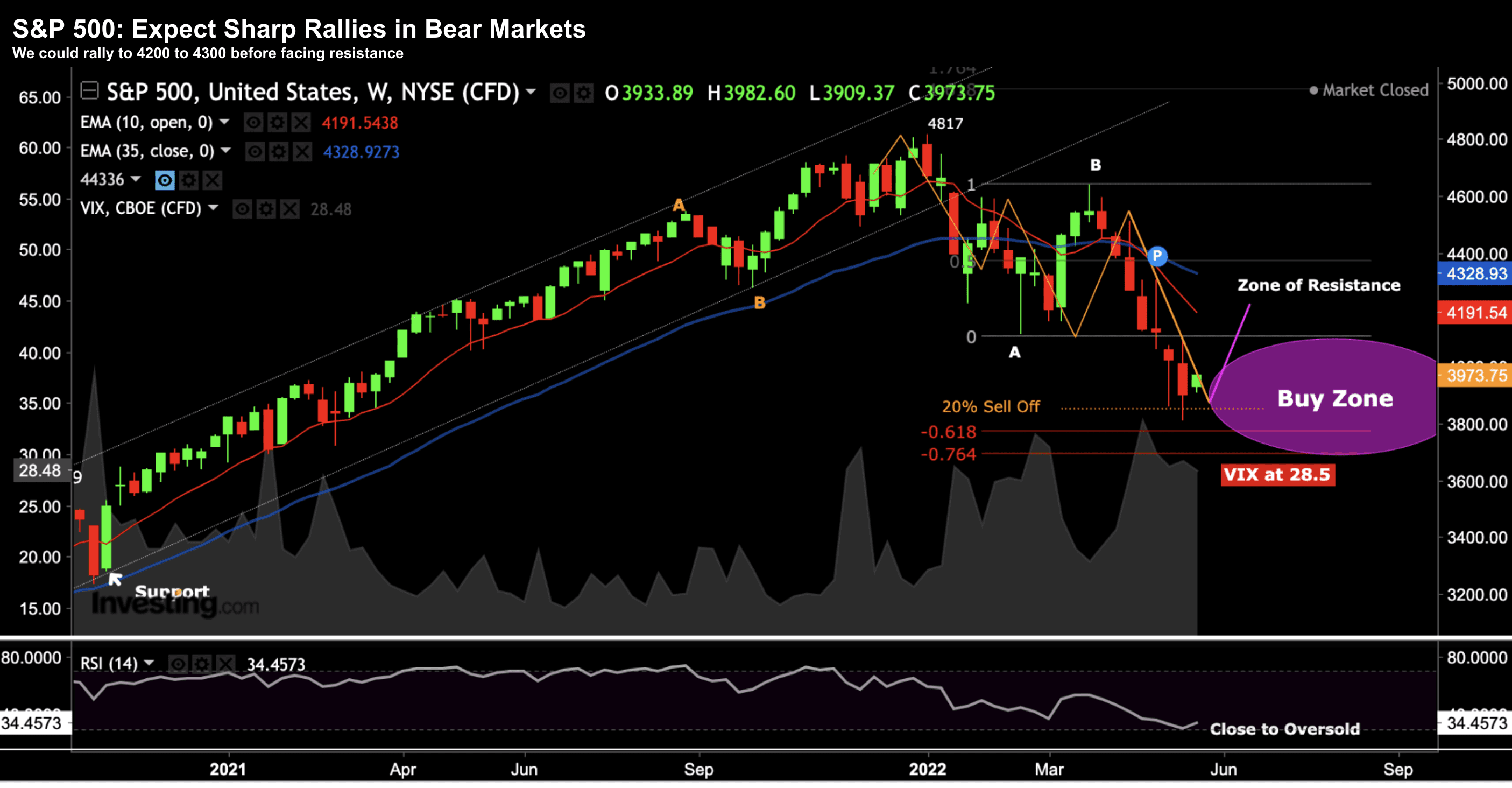

Market Poised to Rally… But Tread Carefully

Market Poised to Rally… But Tread CarefullyBear market bounce or market bottom? For me, it's the former. Two things: (i) we still need to see earnings revisions come down; and (ii) the market has a large technical hurdle it's yet to clear...

