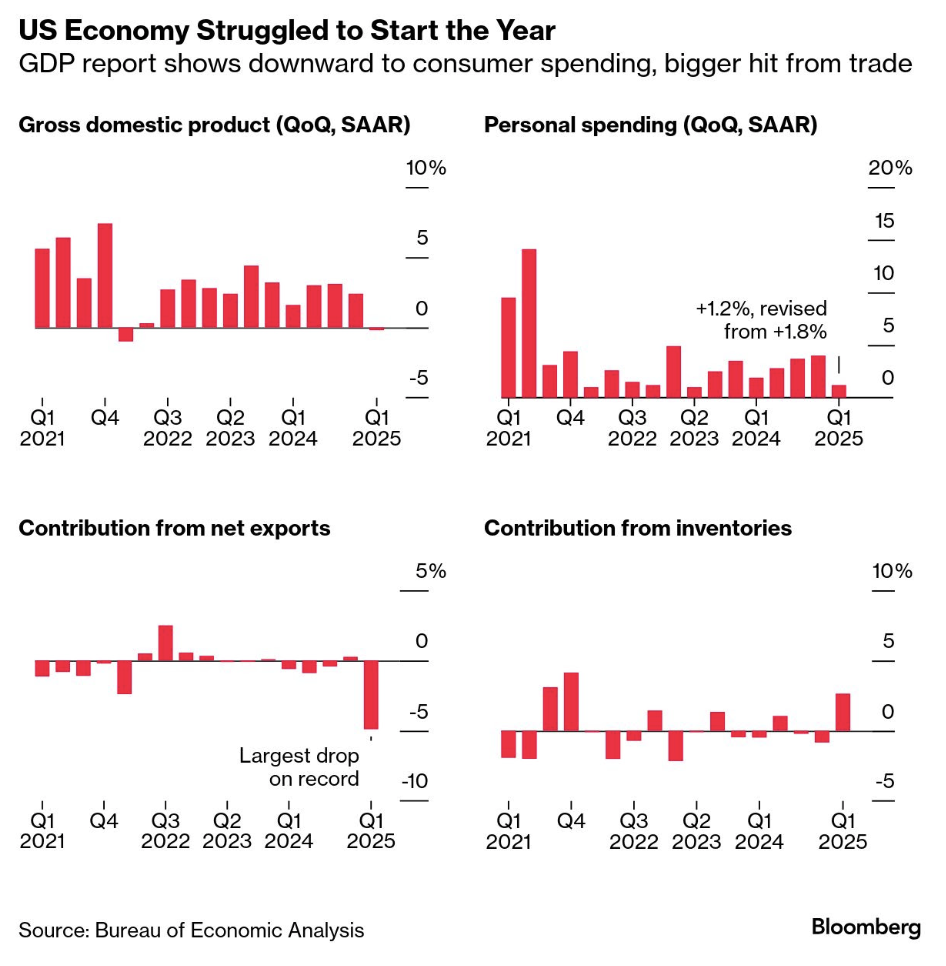

Economic Growth Slows

Economic Growth Slows

If we needed confirmation that economic growth is slowing - today we got it. The US economy shrank at the start of the year, restrained by weaker consumer spending and an even bigger impact from trade. Gross domestic product (GDP) decreased at a 0.2% annualized pace in the first quarter. And there were also warning signs from the labor market...