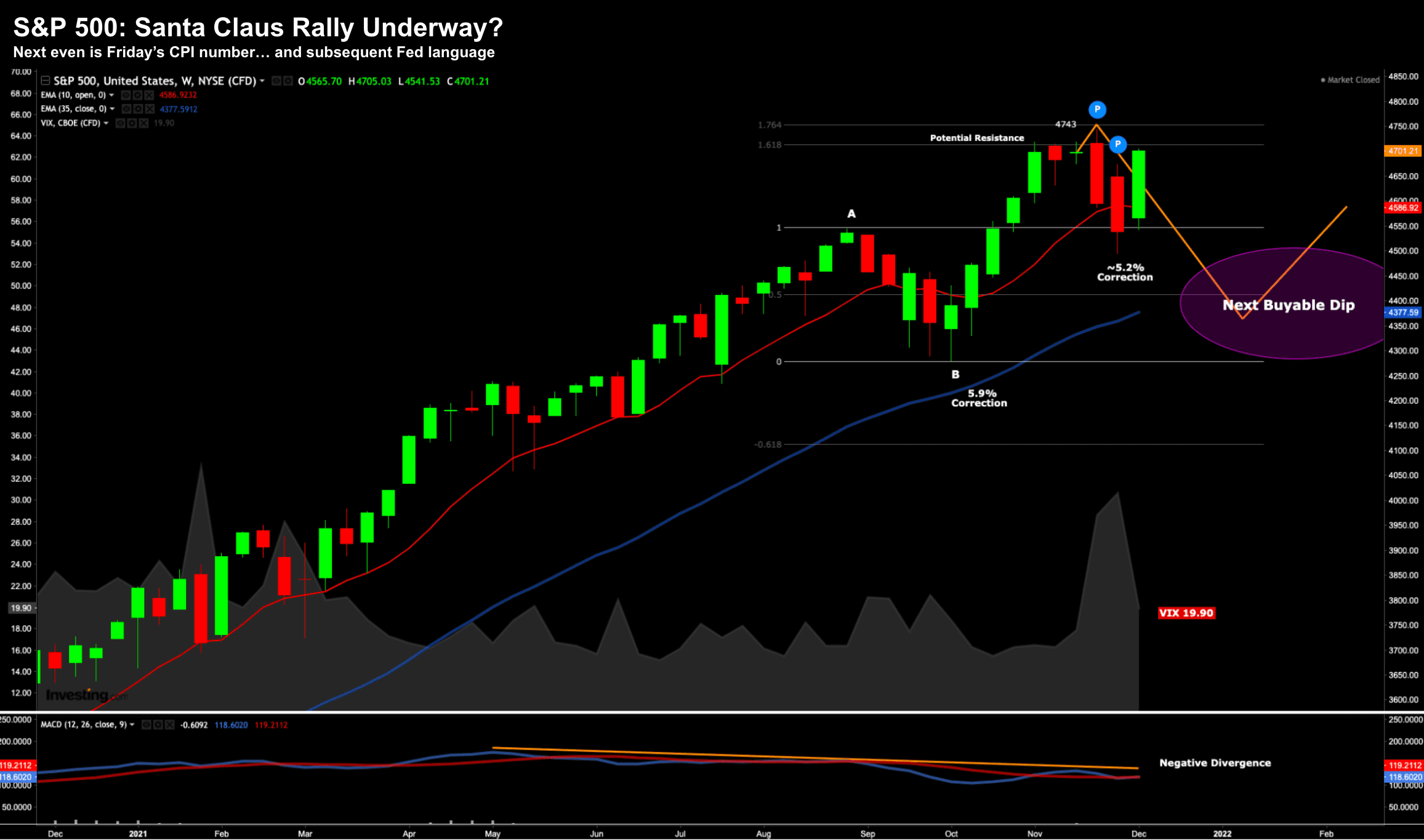