We Haven’t Seen the Lows for 2022

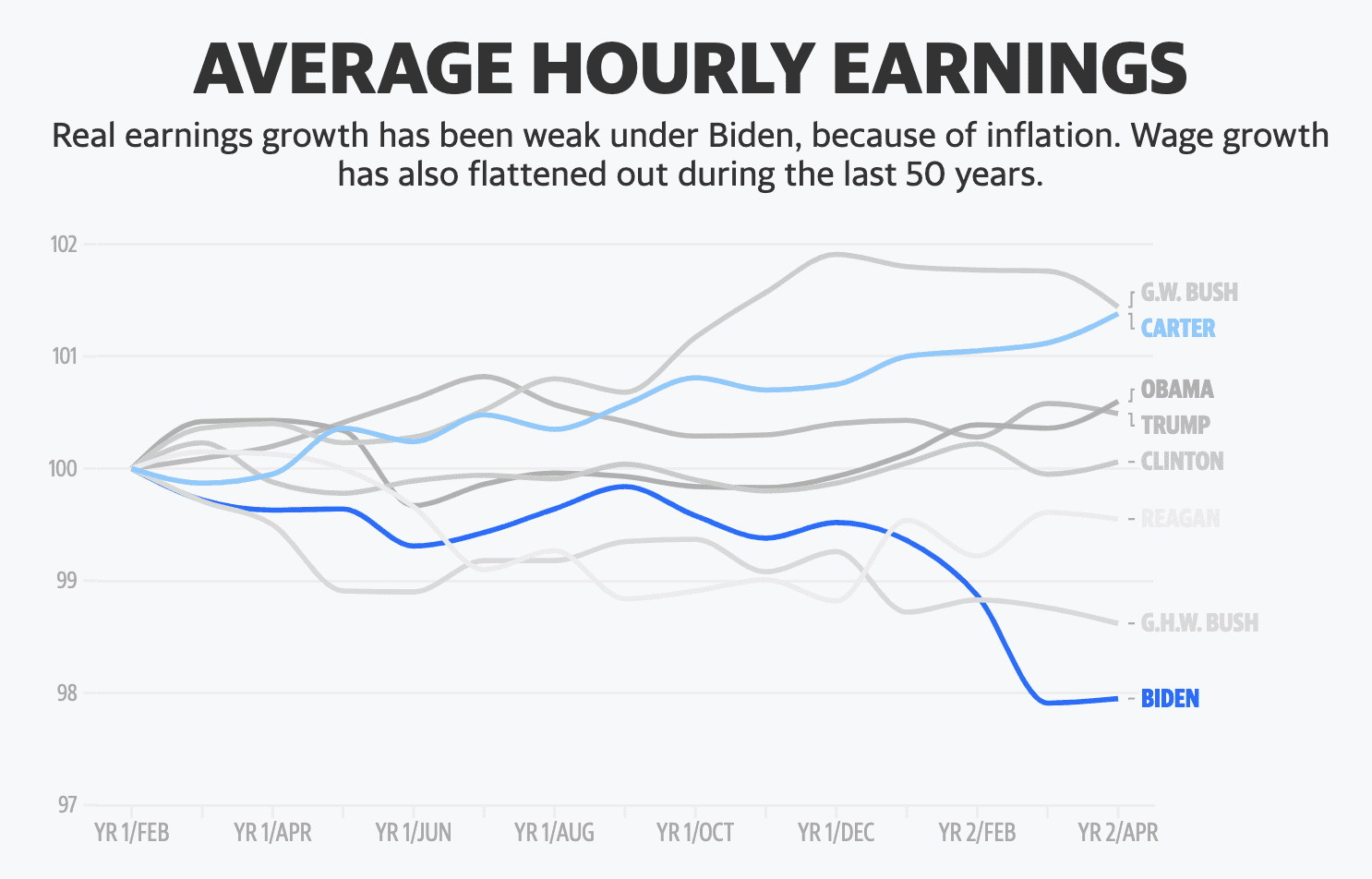

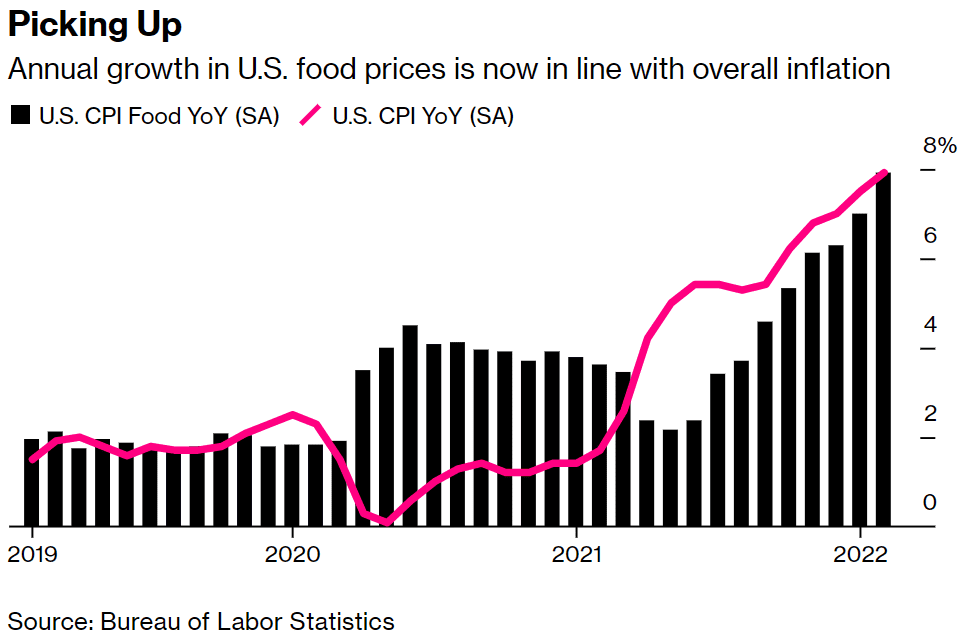

We Haven’t Seen the Lows for 2022Consumer Price Inflation (CPI) continues to run at a 41-year high 8.6%. It's not hard to explain - look no further than monetary and fiscal policy. From mine, the Fed has no choice but to remain very aggressive - where a 75 basis point raise is not off the table. This is not conducive for higher stock market prices in the near-term

