Things Trading Per the Script

Things Trading Per the Script

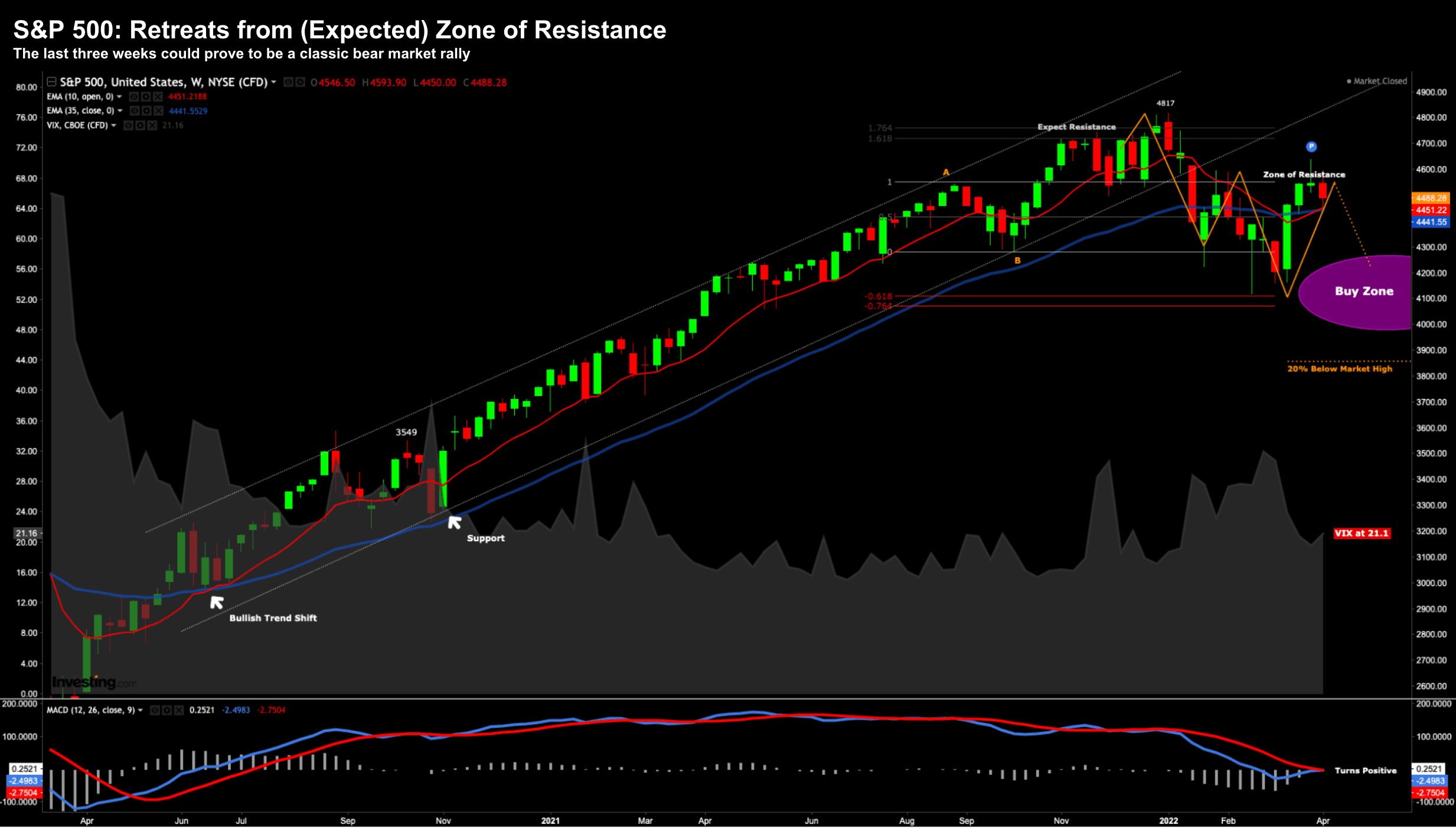