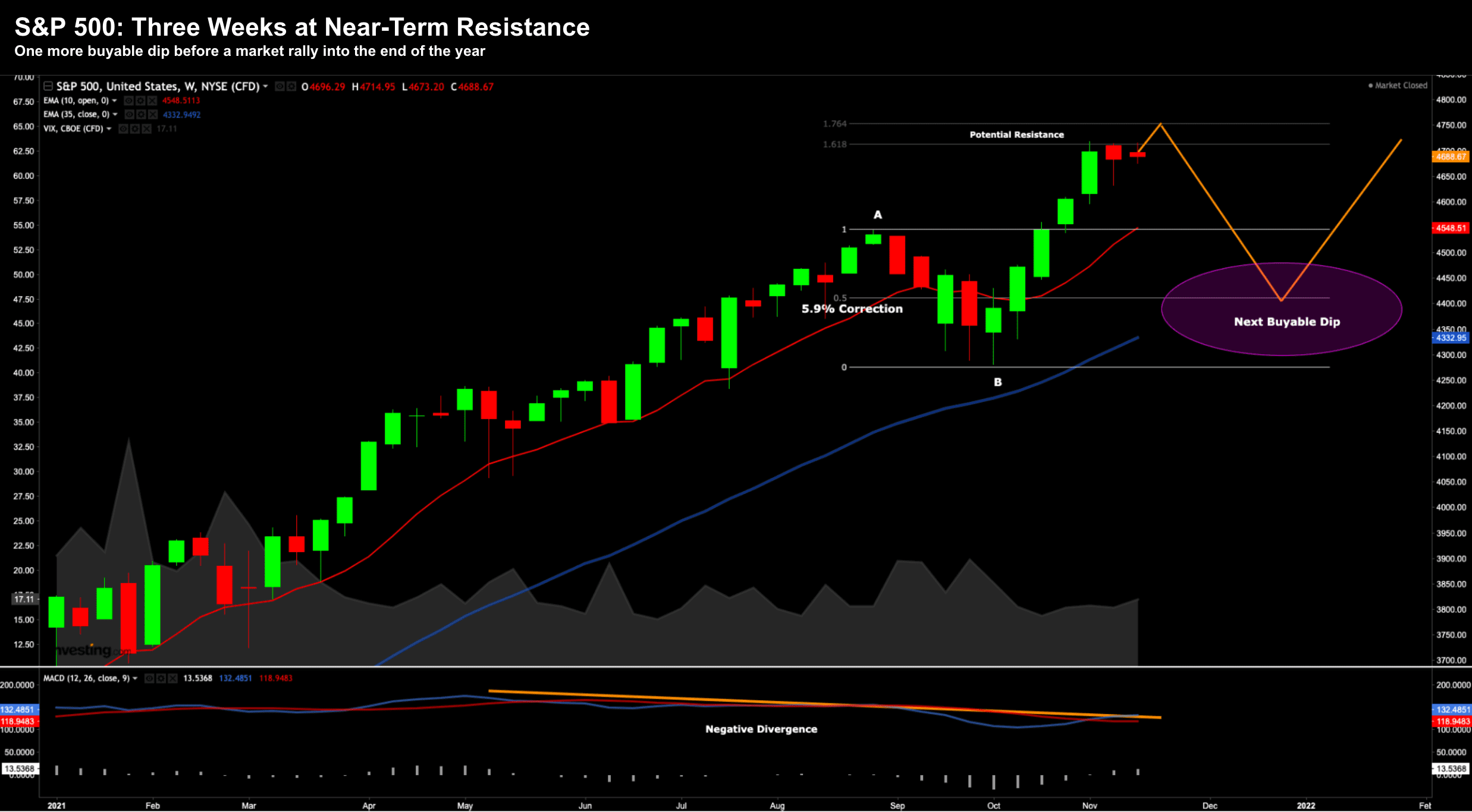

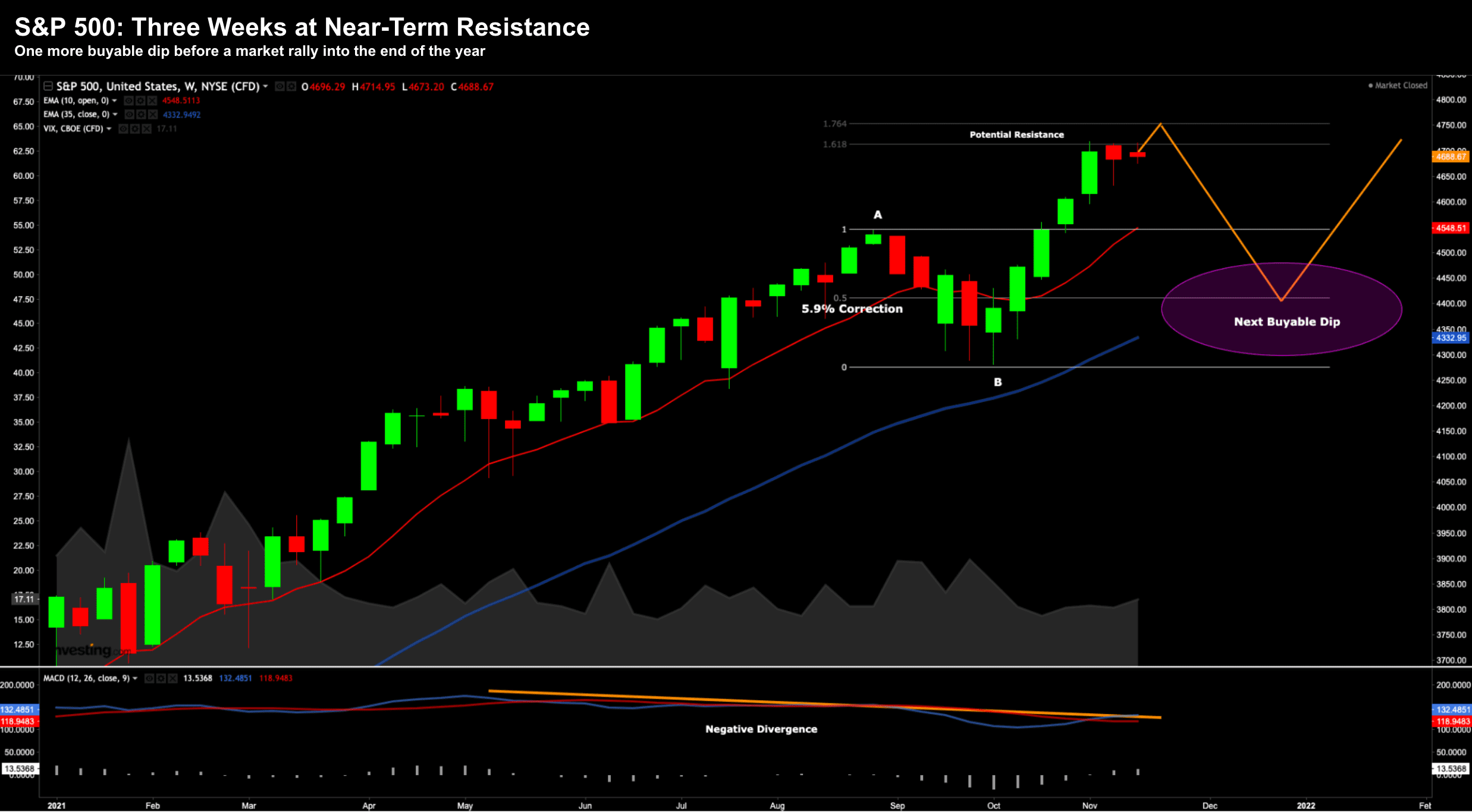