Don’t Be Fooled…

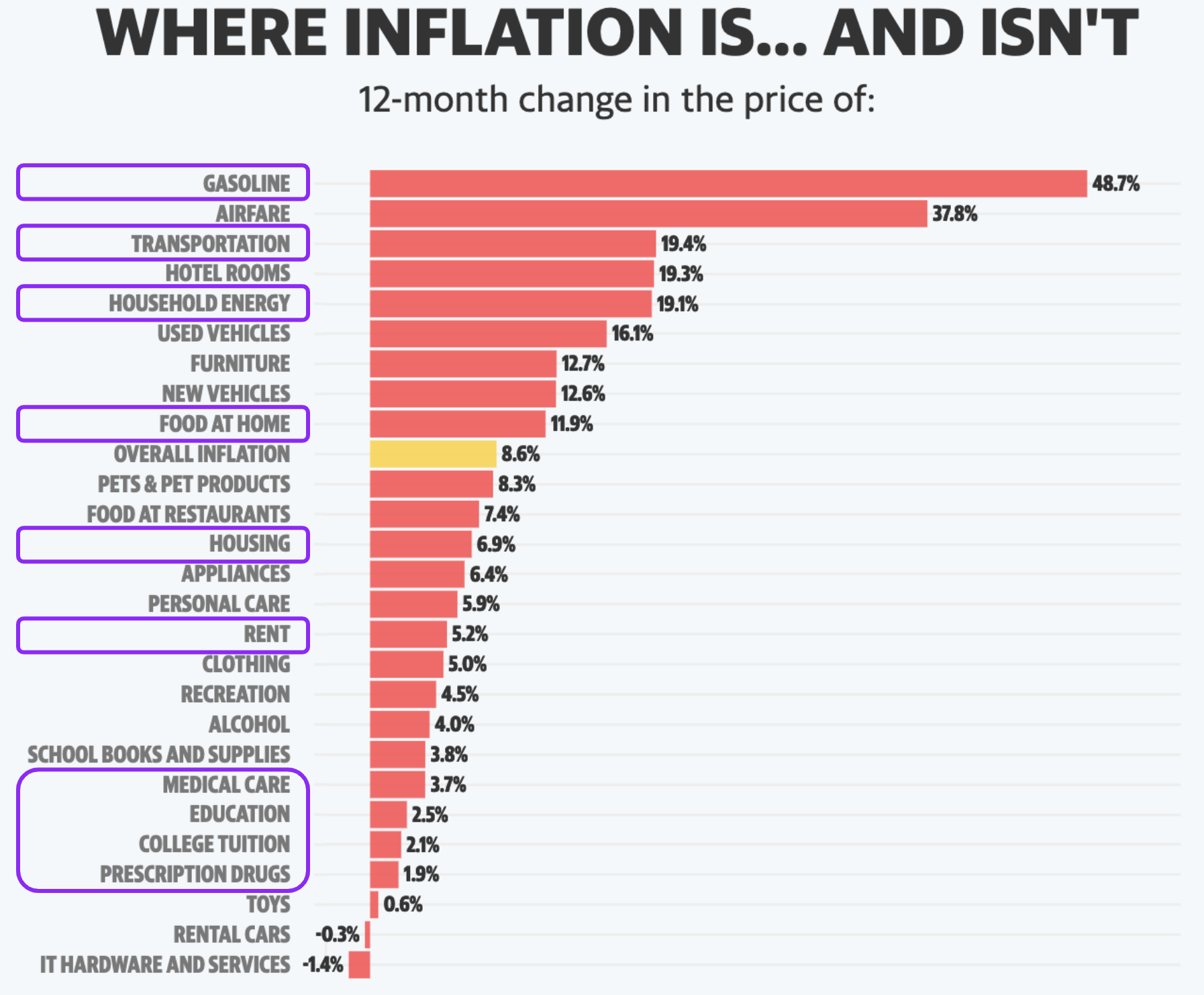

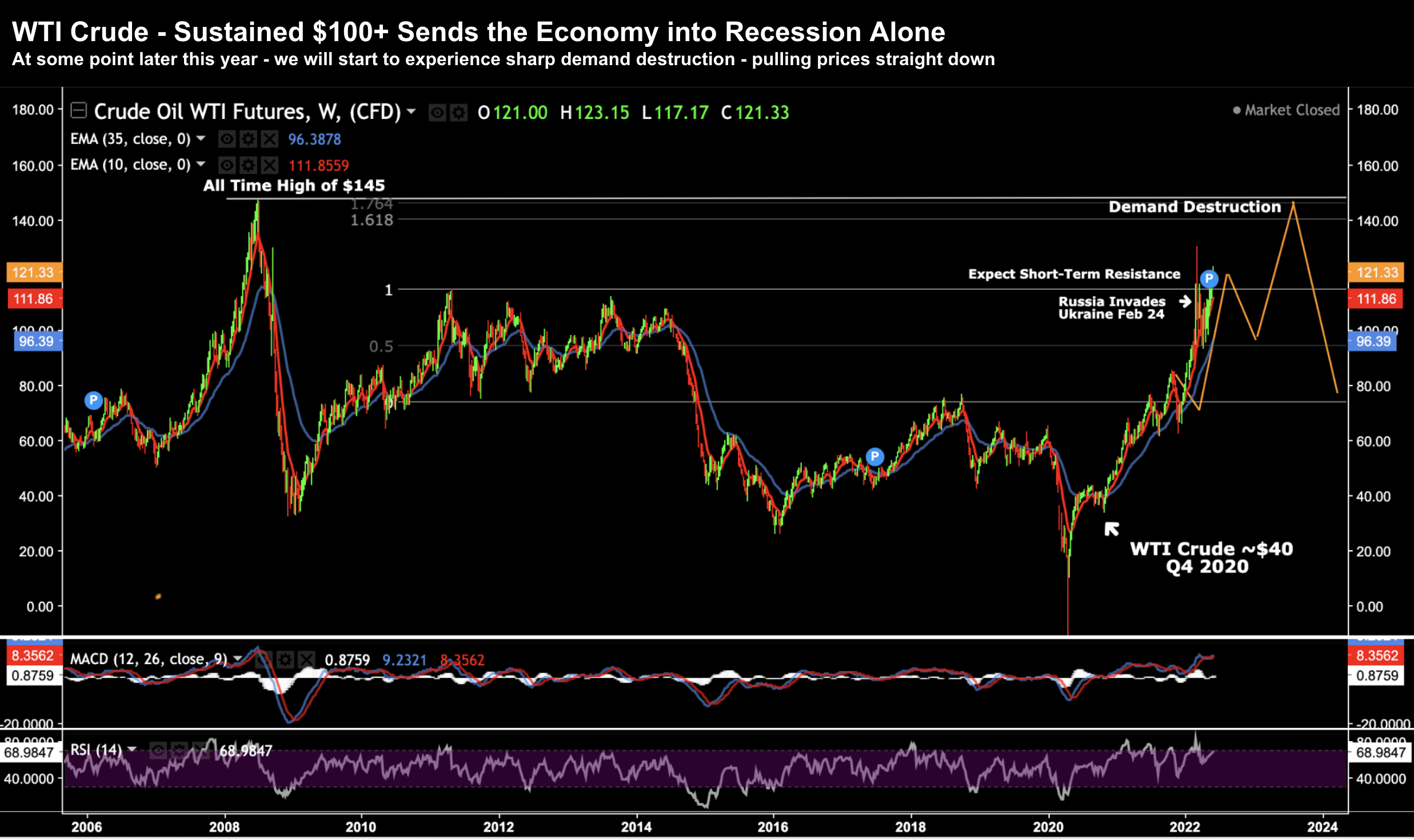

Don’t Be Fooled…CPI for May is expected to come in at a red-hot 8.2%. Anything north of 8% will not change the Fed's aggressive stance. In short, inflation is not likely to go away soon... look no further than energy and food prices. Here's why the Fed will hike straight into a recession.

Bear Market Bounce… Then Down Post Earnings

Bear Market Bounce… Then Down Post EarningsThis market narrative is very much "fire" and "ice" - according to Mike Wilson at MS. "Fire" from the Fed on inflation; and "ice" in terms of lower earnings...