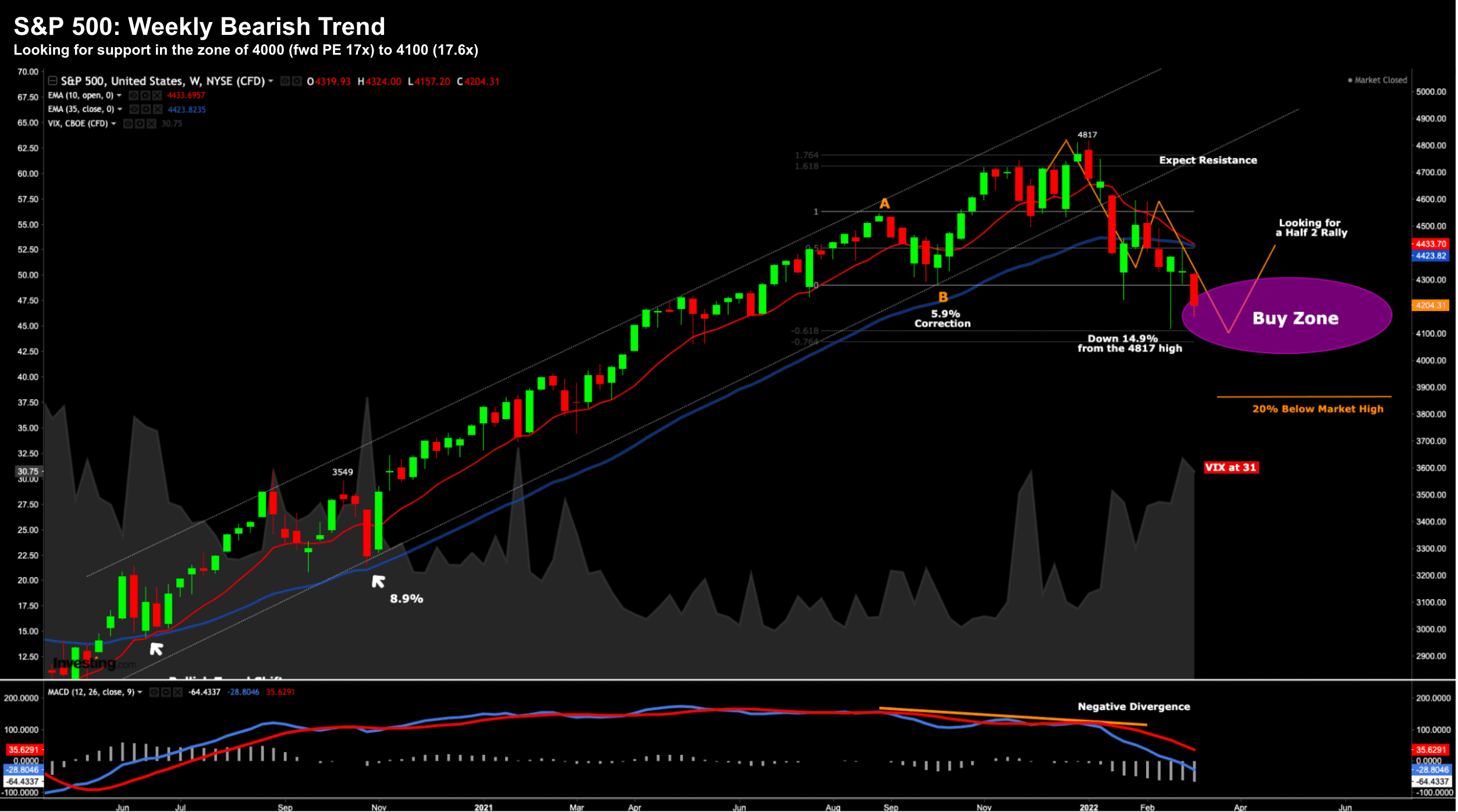

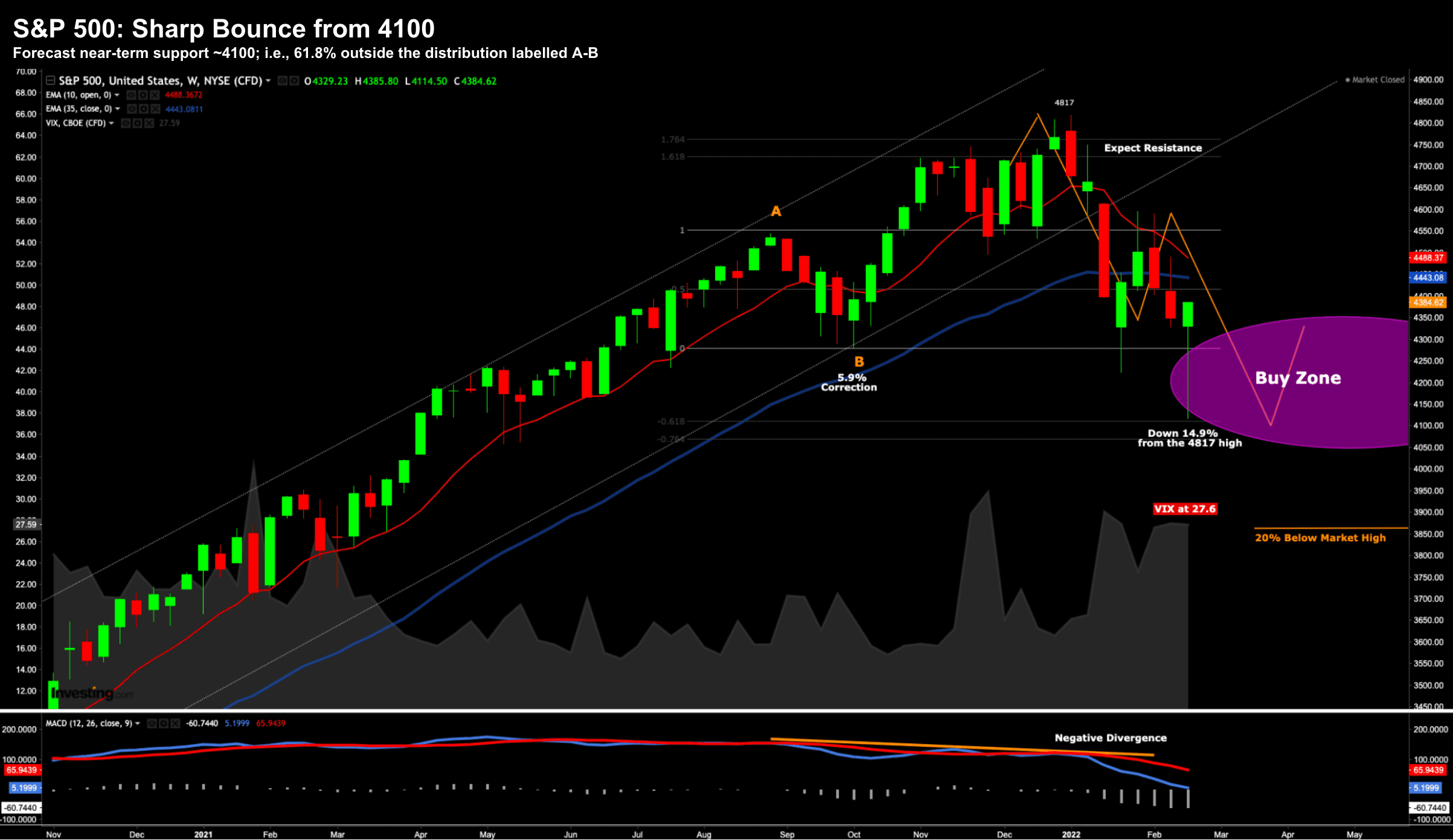

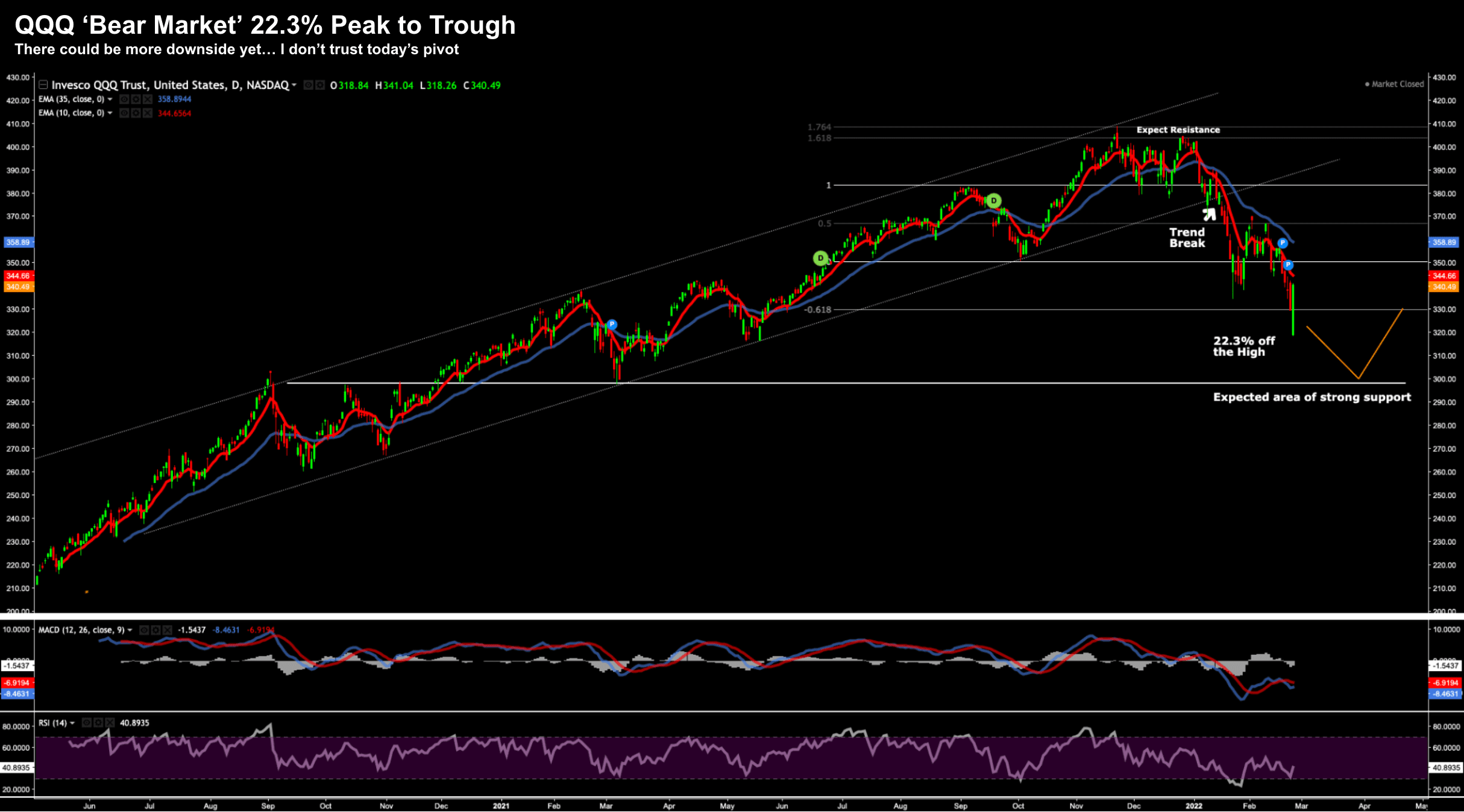

Forecasting the direction of the stock market day-to-day / week-to-week is very hard to do. In fact, it's near impossible. That said, over the past 6 months or so I feel things have traded largely 'per the script'... so what's next?