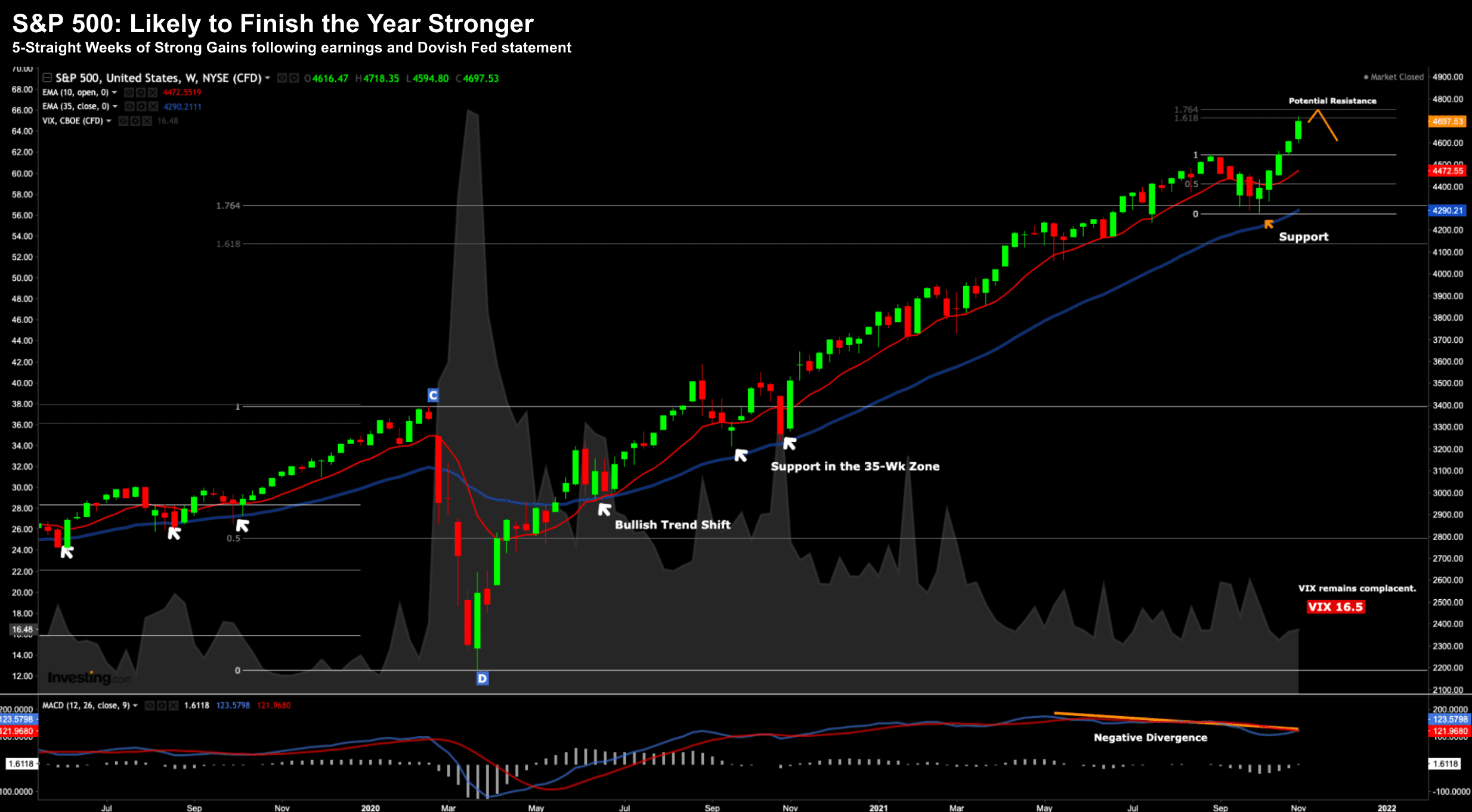

Will We See a Santa Rally?

Will We See a Santa Rally?