A Cautious Market – MSFT & TSLA Warn

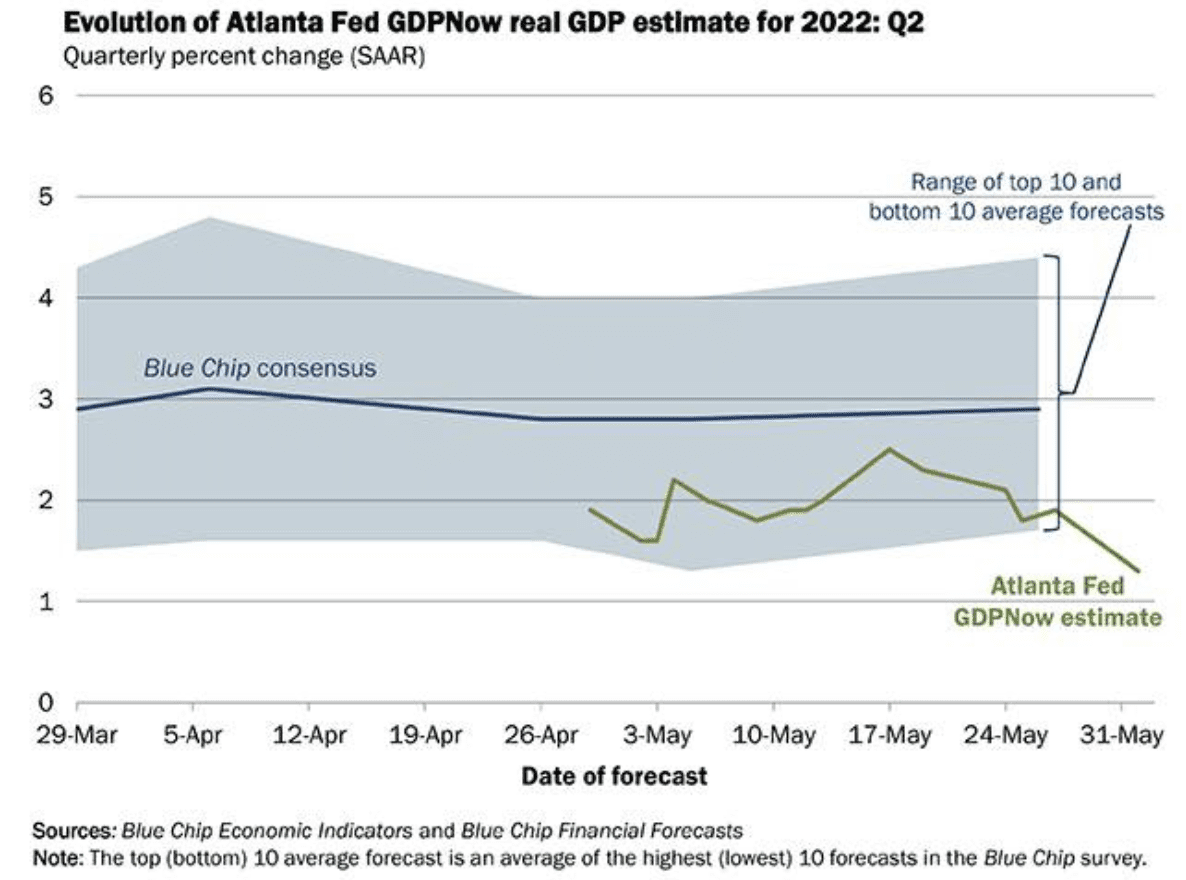

A Cautious Market – MSFT & TSLA WarnLeading CEO's are warning of storm clouds ahead. However, recent economic data suggests near-term recession fears are over-blown. Are the Fed hiking too far too fast?

The Risk/Reward for Equities

The Risk/Reward for EquitiesWhat's the risk/reward equation for equities? My view - the downside risks still outweigh the upside opposite a host of reasons. Let's explore...

What Markets are Trying to Figure Out

What Markets are Trying to Figure OutMarkets are working hard to try and calibrate a rapidly changing environment. Target and Walmart warned how things have turned sharply over the past quarter. And today it was SNAPs turn...

M2 Money Supply Still Far Too High

M2 Money Supply Still Far Too High Heading into the Fed decision - some feared we could see a 75 basis point rise. However, Jay Powell soon put those fears to rest. But the relief didn't last long... the 10-year treasury ripped above 3% as the market digested what a combination of (far) higher nominal rates.

CPI Hits 8.5% – Highest Since 1981

CPI Hits 8.5% – Highest Since 1981Consumer price inflation (CPI) for March hit its highest level since 1981 - a staggering 8.5%. Core CPI — which excludes food and energy prices —was up 6.5% YoY. Troubling numbers...especially for average earning Americans who are now spending $5K per year more just on gas and food.