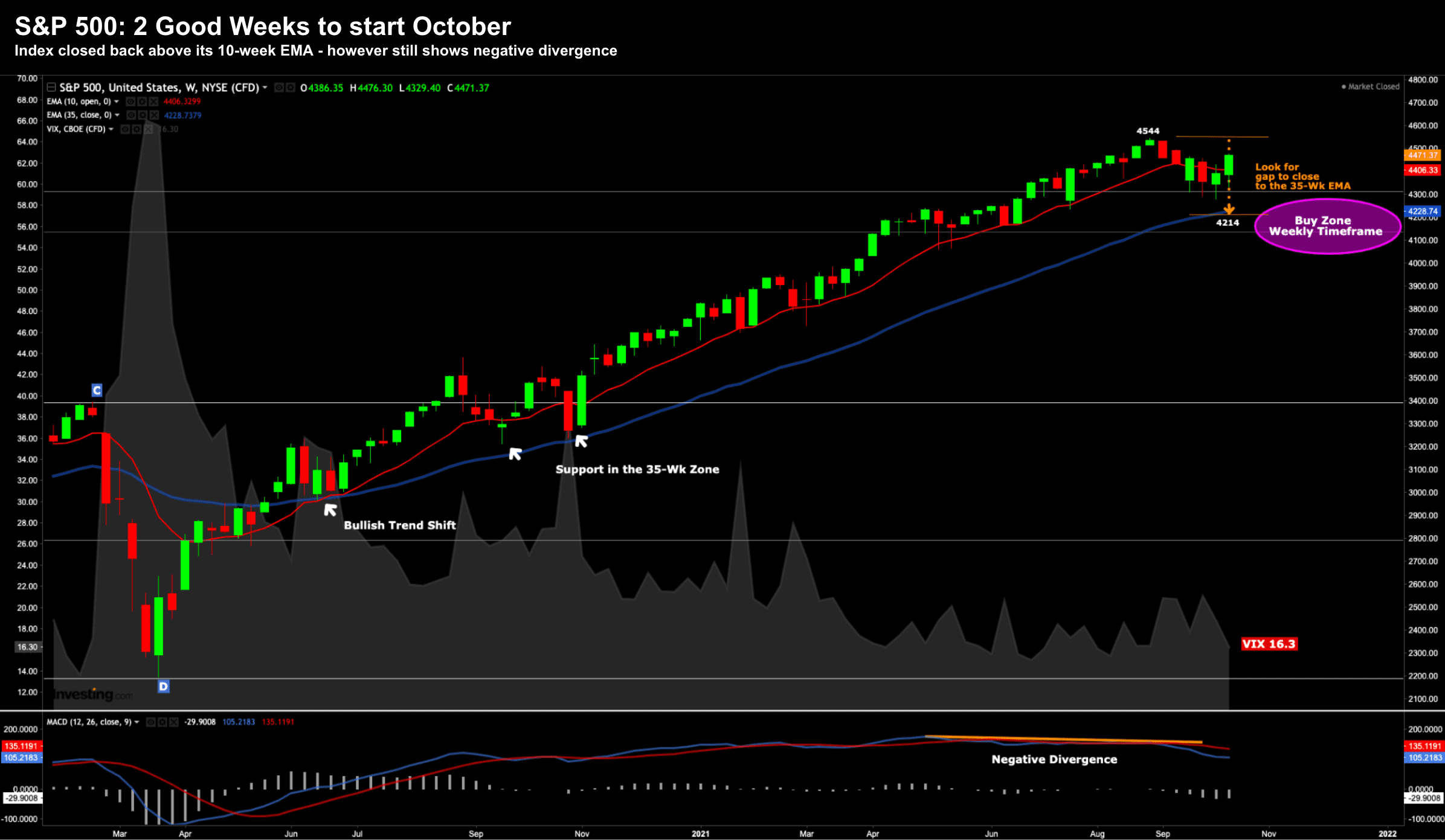

The S&P 500 dropped ~3% over the past three days - marking the worst decline over a three-day span since September. I feel we are working through the early stages of a decent (buyable) correction.